Thread

After the freezing of the Russian central bank reserves, people are asking whether emerging economies could diversify their forex reserves from $ to yuan. Some fancy terms like CBDC etc being thrown as a magic bullet. 1/n

However, this will be an extremely difficult manoeuver for the following reason. Forex reserves are kept in good quality liquid financial assets. And a financial asset—in contrast to a physical asset like gold—must be someone else’s liability. 2/n

And know who incurs financial liabilities? Obviously a debtor. Who is a net debtor in international economics? The economy running CAD (Current Account Deficit)! 3/n

It follows that only an economy that is running persistently high current account deficit should be able to supply financial assets which serve the function of store of value for other economies. 4/n

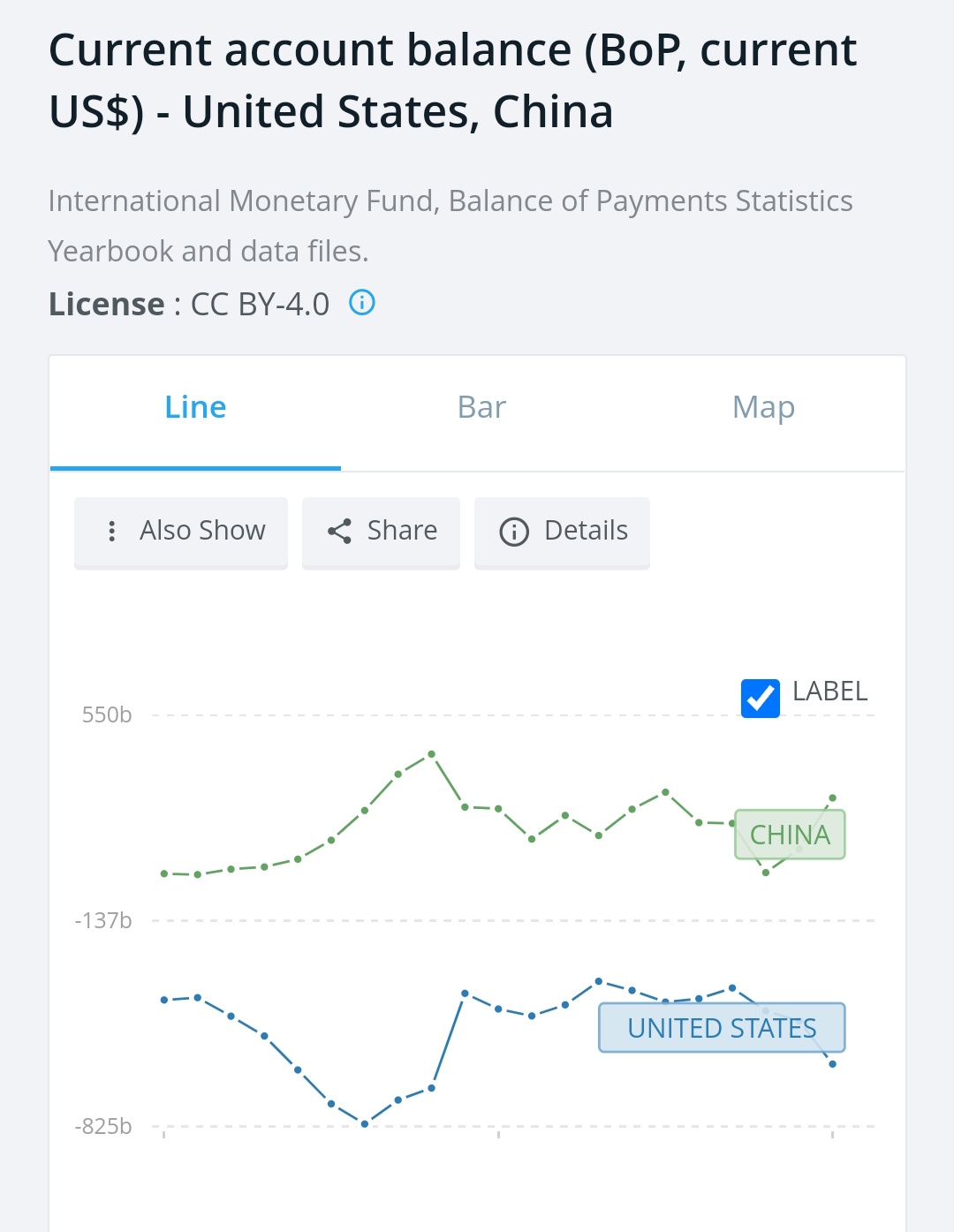

As you can see from this figure, PRC has been running a current account surplus for decades. So broadly speaking, the Chinese economy cannot be the net supplier of liquid assets, at least not without fundamental restructuring of its overall macro model. 5/n

That may be the reason why despite the best efforts, Russia could hold only a small portion of its reserves in renminbi and the chances of diversification away from $ are not high in the future. 6/n

One qualification to the above logic is that CAD measures the net--not gross--borrowing/lending. However, in the present context, this is a detail. The bottom line is that the inability to run CAD constrains the ability of PRC to be supplier of liquid assets. n/n