Thread

The primary reason bond ETFs are selling off is **NOT** due to credit stress.

It's interest rate risk. Anticipation of rate hikes by the Fed is inflicting damage to fixed income all across the curve. This is DIFFERENT than credit spreads blowing out

🧵

It's interest rate risk. Anticipation of rate hikes by the Fed is inflicting damage to fixed income all across the curve. This is DIFFERENT than credit spreads blowing out

🧵

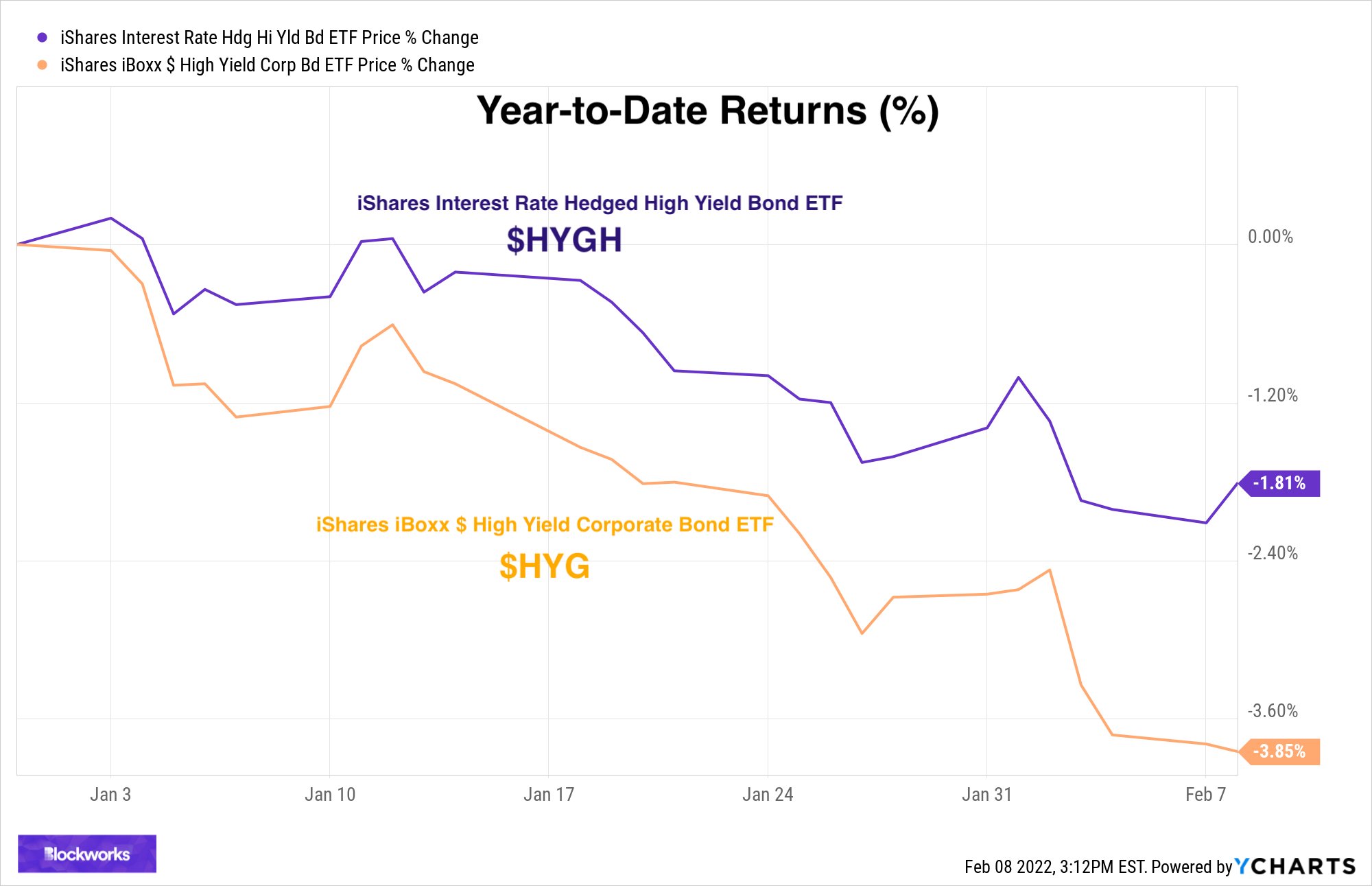

Let's compare the U.S. High-Yield ETF ($HYG) to it's interest rate hedged counterpart, ($HYGH).

While $HYG, which has credit risk AND interest rate risk, $HYGH has only credit risk (effective duration near 0).

While $HYG, which has credit risk AND interest rate risk, $HYGH has only credit risk (effective duration near 0).

$HYG is down 3.84% year-to-date, while $HYGH is down only 1.81%.

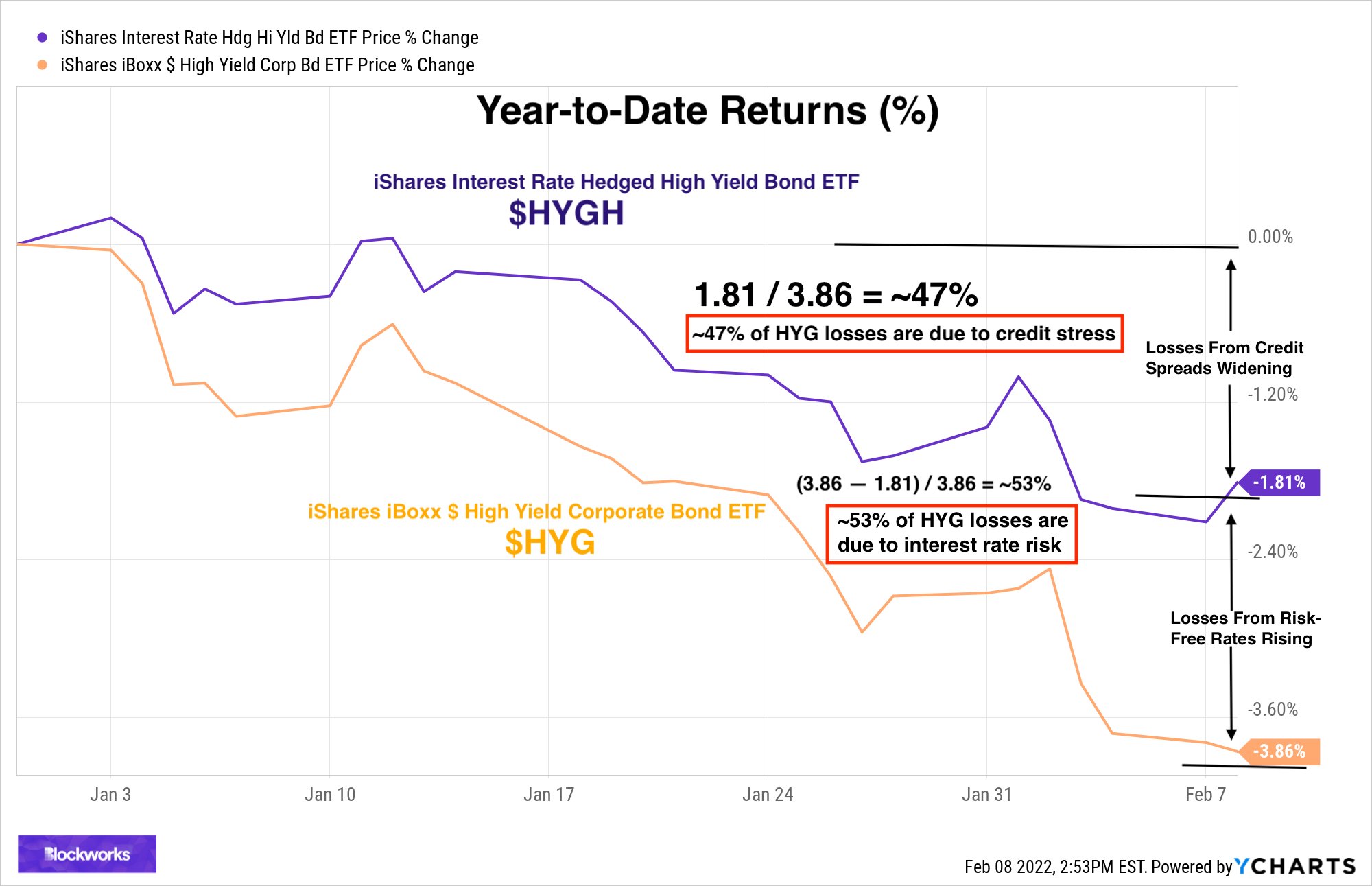

$HYGH's performance represents the credit portion of $HYG's performance, and the spread between $HYGH and $HYG indicates the interest rate portion (i.e. what's left)

$HYGH's performance represents the credit portion of $HYG's performance, and the spread between $HYGH and $HYG indicates the interest rate portion (i.e. what's left)

Decomposing this, we find that ~47% of $HYG's drawdown is due to credit stress, and ~53% by interest rates rising.

So credit spreads are a major, but not the dominant, cause of $HYG's poor performance.

So credit spreads are a major, but not the dominant, cause of $HYG's poor performance.

Okay, 47% vs. 53%? You may think I'm picking favorites and fair enough.

But when it comes to investment grade, it's not even close...

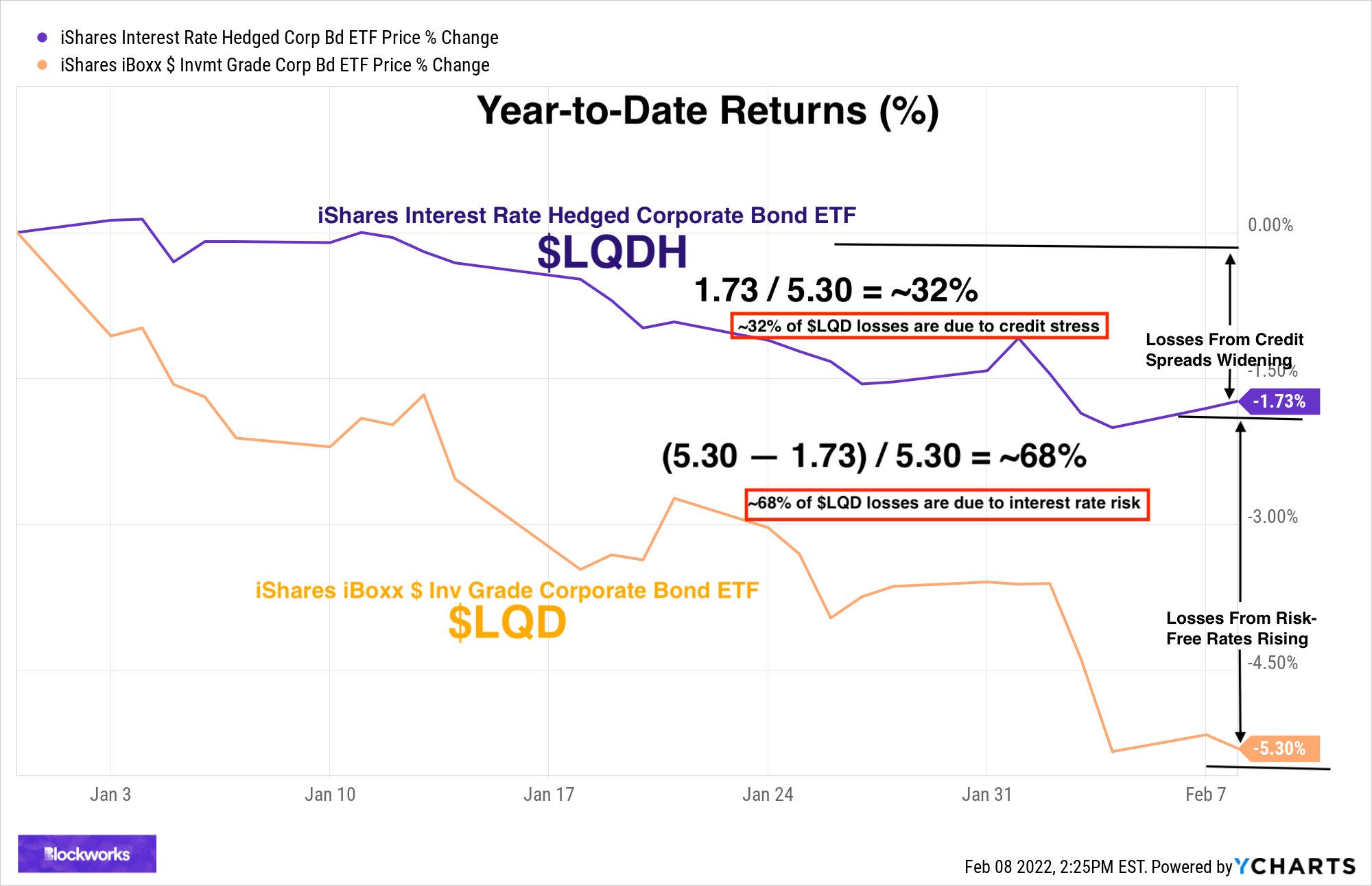

only 1/3 of $LQD's drawdown can be explained by credit stress - a full 2/3 is explained by interest rate risk

But when it comes to investment grade, it's not even close...

only 1/3 of $LQD's drawdown can be explained by credit stress - a full 2/3 is explained by interest rate risk

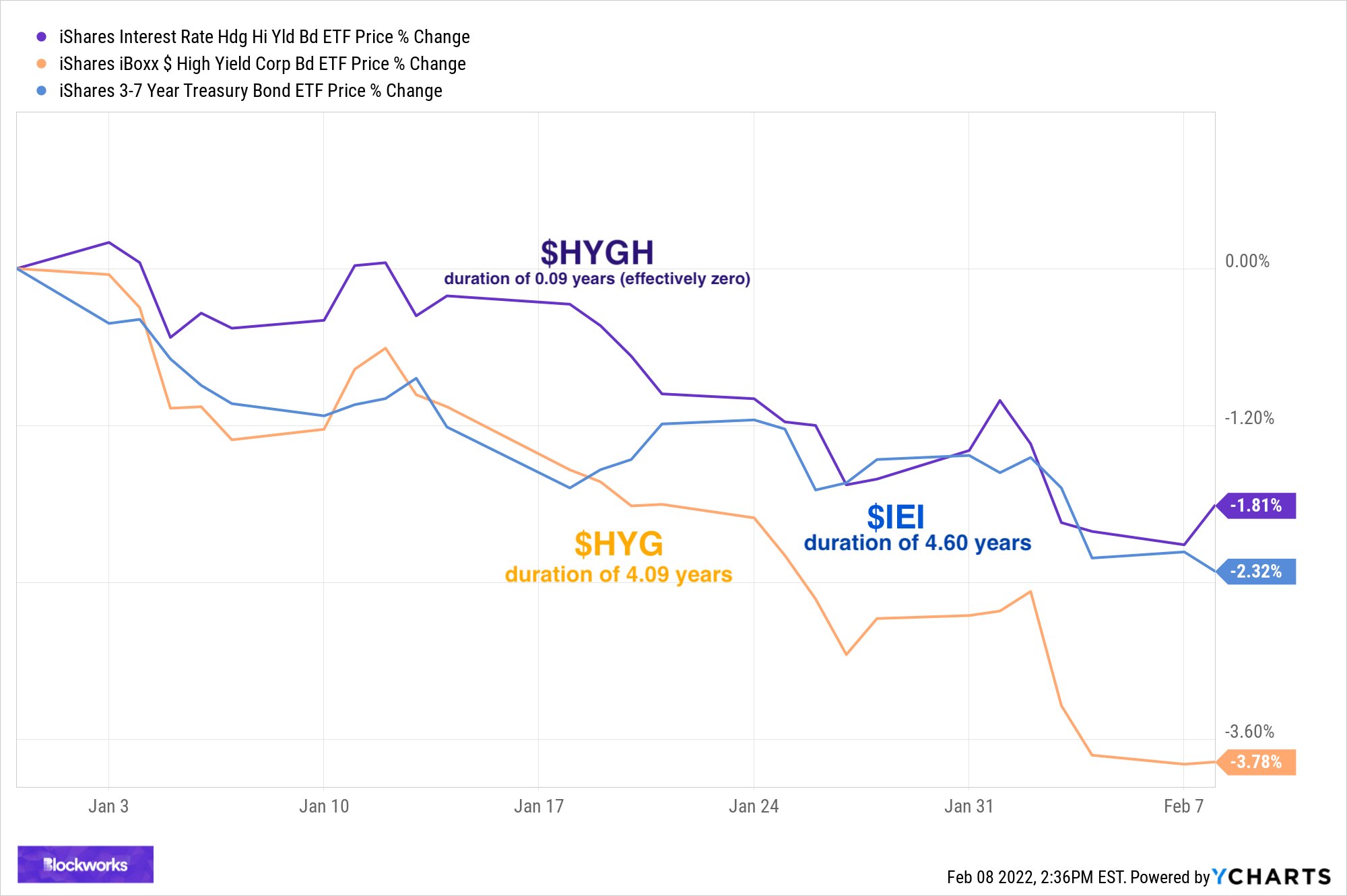

so the next time someone posts a chart of major drawdowns in bond ETFs, know that, likely, a great portion of the pain is due to the anticipation of interest rate hikes (Fed taking the punch bowl away to cool down the economy) than because credit stress is blowing out.

a note for all my deflationist friends: this is true in the U.S., for now, but that may change soon! if credit spreads blow out and the market prices in fewer Fed hikes (or none at all), then that will most certainly change.

this makes sense as $LQD's effective duration is more than twice that of $HYG (9.33 vs. 4.09)

h/t to @Altheaspinozzi and @MrBlonde_macro for their work on this, here is the original thread that sparked this one:

h/t to @Altheaspinozzi and @MrBlonde_macro for their work on this, here is the original thread that sparked this one:

Mentions

See All

Kyla Scanlon @kylascan

·

Feb 18, 2022

- We can look at the difference between HYG and HYGH to parse out the relationship a bit more - HYG has credit risk and interest rate risk and HYGH has only credit risk (Jack Farley has a great thread on this and special thanks to him for sharing the below charts with me) - HYG (purple line) is down 5.08% and HYGH (purple line) is down 2.64%.