Thread by Srivatsan Prakash

Thread

Russia-Ukraine has become the #1 event that everyone's watching right now.

Here's a few things to keep in mind while watching things play out👇🧵

Here's a few things to keep in mind while watching things play out👇🧵

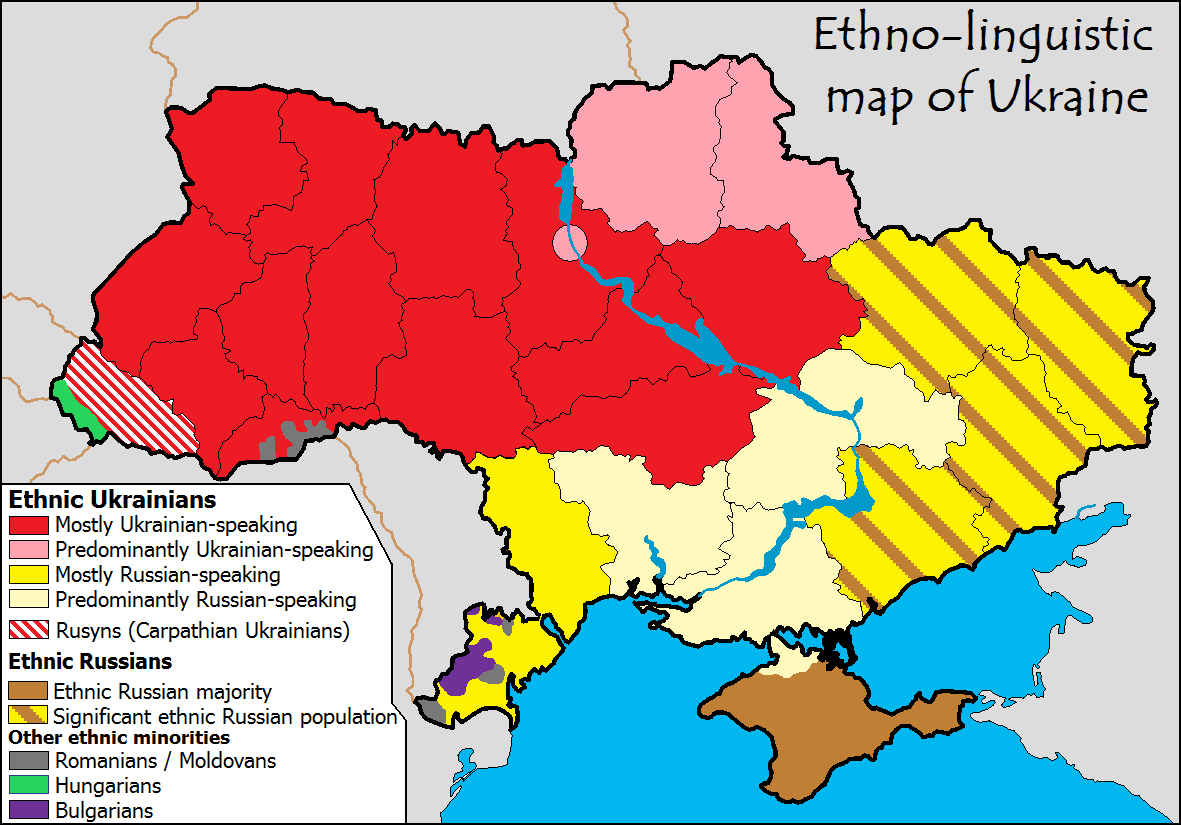

2/Ukraine is an ethnically divided and poor nation. Eastern Ukraine is majority Russian, while the west is majority Ukrainian.

It's not a cohesive entity at all.

It's not a cohesive entity at all.

3/It's also highly dependent on the inflow of aid - it's one of the four largest borrowers from the IMF.

To this end, Ukraine remains poor in per capita GDP, as well as losing parts of it's industrialization to political and economic crises.

To this end, Ukraine remains poor in per capita GDP, as well as losing parts of it's industrialization to political and economic crises.

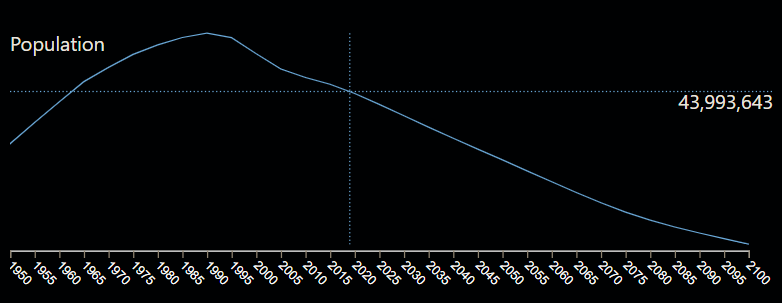

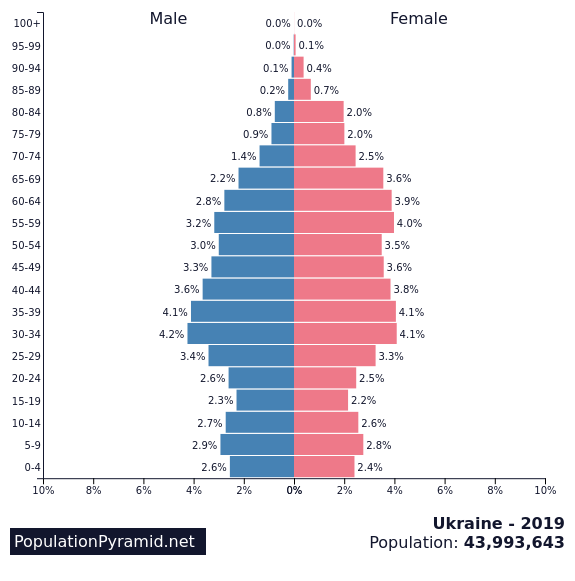

4/Ukraine has very poor demographics (source: PopulationPyramid), with the population expected to drop nearly 20% by 2050.

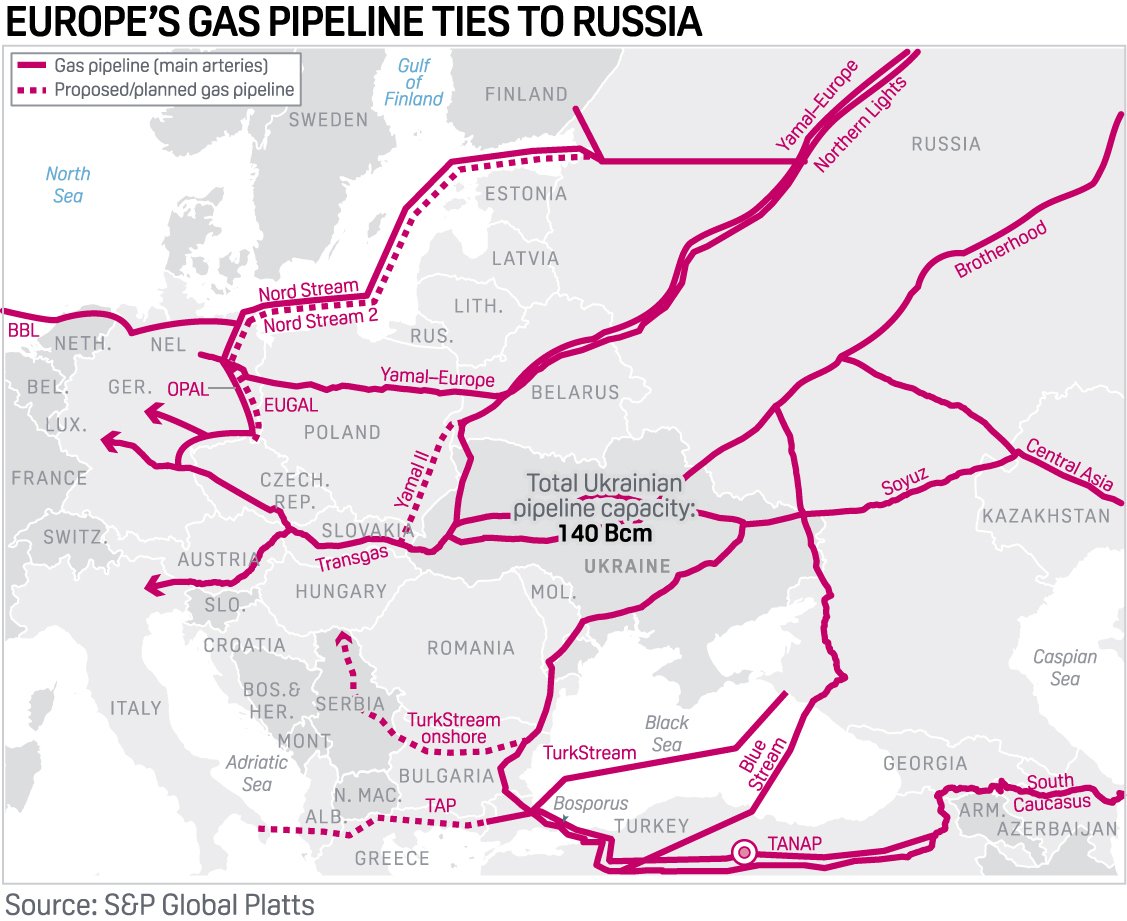

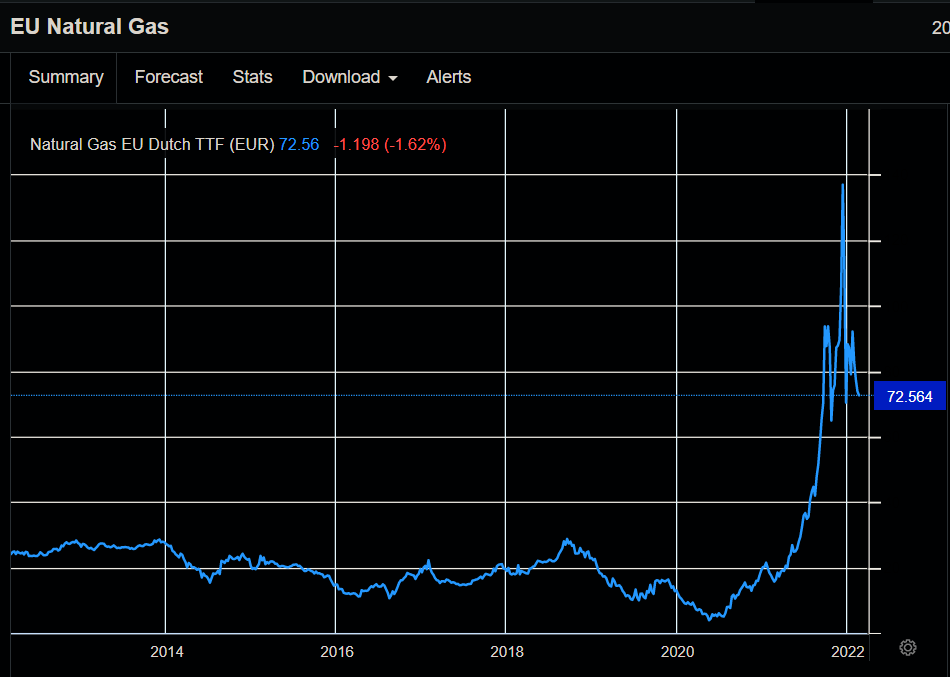

5/How dependent is the EU (and the world) really on Russia based supply chains?

Russia is a global commodity powerhouse, while the EU is highly dependent on imported basic goods - a lot of energy supply chains being located in Russia...

Russia is a global commodity powerhouse, while the EU is highly dependent on imported basic goods - a lot of energy supply chains being located in Russia...

6/About 30% of the EU's oil and 39% of it's natural gas was imported from Russia - and for parts of the EU like Finland, Poland and Estonia, >75% of imported petroleum was Russian.

Here are the pipelines:

Here are the pipelines:

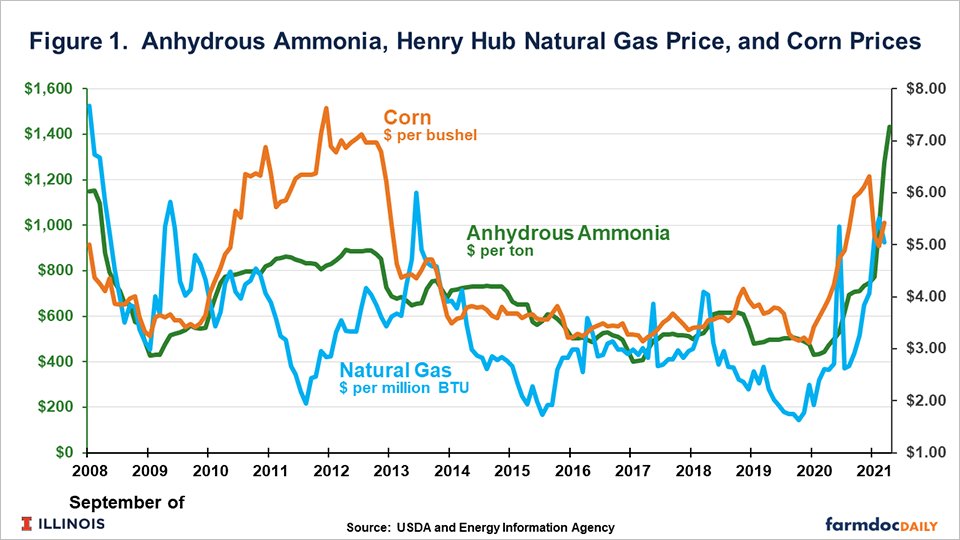

7/Similarly, this is a more global statistic - Russia controls about half to two-thirds of global ammonium nitrate supply

Developments like this aren't the best when we consider crazy high food prices:

www.spglobal.com/platts/en/market-insights/latest-news/agriculture/020222-russia-bans-ammonium-nitrat...

Developments like this aren't the best when we consider crazy high food prices:

www.spglobal.com/platts/en/market-insights/latest-news/agriculture/020222-russia-bans-ammonium-nitrat...

8/This is placed within a back drop of high energy and food inflation in the EU, both of which are heavily imported - and higher rates which doesn't solve much.

Similarly, Russia's the largest exporter of wheat in the world, so sanctions are likely to send commodities higher.

Similarly, Russia's the largest exporter of wheat in the world, so sanctions are likely to send commodities higher.

9/Within this framework, where in the event of war Europe is thrown on the back foot (higher rates, war and high food/energy prices), $EURGBP looks interesting (support at 0.8280-0.8300 on a technical basis):

11/And the chief source of ammonia is nat gas, so higher prices remains a tailwind for being bullish ags and fertilizers:

12/If you want to read more about Ukraine's future, check out @realJohnFadool article on Substack:

johnfadool.substack.com/p/ukraine-an-uncertain-and-unforgiving

johnfadool.substack.com/p/ukraine-an-uncertain-and-unforgiving

13/If push does come to shove, and there are disruptions to the supply of various commodities, it becomes a very difficult scenario for Europe.

Once again, this thread was purely to highlight some of the risks and possibly opportunities in the situation.

Once again, this thread was purely to highlight some of the risks and possibly opportunities in the situation.

14/Thank you for reading! If you liked/shared/RT'd it would mean the world to me!

If you enjoyed reading this thread, make sure to follow @SrivatsPrakash to get more of this every week.

Once again thank you for reading!

If you enjoyed reading this thread, make sure to follow @SrivatsPrakash to get more of this every week.

Once again thank you for reading!