Thread

Hodling BTC & ETH doesn’t get you far. Outperformance comes from betting on winners b/f the crowd.

Yes that’s hard. But crypto is more equal than tradFi. W/ solid process, you can beat many larger players.

A 5-step framework for picking winners w/o hot tips or “expert” help 👇

Yes that’s hard. But crypto is more equal than tradFi. W/ solid process, you can beat many larger players.

A 5-step framework for picking winners w/o hot tips or “expert” help 👇

Note if you have PTSD from prior cycles that tells you all “alt coins” go to zero, you need to deal w/ that emotional baggage rn b/f it does even more damage to your bank account.

Time is different. Crypto has order-of-magnitude more adoption w/ real use cases compared to 4 yrs ago & train isn’t stopping. If you don’t adapt, you’ll get left behind.

That said, it’s still an early & risky mkt. Higher return comes from going out on risk curve & investing like early-stage VCs. So embrace VC mentality— most bets may not pay off, but if you make choices based on sound principles, a few of them will 10x-100x & cover for rest.

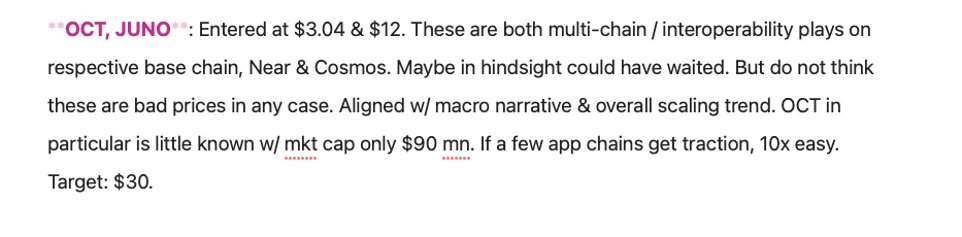

Also note in following I’ll use a recent investment of mine, Octopus Network (OCT), as example to make my points. This is not abt OCT. It’s an illustration & NOT investment advice.

STEP 1: SCOUT

First we need a list of high-potential investment leads to fill your watchlist & keep adding to it. How do we find the leads?

Two ways: top down or bottom up.

First we need a list of high-potential investment leads to fill your watchlist & keep adding to it. How do we find the leads?

Two ways: top down or bottom up.

**Top down:**

Figure out what the next high-level growth areas will be in crypto & look for projects in those areas.

Example. I wrote abt earlier 3 growth themes for this yr: 1) alt L1s/L2s, 2) gaming, 3) multi chain/ interoperability.

Figure out what the next high-level growth areas will be in crypto & look for projects in those areas.

Example. I wrote abt earlier 3 growth themes for this yr: 1) alt L1s/L2s, 2) gaming, 3) multi chain/ interoperability.

1) b/c huge demand for cheaper, faster blockchains. 2) b/c it’s next frontier for end user adoption in crypto. 3) b/c once you have 1), demand for inter-chain communication surges.

Once growth themes identified, we just need to go find promising projects that fit those themes. That’s how I found OCT— I was researching abt NEAR, a L1 chain (theme #1) & OCT was listed right on home page of NEAR website.

It caught my eyes b/c this project allows apps to deploy their own blockchain easily, cheaply & communicate w/ other chains, i.e. it fits both themes #1 & #3. Value props are clear. If it can pull them off, mkt demand will be huge.

Other ways to do ‘top down’: check ‘ecosystem’ or ‘projects’ page on sites of L1s & find projects that fit high-growth themes. Analytic sites like DefiLlama & DappRadar also list projects by chain, where you can get data on their growth track records that’ll come in handy later.

** Bottom up:**

This is prob the easiest way to scout ever: find those names that go against grain when mkt tanks & investigate why (bonus point if they fit your high-level growth themes).

This is prob the easiest way to scout ever: find those names that go against grain when mkt tanks & investigate why (bonus point if they fit your high-level growth themes).

There’re multiple promising names even in these two example screenshots below.

And if your capital is under $10 mil, you actually don’t have to limit to top 300 names. Your bid size would be small enough for lower-rank tokens w/ thinner liquidity— ’tis the retail advantage. More on this in a sec.

Twitter is another way for ‘bottom up’ scouting. Read replies on big accounts. Everyone loves to shill their bags, e.g. if I mention 3 tokens in my ‘notes of the day’ tweets, there’re often 10 unrelated tokens shilled in reply. If you hear a new name, give it a quick look.

STEP 2: INVESTIGATE

You’ve filled your watchlist w/ some names. It’s time for forensics. Read project website, docs, blogs. Search them on youtube, podcasts, reddit. Join their discord. If it’s a consumer project, use it yourself.

You’ve filled your watchlist w/ some names. It’s time for forensics. Read project website, docs, blogs. Search them on youtube, podcasts, reddit. Join their discord. If it’s a consumer project, use it yourself.

All info is to help you answer these 5 main Qs:

1/ Is project solving a big problem?

2/ What’s the token used for?

3/ How much traction is there?

4/ Does it have any moat?

5/ Can team execute?

1/ Is project solving a big problem?

2/ What’s the token used for?

3/ How much traction is there?

4/ Does it have any moat?

5/ Can team execute?

If information is overwhelming, good! It means you’re stretched & learning something new.

Go back to our OCT example. They didn’t have a ton of content, so I found the project’s YT channel & watched all their vids.

Their founder is obv a nerd & presentation awkward. But at least you can tell he is a) not an idiot, b) insightful abt the industry, c) down to earth & unassuming.

After a round of intel gathering abt OCT, here’s my first-pass answers to the 5 big Qs.

1/ Is project solving a big problem?

Totally. It’s trying to solve 2 major blockchain growth bottlenecks: scaling & interoperability.

1/ Is project solving a big problem?

Totally. It’s trying to solve 2 major blockchain growth bottlenecks: scaling & interoperability.

2/ What’s the token used for?

For validator staking to secure all app chains built w/ OCT. More app chains built, more demand for OCT token.

For validator staking to secure all app chains built w/ OCT. More app chains built, more demand for OCT token.

3/ How much traction is there?

Not much. Only 1 app chain deployed when I 1st checked. But roadmap says plan to launch 17 more chains by Q3. Unclear if that’ll pan out.

4/ Does it have moat?

Not much. Only 1 app chain deployed when I 1st checked. But roadmap says plan to launch 17 more chains by Q3. Unclear if that’ll pan out.

4/ Does it have moat?

Obv of strategic importance to NEAR. Once app chain launches, switching cost is high. The more app chains, the bigger network effect & scale economy. Plus it’s a similar offering to Cosmos & Polkadot, but cheaper. So moat can be huge if executed well.

5/ Can team execute?

Launched 1 app chain & an app incubator. Doing ok on executing roadmap.

Launched 1 app chain & an app incubator. Doing ok on executing roadmap.

STEP 3: CALCULATE

You have answered 5 big Qs abt project fundamentals. Now you need to do some math to figure out how cheap or expensive the project is selling for.

You have answered 5 big Qs abt project fundamentals. Now you need to do some math to figure out how cheap or expensive the project is selling for.

We can do this by finding the project’s mkt cap, fully diluted mkt cap, token issuance plan & distribution, & comparing them w/ competitors.

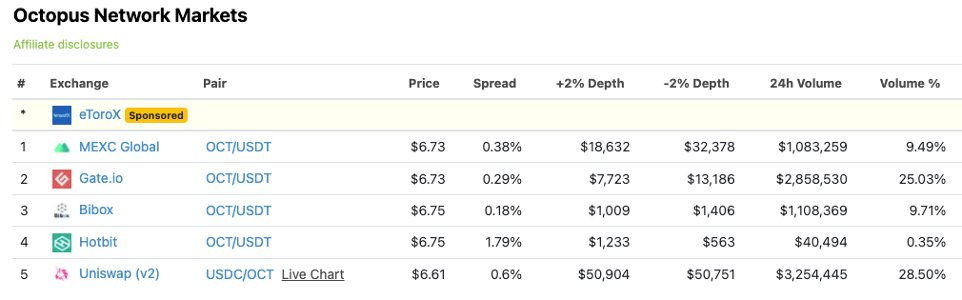

At the time I looked at OCT, it had fully diluted mkt cap of $300 mn & circulating mkt cap of under $100 mn. This is extremely small compared to competitors solving same problem (DOT $30 bn, ATOM $10 bn).

Granted it’s newer w/ much smaller traction. But even taking that into account, it seemed cheap in comparison w/ big room to grow. (One reason is perhaps project team isn’t in US & marketing effort has been light.)

(BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter .)

STEP 4: COUNTER

Now you’ve decided a project has potential & isn’t expensive, time to play devil’s advocate. Think abt how your investment thesis can go wrong. What are the major risks?

Now you’ve decided a project has potential & isn’t expensive, time to play devil’s advocate. Think abt how your investment thesis can go wrong. What are the major risks?

To me biggest risk w/ OCT is it’ll live or die by the traction of app chain projects launched on top. App chains launching this yr are by definition new projects, but late-stage bull cycle is not best time to launch new projects.

If mkt condition turns sour this yr & app chains can’t get enough traction, OCT momentum may die.

2nd risk is related to NEAR. Actual usage of the chain is still light compared to tier 1 alt L1s. Whether NEAR can graduate to tier 1 is open question. If it stays a B player, obv no good for OCT since this is indirectly a bet on NEAR.

Other risks are too numerous to count. But one thing I note is all risks I can think of will be more relevant as the project grows, but not necessarily so at $100 mn mkt cap.

Obv how much weight you give each risk factor is a judgement call. Good judgement is an art that takes practice. We can all strive to see more of forest beyond trees.

STEP 5: SYNTHESIZE

Let’s say you’ve decided a project is investment worthy after looking at its fundamentals, valuation, risks & consolidating all info. Now you need to decide 1) how much to buy, 2) when to buy.

Let’s say you’ve decided a project is investment worthy after looking at its fundamentals, valuation, risks & consolidating all info. Now you need to decide 1) how much to buy, 2) when to buy.

The 1st issue depends on your assessment of how big the opportunity is relative to risk. General rule of thumb for small cap early stage projects like OCT: 1-5% of portfolio. If it succeeds, upside is huge. If it doesn’t, it won’t be end of world.

Btw this is also why early stage small caps are your true advantage as retail investor.

Liquidities in these tokens are thin. If you’re an institution w/ billion $ in capital, it’s almost impossible to allocate even 1-5% to something like OCT w/o causing havoc. Crypto is a rare mkt where retail can systemically front run large players.

As for when to buy, we need to think abt if there’s any short-term catalyst or if it can wait, as there’s always opportunity cost to any investment. If you like TA, that obv can help too.

For OCT, I positioned quickly b/c there was indeed ST catalyst— NEAR had strong price action the month prior & just launched large incentive fund for ecosystem projects.

It looked like more incentives might come (it did). Since OCT is prominent project for NEAR, this should benefit both OCT & its app chains in short term.

That was the thought process, which worked out fine. But tbh if there weren’t any catalyst, I’d prob have bought too as valuation was cheap.

TLDR: 5-step process to find crypto winners--

1/ Scout candidates (top down & bottom up)

2/ Investigate fundamentals (5 major Qs)

3/ Calculate valuation (relative to traction & competition)

4/ Counter arguments (main risks)

5/ Synthesize decisions (position size & timing)

1/ Scout candidates (top down & bottom up)

2/ Investigate fundamentals (5 major Qs)

3/ Calculate valuation (relative to traction & competition)

4/ Counter arguments (main risks)

5/ Synthesize decisions (position size & timing)

Full article at taschalabs.com/how-to-find-the-10x-winners-in-crypto/

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @TaschaLabs

Questions? Thoughts? Put in the comments & I’ll address the interesting ones in future articles. Be civil.

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @TaschaLabs

Questions? Thoughts? Put in the comments & I’ll address the interesting ones in future articles. Be civil.

Mentions

See All

Misha @MishadaVinci

·

Jan 17, 2022

Investing in crypto? Read this first 👇