Thread

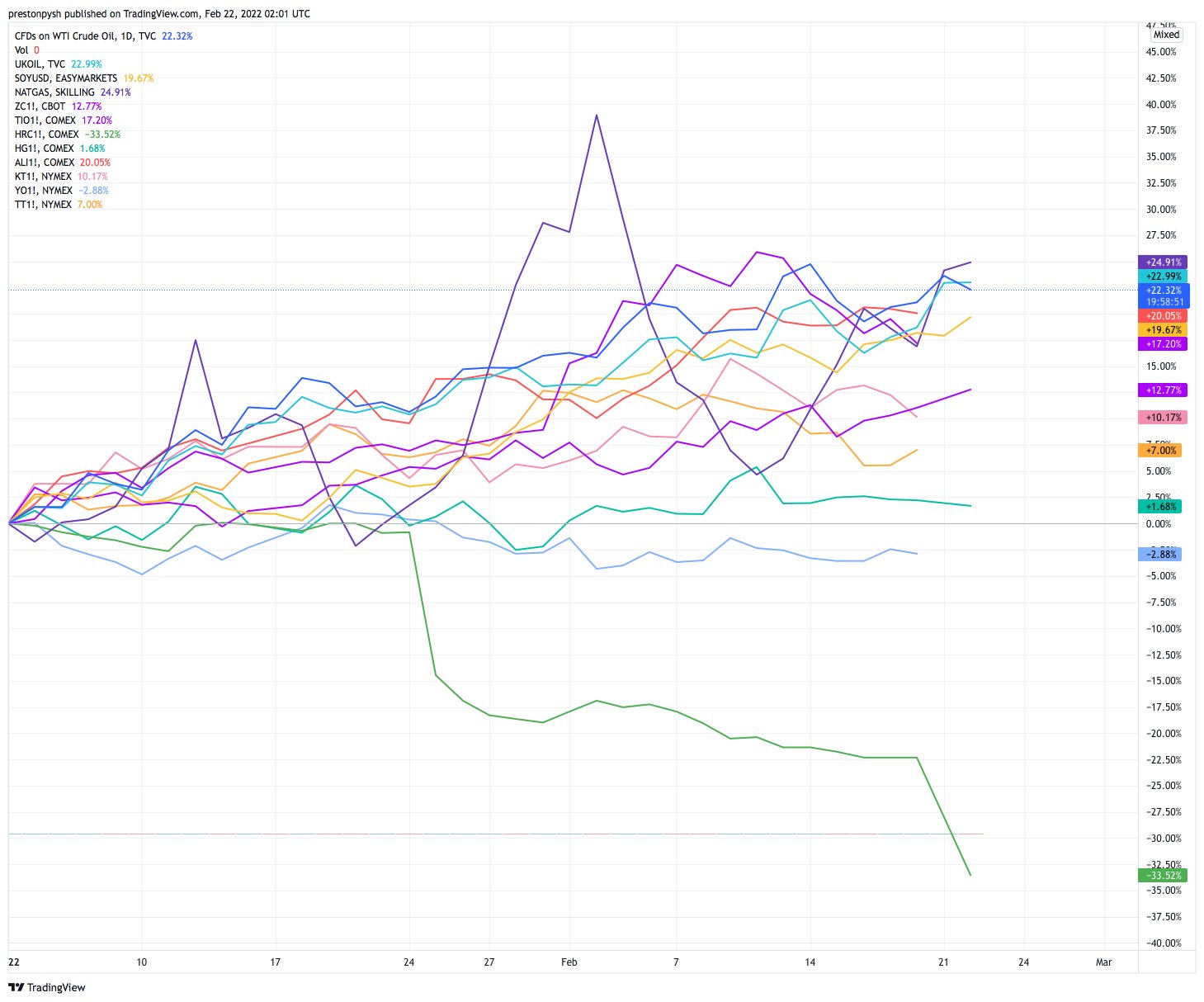

The prices of some major commodities since the start of 2022 (50 days).

Nat Gas: +25%

Oil: 23%

Aluminum: 20%

SoyB: 20%

Iron Ore: 17%

Corn: 12%

Coffee: 10%

Cotton: 7%

Copper 2%

Sugar: - 2.88%

Hot Rolled Steel: - 33%

If broader markets keep selling-off expect an EPIC reversal.

Nat Gas: +25%

Oil: 23%

Aluminum: 20%

SoyB: 20%

Iron Ore: 17%

Corn: 12%

Coffee: 10%

Cotton: 7%

Copper 2%

Sugar: - 2.88%

Hot Rolled Steel: - 33%

If broader markets keep selling-off expect an EPIC reversal.

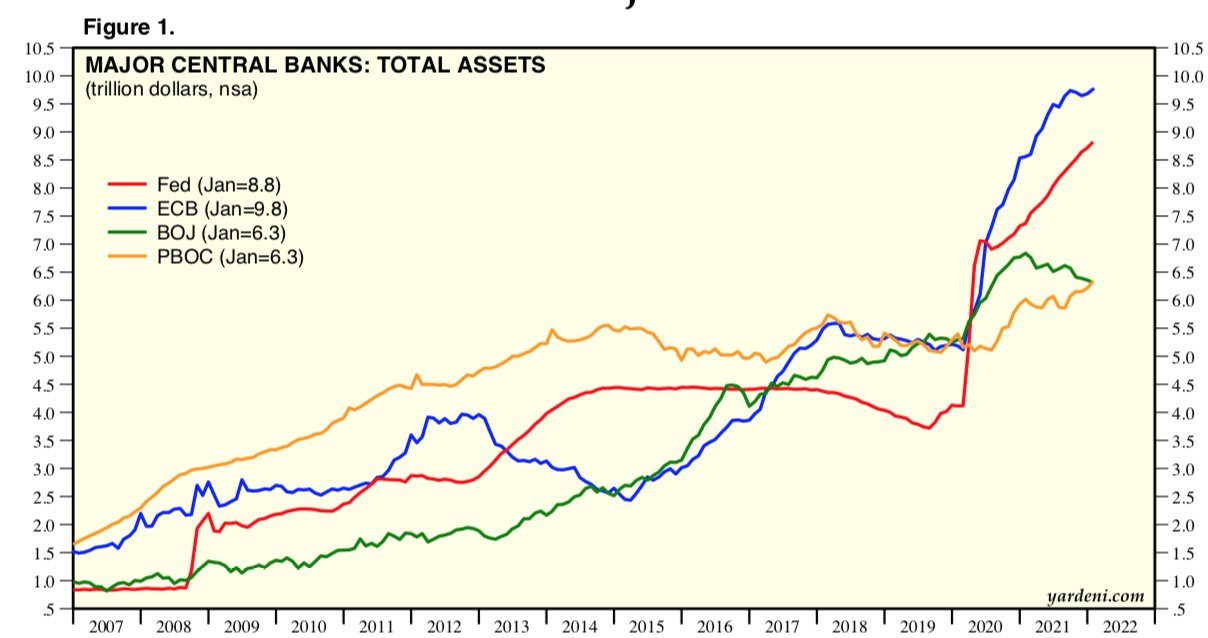

As we "birth" this new economic system, the inflationary periods will be accompanied with violent deflationary fits. This is simply the fiat currency failing. It should be expected. Right now, it appears the fixed income market and equity markets are starting their big

sell-off due to the unprecedented spread between "investments" (FI | equity) & sustained inflation prints (CPI). Those "securities" are selling-off in an attempt at yield parity w/ the CPI figures. The central bankers are in an impossible position because they NEED this sell-off

to squash the massively high CPI prints. The insane part is the FI & equity macro markets are already starting to throw a deflationary fit and the central banks are still easing into the cycle. As I've been saying for awhile, this process is

anything but comfortable. It's going to be violent and volatile. This next deflationary fit is likely to bring a massive call from the public for UBI. QE has been obscenely overused and now it's becoming obvious even to the non-economic observer. They might not know why, but

they sure as hell can feel the impacts. By years end, I expect UBI to be politically popular by all parties in the world. Make no mistake, use of QE and UBI are tools for failing currencies. I'm not promoting their use, but instead providing a projection of what I think is

likely. Once UBI becomes the preferred tool for fiscal/monetary policy (yes, they are merging into one), you'll also quickly realize that it must be accompanied with more QE. The reason why? Because UBI will cause extreme price dislocation and abnormalities. Similar to the

substantial CPI prints we've seen over the past year. Once these price distortions happen, it wrecks havoc on supply chains and economic calculation for businesses, individuals, and governments. This means yields need to remain accommodative to assist. This will cause

enhanced use of QE, or what the Gulfstream-ESG'ers at the WEF would call, Yield Curve Control. Which is just unlimited amounts of fiat printing to peg the yields at nothing percent. So in short, once they start using UBI it will cause QE+. This will then lead to the

next inflationary period (as measured by CPI). That's when I suspect things may get unsustainable. So what's the point? 1)Expect the system to throw inflationary - deflationary fits. 2)Expect extreme volatility. 3)Expect elites, companies, and governments of the old

system, who's only competitive advantage was their vicinity to the fiat printer, to start getting scared & forceful with their remaining power. 4)The event can evolve into an enormously beneficial financial system for the masses if we collectively steer it there. 5)Steering the

globe in a beneficial direction will take knowledge, love for mankind, and courage. It will require a sound money that can't be silenced through gatekeepers. It will require privacy resistance and decentralization. I own #Bitcoin and plan on buying a lot more. Don't

buy anything without building your own conviction and research. Let knowledge be your sword to slay the beast of evil, fear, and doubt.