Thread

The inflation surge has brought #bottlenecks under the spotlight

Today's #BIS_Bulletin takes a closer look at what's going on and what we might encounter going forward

A short thread follows

www.bis.org/publ/bisbull48.htm

Today's #BIS_Bulletin takes a closer look at what's going on and what we might encounter going forward

A short thread follows

www.bis.org/publ/bisbull48.htm

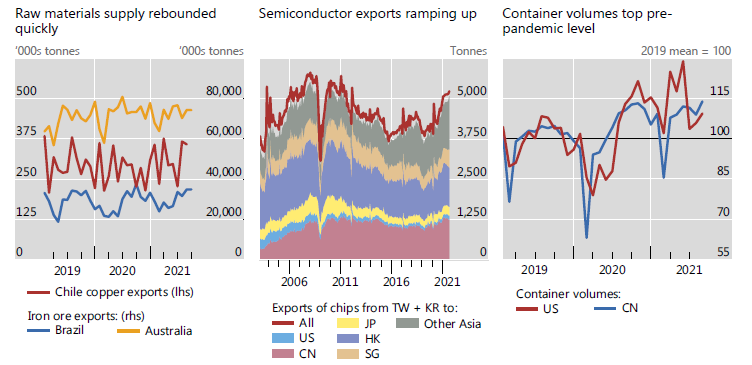

Bottlenecks started out as disruptions to supply, but they have morphed into something more

Key point to bear in mind: in aggregate at least, supply has caught up to pre-pandemic levels in key sectors like semi-conductors as well as in raw materials and shipping

Key point to bear in mind: in aggregate at least, supply has caught up to pre-pandemic levels in key sectors like semi-conductors as well as in raw materials and shipping

So, what then is going on?

Two factors are key: (1) shift in composition of demand and (2) the endogenous changes in behaviour that's given rise to bullwhip effects

Let me takes these in turn

Two factors are key: (1) shift in composition of demand and (2) the endogenous changes in behaviour that's given rise to bullwhip effects

Let me takes these in turn

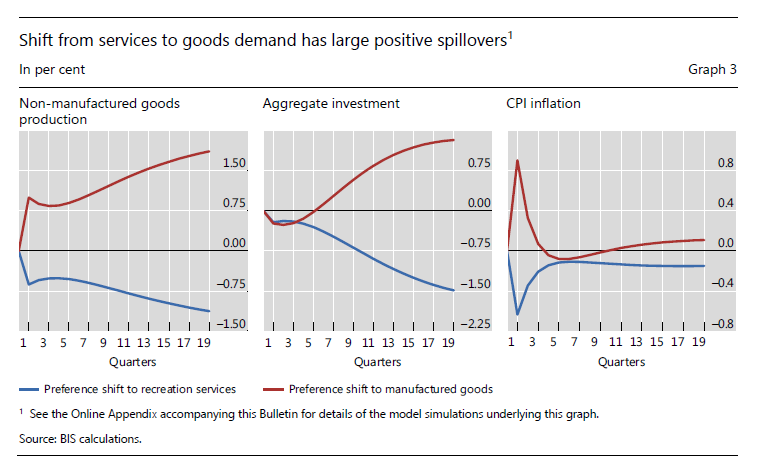

First, the composition of demand

There's been a marked shift toward manufactured goods and away from services

There's been a marked shift toward manufactured goods and away from services

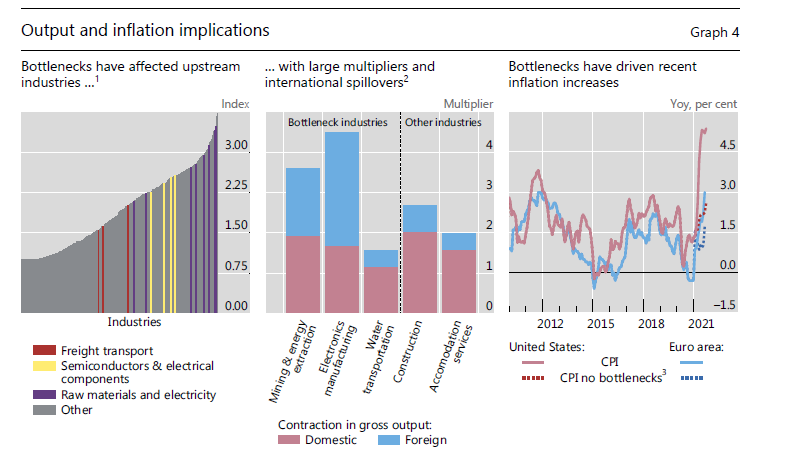

This shift toward manufactured goods shows up clearly in the "upstreamness" measures derived from input-output matrices

These are the sectors that have the biggest international spillovers

These are the sectors that have the biggest international spillovers

The second important element is the endogenous changes in behaviour along the supply chain

It is rational (prudent, event) to react to shortages by ordering more, ordering earlier and to hoard inputs

But this kind of reaction is self-defeating in the aggregate

It is rational (prudent, event) to react to shortages by ordering more, ordering earlier and to hoard inputs

But this kind of reaction is self-defeating in the aggregate

This phenomenon is sometimes known as the "bullwhip effect" in operations management

en.wikipedia.org/wiki/Bullwhip_effect

en.wikipedia.org/wiki/Bullwhip_effect

Thomas Schelling's 1978 classic "Micromotives and macrobehavior" is all about the paradoxes that arise when prudent and rational behaviour at the individual level could nevertheless be self-defeating in the aggregate

Fixing broken thread:

Mentions

See All

Joe Weisenthal @TheStalwart

·

Nov 11, 2021

Good thread here from @HyunSongShin on the BIS' latest research into "bottlenecks". Teasing out what even constitutes bottleneck vs. what's simply a system under strain from higher demand due to increased or changing consumption patterns is obviously not easy.