Thread

Is Bitcoin better than Gold for oil?

In a recent podcast by @ttmygh and @LukeGromen I heard the phrase “keeping the Dollar as good as Gold for Oil”.

They discuss how the turn of events in 🇺🇦 and 🇷🇺 is part of the bigger scheme of unraveling the Dollar as reserve currency.

1/

In a recent podcast by @ttmygh and @LukeGromen I heard the phrase “keeping the Dollar as good as Gold for Oil”.

They discuss how the turn of events in 🇺🇦 and 🇷🇺 is part of the bigger scheme of unraveling the Dollar as reserve currency.

1/

So, first, let’s establish what does “keeping Dollars as good as Gold for Oil” mean.

Era 1: Dollar = Gold -> Stable Oil

Era 2: Pre-Printing ->Stable(ish) Range

Era 3: Post-Printing -> One direction down

Era 1: Dollar = Gold -> Stable Oil

Era 2: Pre-Printing ->Stable(ish) Range

Era 3: Post-Printing -> One direction down

Essentially, what it comes down to, is that since all the money printing started after the GFC, the Dollar stopped being as good as gold for oil.

The theory here is that most of the countries want an alternative to the Dollar as a world reserve currency.

The theory here is that most of the countries want an alternative to the Dollar as a world reserve currency.

When it comes to currencies, it’s a classic prisoner’s dilemma for countries involved.

Work together and you are fucked.

Work against each other and you might get even more fucked.

What do you do?

Start using something that everyone believes in, but no one controls.

Work together and you are fucked.

Work against each other and you might get even more fucked.

What do you do?

Start using something that everyone believes in, but no one controls.

Like gold right?

Yes, gold is not bad

But there is only $12 Trillion of gold in the world.

We are using 100 Million barrels of oil a day. $3T -$4T a year.

That means that if all oil purchases are settled in gold, all the gold in the word will change hands every 3-4 years.

Yes, gold is not bad

But there is only $12 Trillion of gold in the world.

We are using 100 Million barrels of oil a day. $3T -$4T a year.

That means that if all oil purchases are settled in gold, all the gold in the word will change hands every 3-4 years.

That is what made the Dollar so practical.

Everyone used to be friends and trusted the US to keep the peace and be good for the money.

But the US started printing…

And then they sanctioned Russian reserves kept in Dollar a few weeks ago…

Everyone used to be friends and trusted the US to keep the peace and be good for the money.

But the US started printing…

And then they sanctioned Russian reserves kept in Dollar a few weeks ago…

If the US is no longer good for the money, why would you sell your oil (or anything else) for Dollars, if the US can just block you from using it.

Rather sell it in exchange for something else.

But that something else - being gold - is not practical for trading.

Rather sell it in exchange for something else.

But that something else - being gold - is not practical for trading.

Paper gold also won’t work, because remember no one trusts the US anymore.

If you don’t trust the US, who can you trust (except yourself) to store the gold?

Even Switzerland will sanction you these days.

If you store it yourself, you’ll have to issue paper that no one trusts.

If you don’t trust the US, who can you trust (except yourself) to store the gold?

Even Switzerland will sanction you these days.

If you store it yourself, you’ll have to issue paper that no one trusts.

But, I have a solution for you Mr. Government.

@balajis phrases it well in the attached tweet.

@saylor calls it digital energy.

Bitcoin is better than gold for oil.

And I will show you why.

@balajis phrases it well in the attached tweet.

@saylor calls it digital energy.

Bitcoin is better than gold for oil.

And I will show you why.

We’ve talked about the Dollar, we’ve talked about Gold, but what about Oil?

Oil is energy that can be transported.

The world needs energy.

Converted to something we understand, in raw form there are about 1700KWh in a oil barrel

Enough to power your work computer for a week

Oil is energy that can be transported.

The world needs energy.

Converted to something we understand, in raw form there are about 1700KWh in a oil barrel

Enough to power your work computer for a week

But it is also an inefficient form of energy, so we roughly only use about 1/3 of the energy produced.

We only get to use 566 of the 1700 KWh.

If Oil is Energy and Bitcoin is Digital Energy how do you value the one relative to the other?

How much barrels is a bitcoin good for?

We only get to use 566 of the 1700 KWh.

If Oil is Energy and Bitcoin is Digital Energy how do you value the one relative to the other?

How much barrels is a bitcoin good for?

I really need help from smart people like @100trillionUSD or @DylanLeClair_

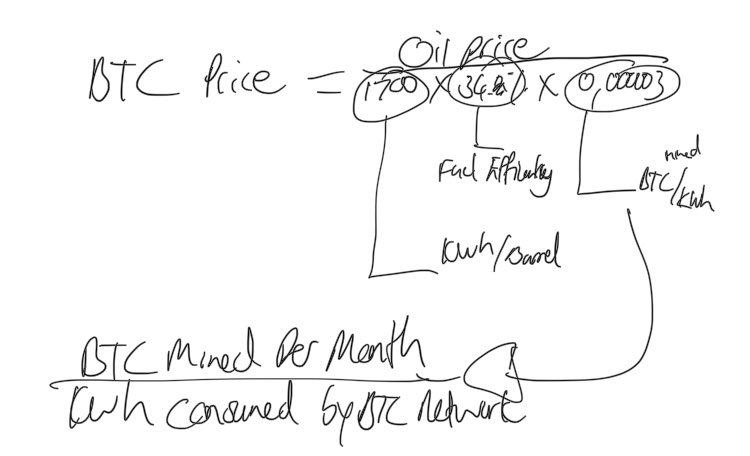

If the oil price is $100 a barrel,

Generating 566KWh of efficient energy, and the Bitcoin network consumed 10.5TWh to mine 28600 new bitcoins in the last month…

The Bitcoin price should be $65K

If the oil price is $100 a barrel,

Generating 566KWh of efficient energy, and the Bitcoin network consumed 10.5TWh to mine 28600 new bitcoins in the last month…

The Bitcoin price should be $65K

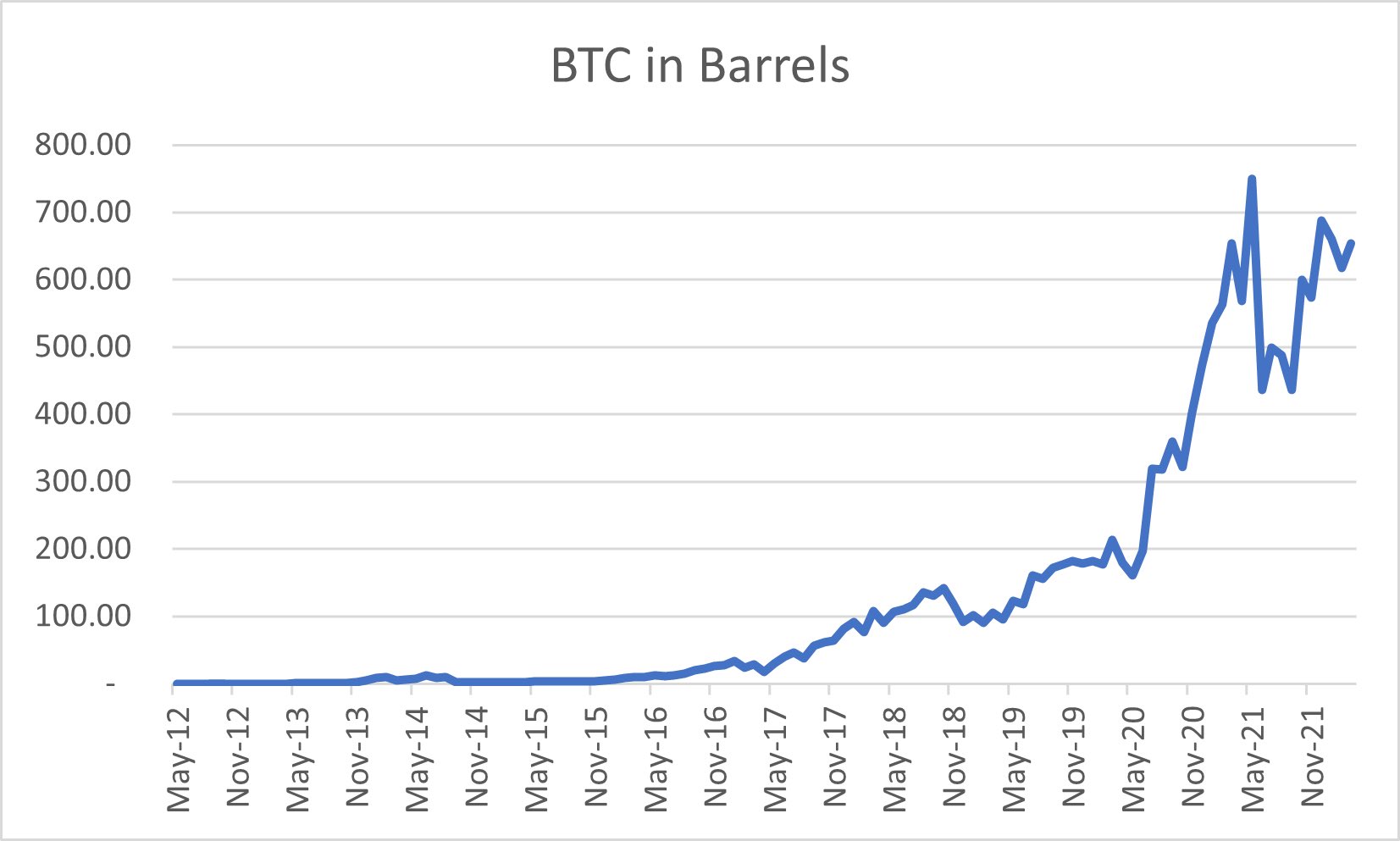

That would mean, that based on the current energy consumption of the bitcoin network, one bitcoin should be good for 650 barrels of oil.

If that was the standard, theoretically you can buy btc now for $45k, and use it to buy 650 barrels that you can sell for $65 (arb).

If that was the standard, theoretically you can buy btc now for $45k, and use it to buy 650 barrels that you can sell for $65 (arb).

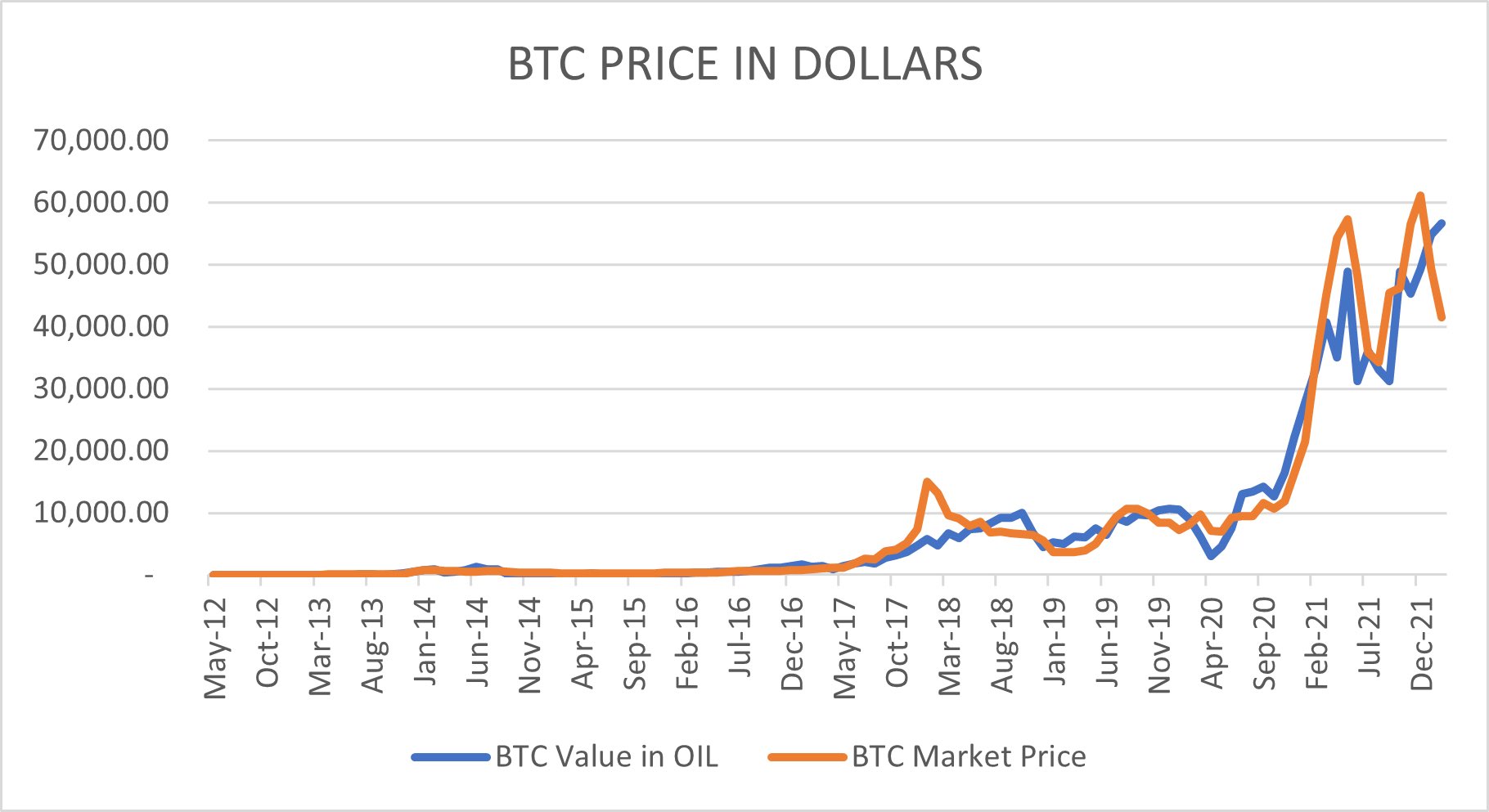

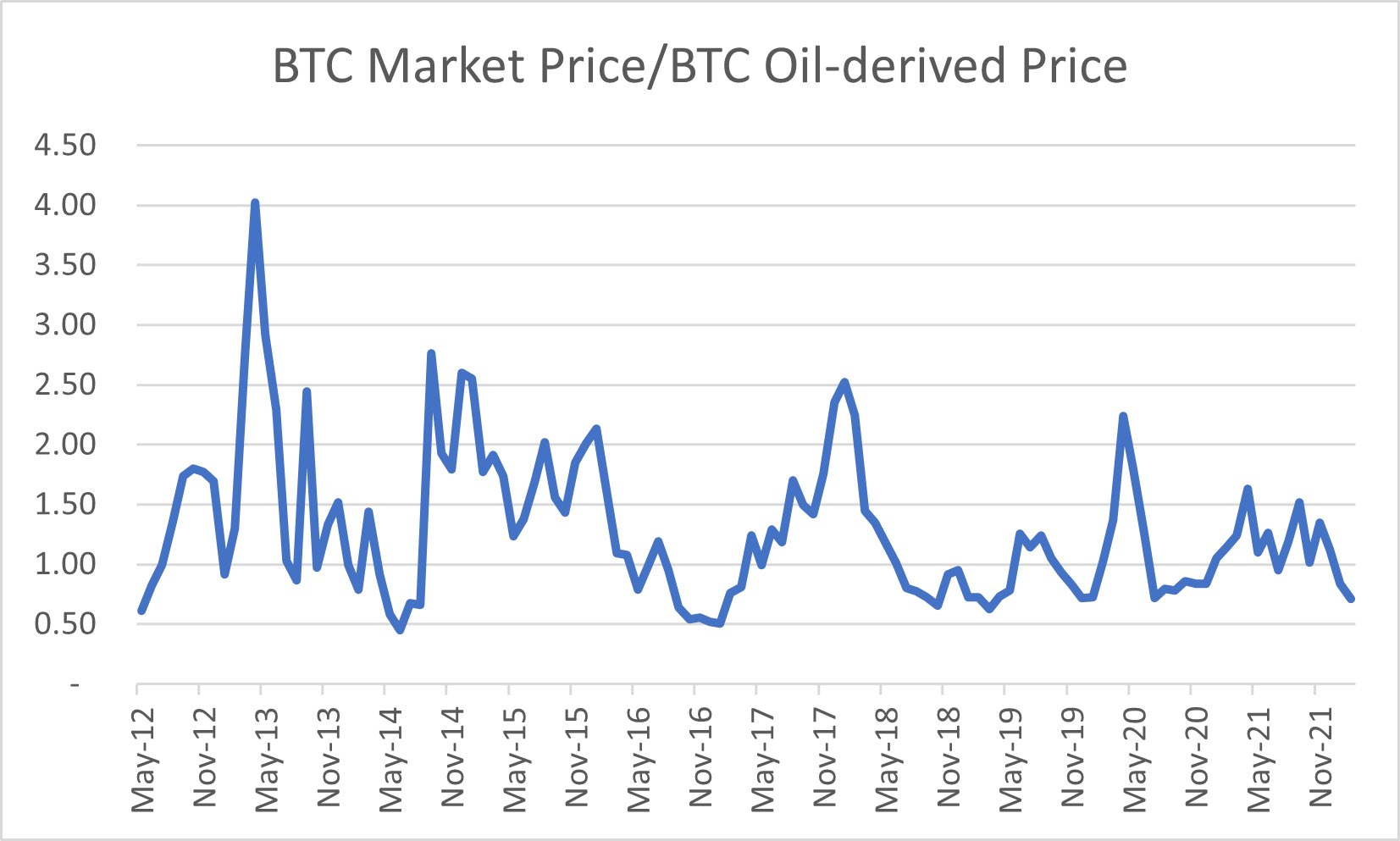

Now I have modeled it on a high level based on the formula above and these are the charts.

You will also note that for the first time in a long time btc is highly undervalued vs oil

You will also note that for the first time in a long time btc is highly undervalued vs oil

I know correlation does not equal causation, but I think this established that BTC is as good as Gold for Oil.

What makes it better is the fact that countries can use it to seamlessly trade and transact without the hassle of storing and transporting gold across the world.

What makes it better is the fact that countries can use it to seamlessly trade and transact without the hassle of storing and transporting gold across the world.

So if you are the President of a country that is reliant on imported energy, stack some bitcoins.

It is the one thing that Russians and Americans can agree on.

It is the one thing that Russians and Americans can agree on.

Mentions

See All

Dylan LeClair @BTCization

·

Mar 31, 2022

nice thread man 💯💯