Thread

Would you recognise an economic reset if it was happening before our very eyes?🛑

Time for a thread🧵 discussing this and👇

-Why the 1944 Bretton Woods system has already been reset

-When the world entered the ‘’Silent Bretton Woods 2 era’’

-Are we currently watching BW3?

1/

Time for a thread🧵 discussing this and👇

-Why the 1944 Bretton Woods system has already been reset

-When the world entered the ‘’Silent Bretton Woods 2 era’’

-Are we currently watching BW3?

1/

I'm sure most of you are all familiar with the Bretton Woods conference that occurred in 1944 after WW1.

This economic reset pegged every currency around the world to the $US, which was pegged to gold, meaning the world was essentially on a commodity money standard.

2/

This economic reset pegged every currency around the world to the $US, which was pegged to gold, meaning the world was essentially on a commodity money standard.

2/

Many macroeconomic commentators, including myself have been waiting for an economic reset after watching the IMF announce in 2020 that the world needs a ' Bretton Woods 2 Moment'

Even those in power of the current system understand the unsustainability of this fiat experiment

3/

Even those in power of the current system understand the unsustainability of this fiat experiment

3/

A former FED insider and macroeconomist by the name of Zoltan Pozsar, has ignited discussion in the macro world this week after putting forward a thought provoking thesis surrounding the current global monetary order.

He claims we're witnessing the BW3 moment RIGHT NOW!

4/

He claims we're witnessing the BW3 moment RIGHT NOW!

4/

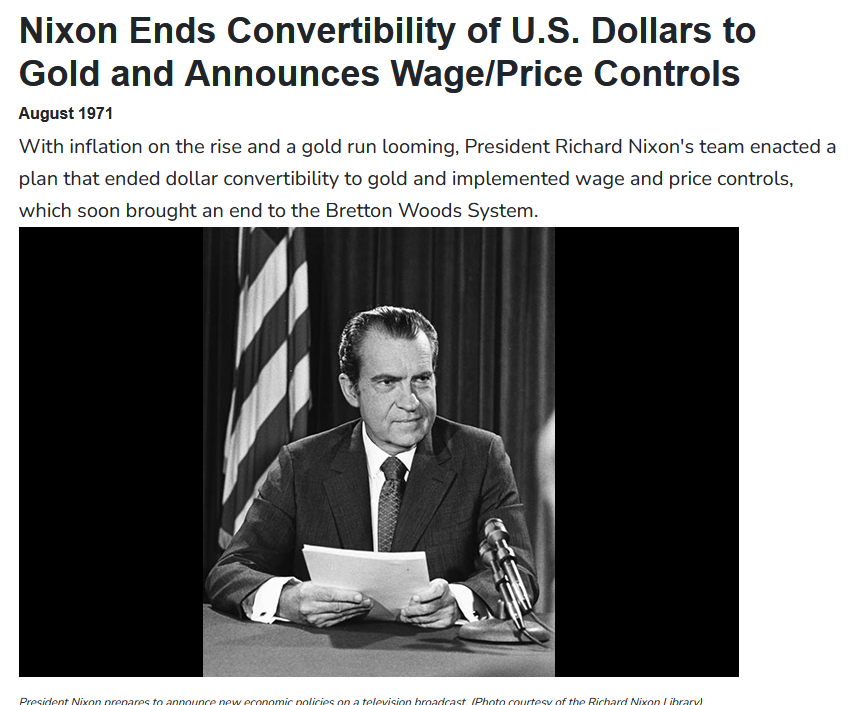

Pozsar explains that the second global reset, or ‘’Bretton Woods 2 moment,’’ actually took place in 1971 when Nixon closed the gold window.

This transitioned the entire world off of a commodity backed system and onto an entirely fiat based system.

5/

This transitioned the entire world off of a commodity backed system and onto an entirely fiat based system.

5/

The first signs that this Bretton Woods 2 monetary era was beginning to break down emerged after the 2008 GFC.

For the first time in 50 years, central banks began heavily accumulating gold after the 2008 GFC, as faith in the fiat system appeared to deteriorate.

6/

For the first time in 50 years, central banks began heavily accumulating gold after the 2008 GFC, as faith in the fiat system appeared to deteriorate.

6/

This trend was exacerbated in 2014 as Russia began de-dollarizing its economy aggressively, after being sanctioned by the world for its invasion of Crimea.

Since 2014 central banks around the globe have bought 3X times more gold than US treasuries.

8/

Since 2014 central banks around the globe have bought 3X times more gold than US treasuries.

8/

Now it appears as if the final nail has been put in the coffin of the Bretton Woods 2 system earlier this week, as the West decided to freeze the foreign reserves of Russia

This has made it explicitly clear that holding onto fiat money as a reserve asset is no longer safe

9/

This has made it explicitly clear that holding onto fiat money as a reserve asset is no longer safe

9/

Zoltan makes the case that this move has begun the ‘’Bretton Woods 3 era.’’

The freezing of fiat reserves incentivises this transition away from fiat to commodity backed money.

There’s an important aspect to this POTENTIAL monetary reset that’s also unfolding as we speak

10/

The freezing of fiat reserves incentivises this transition away from fiat to commodity backed money.

There’s an important aspect to this POTENTIAL monetary reset that’s also unfolding as we speak

10/

The sanctions placed on Russia are bifurcating the commodities markets.

Nobody wants Russian oil, not even for an $18 per barrel discount!!

Meanwhile commodities prices are soaring!

This is creating SIGNIFICANT volatility in the commodity based markets.

11/

Nobody wants Russian oil, not even for an $18 per barrel discount!!

Meanwhile commodities prices are soaring!

This is creating SIGNIFICANT volatility in the commodity based markets.

11/

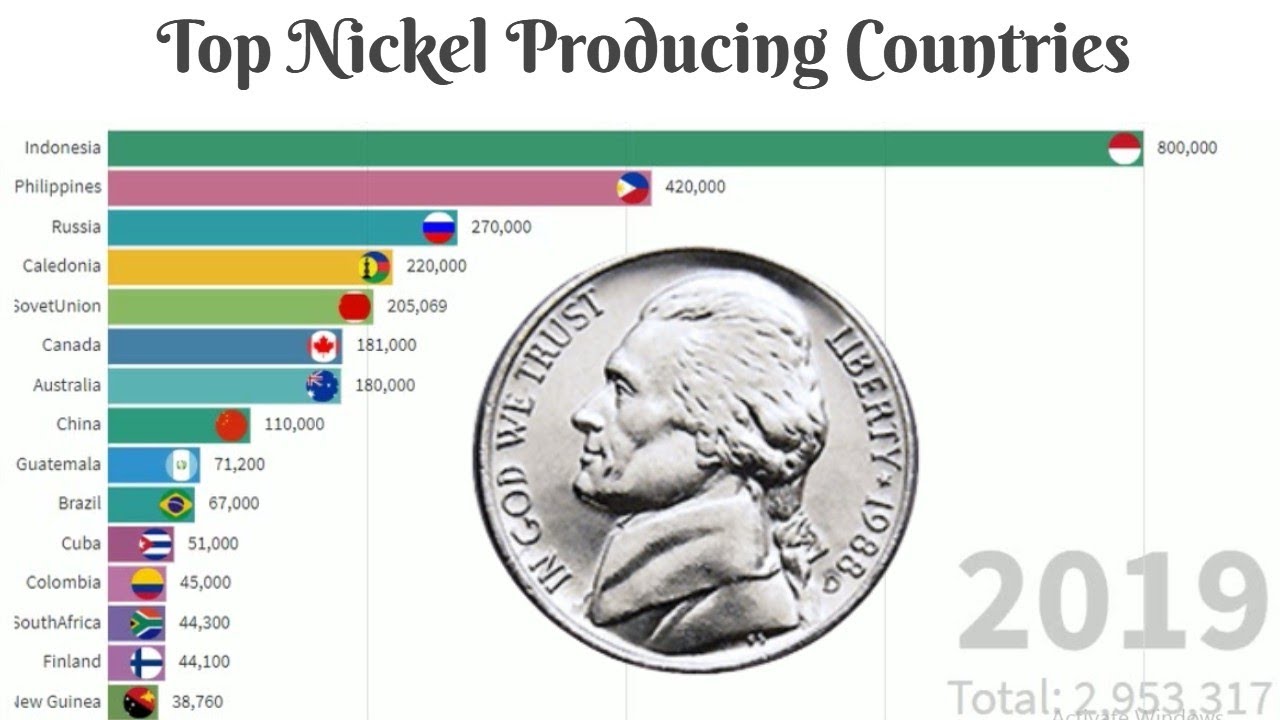

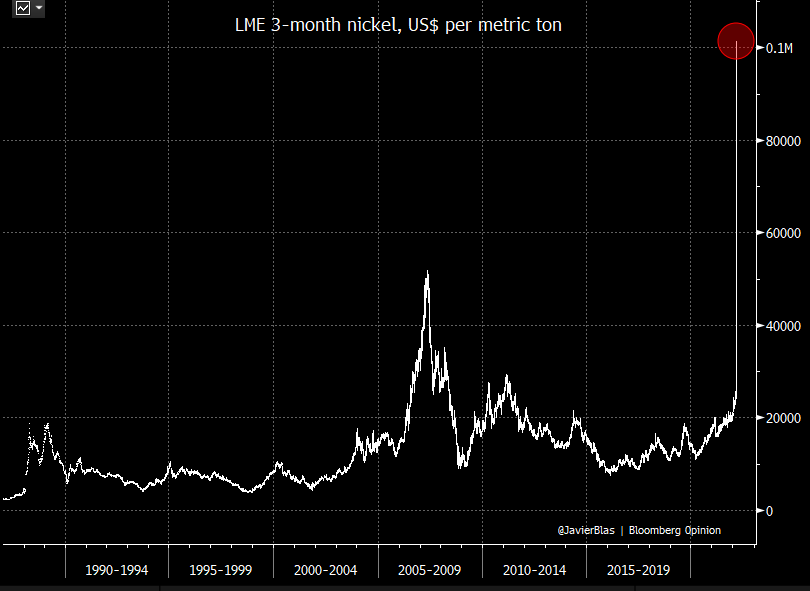

For example, Russia produces around 10% of the worlds nickel.

The sanctions placed on Russia, one of the worlds largest producers of the metal, have caused Nickel to slowly increase in price until last week it EXPLODED 500%!

9/

The sanctions placed on Russia, one of the worlds largest producers of the metal, have caused Nickel to slowly increase in price until last week it EXPLODED 500%!

9/

This Nickel short squeeze unfolded because the worlds largest Nickel producer, Xiang Guangda, has a massive short position on the metal.

Is this increasing volatility in oil, metal, food and all commodities a sign of things to come?

10/

Is this increasing volatility in oil, metal, food and all commodities a sign of things to come?

10/

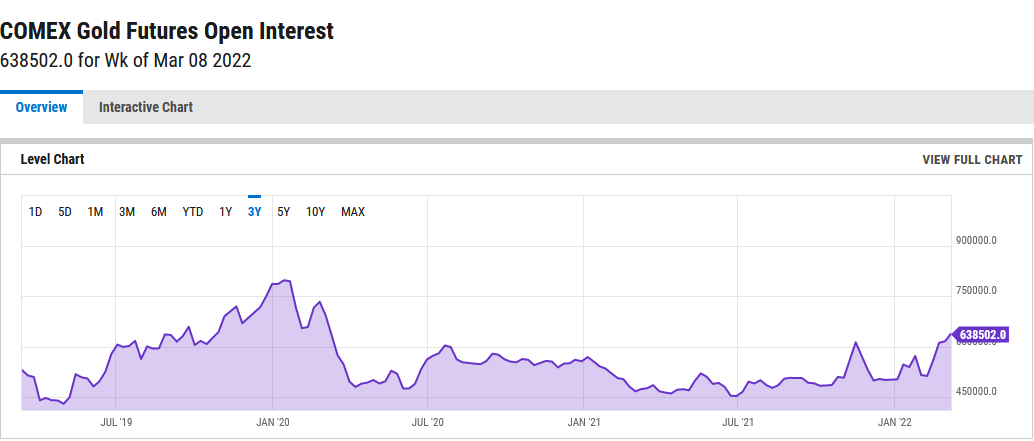

What if the same thing happened to gold as countries scramble to diversify their holdings of FX reserves into commodity backed money?

Gold is up 18% this year alone and the open interest on the Comex is exploding higher to levels not seen since early 2020📢

11/

Gold is up 18% this year alone and the open interest on the Comex is exploding higher to levels not seen since early 2020📢

11/

So the big question is what comes next?

Is the world going to transition back onto a gold backed monetary standard?

Will our leaders roll out a financial system backed by SDR’s or CBDC's?

12/

Is the world going to transition back onto a gold backed monetary standard?

Will our leaders roll out a financial system backed by SDR’s or CBDC's?

12/

Or are we about to witness the rise of an alternative monetary order backed by a neutral settlement asset like Bitcoin, gold or even oil?

One things for sure, our current monetary order looks set to change dramatically in the coming handful of years

13/

One things for sure, our current monetary order looks set to change dramatically in the coming handful of years

13/

If you enjoyed this thread:

1. Follow me

@1MarkMoss

for more of these

2. Like and RT this thread

You can watch my full video linked below, where I explain all of this and how you can protect yourself in this coming monetary reset 👇

www.youtube.com/watch?v=PN59v7_rqTw&t=197s

1. Follow me

@1MarkMoss

for more of these

2. Like and RT this thread

You can watch my full video linked below, where I explain all of this and how you can protect yourself in this coming monetary reset 👇

www.youtube.com/watch?v=PN59v7_rqTw&t=197s

Mentions

See All

Sam Callahan @samcallah

·

Mar 12, 2022

Great thread 👇

Brad Mills @bradmillscan

·

Mar 14, 2022

Great thread