Thread by The Calculator Guy

- Tweet

- Mar 30, 2022

- #Cryptocurrency

Thread

1/x

ETH Chain

Conservative/Consistent, Mostly Validator-Based

@LidoFinance (ETH): 4% APR

@0xconcentrator (STETH): 8.68% APY

@ConvexFinance (STETH): 5.67% APY

@Alpha_HomoraV2 (BTC-ETH): 15% APY (volatile)

@Rocket_Pool (ETH): 5.45% APR

@andrew_eth (ETHMAXY): 9% APY

ETH Chain

Conservative/Consistent, Mostly Validator-Based

@LidoFinance (ETH): 4% APR

@0xconcentrator (STETH): 8.68% APY

@ConvexFinance (STETH): 5.67% APY

@Alpha_HomoraV2 (BTC-ETH): 15% APY (volatile)

@Rocket_Pool (ETH): 5.45% APR

@andrew_eth (ETHMAXY): 9% APY

2/x

Other Chains

Polygon Chain

@beefyfinance (ETH-cxETH LP): 14% APY

Multiple Chains

@CelerNetwork Bridge (ETH): 10-18% APY

Fusion Chain

@FinanceChainge (TF ETH-ETH): 15% APY

Arbitrum Chain

@DAOJonesOptions (jETH-ETH): 15% APR

Other Chains

Polygon Chain

@beefyfinance (ETH-cxETH LP): 14% APY

Multiple Chains

@CelerNetwork Bridge (ETH): 10-18% APY

Fusion Chain

@FinanceChainge (TF ETH-ETH): 15% APY

Arbitrum Chain

@DAOJonesOptions (jETH-ETH): 15% APR

3/x

Risky Covered Call Yields:

(Not a Comprehensive List)

ETH Chain

@ThetanutsFi (WETH): 24% APY

Arbitrum Chain

@dopex_io (ETH): 16-100% APR

ETH Chain

@ribbonfinance (ETH & stETH): 15-19% APY

Solana Chain

@friktion_labs (ETH): 19% APY

Solana Chain

@Katana_HQ (ETH): 34% APY

Risky Covered Call Yields:

(Not a Comprehensive List)

ETH Chain

@ThetanutsFi (WETH): 24% APY

Arbitrum Chain

@dopex_io (ETH): 16-100% APR

ETH Chain

@ribbonfinance (ETH & stETH): 15-19% APY

Solana Chain

@friktion_labs (ETH): 19% APY

Solana Chain

@Katana_HQ (ETH): 34% APY

4/x

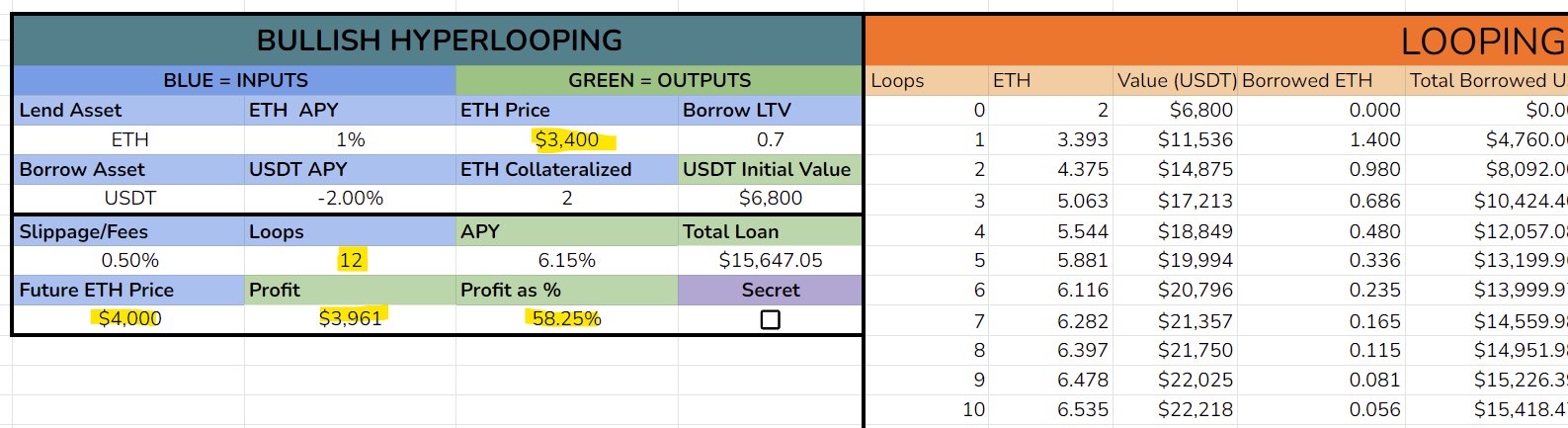

Degen Hyperlooping:

Solana Chain

@solendprotocol (soETH/USDT): Variable

Strat:

1. Deposit soETH

2. Borrow USDT

3. Swap USDT for soETH

4. Deposit soETH

5. Repeat from step 2

This allows leveraging upside 2-4x.

e.g., If ETH goes from $3400 to $4000, you make a 58% profit

Degen Hyperlooping:

Solana Chain

@solendprotocol (soETH/USDT): Variable

Strat:

1. Deposit soETH

2. Borrow USDT

3. Swap USDT for soETH

4. Deposit soETH

5. Repeat from step 2

This allows leveraging upside 2-4x.

e.g., If ETH goes from $3400 to $4000, you make a 58% profit