Thread

The US just unveiled the details of its sanctions against the Central Bank of Russia. Bottom line: This is close to the most ambitious form that this action could take. Here's my initial analysis (🧵):

(1) As I explained on Saturday, the joint statement hinted at limited sanctions against the CBR. Not blocking sanctions (i.e., asset freeze and transaction ban), but something more scalpel-like to prevent the CBR from undermining other sanctions.

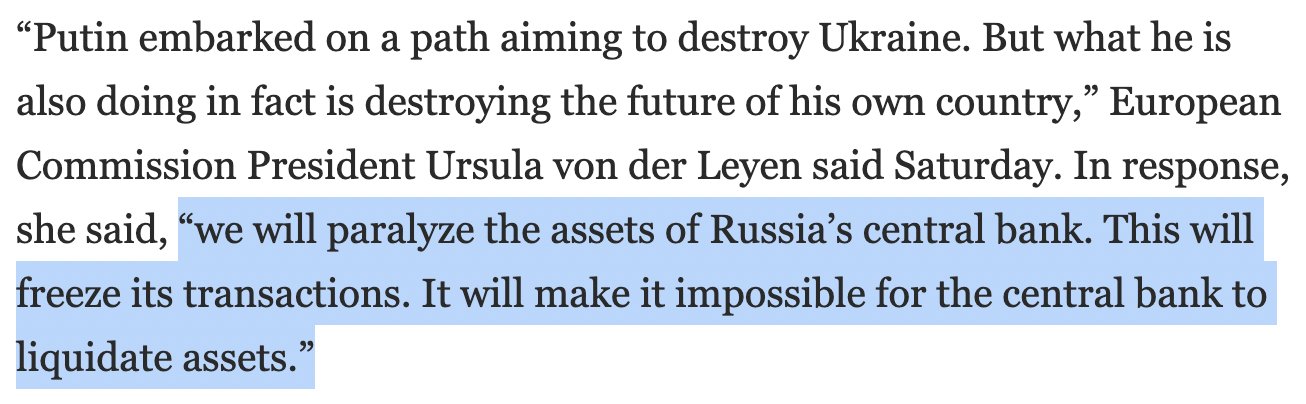

(2) Then, Ursula von der Leyen, European Commission president, dropped a bombshell, saying sanctions would "paralyze the assets of Russia’s central bank" & "freeze its transactions." To my ear, this sounded a lot like blocking sanctions—the strongest sanctions tool we have.

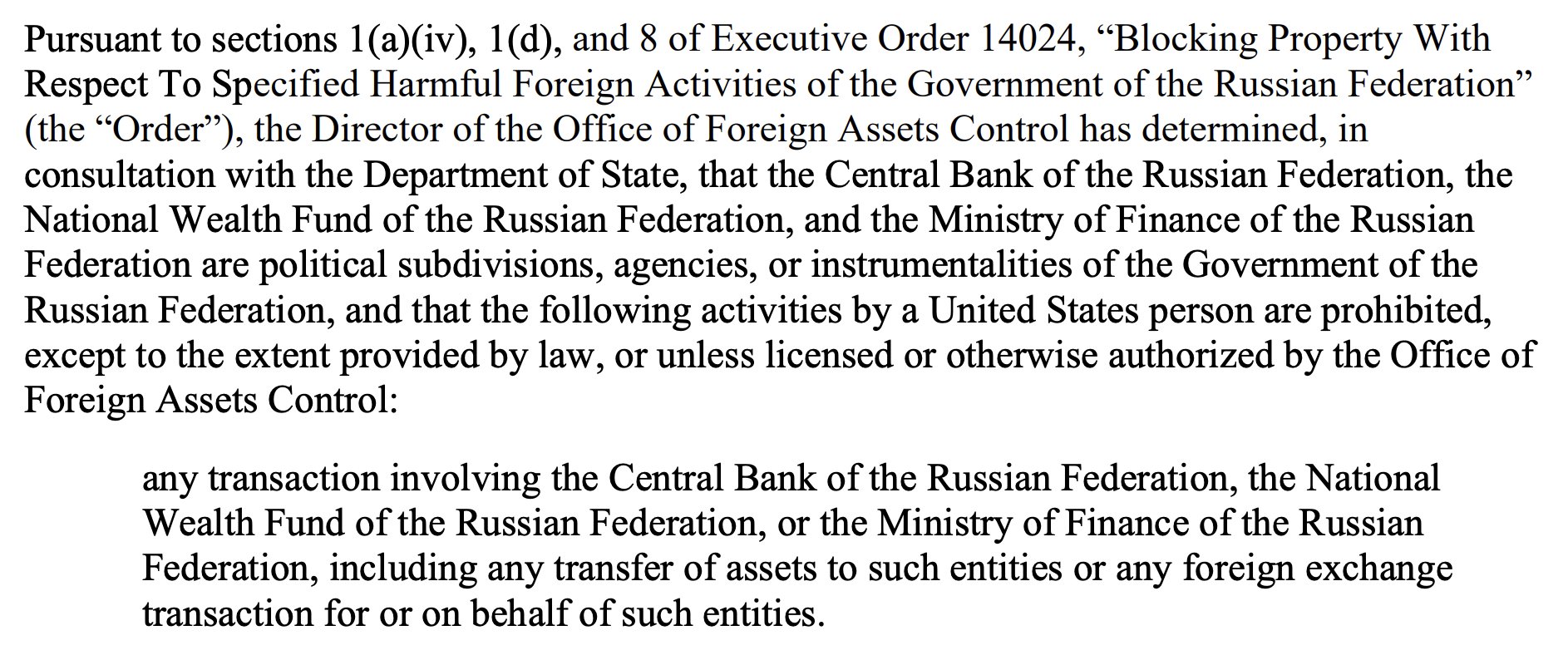

(3) Now that the details are out, it looks like these are essentially blocking sanctions. (There are technical differences, but the effect is the same—"any transaction" with the CBR is prohibited.) The CBR will be unable to intervene in FX markets to prop up the ruble, full stop.

(4) The US directive also applies to Russia's National Wealth Fund and Ministry of Finance. Consequently, the action renders ALL of the Russian government's rainy day funds inert. It is comprehensive. (SOEs aren't included, but their FX holdings aren't nearly as large.)

(5) This is a sanctions action without precedent. As a result, the specific consequences aren't easy to predict with a high level of confidence. But the consequences will certainly be far-reaching. And it took a whole lot of courage for the US and Europe to take this step.

Mentions

See All

Michael Green @profplum99

·

Feb 28, 2022

1/n Mea culpa. I have been surprised by the magnitude of the financial sanctions the West has chosen to apply on Putin. A good thread on the CBR sanctions is below. I have been suspicious that the story on the ground is not as favorable to Ukraine as the Western press