Thread

3 years ago, Lawtrades was about to go bankrupt.

We failed to raise a Series A.

Nobody wanted to invest.

This month, we closed $6M in funding ($80M valuation) from 100+ customers and investors using a link and no meetings.

Here’s how it happened, step by step.

🧵👇

We failed to raise a Series A.

Nobody wanted to invest.

This month, we closed $6M in funding ($80M valuation) from 100+ customers and investors using a link and no meetings.

Here’s how it happened, step by step.

🧵👇

1/ @justinkan raised $75M for Atrium (legaltech startup that competed with us)

We had only raised $3.7M.

This killed investor interest so we were forced to make a decision:

Shut down the company or try something radically different.

👇

We had only raised $3.7M.

This killed investor interest so we were forced to make a decision:

Shut down the company or try something radically different.

👇

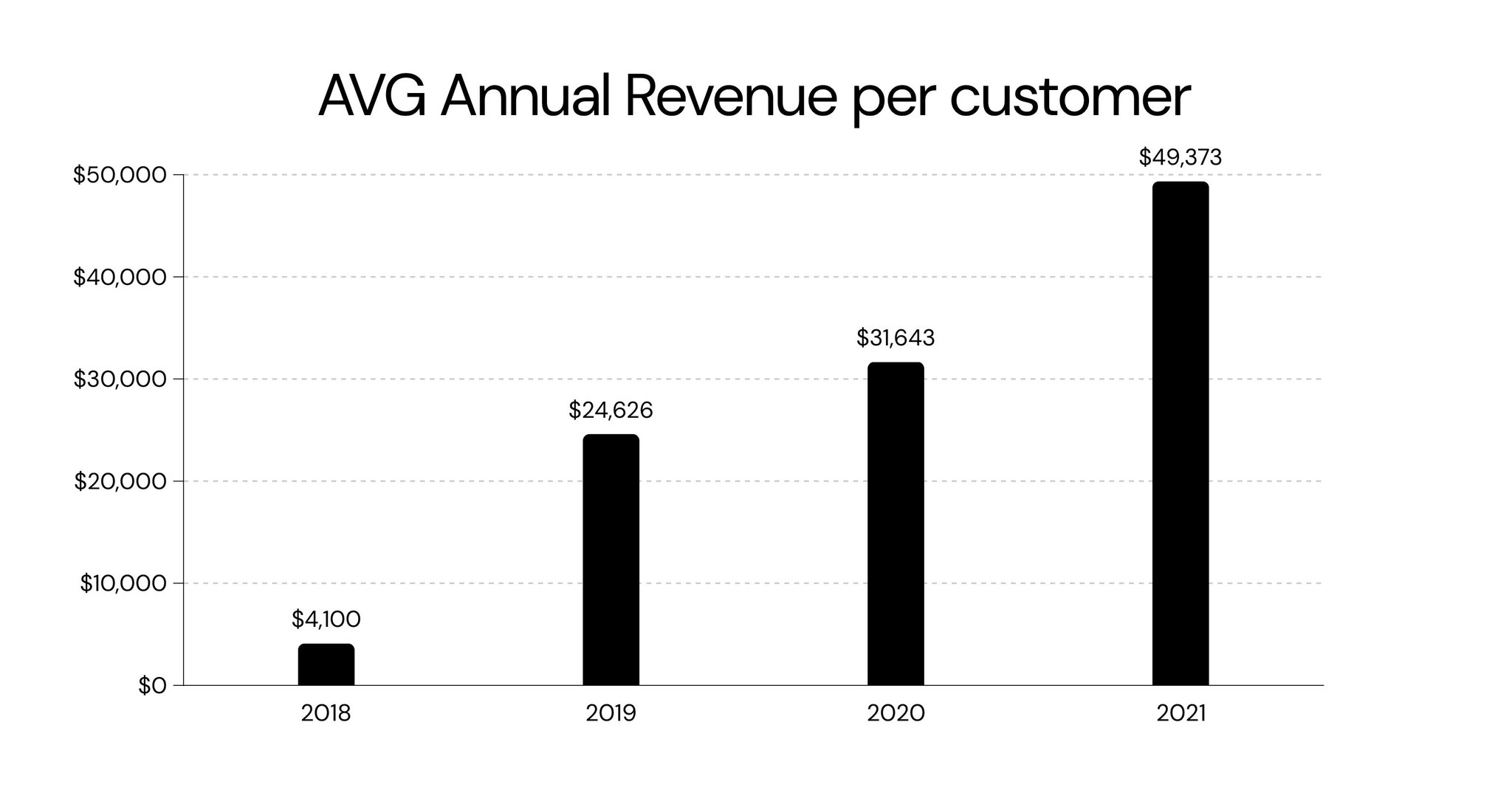

2/ Pivoted Lawtrades to keep it alive.

• “Fired” unprofitable customers

• Sharpened the product specifically for power users

• Borrowed against our receivables to keep growing without dilution (thanks @GetCapchase!)

• Scaled revenues 10x: $70k/mo to $700k/mo

👇

• “Fired” unprofitable customers

• Sharpened the product specifically for power users

• Borrowed against our receivables to keep growing without dilution (thanks @GetCapchase!)

• Scaled revenues 10x: $70k/mo to $700k/mo

👇

3/ Decided to revisit fundraising—but do it differently.

• VCs were still sour on legaltech since Atrium shut down (but it did get them thinking about the space)

• Didn't want to sell >10% of the company

So we spun up an @angellist RUV & emailed the link to our customers.

👇

• VCs were still sour on legaltech since Atrium shut down (but it did get them thinking about the space)

• Didn't want to sell >10% of the company

So we spun up an @angellist RUV & emailed the link to our customers.

👇

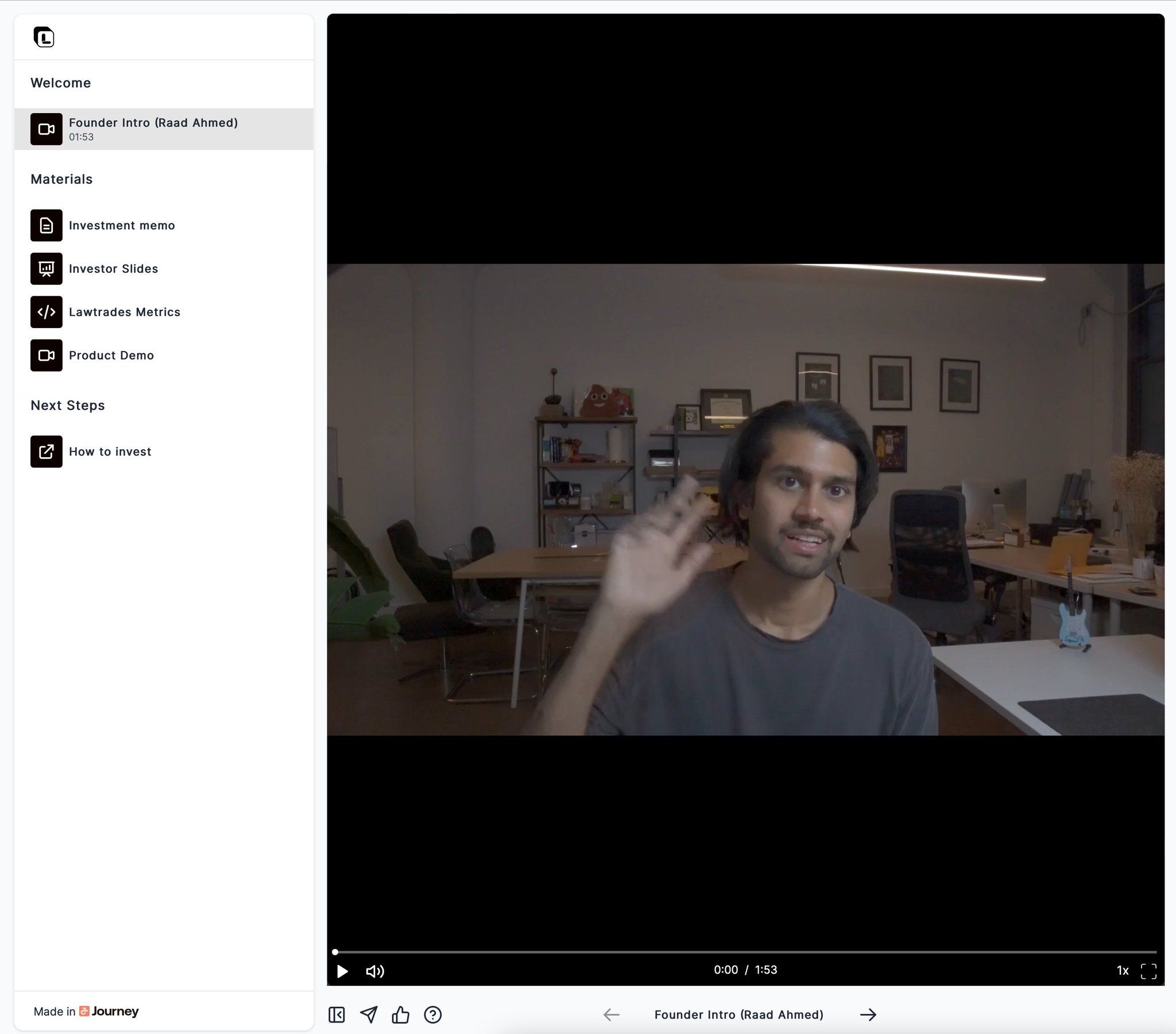

4/ More people found out and wanted to invest.

So I created a @journeyio and shared the Lawtrades story at scale in a few key mediums:

• Slides

• Video pitch from me

• Investor testimonial

• Product demo

• Live financials

• A link to invest

Pitch once, close twice.

👇

So I created a @journeyio and shared the Lawtrades story at scale in a few key mediums:

• Slides

• Video pitch from me

• Investor testimonial

• Product demo

• Live financials

• A link to invest

Pitch once, close twice.

👇

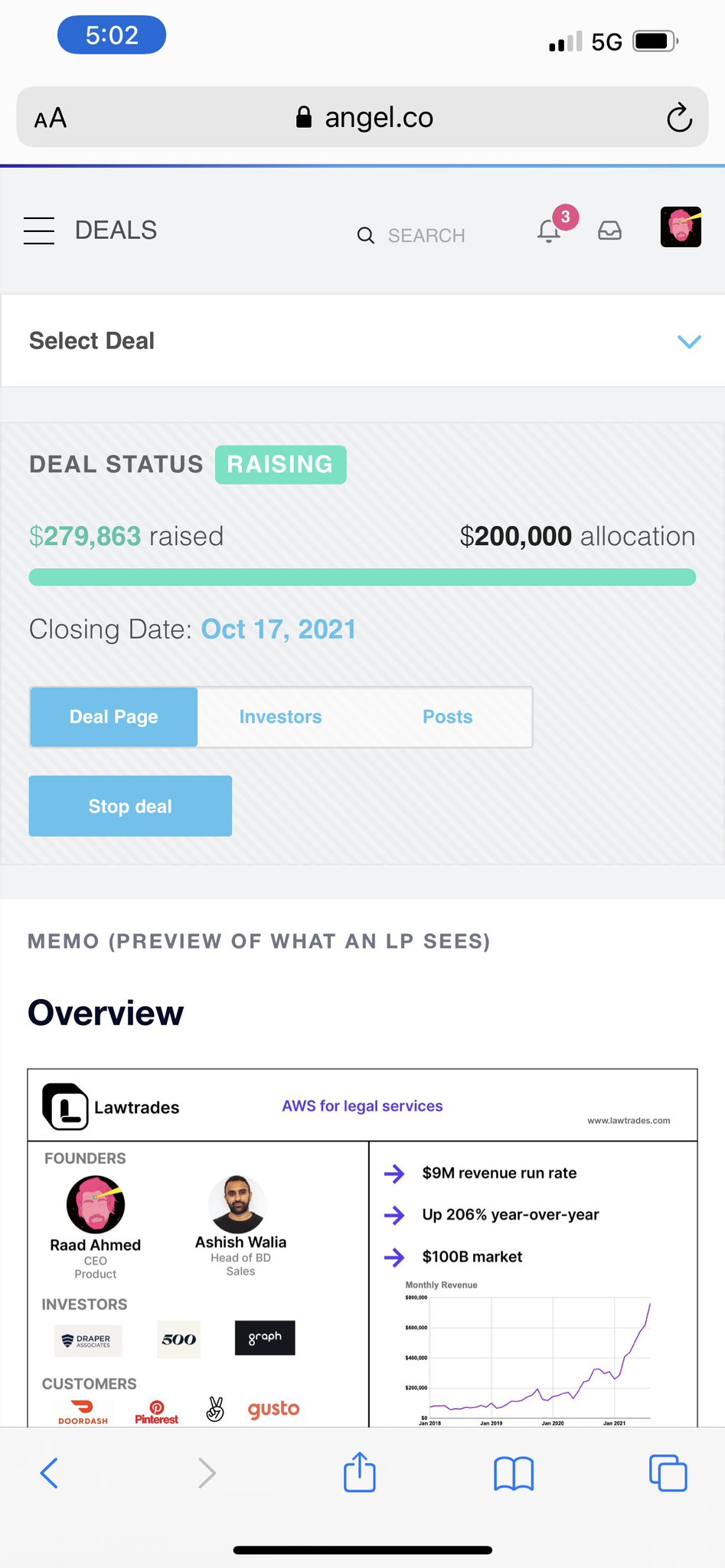

5/ Dropped our Journey link into the @ruv_alliance Discord, where:

• Over 600 accredited investors immediately saw it

• Investors became customers

• We hit over $250k

👇

• Over 600 accredited investors immediately saw it

• Investors became customers

• We hit over $250k

👇

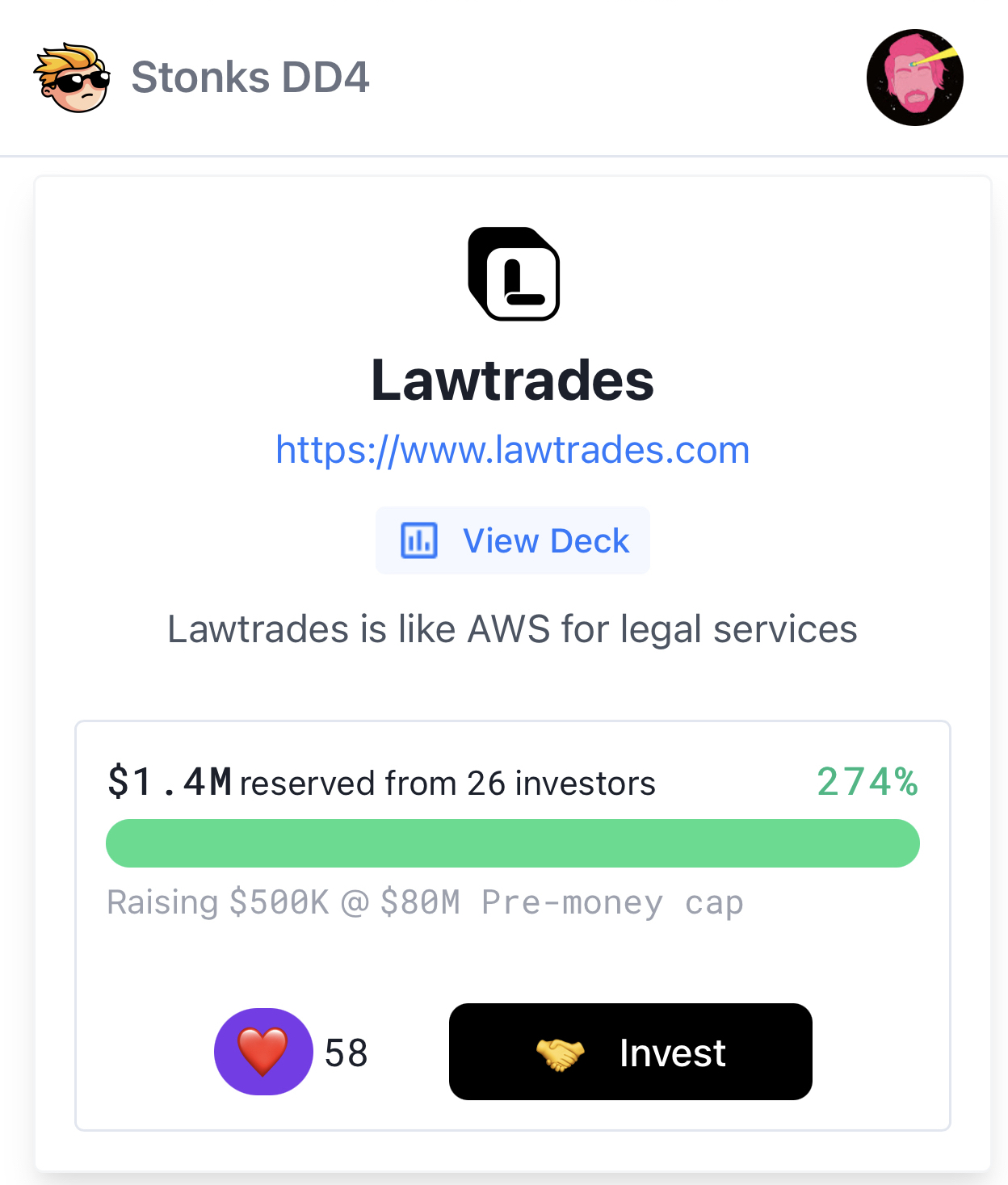

6/ Live-streamed our pitch on @Stonks_dot_com, which led to:

• Our link crossing a thousand views

• Over $1.4M committed from people I’ve never met

• Growing momentum in the fundraise

👇

• Our link crossing a thousand views

• Over $1.4M committed from people I’ve never met

• Growing momentum in the fundraise

👇

7/ Started sharing investor updates on @pumpdotapp, which led to:

• DM's from more investors wanting to get in the round

• @shl viewing my post and investing $100k after initially rejecting me

👇

• DM's from more investors wanting to get in the round

• @shl viewing my post and investing $100k after initially rejecting me

👇

6/ Leveraged network effects to fill the round.

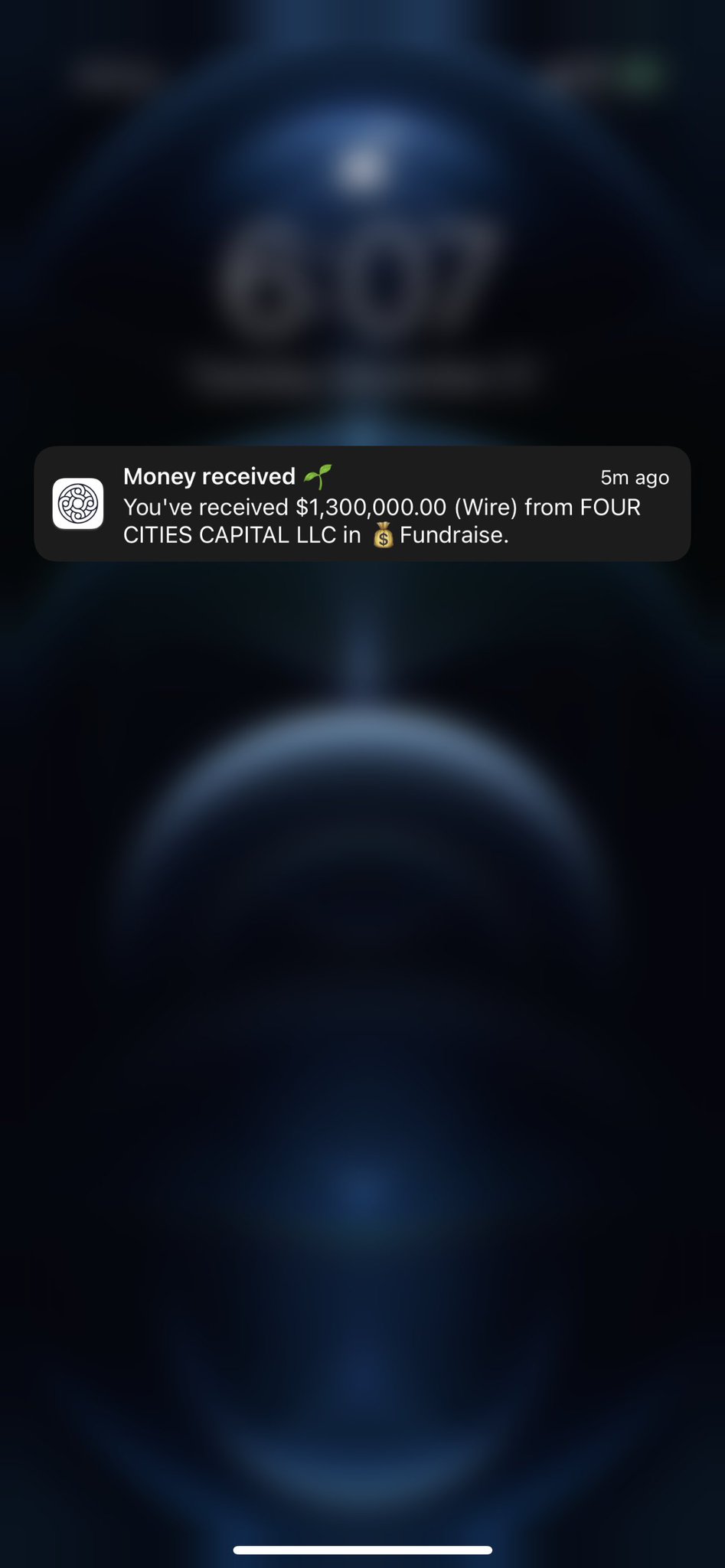

Instead of wasting time finding a VC to lead the round, we closed over $2.3M on our own with new checks coming in daily.

This eventually led to a founder-turned-VC investing the remaining $3.7M after noticing the momentum

👇

Instead of wasting time finding a VC to lead the round, we closed over $2.3M on our own with new checks coming in daily.

This eventually led to a founder-turned-VC investing the remaining $3.7M after noticing the momentum

👇

7/ Closed $6M ($80M valuation) from 100+ customers & investors.

Our unorthodox fundraising method let us:

• Share our vision at scale w/o meetings

• Create our own leverage

• Sell <10% of the company

• Preemptively halt churn by turning our users into owners

Our unorthodox fundraising method let us:

• Share our vision at scale w/o meetings

• Create our own leverage

• Sell <10% of the company

• Preemptively halt churn by turning our users into owners

If you enjoyed this thread, follow me @R44D for more!

I love talking about startups, and writing about:

• Building in public

• Marketplaces

• Fundraising

I love talking about startups, and writing about:

• Building in public

• Marketplaces

• Fundraising

thank you @bweitz1 @HarveyMultani @jay_azhang @jeremykuoo for reading drafts of this.

and my co founder @AshishW203 who never flinched when 💩 hit the fan.

and my co founder @AshishW203 who never flinched when 💩 hit the fan.