Thread by Deribit Insights

- Tweet

- Jan 22, 2022

- #Cryptocurrency

Thread

1) When markets break it's impossible to differentiate between desired and forced Option flow.

Will avoid discussing precise forensics today as an Options trade may appear bullish/bearish when actually it's risk mitigation or taking profits.

Big picture of the last 24hours:

🧵

Will avoid discussing precise forensics today as an Options trade may appear bullish/bearish when actually it's risk mitigation or taking profits.

Big picture of the last 24hours:

🧵

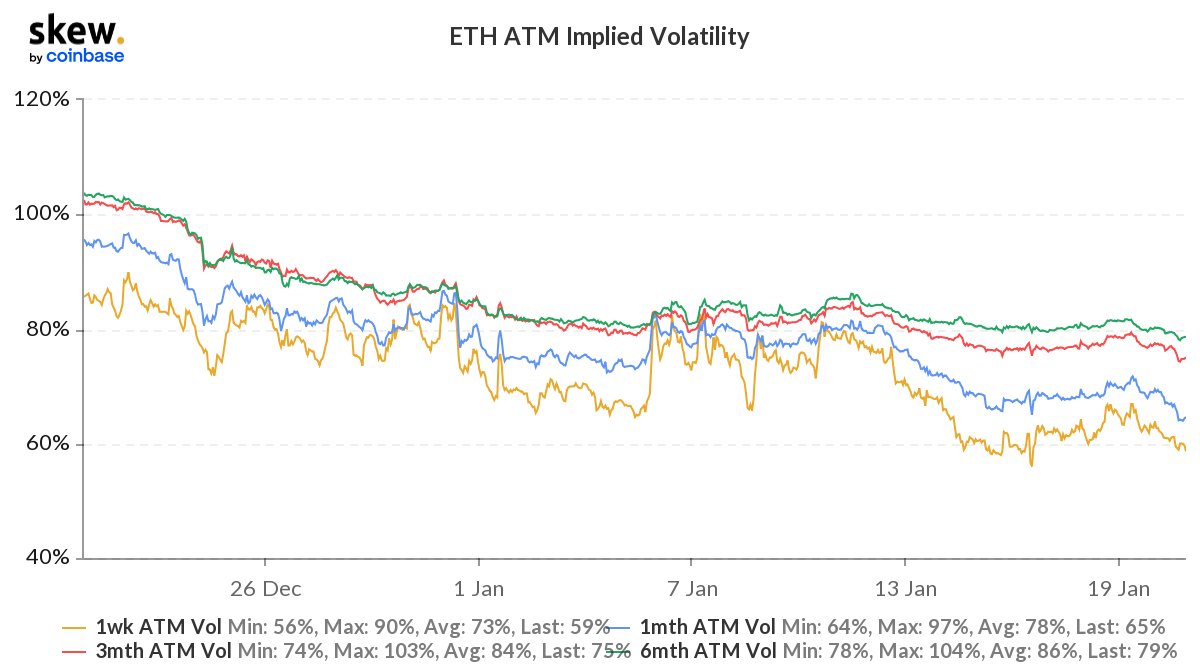

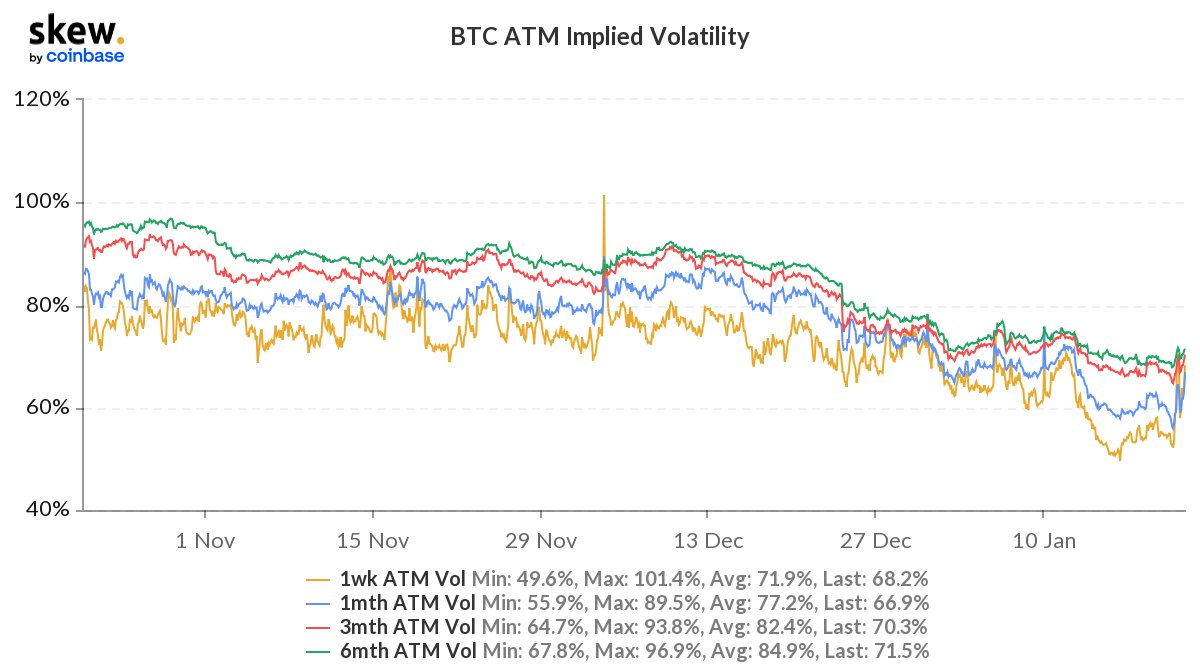

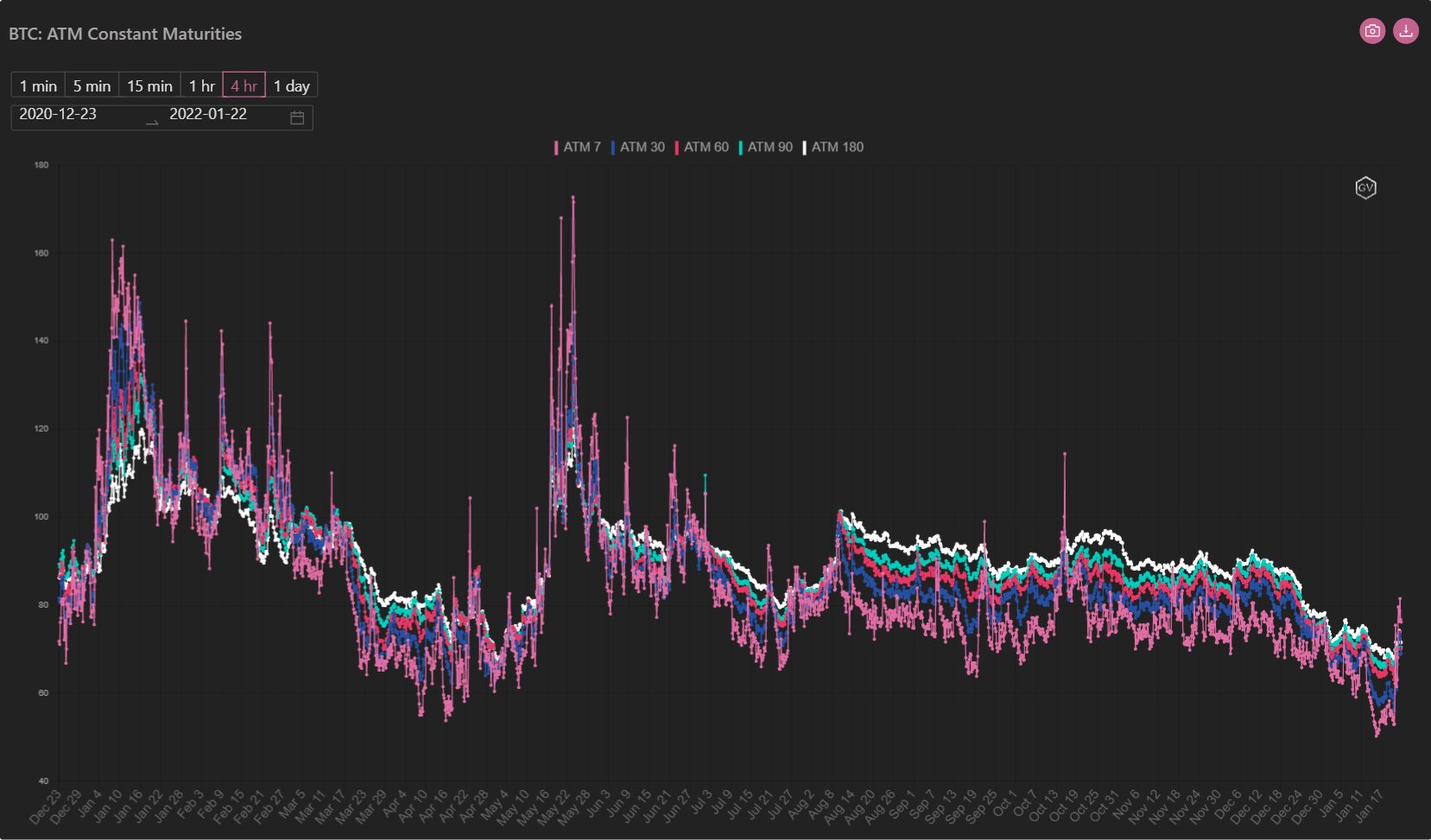

2) A painfully quiet week for Option MMs as most were saturated with gamma + theta from DOVs.

Implied Vols hit year lows and were compounded by low Realized Vol.

Macro, however, was looking uncomfortable ahead of Fed meeting this week and the discussion around raising rates.

Implied Vols hit year lows and were compounded by low Realized Vol.

Macro, however, was looking uncomfortable ahead of Fed meeting this week and the discussion around raising rates.

3) Living in a crypto bubble, there was little reason to fight the falling IV levels with crypto RV falling too.

But outside the bubble, IV on S&P+Nasdaq were rising rapidly as concerns brewed.

This led MMs having to question whether they should hold Long vol through more pain.

But outside the bubble, IV on S&P+Nasdaq were rising rapidly as concerns brewed.

This led MMs having to question whether they should hold Long vol through more pain.

4) Some Funds have fallen out of love with BTC, focussing more on ETH+Alts, and most had wasted money on Call premiums which hadn't paid off, so BTC lacked IV support. A few had Risk-reversals protecting AUM.

ETH Option flow has seen increased activity, as DOVs hit IV, Funds buy.

ETH Option flow has seen increased activity, as DOVs hit IV, Funds buy.

5) What made the decision tougher for MMs was the looming new DOV supply which they would be requested to quote on, which they knew would hit 1week IV even harder, so should they puke their longs to buy cheaper or stay long against macro weakness?

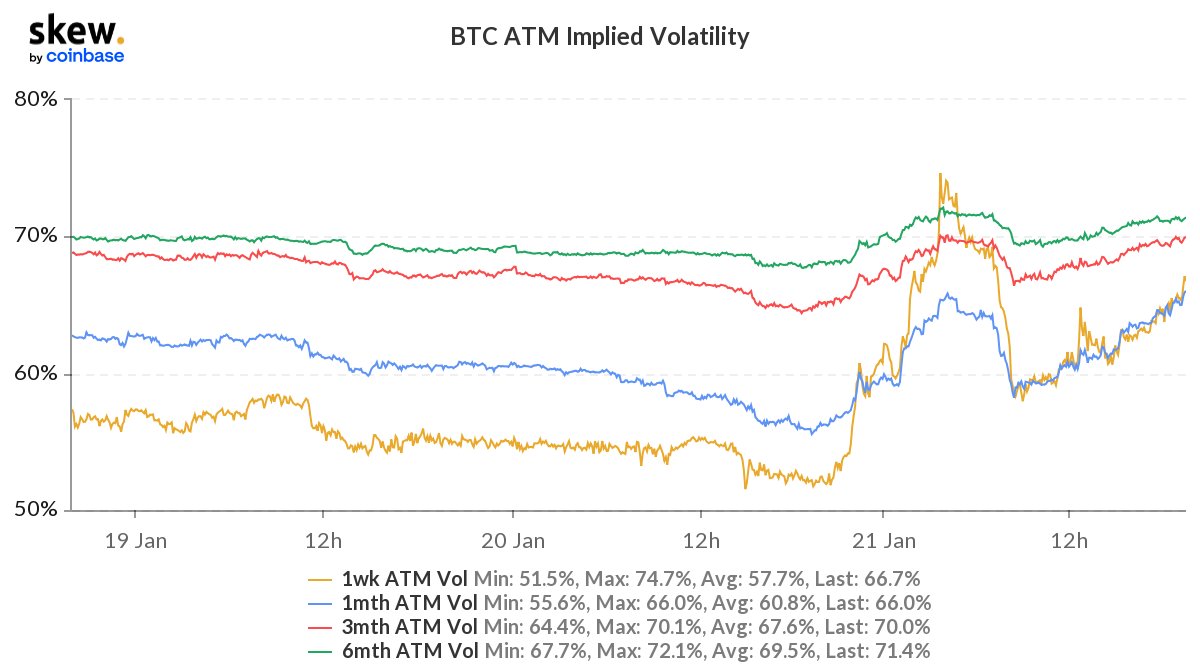

6) There was a mix of responses, but as many went to sleep, they woke up to a US equity drop, and BTC had fallen through 39k, ETH through 2.9k.

IV bounced from lows, but then sold off into DOVs at the front end, before LPs bid to buy the cheapest Vol of the day. Demand for Puts.

IV bounced from lows, but then sold off into DOVs at the front end, before LPs bid to buy the cheapest Vol of the day. Demand for Puts.

7) With Spot not bouncing ahead of the US open, started to see Vol being bought as nerves kicked in.

Observed tight strike Strangles bought in BTC Jan+Feb, wider in March.

These tight strangles often purchased as risk mitigation or to buy Vol with the expectation of a large move.

Observed tight strike Strangles bought in BTC Jan+Feb, wider in March.

These tight strangles often purchased as risk mitigation or to buy Vol with the expectation of a large move.

8) Surprising to many experienced traders was the absolute levels of IV. While IV had bounced, it was still below Dec21 levels, which were already subdued.

Yes, DOVs fill the market with gamma, yes Realized vol HAD been low, but we'd just seen a 10% move and uncertainty reigned.

Yes, DOVs fill the market with gamma, yes Realized vol HAD been low, but we'd just seen a 10% move and uncertainty reigned.

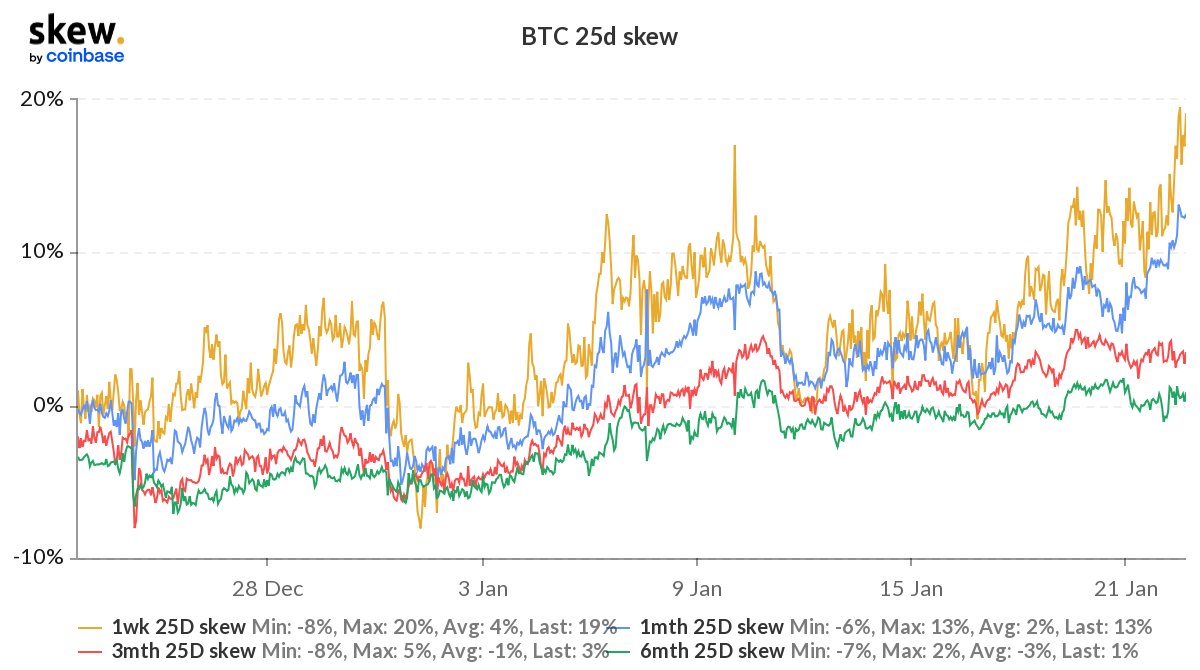

9) Meanwhile, Skew (fear indicator) had moved to extremes (25delta Puts 20%>Calls in 1week tenor) on BTC.

On ETH there was some catching up to do, mainly due to the ETH DOV Put supply that MMs had bought.

The main selling area when ETH spot was around 2850 was the 2500 strike.

On ETH there was some catching up to do, mainly due to the ETH DOV Put supply that MMs had bought.

The main selling area when ETH spot was around 2850 was the 2500 strike.

10) Option buyers took advantage of this supply and started accumulating around those strikes.

Nasdaq support fell and equities dipped below the 200MA.

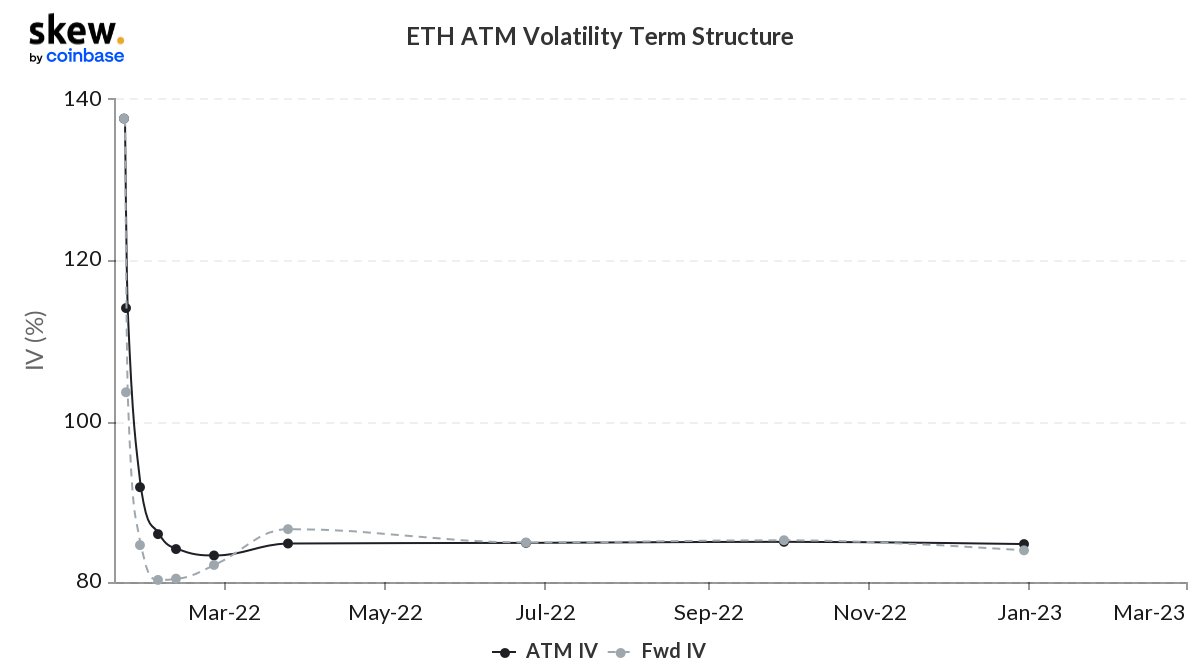

Combined this with a Maker ETH auction and Spot fell sharply <2500.

The term-structure changed form. Spike at the front.

Nasdaq support fell and equities dipped below the 200MA.

Combined this with a Maker ETH auction and Spot fell sharply <2500.

The term-structure changed form. Spike at the front.

11) As I highlighted in last week's DOV thread, these Vault sellers don't buy back the Options, so we don't get to see a sudden extra IV vol squeeze from short-covering.

Option market effectively net long gamma.

In IV terms, this sell-off is barely distinguishable.

(far right!).

Option market effectively net long gamma.

In IV terms, this sell-off is barely distinguishable.

(far right!).