Thread by Skanda Amarnath ( Neoliberal Sellout )

- Tweet

- Mar 15, 2022

- #Laboureconomics

Thread

Now on the @employamerica blog:

March FOMC Preview: Two Cheers For The Fed's Commitment To Its Liftoff Guidance

www.employamerica.org/blog/march-fomc-preview/

March FOMC Preview: Two Cheers For The Fed's Commitment To Its Liftoff Guidance

www.employamerica.org/blog/march-fomc-preview/

Consensus is that the Fed is behind the curve, while the Fed itself seems to have fallen short of laying out what they really meant by "broad and inclusive" with respect to maximum employment.

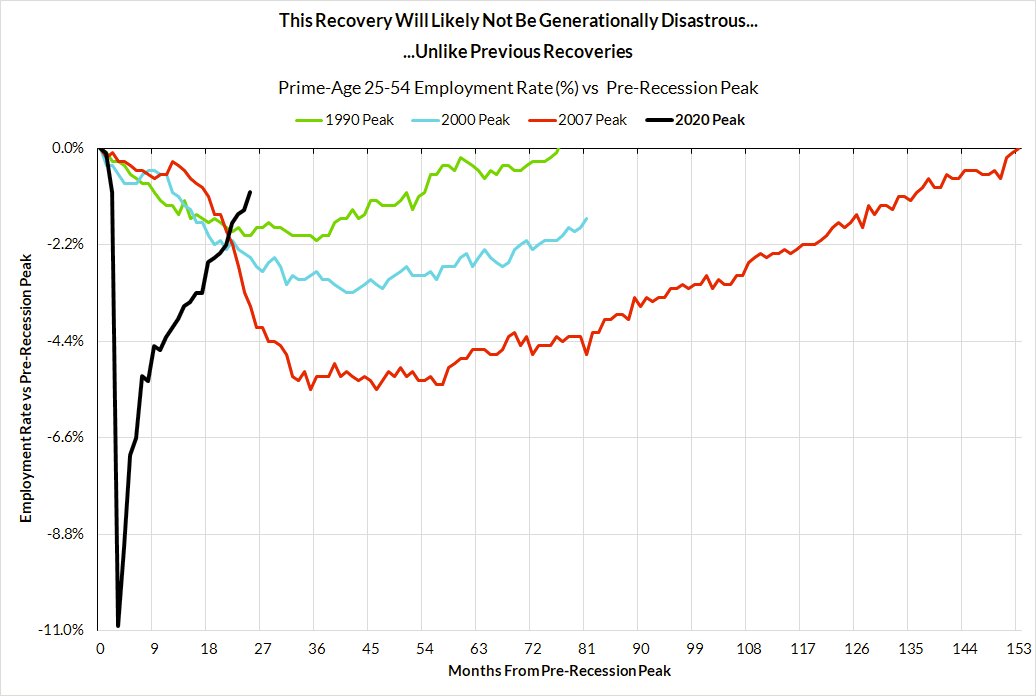

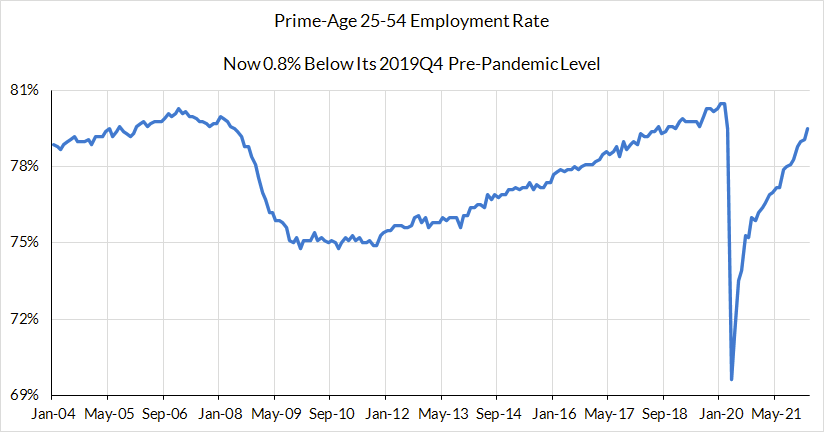

But we should take stock of what has been a historic labor market recovery.

But we should take stock of what has been a historic labor market recovery.

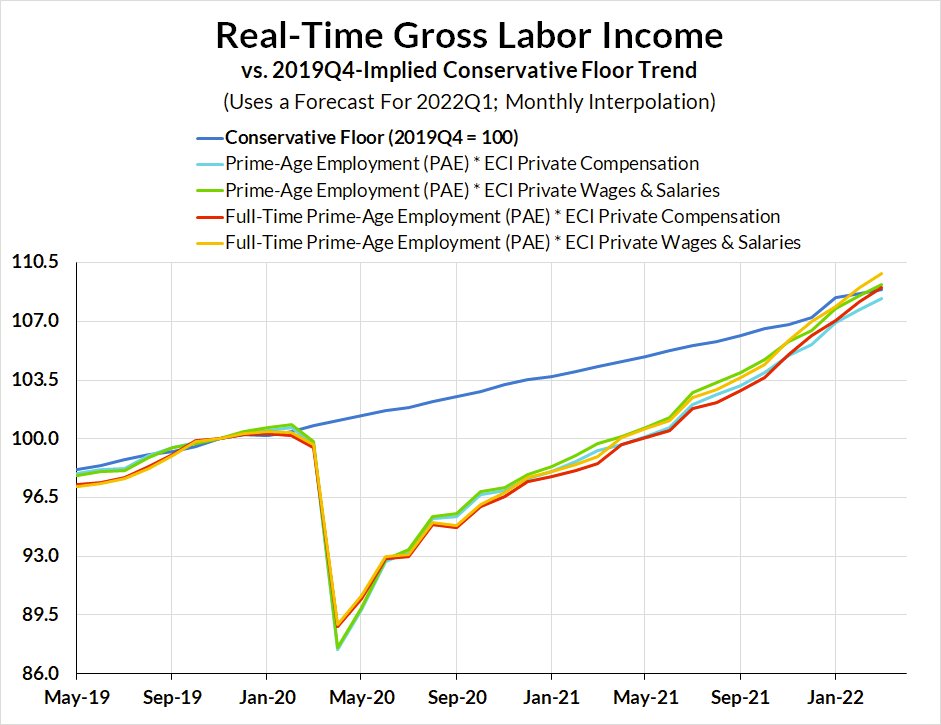

By our own framework (#FloorGLI) & benchmarks, we are likely to havefilled the aggregate employment and wage hole this month (March 2022)

The case for rate hikes is a case for slowing job growth and wage growth. Better to pursue such a policy only after bringing workers back in

The case for rate hikes is a case for slowing job growth and wage growth. Better to pursue such a policy only after bringing workers back in

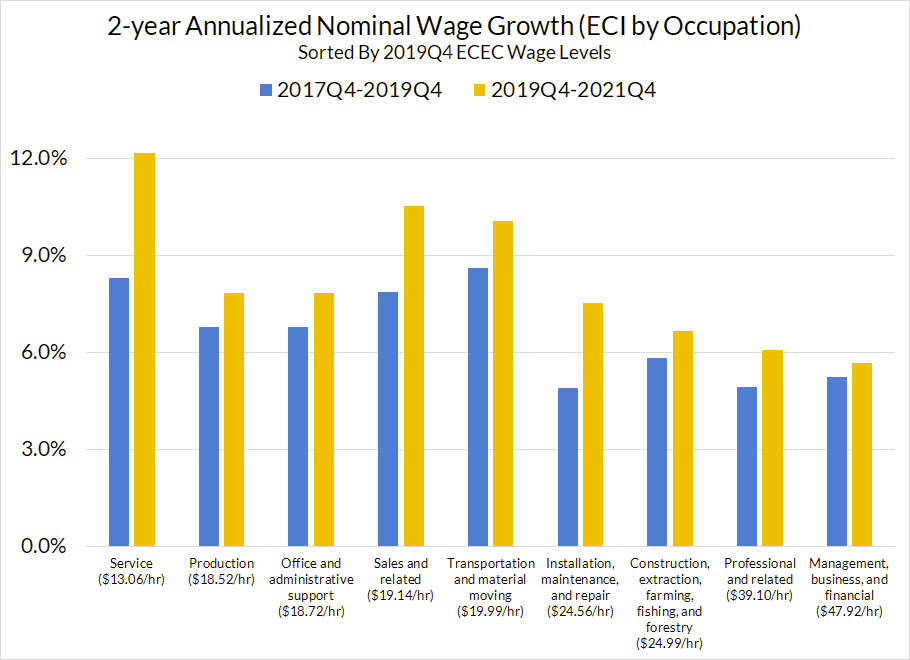

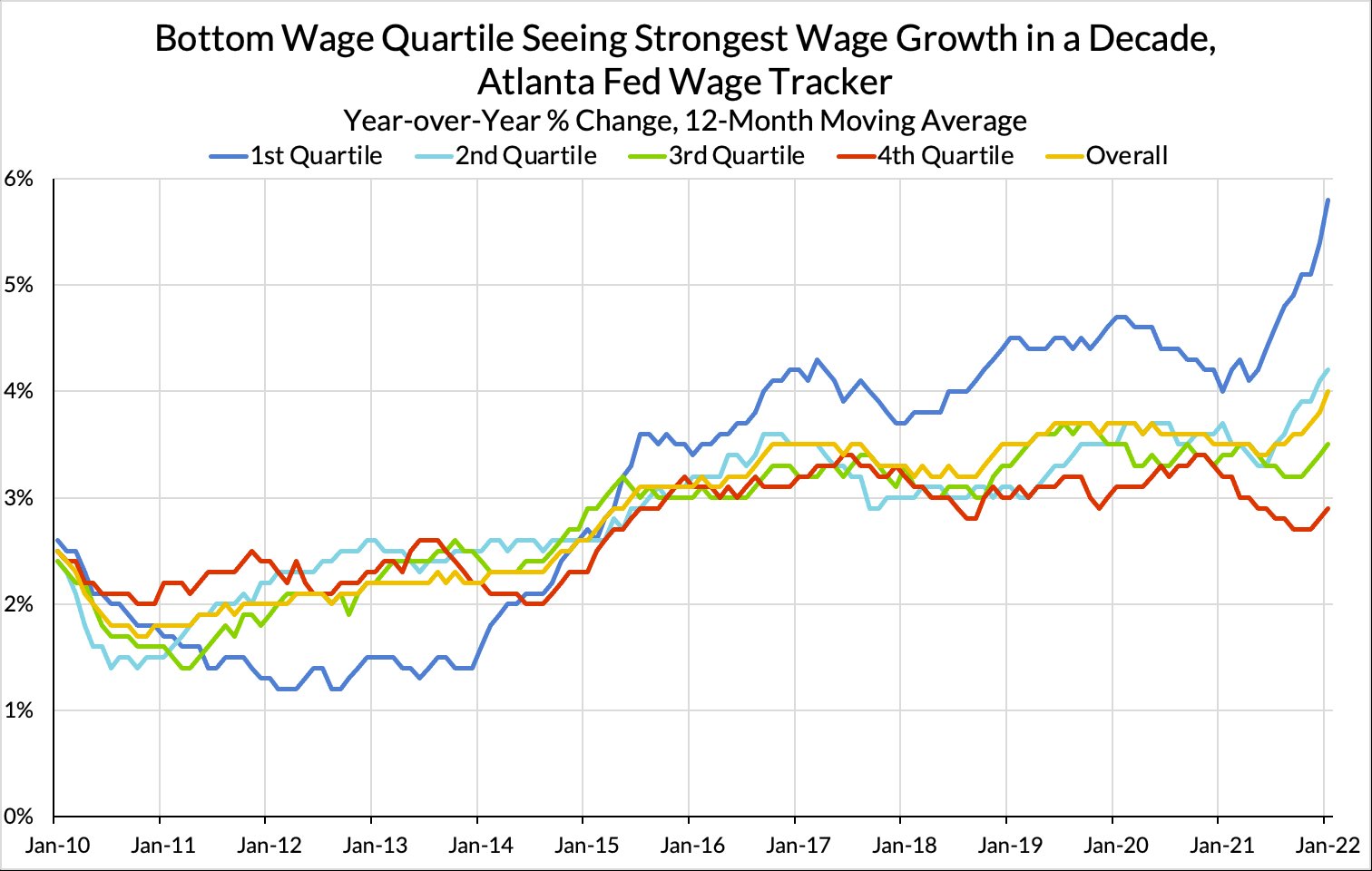

Aggregations of employment and wages certainly miss key communities that are systematically underrepresented and under-sampled in labor market statistics, but we have seen good evidence that labor market dynamics are more egalitarian right now.

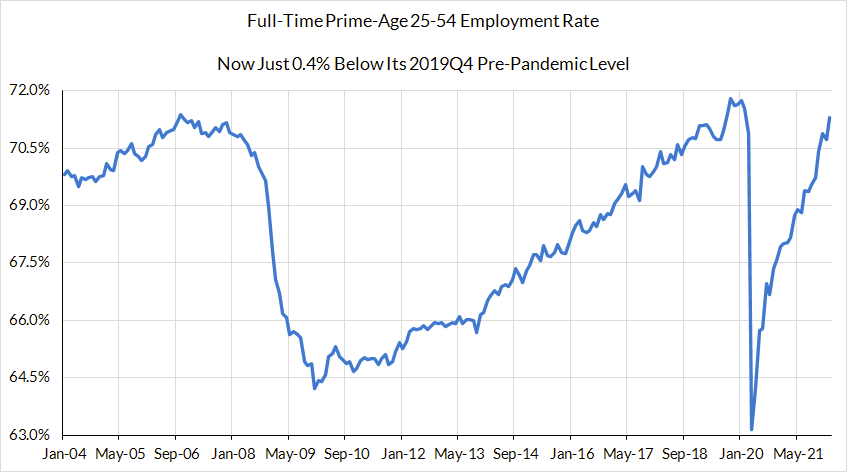

While gross labor income has recovered faster due to especially strong wage growth in 2021, even more robust measures of employment and labor utilization are nearing recovery.

Full-time prime-age employment could be back to pre-pandemic peak this month given current trends

Full-time prime-age employment could be back to pre-pandemic peak this month given current trends

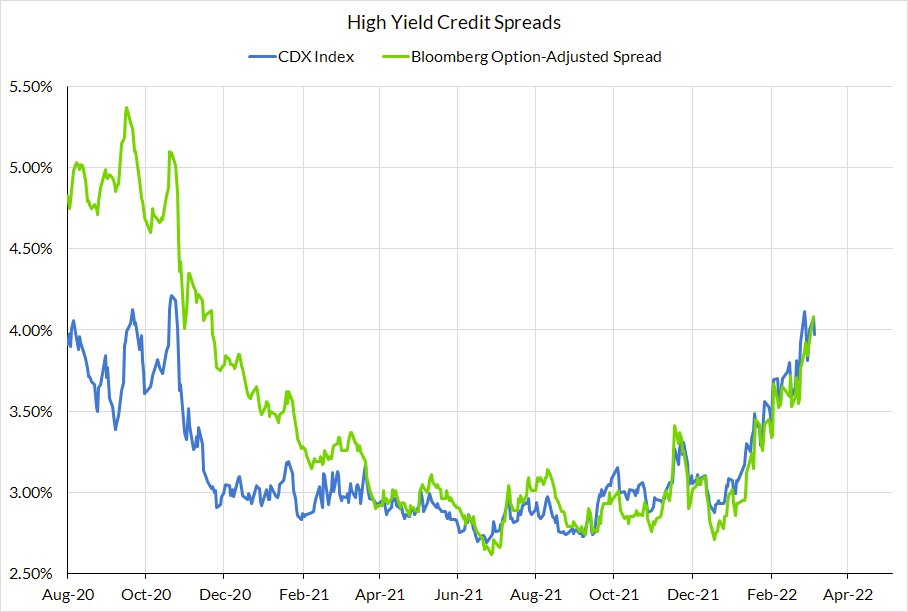

As for how quickly the Fed must hike, that decision must be a function of both economic forecasts and what we're already seeing in financial markets. Financial conditions are tightening in part due to expected rate hikes but with more amplified effect, given wider credit spreads

END/ Credit spread widening is a good gauge of slowdown/recession risk (& better than the outright level of interest rates). While current levels of credit spreads are not necessarily recessionary, the uncertain effects from current shocks calls for both prudence and adaptability

Mentions

See All

Joe Weisenthal @TheStalwart

·

Mar 15, 2022

Good thread on the historically rapid labor market recovery. Almost all the talk these days is about inflation, and whether behind the curve, and the fact that jobs came back blisteringly fast vs. historical patterns and the expectations of economists remains under-appreciated.