Thread

We've used "seller financing" on two self storage deals in the past.

And it raised our cash on cash return by 20%+.

And lowered the amount of capital we needed by $500k.

Here's a THREAD about a deal of mine and how this magical debt structure can work.

👇👇

And it raised our cash on cash return by 20%+.

And lowered the amount of capital we needed by $500k.

Here's a THREAD about a deal of mine and how this magical debt structure can work.

👇👇

My method is simple. In the late stages of negotiation I submit two offers:

One at a lower price.

And one at the exact price the seller wants but with him holding back 10-20% of the purchase price in the form of a 2nd mortgage (with a second position to your bank loan).

One at a lower price.

And one at the exact price the seller wants but with him holding back 10-20% of the purchase price in the form of a 2nd mortgage (with a second position to your bank loan).

Contrary to popular belief seller financing rarely includes the seller holding back 70-80% and acting as your bank.

Two reasons:

#1 most have some debt on the property.

#2 most want most of their money now.

Two reasons:

#1 most have some debt on the property.

#2 most want most of their money now.

Have you heard the saying:

"you name the price and i'll name the terms?"

This is a case of that situation exactly.

Lets paint a picture here:

"you name the price and i'll name the terms?"

This is a case of that situation exactly.

Lets paint a picture here:

I was negotiating with a seller on a property.

Not many interested buyers so I knew I had some leverage.

His asking price was $4.5MM. I wanted to pay $4.2M.

After a week or two and a lot of back and forth I found his lowest number.

Not many interested buyers so I knew I had some leverage.

His asking price was $4.5MM. I wanted to pay $4.2M.

After a week or two and a lot of back and forth I found his lowest number.

$4.325MM.

At that point I made the two offers.

One at $4.2MM with normal terms and a bank financed closing.

The second at a price of $4.325MM with $500k of "seller financing".

So lets go over the dynamics:

At that point I made the two offers.

One at $4.2MM with normal terms and a bank financed closing.

The second at a price of $4.325MM with $500k of "seller financing".

So lets go over the dynamics:

My advantage is clear.

Instead of getting 70% ($3MM) financed through my bank and coming up with the last 30% ($1.3MM)...

I finance 70% ($3MM) through my bank, 11.5% ($500k) through the seller, and only needed to come up with 18.5% ($800k).

Instead of getting 70% ($3MM) financed through my bank and coming up with the last 30% ($1.3MM)...

I finance 70% ($3MM) through my bank, 11.5% ($500k) through the seller, and only needed to come up with 18.5% ($800k).

Quick note:

This deal was done over a year ago when the market was much different and good deals were easier to find.

It had a lot of cashflow and a good debt coverage ratio.

I wouldn't feel comfortable going to 80%+ leverage today.

Ok back to it:

This deal was done over a year ago when the market was much different and good deals were easier to find.

It had a lot of cashflow and a good debt coverage ratio.

I wouldn't feel comfortable going to 80%+ leverage today.

Ok back to it:

When you raise money on a deal the equity you raise is expensive over time.

Generally 15-25% per year is what you pay to your LPs or what you expect as a return on your own capital.

But the seller only gets 5%.

Lets talk about how its structured with him:

Generally 15-25% per year is what you pay to your LPs or what you expect as a return on your own capital.

But the seller only gets 5%.

Lets talk about how its structured with him:

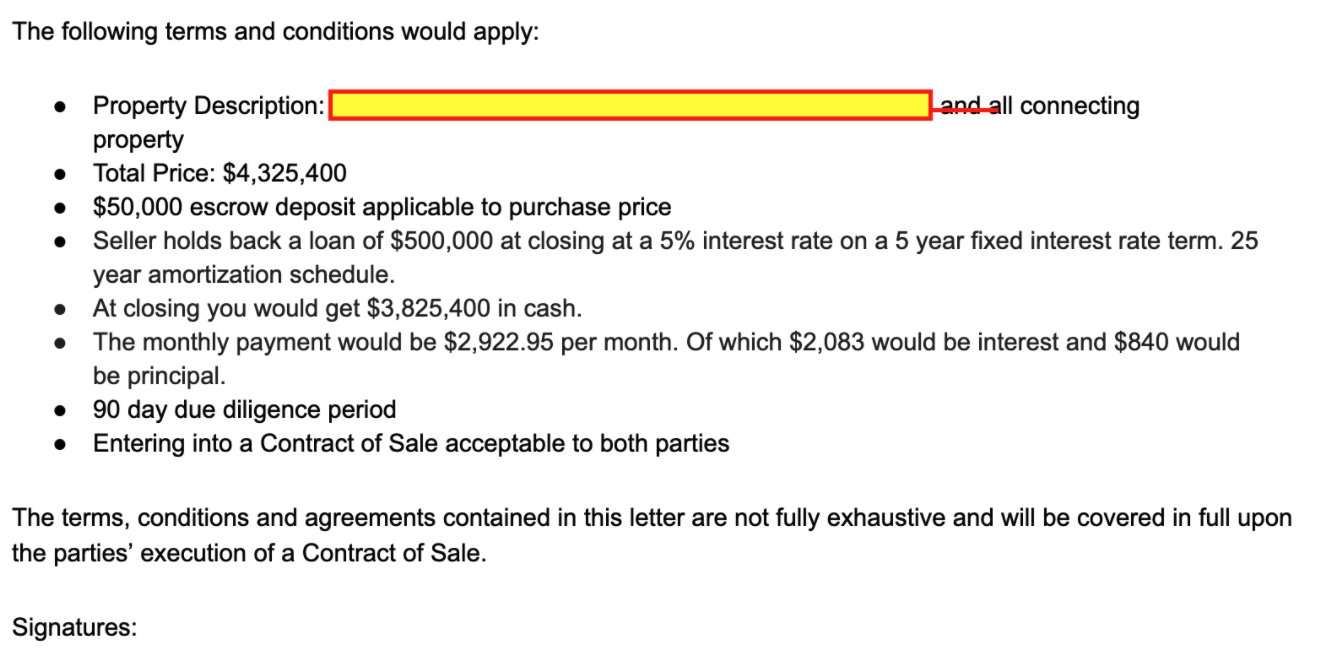

Here's a picture of my Letter of Intent.

It's a 5 year term, meaning the rate is locked for 5 years. After that the rate goes up to 7%.

If I ever refinance, which I plan to do at 18 months, I have to clear his loan and pay it off.

It's a 5 year term, meaning the rate is locked for 5 years. After that the rate goes up to 7%.

If I ever refinance, which I plan to do at 18 months, I have to clear his loan and pay it off.

Our bank is fine with this because our entire debt obligation on the deal still meets their 1.25x DSCR and 8%+ debt yield. Aka its juicy.

And they have first position. Meaning if we default, they get made whole first.

+ they trust us and like us (that matters, a lot).

And they have first position. Meaning if we default, they get made whole first.

+ they trust us and like us (that matters, a lot).

Debt yield is the almighty stress test in real estate.

If you aren't sure what that means, take this free quiz:

nickhuber.podia.com/debtcashflow

If you aren't sure what that means, take this free quiz:

nickhuber.podia.com/debtcashflow

I don't use this on every offer.

Definitely not on competitive properties.

And not unless I have some leverage and rapport with the sellers.

Because it's a risk for them. They are your new banker. You stop paying or run the property into the ground, they lose big.

Definitely not on competitive properties.

And not unless I have some leverage and rapport with the sellers.

Because it's a risk for them. They are your new banker. You stop paying or run the property into the ground, they lose big.

Today, almost a year after closing, that $4.35 million property is worth about $6 million.

So that little bit of seller financing really helped us increase our returns and it has been a great deal.

In the next few months we'll refinance it and pay the seller the rest of the $.

So that little bit of seller financing really helped us increase our returns and it has been a great deal.

In the next few months we'll refinance it and pay the seller the rest of the $.

If you like this kind of thing, make sure you're on my email newsletter - as I send deal breakdowns and stuff like this often:

sweatystartup.ck.page

sweatystartup.ck.page

Lets breifly touch on what this seller financing does for cashflow.

NOI on the property is $360k per year.

Without seller financing we would have gotten $3m from bank and $1.5m of cash.

Debt service of $195k.

Cashflow of $165k, or 11% deal level Cash on Cash.

NOI on the property is $360k per year.

Without seller financing we would have gotten $3m from bank and $1.5m of cash.

Debt service of $195k.

Cashflow of $165k, or 11% deal level Cash on Cash.

Seller financed version, NOI is still $360k per year.

We have $3.5m in debt and $1m in cash.

Debt service is $227,500.

Cashflow of $132,500 on our $1m investment for 13.25% CoC.

We have $3.5m in debt and $1m in cash.

Debt service is $227,500.

Cashflow of $132,500 on our $1m investment for 13.25% CoC.

The equity multiple if we were to sell for the $6m valuation is even more significant.

$4.5m in total costs and a $6m valuation now means $1.5m in value created.

If you put $1.5m in the deal you've doubled your money in 18 months.

After $250k cashflow about a 77% IRR.

$4.5m in total costs and a $6m valuation now means $1.5m in value created.

If you put $1.5m in the deal you've doubled your money in 18 months.

After $250k cashflow about a 77% IRR.

With $1m of cash in the deal and $1.5m in value and $200k in cashflow, you're looking at a 113% IRR.

A big difference!

Note: The same can work the other way and leverage can amplify your losses and crush cashflow if the revenue slows down.

A big difference!

Note: The same can work the other way and leverage can amplify your losses and crush cashflow if the revenue slows down.

Mentions

See All

Blake Burge @blakeaburge

·

Mar 10, 2022

Great thread, Nick.