Thread

1/

I'm not a reg. financial advisor.

For that you take a Series65 Exam, fill registration forms, and prove $10k in assets.

Then make $85k advising ppl to split $ btw stock ETFs and gvt bonds (by counting years to retirement).

Cool story bro. Here's the real stuff for free 👇

I'm not a reg. financial advisor.

For that you take a Series65 Exam, fill registration forms, and prove $10k in assets.

Then make $85k advising ppl to split $ btw stock ETFs and gvt bonds (by counting years to retirement).

Cool story bro. Here's the real stuff for free 👇

2/

100% of the population need to be able to manage their own finances:

Lawyers, construction workers, teachers..

My mother was a prudent college professor, but in 2013 she still lost a chunk of her life savings listening to her local banker's "safe and professional" advice.

100% of the population need to be able to manage their own finances:

Lawyers, construction workers, teachers..

My mother was a prudent college professor, but in 2013 she still lost a chunk of her life savings listening to her local banker's "safe and professional" advice.

3/

The problem is that the financial system is so complex that unless you spend years digging in, you cant achieve full financial literacy.

Indeed, it would be suboptimal for society if everyone spent their waking lives learning this instead of working on what they are best at.

The problem is that the financial system is so complex that unless you spend years digging in, you cant achieve full financial literacy.

Indeed, it would be suboptimal for society if everyone spent their waking lives learning this instead of working on what they are best at.

4/

I'm not going to try to teach people how to make or save up money-

I've never been a "make coffee at home and save $4.69/day" kinda guy.

I suggest @LynAldenContact for how to build up: www.lynalden.com/financial-freedom/

Rather I'll discuss what you can do once you have large savings.

I'm not going to try to teach people how to make or save up money-

I've never been a "make coffee at home and save $4.69/day" kinda guy.

I suggest @LynAldenContact for how to build up: www.lynalden.com/financial-freedom/

Rather I'll discuss what you can do once you have large savings.

5/

Say you're a young person lucky enough to have come into a good amount of cash-

Maybe it was from a trust fund/inheritance, or maybe you earned it as an athlete or by selling your specialty business.

How to keep your purchasing power through inflation, without over-risking?

Say you're a young person lucky enough to have come into a good amount of cash-

Maybe it was from a trust fund/inheritance, or maybe you earned it as an athlete or by selling your specialty business.

How to keep your purchasing power through inflation, without over-risking?

6/

The world is changing fast and its important to stay with the times to avoid getting rekt.

Traditionally there are these 5 main asset classes.

(btw LOL at the cow being below the bonds on returns)

I would now add Crypto as an important emerging 6th asset class.

The world is changing fast and its important to stay with the times to avoid getting rekt.

Traditionally there are these 5 main asset classes.

(btw LOL at the cow being below the bonds on returns)

I would now add Crypto as an important emerging 6th asset class.

7/

1. Bonds: Understand that 60-40 is dead. Young people should have exactly 0% in gvt bonds now.

We are at the end of the long-term debt cycle.

Read @RayDalio to understand this deeper, but as @biancoresearch has said, the multi-decade bull market in bonds ended in 2020.

1. Bonds: Understand that 60-40 is dead. Young people should have exactly 0% in gvt bonds now.

We are at the end of the long-term debt cycle.

Read @RayDalio to understand this deeper, but as @biancoresearch has said, the multi-decade bull market in bonds ended in 2020.

8/

Bonds pay close to nothing, and when you factor in inflation they pay negative real returns.

They have historically been countercyclical because the Central banks would cut rates during slowdowns.

But with such high and persistent inflation, that is no longer the case.

Bonds pay close to nothing, and when you factor in inflation they pay negative real returns.

They have historically been countercyclical because the Central banks would cut rates during slowdowns.

But with such high and persistent inflation, that is no longer the case.

9/

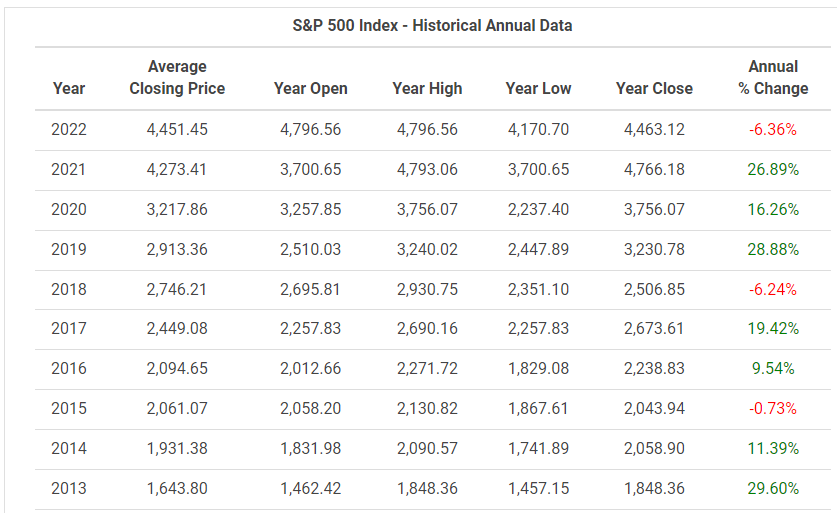

2. Equities. The end of the debt cycle affects equity returns too.

Equities are a car and monetary easing is the gas in the tank.

Real returns are the car's speed and we have used up too much gas to get these unsustainable returns during 2013 to 2021.

2. Equities. The end of the debt cycle affects equity returns too.

Equities are a car and monetary easing is the gas in the tank.

Real returns are the car's speed and we have used up too much gas to get these unsustainable returns during 2013 to 2021.

10/

Nature is balancing and the reality is the REAL economy doesn't grow at 20% a year.

With little gas left in the tank, real returns (adjusted for inflation) will likely be close to zero for many years to come now.

So what to do as an investor?

Nature is balancing and the reality is the REAL economy doesn't grow at 20% a year.

With little gas left in the tank, real returns (adjusted for inflation) will likely be close to zero for many years to come now.

So what to do as an investor?

11/

I think 20% in a low cost SP500 ETF is still an ok long-term allocation.

At the end of the day, the stock market is the ultimate ponzi but it is a government-supported one.

Follow incentives- if decision makers are all invested, they won't let things collapse completely.

I think 20% in a low cost SP500 ETF is still an ok long-term allocation.

At the end of the day, the stock market is the ultimate ponzi but it is a government-supported one.

Follow incentives- if decision makers are all invested, they won't let things collapse completely.

12/

3. Property. In terms of REITS and investing in commercial Real Estate, the reality is it's all very bespoke and tricky to navigate.

I would say the guiding principles are same as investing in NFTs- think about what property is easy to print more of, and what is unique.

3. Property. In terms of REITS and investing in commercial Real Estate, the reality is it's all very bespoke and tricky to navigate.

I would say the guiding principles are same as investing in NFTs- think about what property is easy to print more of, and what is unique.

13/

It can be a good investment if you pick the right properties but it takes a lot of expertise to do that and I wouldn't suggest it for average investors.

Otoh owning a place you plan to live in for a long time can be a great investment for your life, even if not monetarily.

It can be a good investment if you pick the right properties but it takes a lot of expertise to do that and I wouldn't suggest it for average investors.

Otoh owning a place you plan to live in for a long time can be a great investment for your life, even if not monetarily.

14/

Investment property is tricky to navigate, but it can make sense sometimes.

I still would take into account how likely the country its is in is to impose more taxes on it in the case of a recession. E.g. I'd be unseasy in the UK.

15-20% depending on personal circumstances.

Investment property is tricky to navigate, but it can make sense sometimes.

I still would take into account how likely the country its is in is to impose more taxes on it in the case of a recession. E.g. I'd be unseasy in the UK.

15-20% depending on personal circumstances.

15/

4. Commodities- lets address the Cow in the room.

Commodities prices have been a big story lately, with violent up-moves in everything from oil to wheat and nickel.

In many ways this is to be expected in an inflationary environment with increasing geopolitical tension.

4. Commodities- lets address the Cow in the room.

Commodities prices have been a big story lately, with violent up-moves in everything from oil to wheat and nickel.

In many ways this is to be expected in an inflationary environment with increasing geopolitical tension.

16/

There's several issues with investing in commodities though, with the main one being that direct exposure through futures means you are exposed to the cost of constantly rolling those futures.

A commodity ETF does the rolling for you but its just going to pass down the cost.

There's several issues with investing in commodities though, with the main one being that direct exposure through futures means you are exposed to the cost of constantly rolling those futures.

A commodity ETF does the rolling for you but its just going to pass down the cost.

17/

With many commodities being in 'contango' you can lose a lot of your money even in a sideways market.

Contango means the long dated futures are more expensive than the short dated ones.

ETFs like USO (oil) bleed a ton over time due to this. Its down despite oil being 🚀:

With many commodities being in 'contango' you can lose a lot of your money even in a sideways market.

Contango means the long dated futures are more expensive than the short dated ones.

ETFs like USO (oil) bleed a ton over time due to this. Its down despite oil being 🚀:

18/

There's a reason why firms like Jane Street make a killing trading ETFs, and you don't want to be constantly on the other side of their frontrunning.

Still, its reasonable to invest 10% in the sector during such inflationary periods. Just try to pick your poison on the fees.

There's a reason why firms like Jane Street make a killing trading ETFs, and you don't want to be constantly on the other side of their frontrunning.

Still, its reasonable to invest 10% in the sector during such inflationary periods. Just try to pick your poison on the fees.

19/

You could divide that between things like:

-Commodity producers ETF like $GUNR

-Gold $GLD

-Uranium $URA

If you have access to futures through IB for example, you can instead buy Dec' expiry futures and roll once/twice year to the next year Dec.

E.g. on CME:

CLZ2, GCZ2

You could divide that between things like:

-Commodity producers ETF like $GUNR

-Gold $GLD

-Uranium $URA

If you have access to futures through IB for example, you can instead buy Dec' expiry futures and roll once/twice year to the next year Dec.

E.g. on CME:

CLZ2, GCZ2

20/

5. Cash

"Cash is trash" Dalio likes to say, and indeed with inflation at 10% keeping $ in a non-yielding bank account is a steady squeeze on your purchasing power.

Still its good to have liquidity, for unexpected expenses and to have dry powder for opportunities.

5. Cash

"Cash is trash" Dalio likes to say, and indeed with inflation at 10% keeping $ in a non-yielding bank account is a steady squeeze on your purchasing power.

Still its good to have liquidity, for unexpected expenses and to have dry powder for opportunities.

21/

For the modern portfolio cash doesn't mean it has to be sitting in a Wells Fargo account getting slowly wasted like the bills in Pablo Escobar's back yard.

Instead it would better to learn how to turn it into stablecoins and yield farm to generate above the 10% CPI bar.

For the modern portfolio cash doesn't mean it has to be sitting in a Wells Fargo account getting slowly wasted like the bills in Pablo Escobar's back yard.

Instead it would better to learn how to turn it into stablecoins and yield farm to generate above the 10% CPI bar.

22/

Converting to $USDC through Circle or by depositing into an exchange like FTX opens up the door to defi yields which are much more attractive that traditional money markets.

Most of it should stay in safe and tested protocols, and there are various options for 10%+ yields.

Converting to $USDC through Circle or by depositing into an exchange like FTX opens up the door to defi yields which are much more attractive that traditional money markets.

Most of it should stay in safe and tested protocols, and there are various options for 10%+ yields.

23/

20-30% of your assets in stablecoins makes sense if you are young and willing to learn to navigate the defi space.

Bonus points- the experience you gain navigating blockchains and onchain-wallets will be valuable to have far into the future as we digitize further.

20-30% of your assets in stablecoins makes sense if you are young and willing to learn to navigate the defi space.

Bonus points- the experience you gain navigating blockchains and onchain-wallets will be valuable to have far into the future as we digitize further.

24/

6. Crypto- the Newest asset class.

With $2tn in market cap and institutions of all sorts jumping in, a modern portfolio simply cannot ignore cryptocurrencies.

$BTC should replace a portfolio's Gold allocation, and some of the other coins are the new tech stocks to have.

6. Crypto- the Newest asset class.

With $2tn in market cap and institutions of all sorts jumping in, a modern portfolio simply cannot ignore cryptocurrencies.

$BTC should replace a portfolio's Gold allocation, and some of the other coins are the new tech stocks to have.

25/

I suggest holding 25% in BTC and 5-10% in a diversified portfolio of quality coins like ETH and ATOM-

And if over time one manages to become very educated in the space, even newer things a bit further down the risk curve in bite-size. They can produce huge outsized returns.

I suggest holding 25% in BTC and 5-10% in a diversified portfolio of quality coins like ETH and ATOM-

And if over time one manages to become very educated in the space, even newer things a bit further down the risk curve in bite-size. They can produce huge outsized returns.

26/26

So in Summary, my totally NOT 'financial advice' advice to a young person wanting to set a financial basis for their future-

Bonds: 0%

Equities: 20% low cost-index ETF

Real Estate: 15-20%

Commodities: 10%

Cash: 20% in stablecoins

Crypto: 25% BTC, 5-10% Alts

++education

So in Summary, my totally NOT 'financial advice' advice to a young person wanting to set a financial basis for their future-

Bonds: 0%

Equities: 20% low cost-index ETF

Real Estate: 15-20%

Commodities: 10%

Cash: 20% in stablecoins

Crypto: 25% BTC, 5-10% Alts

++education