Thread

"ESG investing" in its current form is similar to people who take selfies of themselves in fancy locations to show they were there, while barely experiencing it for real.

Mostly theater, little substance.

Mostly theater, little substance.

For example, we pollute, but buy offsets to make it someone else's problem.

We outsource our manufacturing base to another country to reduce headline energy consumption, but then buy products they make while blaming them for polluting.

This is deflection, not reform.

We outsource our manufacturing base to another country to reduce headline energy consumption, but then buy products they make while blaming them for polluting.

This is deflection, not reform.

Software companies that build a business around addicting teens to their platform with regular dopamine hits & abuse user data sit atop the ESG investment indices, while fossil fuel producers that keep billions of people alive and comfortable are often excluded as a whole sector.

There's a trend to cut off existing energy production before having viable replacements.

Solar and wind for example, are intermittent. They require grid-scale storage, which doesn't exist in cost-effective form yet. It requires massive copper/nickel/other-metals production.

Solar and wind for example, are intermittent. They require grid-scale storage, which doesn't exist in cost-effective form yet. It requires massive copper/nickel/other-metals production.

If you run the math on how much copper, nickel, and other metals the world needs to produce in order to reduce oil/gas/coal usage as a percentage of global energy production, it's far beyond what we can currently produce. And those metals require fossil fuels to dig up.

Politicians score narrative points by making goals to do a certain thing by a certain date, without the technology in place to make it possible.

It's often a bunch of non-engineers making engineering decisions.

And as voters we feel good, despite having done little yet.

It's often a bunch of non-engineers making engineering decisions.

And as voters we feel good, despite having done little yet.

The majority of solar equipment currently comes out of China, which manufactures the equipment using coal and very ethically-questionable labor (to say the least).

foreignpolicy.com/2021/07/14/us-chinese-solar-panels-green-tech-strategy/

www.bbc.com/news/world-asia-china-57124636

foreignpolicy.com/2021/07/14/us-chinese-solar-panels-green-tech-strategy/

www.bbc.com/news/world-asia-china-57124636

We barely know how to recycle wind turbines yet (which are made from petroleum and don't biodegrade), so we just burry them in mass graves.

Wind is renewable but wind turbines are not, yet we pretend they are or simply assume they one day will be.

www.bloomberg.com/news/features/2020-02-05/wind-turbine-blades-can-t-be-recycled-so-they-re-piling-up...

Wind is renewable but wind turbines are not, yet we pretend they are or simply assume they one day will be.

www.bloomberg.com/news/features/2020-02-05/wind-turbine-blades-can-t-be-recycled-so-they-re-piling-up...

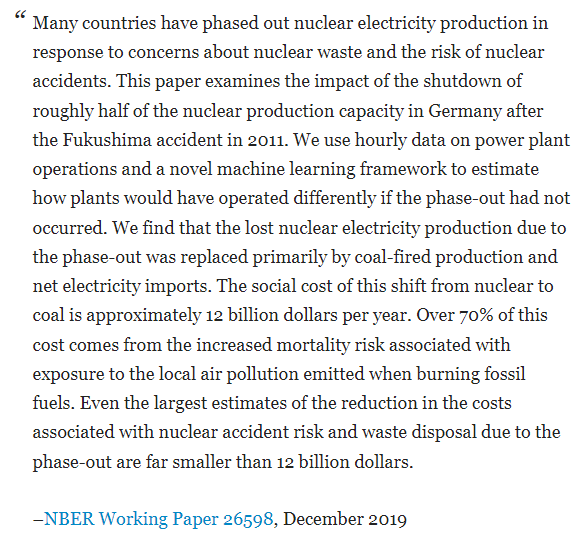

We cut existing nuclear production and end up relying more on coal than we otherwise would have.

We overbuild intermittent sources of power production, without proper storage, run into energy shortages, and then act surprised and resort to coal.

www.nber.org/papers/w26598

We overbuild intermittent sources of power production, without proper storage, run into energy shortages, and then act surprised and resort to coal.

www.nber.org/papers/w26598

We rightly condemn human rights violations that China is doing to Uyghurs, but the biggest holding in Vanguard's ESG ETF is Apple, which signs quarter-trillion dollar deals with the CCP:

www.theguardian.com/technology/2021/dec/07/apple-china-deal-tim-cook

www.theguardian.com/technology/2021/dec/07/apple-china-deal-tim-cook

So people sell their Chinese shares, buy Apple shares instead, and pat themselves on the back.

Meanwhile their phone, computer, chair, sneakers, cookware, electronic devices, and kids' toys are all partly Chinese made.

A lot of it is window dressing.

Meanwhile their phone, computer, chair, sneakers, cookware, electronic devices, and kids' toys are all partly Chinese made.

A lot of it is window dressing.

"ESG" as currently used is corporate, sanitized, and nearly meaningless.

It's like the the word "synergy". It's a TPS report.

It's policymakers vowing to increase taxes on public air travel while excluding the impact on private jets for themselves. That sort of thing.

It's like the the word "synergy". It's a TPS report.

It's policymakers vowing to increase taxes on public air travel while excluding the impact on private jets for themselves. That sort of thing.

I'm 100% in favor of environmentalism. We should absolutely prioritize less pollutants going into the air, water, and ground.

And I'm very in favor of diverse boards of directors. A broad background of experiences is beneficial for risk management and growth opportunities.

And I'm very in favor of diverse boards of directors. A broad background of experiences is beneficial for risk management and growth opportunities.

And a good company over the long run takes care of its employees and clients rather than just emphasizing executives and shareholders.

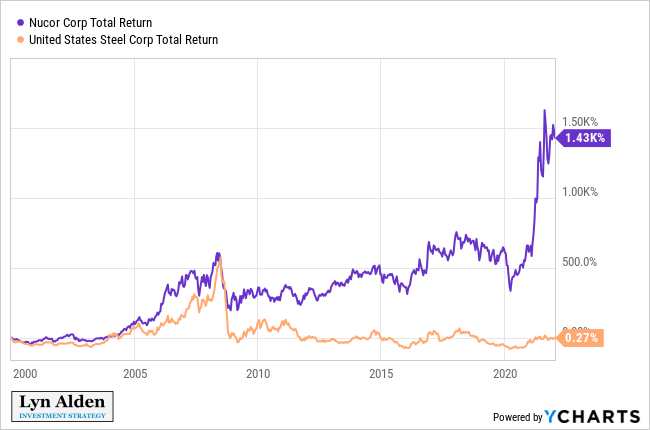

Nucor outperformed US Steel in large part because it took care of its employees through cycles, realizing how valuable they are.

Nucor outperformed US Steel in large part because it took care of its employees through cycles, realizing how valuable they are.

We should absolutely reward companies that do good, fundamentally. That treat employees and customers well. That maximize environmental efficiency over the long run. That are aware of their limitations and echo chambers and seek diverse expertise to flourish.

It's less about what sector a company is in, and what check boxes they are ticking off, and more about whether they, at the core philosophy of their business, are emphasizing the long-term or the short-term in terms of investment and stakeholders.

Most government and corporate actions are about the next election cycle, the next quarterly report, the next vesting period. Almost all short-term.

Real progress is more about long-term thinking and sustainable designs, not short-term narrative point-scoring and signaling.

Real progress is more about long-term thinking and sustainable designs, not short-term narrative point-scoring and signaling.

If anything, pretending we are doing good to check off certain boxes as perceived by others, while still doing whatever we were doing before, slows real progress.

One of the worst things we can do is to feel like we are doing something constructive, without actually doing so.

One of the worst things we can do is to feel like we are doing something constructive, without actually doing so.

Mentions

See All

Alex Gladstein @gladstein

·

Jan 18, 2022

Must-read thread from Lyn. Remember: in the 10,000 word manifesto of the ESG-steering UN Sustainable Development Goals, here’s how often these terms are mentioned: -Democracy = 0 -Journalism = 0 -Elections = 0 -Civil rights = 0 -Free expression = 0 -Privacy = 0 -Corruption = 1