Thread by Nathan Benaich

- Tweet

- Mar 8, 2022

- #Investment #ArtificialIntelligence

Thread

Last month, a group of founders, investors and policy makers met to discuss the state of empirical computing in bio.

I'm sharing my take on AI-first bio investing below to hear what you think!

We're in a "fringe" space that has a rich history, an evolving playbook and open Qs:

I'm sharing my take on AI-first bio investing below to hear what you think!

We're in a "fringe" space that has a rich history, an evolving playbook and open Qs:

The use of software in biology dates back to the early 80s when designing drugs with computers was hailed as "the next industrial revolution".

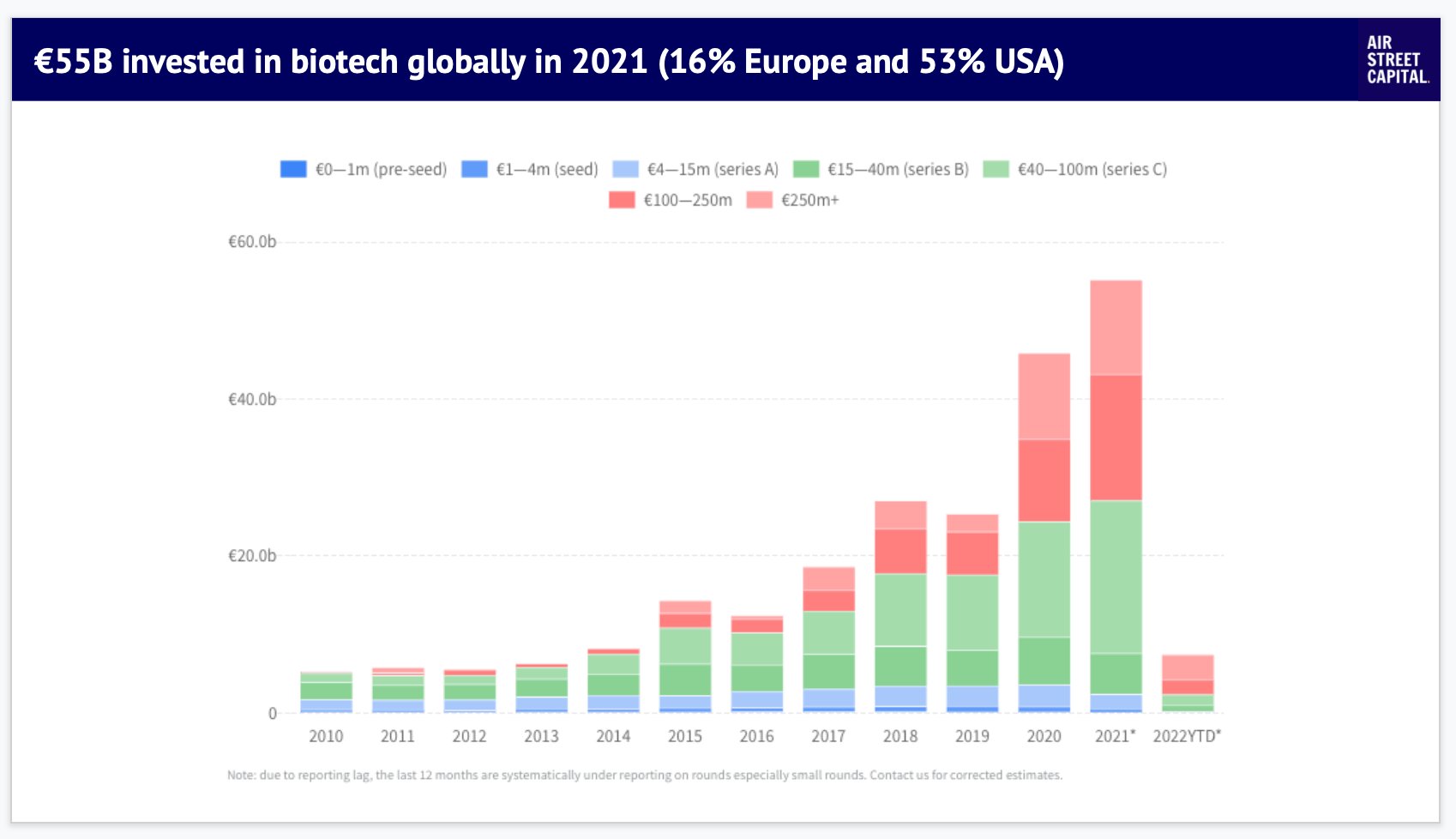

Today, private capital is rapidly flowing into biotech globally. Methods have evolved dramatically, so it's day 1 for AI-first biotech.

Today, private capital is rapidly flowing into biotech globally. Methods have evolved dramatically, so it's day 1 for AI-first biotech.

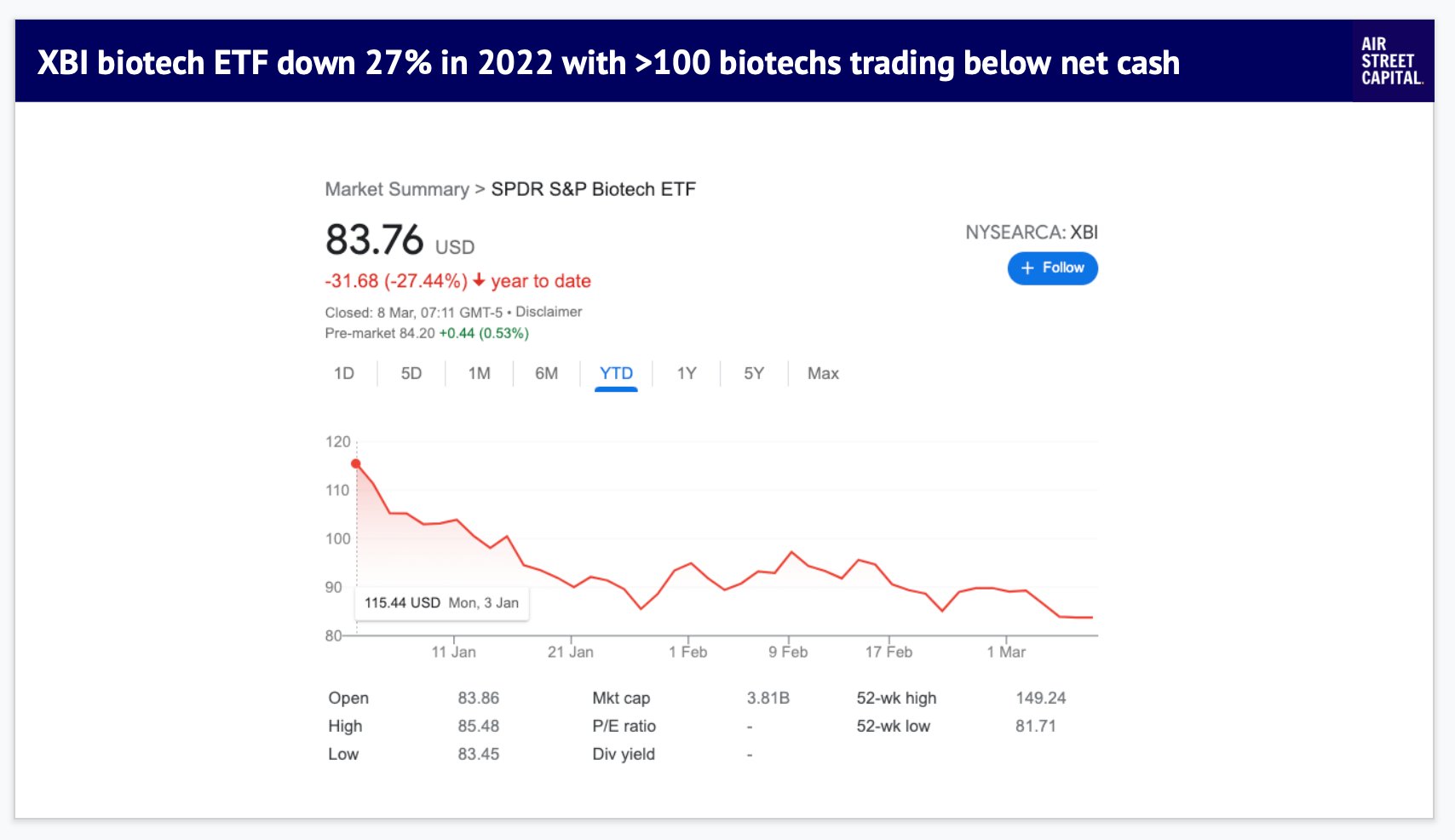

Meanwhile, in the public markets, biotechs have taken a beating this year (along with the broader market). This has been documented ad nauseam.

Tons of public biotechs trade at extremely low multiples of their cash on balance, some even below net cash...

Tons of public biotechs trade at extremely low multiples of their cash on balance, some even below net cash...

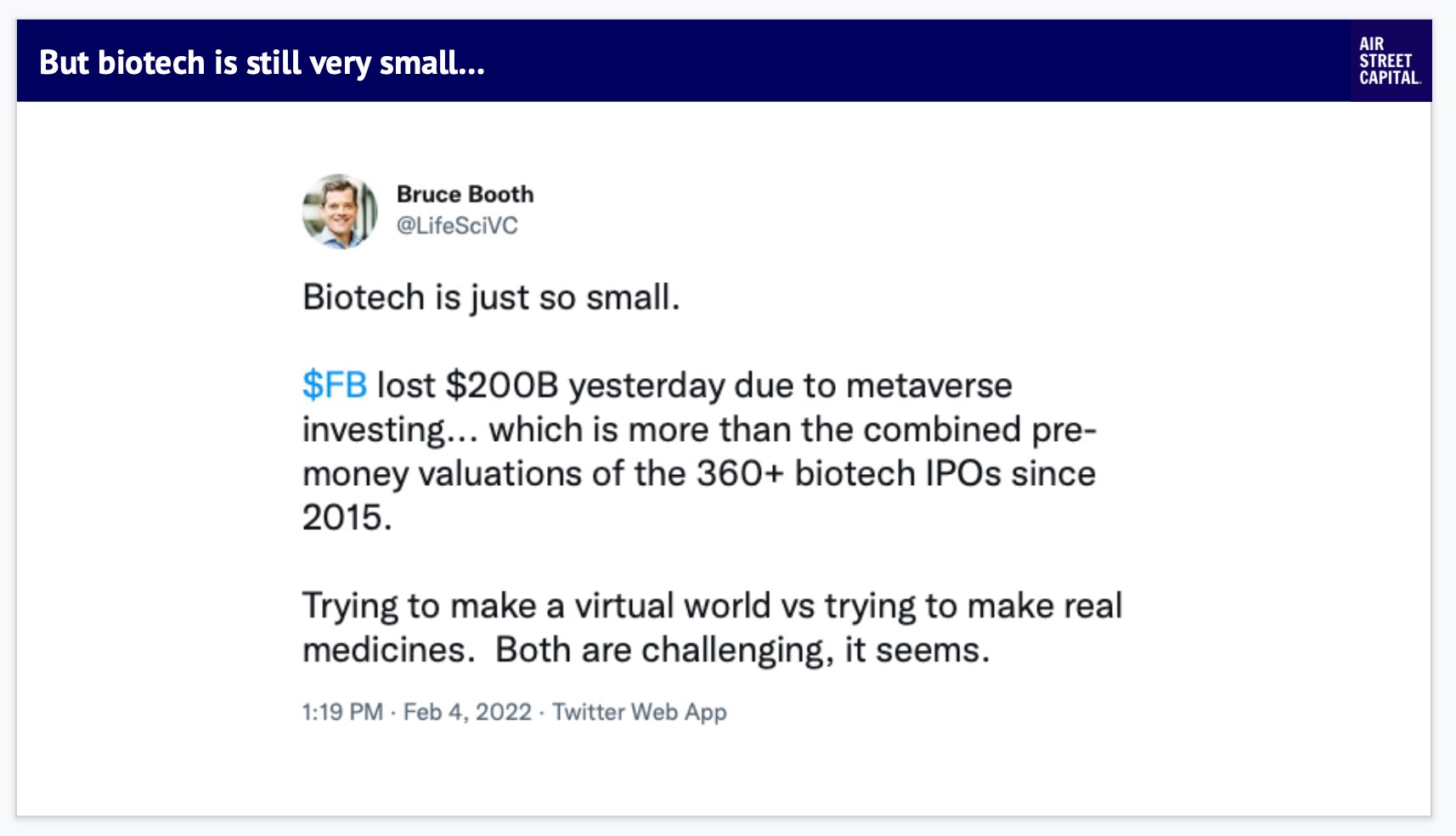

But while we see red everywhere, recall that "biotech is just so small" compared to the broader tech market.

This tweet by @LifeSciVC puts things into perspective: Meta's downdraft 4 weeks ago summed to greater than the combined pre-money valuations of biotech IPOs *since 2015*.

This tweet by @LifeSciVC puts things into perspective: Meta's downdraft 4 weeks ago summed to greater than the combined pre-money valuations of biotech IPOs *since 2015*.

The universe of investable AI-first biotech companies has expanded dramatically since last few years alone.

These cos are tackling drug discovery and design (e.g. @valence_ai @exscientiaAI @labgeni_us @anagenex), cell therapy (e.g. @bitbio), liquid biopsy (e.g. @HederaDx)...

These cos are tackling drug discovery and design (e.g. @valence_ai @exscientiaAI @labgeni_us @anagenex), cell therapy (e.g. @bitbio), liquid biopsy (e.g. @HederaDx)...

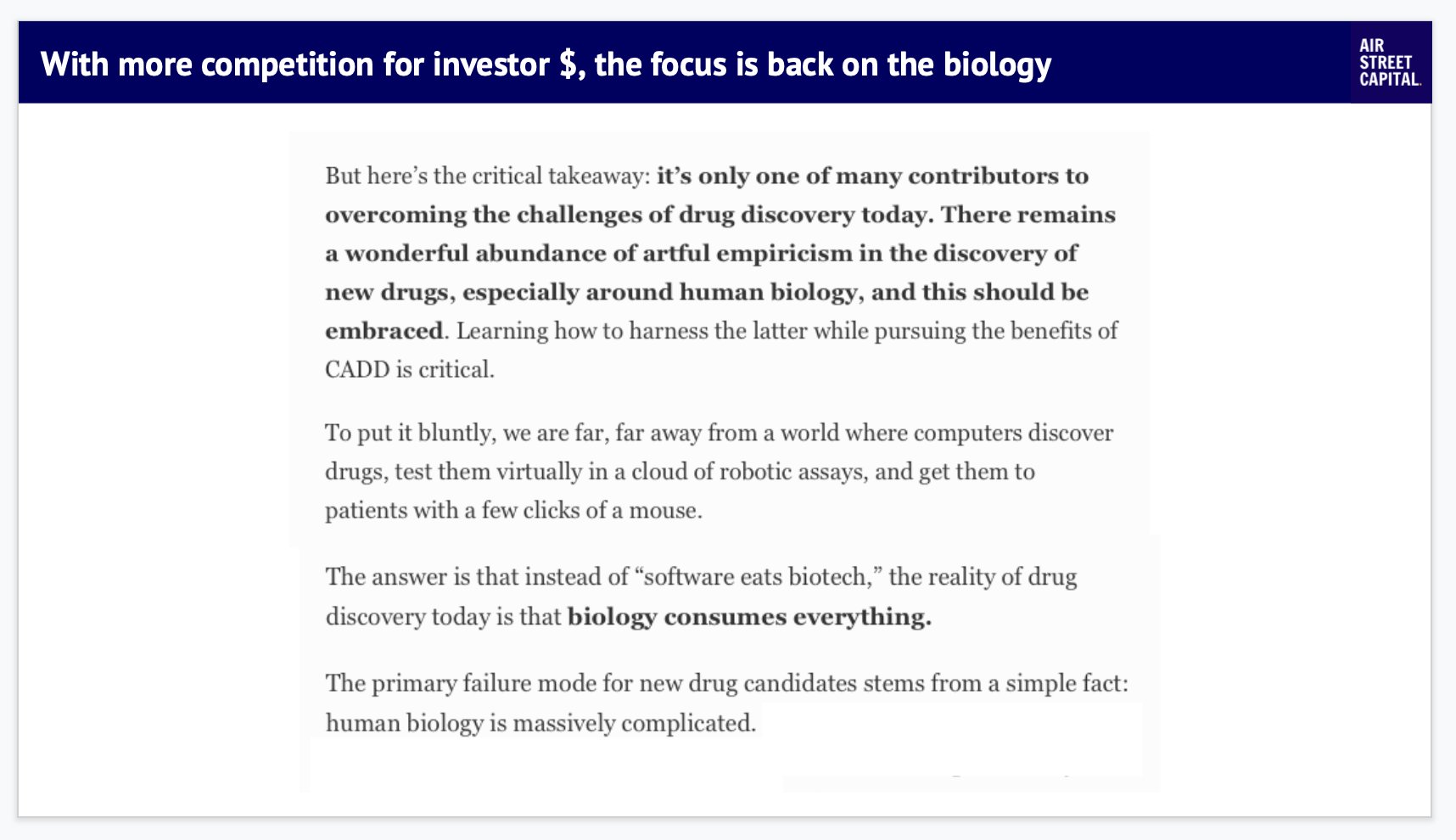

The proliferation of startups means more competition for investor and customer dollars. This leads to a greater need to differentiate one's product offering: you're no longer "n=1".

Thus, AI-first bio startups *must* become "bio-y" much sooner than before. AI only no more.

Thus, AI-first bio startups *must* become "bio-y" much sooner than before. AI only no more.

The implication of investors is quite significant.

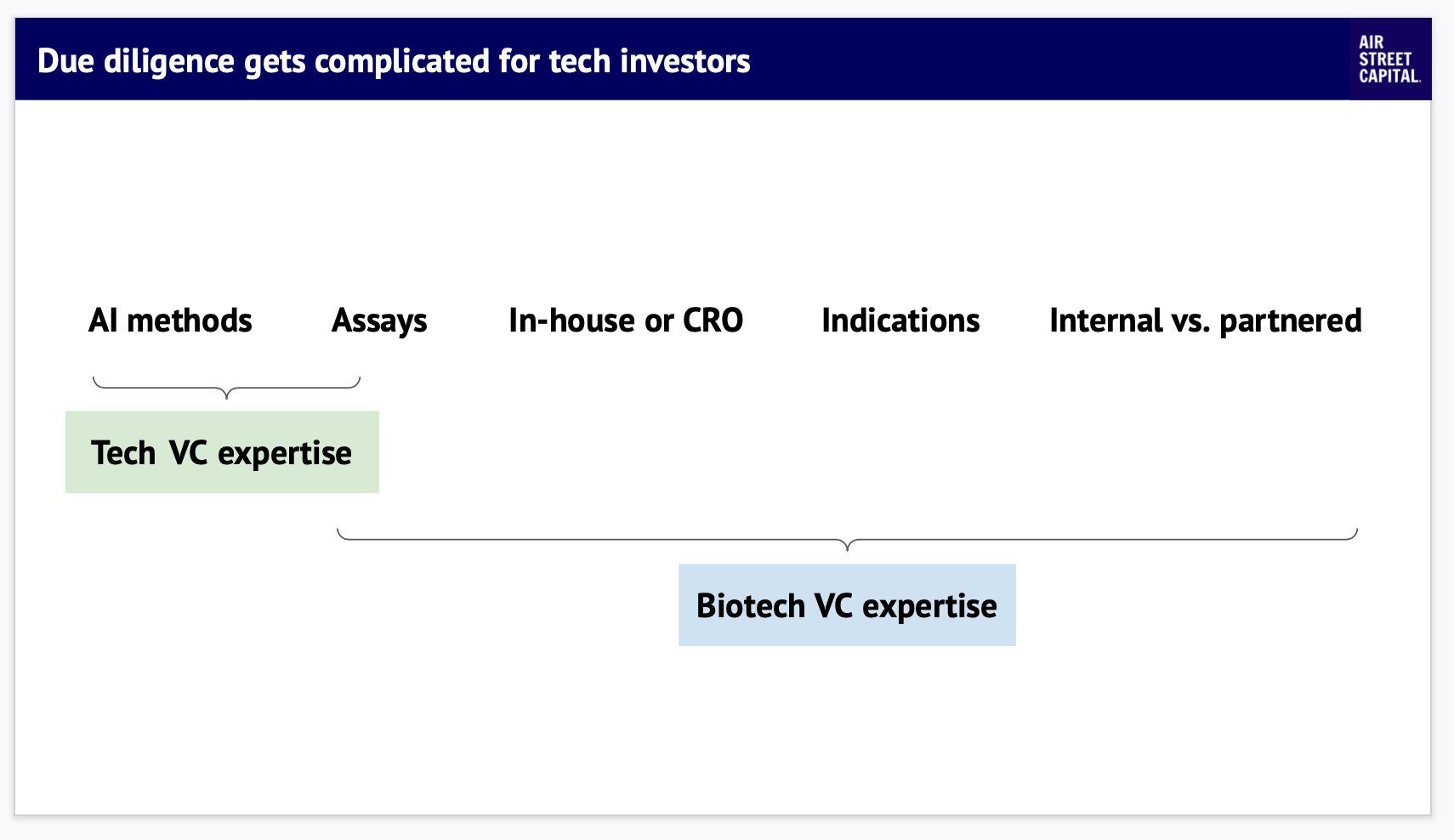

Let's consider the "risk" buckets that AI-first drug disco companies have and overlay the native due diligence expertise of Tech VCs and Biotech VCs.

I'd wager that Tech VCs aren't equipped to assess the risks they're buying:

Let's consider the "risk" buckets that AI-first drug disco companies have and overlay the native due diligence expertise of Tech VCs and Biotech VCs.

I'd wager that Tech VCs aren't equipped to assess the risks they're buying:

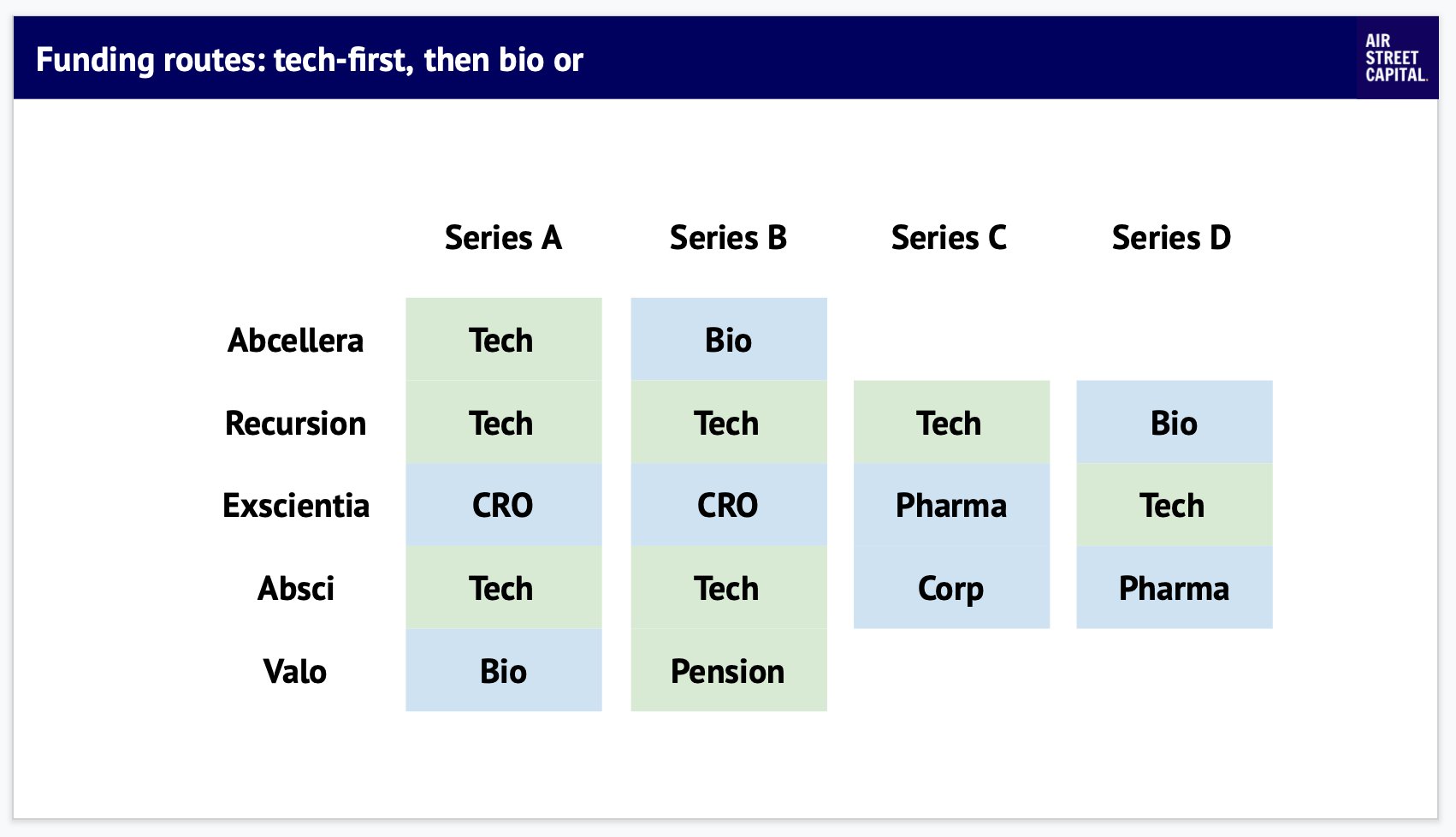

Another way to slice this question is to look at the different funding routes for household names in AI-first bio. Note: there is yet no canonical path:

Tech VC first, then Biotech @RecursionPharma

Biotech VC, then Tech @ValoHealth

Customers first, then Tech @exscientiaAI

Tech VC first, then Biotech @RecursionPharma

Biotech VC, then Tech @ValoHealth

Customers first, then Tech @exscientiaAI

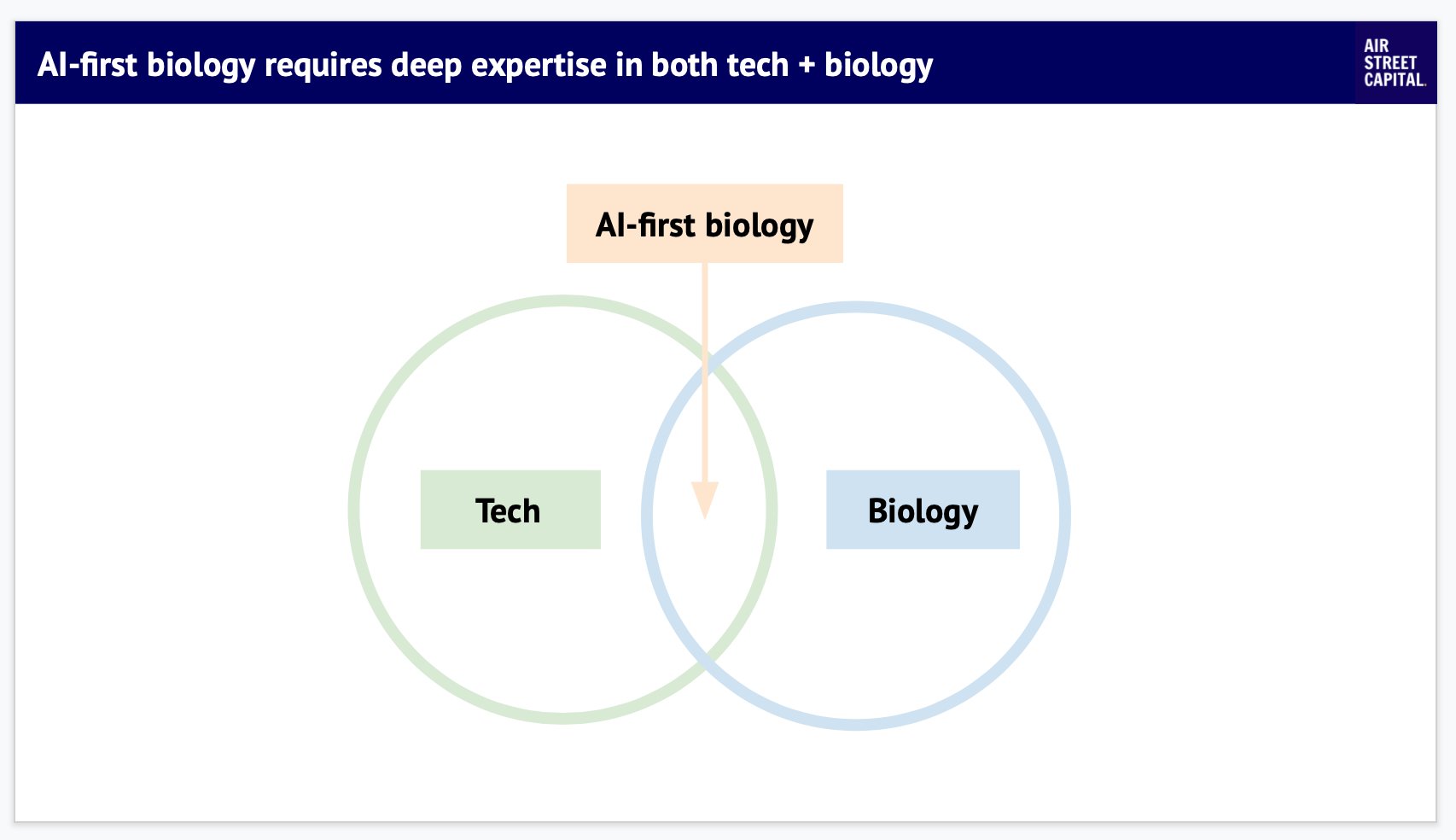

The AI-first biology playbook for company building draws from both software and biology best practices. So too does the evaluation from an investor's standpoint.

It's becoming clear that a new breed of "TechBio" investor is needed: one must be native to both software and bio.

It's becoming clear that a new breed of "TechBio" investor is needed: one must be native to both software and bio.

To sum up:

- Tons of opportunity in AI-first bio

- Lots more money coming in to fund companies

- Lots more startups on the field

- Need to "grow up" on the bio front much sooner if you're AI-first

- Tech VCs and Biotech VCs have very different expertise

- New investors needed :-)

- Tons of opportunity in AI-first bio

- Lots more money coming in to fund companies

- Lots more startups on the field

- Need to "grow up" on the bio front much sooner if you're AI-first

- Tech VCs and Biotech VCs have very different expertise

- New investors needed :-)