Thread

How high will inflation go? Forecasting it is an age-old problem.

Prediction markets have forecasted inflation correctly 85% of the time. Far better than any other method.

Here’s why it works and how you can take advantage:

Prediction markets have forecasted inflation correctly 85% of the time. Far better than any other method.

Here’s why it works and how you can take advantage:

Let’s start with our current methods for forecasting inflation.

1. Pundits, ie politically motivated important people

This group includes people that

A) we listen to (cause otherwise we wouldn’t even know or care about what they think or their forecast is)

1. Pundits, ie politically motivated important people

This group includes people that

A) we listen to (cause otherwise we wouldn’t even know or care about what they think or their forecast is)

B) have some incentives through their personal motivations and goals.

This includes politicians (cause they’re *obviously* experts in all matters), government economists, J Powell, CNN news anchors, etc.

This includes politicians (cause they’re *obviously* experts in all matters), government economists, J Powell, CNN news anchors, etc.

They all have an incentive to weigh in on inflation cause their success at their jobs is tied to it.

They also all have an incentive to make inflation “look” a certain way.

Fed Chair Powell was looking to get renominated, so he needed inflation to be “transitory”...

They also all have an incentive to make inflation “look” a certain way.

Fed Chair Powell was looking to get renominated, so he needed inflation to be “transitory”...

... otherwise, he’d get called out for turning on the money printing machine.

Biden needs inflation to seem under control, cause otherwise, the midterms won't look so good.

News anchors need to say stuff about inflation… or about anything really: they get paid to say stuff.

Biden needs inflation to seem under control, cause otherwise, the midterms won't look so good.

News anchors need to say stuff about inflation… or about anything really: they get paid to say stuff.

The White House’s November forecast for inflation was laughable: they forecasted 4.7% inflation for the year.

It looks like it has the potential to be 1.5-2x that…

Pretty off.

www.bloomberg.com/news/articles/2022-03-28/biden-budget-predicts-inflation-slowdown-it-knows-won-t-ha...

It looks like it has the potential to be 1.5-2x that…

Pretty off.

www.bloomberg.com/news/articles/2022-03-28/biden-budget-predicts-inflation-slowdown-it-knows-won-t-ha...

2. Economists’ surveys, ie. “I am never wrong” experts.

Economist surveys are the most popular forecasting method. Bloomberg is often considered the gold standard.

Is there skin in the game here? Not really.

Economist surveys are the most popular forecasting method. Bloomberg is often considered the gold standard.

Is there skin in the game here? Not really.

When economists are right, they tweet about it.

When they’re wrong, well… they just don't... and hope people forget.

All upside. No downside.

Actually, I’ll be more nuanced: there could be some downside in a very specific case.

When they’re wrong, well… they just don't... and hope people forget.

All upside. No downside.

Actually, I’ll be more nuanced: there could be some downside in a very specific case.

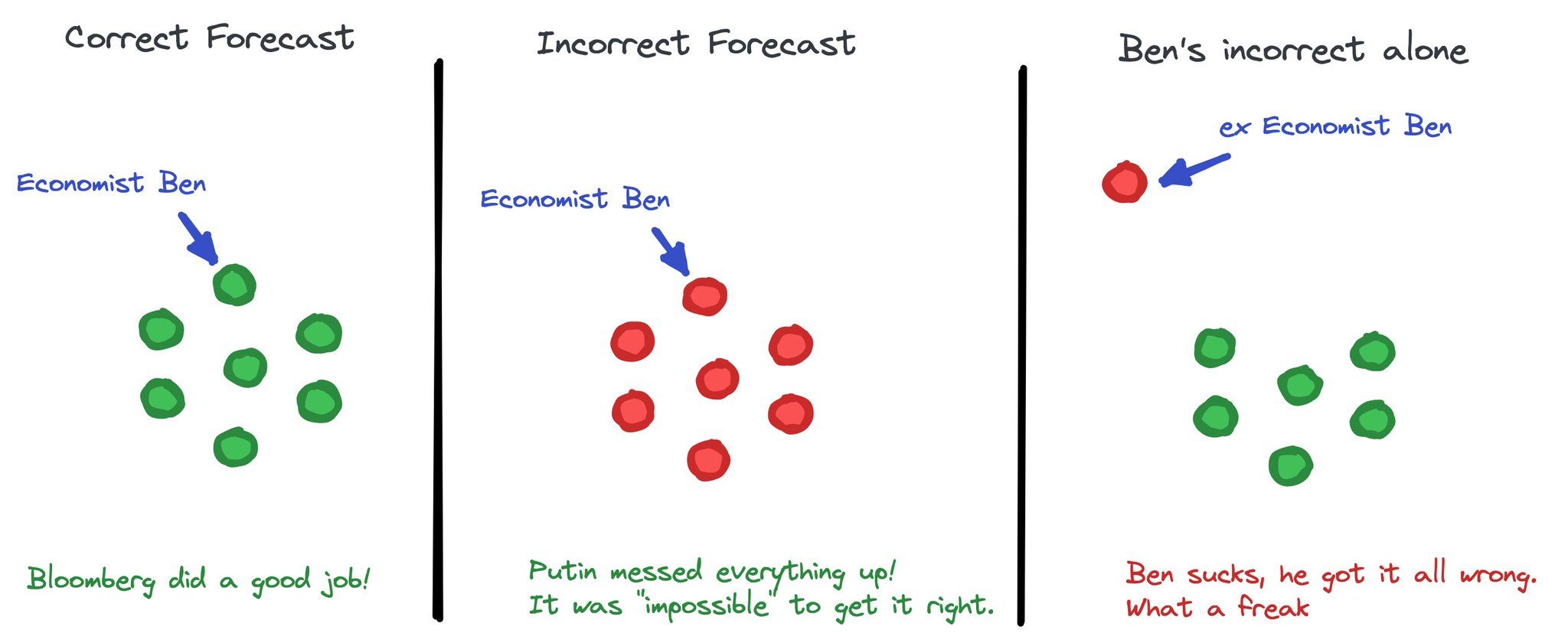

Imagine you’re a fancy economist. You’re always right… right?

Yes, *obviously* you are cause you’re the expert.

But sometimes, you’re wrong. Shameful!

…unless everyone else was wrong:

Then it’s not your fault, it’s the economy’s fault, or Putin’s, or Will Smith’s slap…

Yes, *obviously* you are cause you’re the expert.

But sometimes, you’re wrong. Shameful!

…unless everyone else was wrong:

Then it’s not your fault, it’s the economy’s fault, or Putin’s, or Will Smith’s slap…

The point is: as long as you’re not the only one who was wrong, you get to blame something else for why your forecast was off.

If you sucked, but everybody sucked just as much, then you’re good.

The most important thing is to avoid being a loner.

If you sucked, but everybody sucked just as much, then you’re good.

The most important thing is to avoid being a loner.

This screws up the forecasting process.

Instead of trying to forecast right, you try to vote with the others, so that you’re not the freak.

In surveys, economists end up voting based on how they think others will vote rather than what they actually think will happen.

Instead of trying to forecast right, you try to vote with the others, so that you’re not the freak.

In surveys, economists end up voting based on how they think others will vote rather than what they actually think will happen.

The result?

The survey predicted that inflation will be 0.4% in January, well below the actual number, which was 0.6%.

They have actually underestimated the inflation print 8 out of 10 times in the last 10 months...

Pretty lame.

The survey predicted that inflation will be 0.4% in January, well below the actual number, which was 0.6%.

They have actually underestimated the inflation print 8 out of 10 times in the last 10 months...

Pretty lame.

3. Using Markets

Prediction markets are simple: they’re financial exchanges that allow people to trade directly on the outcome of events.

The markets at Kalshi have forecasted inflation correctly 6/7 times since July…

85% accuracy… and we’re just getting started. How?

Prediction markets are simple: they’re financial exchanges that allow people to trade directly on the outcome of events.

The markets at Kalshi have forecasted inflation correctly 6/7 times since July…

85% accuracy… and we’re just getting started. How?

Unlike traditional economic commentators, traders have skin in the game and the right incentives:

They need to be right cause they make money if they are and they lose money if they’re not.

No politics, no reputation, no BS… just simple, clean logic: be right, make money.

They need to be right cause they make money if they are and they lose money if they’re not.

No politics, no reputation, no BS… just simple, clean logic: be right, make money.

This holds true for any type of market (stocks, commodities, derivatives, crypto, etc.) and it’s why I am a fan of markets.

Markets do a phenomenal job at “price basing” or price discovery: they aggregate people’s beliefs in an elegant way to figure out the truth.

Markets do a phenomenal job at “price basing” or price discovery: they aggregate people’s beliefs in an elegant way to figure out the truth.

Why are markets so good at pricing?

A) people are more honest/careful when it comes to money

B) the markets are a good weighing mechanism: the stronger your belief, the more money you put in

In prediction markets, price discovery is probability discovery: price = forecast.

A) people are more honest/careful when it comes to money

B) the markets are a good weighing mechanism: the stronger your belief, the more money you put in

In prediction markets, price discovery is probability discovery: price = forecast.

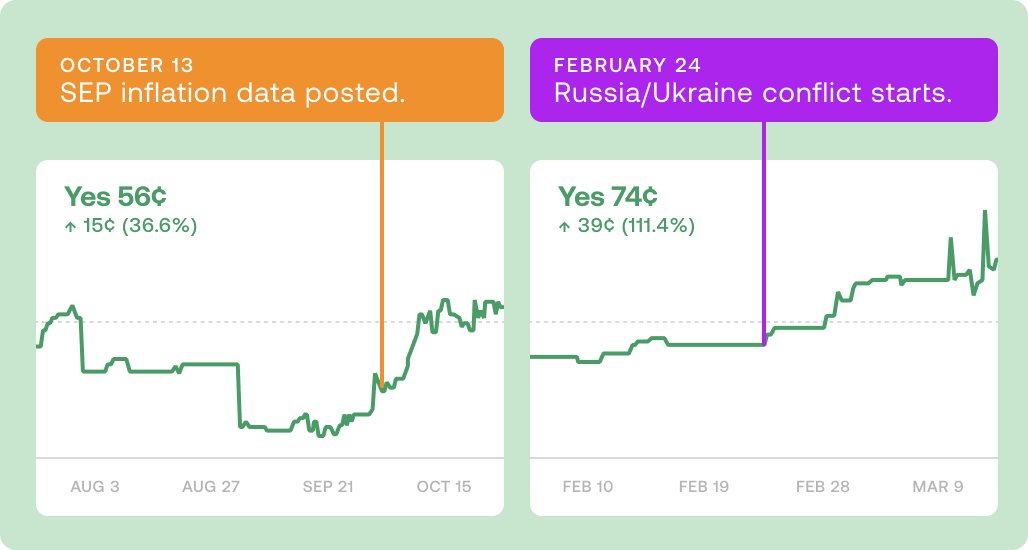

The other big advantage of prediction markets: they provide updates in real-time, by instantly reflecting new developments and economic realities.

Instead of just saying the forecast was wrong because of Putin, they incorporate new information and developments into the price…

Instead of just saying the forecast was wrong because of Putin, they incorporate new information and developments into the price…

Prediction markets will get increasingly more accurate over time.

Accurate traders will do better in the market, accumulate more resources, and so have a bigger say in future predictions.

Long term, I hope that we can all switch to trusting markets when it comes to forecasts.

Accurate traders will do better in the market, accumulate more resources, and so have a bigger say in future predictions.

Long term, I hope that we can all switch to trusting markets when it comes to forecasts.

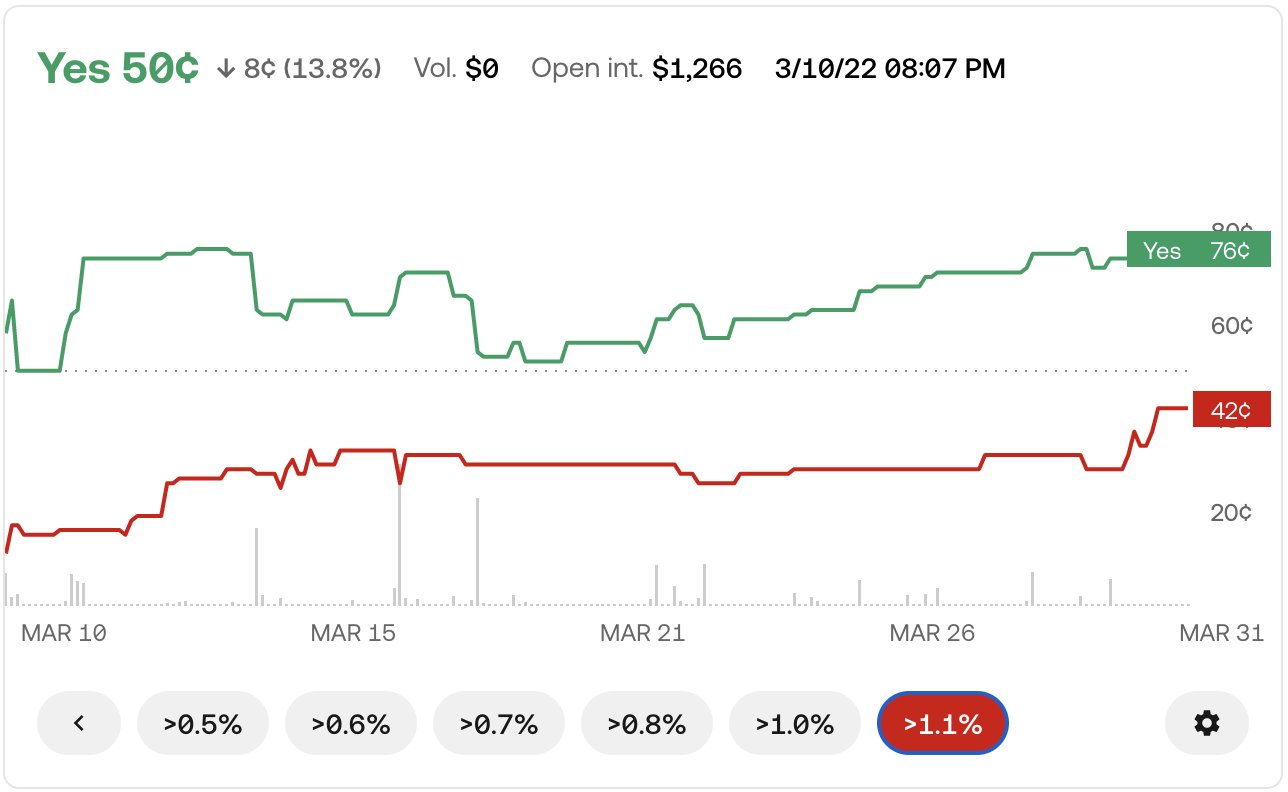

Outlook for future inflation?

Currently, Kalshi’s markets are predicting an 76% chance of inflation above 0.9% in March and 42% chance of inflation above 1.1%:

kalshi.com/events/CPI-22MAR/markets/CPI-22MAR-T0.5

Currently, Kalshi’s markets are predicting an 76% chance of inflation above 0.9% in March and 42% chance of inflation above 1.1%:

kalshi.com/events/CPI-22MAR/markets/CPI-22MAR-T0.5