Thread

I’m worried about America’s energy security.

In just a few weeks, Putin’s war has disproven key tenets of US oil policy, and it’s rapidly downgraded America’s role in the clean-energy transition.

I want to spin out a few of those thoughts here.

www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

In just a few weeks, Putin’s war has disproven key tenets of US oil policy, and it’s rapidly downgraded America’s role in the clean-energy transition.

I want to spin out a few of those thoughts here.

www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

1/ For decades, the US has followed a few plays whenever oil prices spike:

1. Ask Saudi Arabia to drill more.

2. Invest in “US energy independence”—that is, drill more oil & gas domestically.

3. Fund alternative-energy R&D to cut long-term oil demand. www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

1. Ask Saudi Arabia to drill more.

2. Invest in “US energy independence”—that is, drill more oil & gas domestically.

3. Fund alternative-energy R&D to cut long-term oil demand. www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

2/ We can debate whether every president was sincere about every part of the playbook. But the idea—the economy needs oil in the short term, but we must cut oil demand in the long term—was bipartisan. Here’s George W. Bush making the key point in 2008. www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

3/ Over the past few weeks and months, every tenet of that plan has failed or been abandoned.

Start with Step #1: “Ask Saudi Arabia to drill more.”

Start with Step #1: “Ask Saudi Arabia to drill more.”

4/ It’s not working. Saudi Arabia has resisted *months* of Biden admin requests to increase production.

Yes, Aramco finally said today that it will drill more. But its statement is full of asterisks and it’s too little, too late given rising demand.

Yes, Aramco finally said today that it will drill more. But its statement is full of asterisks and it’s too little, too late given rising demand.

5/ Step #2: Embrace US “energy independence.”

This one… already happened.

In 2019, for the first time in 62 years, US energy production exceeded US energy consumption. America is now the world’s largest producer of oil and natural gas.

www.eia.gov/todayinenergy/detail.php?id=43515

This one… already happened.

In 2019, for the first time in 62 years, US energy production exceeded US energy consumption. America is now the world’s largest producer of oil and natural gas.

www.eia.gov/todayinenergy/detail.php?id=43515

6/ But far from winning us independence, America’s massive oil & gas production has made us *dependent* on market whim.

That’s because oil prices are set on the global market. So when Russia invaded Ukraine, oil and gasoline prices soared everywhere. apnews.com/article/russia-ukraine-business-europe-global-trade-prices-05ba4a25cbee9b5281804d3a5b60f05...

That’s because oil prices are set on the global market. So when Russia invaded Ukraine, oil and gasoline prices soared everywhere. apnews.com/article/russia-ukraine-business-europe-global-trade-prices-05ba4a25cbee9b5281804d3a5b60f05...

7/ If we have all those oil reserves, you might ask, why doesn’t the US drill more, then?

Because nobody has that power.

Biden can’t compel companies to drill. And oil firms have sworn to investors that NOTHING—even $150 oil—will make them drill more.

www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

Because nobody has that power.

Biden can’t compel companies to drill. And oil firms have sworn to investors that NOTHING—even $150 oil—will make them drill more.

www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

8/ What’s darkly funny is that the triumph of US “energy independence” is also part of why Saudi Arabia won’t listen to us.

In the 2000s, the US was Saudi’s largest customer. Now, as @MattZeitlin has reported, we’re also their largest competitor. www.grid.news/story/economy/2022/03/03/why-its-so-hard-to-sanction-russias-global-energy-trade/

In the 2000s, the US was Saudi’s largest customer. Now, as @MattZeitlin has reported, we’re also their largest competitor. www.grid.news/story/economy/2022/03/03/why-its-so-hard-to-sanction-russias-global-energy-trade/

9/ That brings us to the last step: “Fund alternative-energy R&D.”

If the US led research into wind, solar, nuclear, EVs, and more, then one day they might become cheap enough that we could—to quote noted environmentalist George W. Bush—“end our addiction to oil.”

If the US led research into wind, solar, nuclear, EVs, and more, then one day they might become cheap enough that we could—to quote noted environmentalist George W. Bush—“end our addiction to oil.”

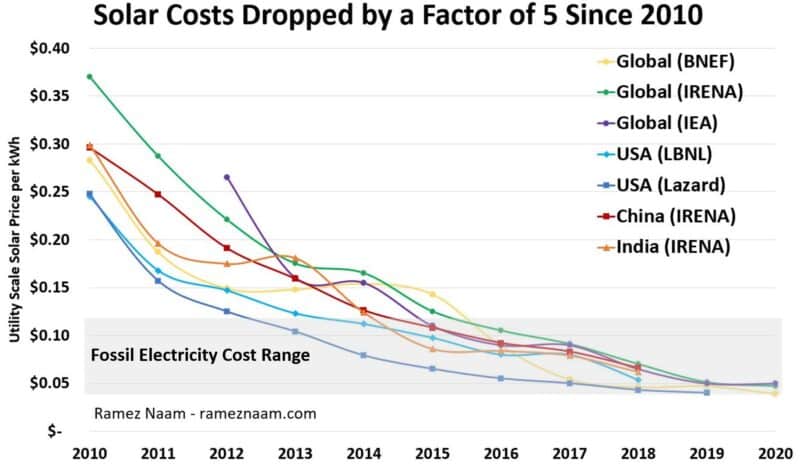

10/ That has happened. Clean energy became cheap. Over the past decade, wind, solar, batteries & EVs have come down the cost curve. They are now ready to be deployed across the country.

rameznaam.com/2020/05/14/solars-future-is-insanely-cheap-2020/

rameznaam.com/2020/05/14/solars-future-is-insanely-cheap-2020/

11/ And a few months ago, Congress was writing a bill to do that. It seemed like the 50-year dream of US energy policy was finally coming true.

Then the talks fell apart. Now Dem leaders despair at passing even a small energy bill.

Then the talks fell apart. Now Dem leaders despair at passing even a small energy bill.

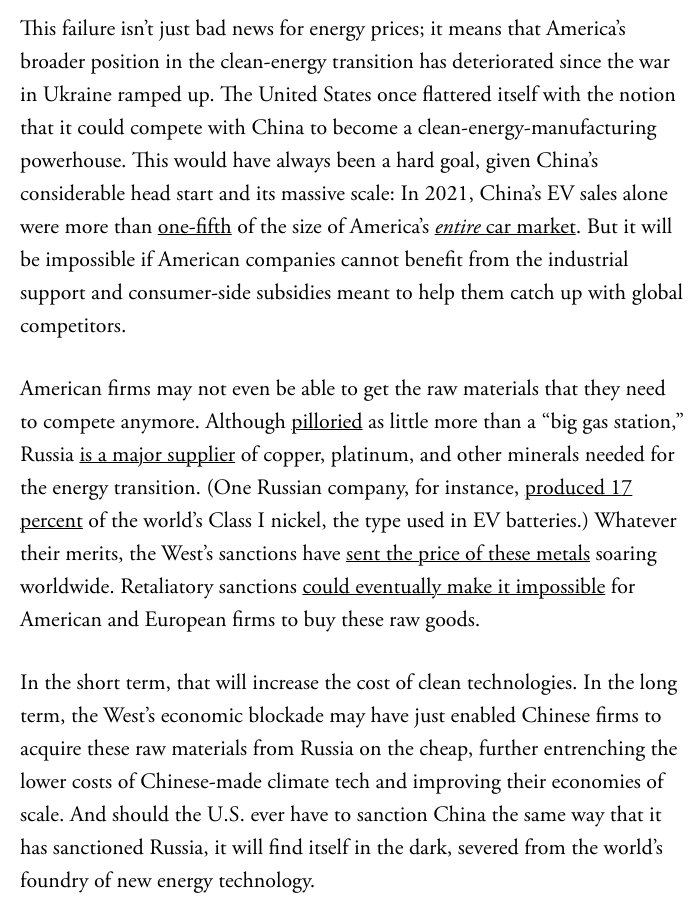

12/ At the same time, Putin’s war has further weakened America’s hand.

As @jholz__ has reported, Russia is a major supplier of key metals needed for clean-energy supply. Geopolitical tumult + the risk of secondary sanctions have sent prices soaring. www.eenews.net/articles/rising-metals-prices-threaten-u-s-green-energy-push/

As @jholz__ has reported, Russia is a major supplier of key metals needed for clean-energy supply. Geopolitical tumult + the risk of secondary sanctions have sent prices soaring. www.eenews.net/articles/rising-metals-prices-threaten-u-s-green-energy-push/

13/ These two factors have rapidly shifted America’s role in any clean-energy transition.

For now, Chinese firms will retain their scale & policy advantage over US firms—and they may have also just gained access to a source of cheap mineral inputs.

www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

For now, Chinese firms will retain their scale & policy advantage over US firms—and they may have also just gained access to a source of cheap mineral inputs.

www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

14/ So to summarize:

• The US can’t trust Saudi Arabia to help in an oil shock

• The US can’t benefit from its oil industry in an oil shock

• The US isn’t deploying tech that would eliminate oil shocks

• China has further entrenched its advantage in clean energy

• The US can’t trust Saudi Arabia to help in an oil shock

• The US can’t benefit from its oil industry in an oil shock

• The US isn’t deploying tech that would eliminate oil shocks

• China has further entrenched its advantage in clean energy

15/ All that would be bad enough for the US. But what worries me is that no major interest group in DC can really right the ship: The oil industry, the White House, and the climate movement are all stuck. Only Congress can help us now. www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

16/ But could Congress really act? That would require @Sen_JoeManchin to step up (and for @SenSchumer to work with him).

But I’m not sure anyone, even those more sympathetic to Manchin’s views, know what he believes or even wants to pass anymore. www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

But I’m not sure anyone, even those more sympathetic to Manchin’s views, know what he believes or even wants to pass anymore. www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

17/ So that’s why I’m so worried.

The question now is whether the US realizes that its energy policy *has already failed*—or whether we just muddle through, secure in our old fantasies, refusing to plan for a far worse crisis than this one.

www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

The question now is whether the US realizes that its energy policy *has already failed*—or whether we just muddle through, secure in our old fantasies, refusing to plan for a far worse crisis than this one.

www.theatlantic.com/science/archive/2022/03/energy-independence-gas-prices/627117/

If you enjoyed this thread, I write a weekly newsletter where I try to think through how climate change and the energy transition are already shaping our world. Subscribe here and join me: www.theatlantic.com/newsletters/sign-up/weekly-planet/

Mentions

See All

Noah Smith @NoahSmith

·

Mar 23, 2022

Important thread.