Thread

I've been behind enemy lines, reading everything published by the Bank of International Settlements in 2021.

Here are 10 pieces that I found the most alarming and most relevant to Bitcoin.

"Know thy enemy and know yourself; in a hundred battles, you will never be defeated." 👇

Here are 10 pieces that I found the most alarming and most relevant to Bitcoin.

"Know thy enemy and know yourself; in a hundred battles, you will never be defeated." 👇

1.) www.bis.org/publ/arpdf/ar2021e.pdf

Some key takeaways from their 2021 Annual Report:

- They advocate for a global digital identity system

- Vaccine rollouts are a focus for them for the economic recovery

- They recommend that CBDC accounts be directly tied to a person’s identity

Some key takeaways from their 2021 Annual Report:

- They advocate for a global digital identity system

- Vaccine rollouts are a focus for them for the economic recovery

- They recommend that CBDC accounts be directly tied to a person’s identity

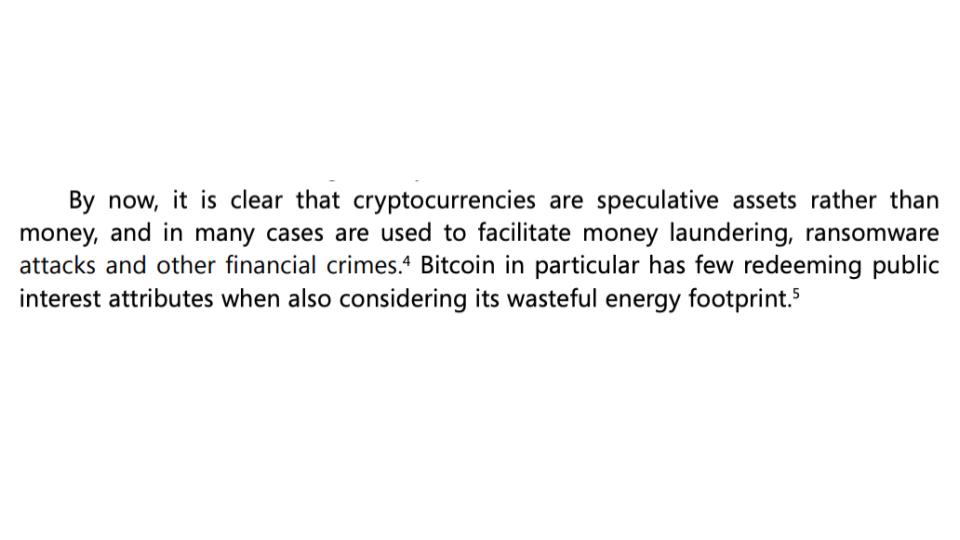

Here is the only mention of Bitcoin in their Annual report (lol).

I expect the misinformed environmental FUD against Bitcoin from Central Banks (CBs) to only grow louder heading into 2022.

I expect the misinformed environmental FUD against Bitcoin from Central Banks (CBs) to only grow louder heading into 2022.

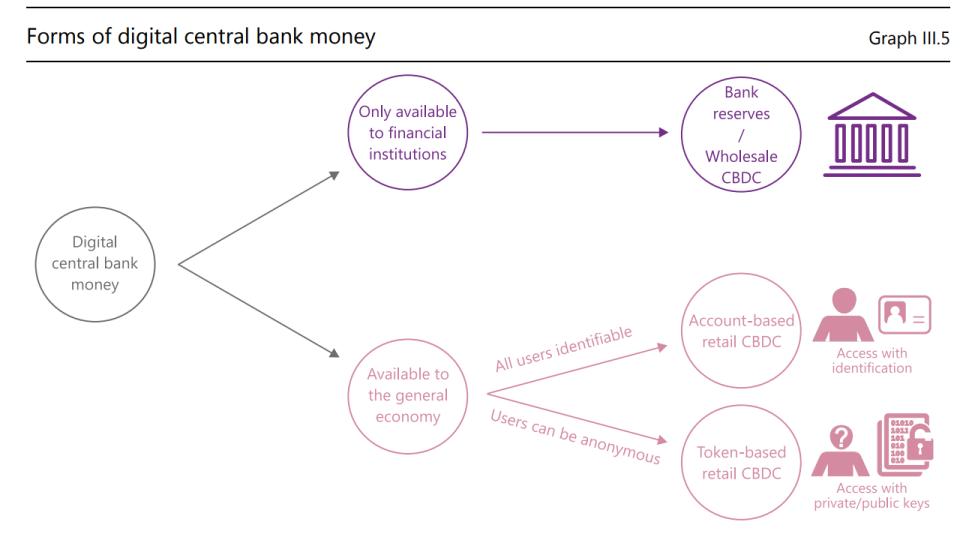

Their main recommendation concerning CBDCs is for what they call an “account-based retail CBDC” which will be a system where individuals have direct accounts with the central bank where all users are identifiable using a universal digital ID scheme.

With CBDCs, some of the most shocking excerpts in the report are where they claim CBs would have the power to "lay the groundwork for privacy assurances” and act “much as local authorities preside over their town’s marketplace."

They want you to trust them with total control.

They want you to trust them with total control.

2.)www.bis.org/fsi/publ/insights37_summary.pdf

In an executive summary, they found that during COVID the use of supervision technology tools increased from 12 tools used in 2019 to 71 tools used in 2021.

The use of financial surveillance tools by CBs has absolutely mooned since the pandemic began.

In an executive summary, they found that during COVID the use of supervision technology tools increased from 12 tools used in 2019 to 71 tools used in 2021.

The use of financial surveillance tools by CBs has absolutely mooned since the pandemic began.

3.)www.bis.org/fsi/publ/insights31_summary.pdf

In this summary, they push the FATF’s recommendations to further regulate CSPs (Cryptoasset Service Providers).

- call for more enforcement action against CSPs.

-call for the implementation of the FATF’s travel rule.

-call for more surveillance.

In this summary, they push the FATF’s recommendations to further regulate CSPs (Cryptoasset Service Providers).

- call for more enforcement action against CSPs.

-call for the implementation of the FATF’s travel rule.

-call for more surveillance.

Here’s the updated FATF’s guidance on “virtual assets” that the BIS is referring to: www.fatf-gafi.org/media/fatf/documents/recommendations/Updated-Guidance-VA-VASP.pdf

TL;DR - they hate Bitcoin.

*Reminder* - the FATF is an unelected non-governmental organization and yet, governments always seem to implement their guidance. weird.🤔

TL;DR - they hate Bitcoin.

*Reminder* - the FATF is an unelected non-governmental organization and yet, governments always seem to implement their guidance. weird.🤔

4.) www.bis.org/publ/work930.pdf

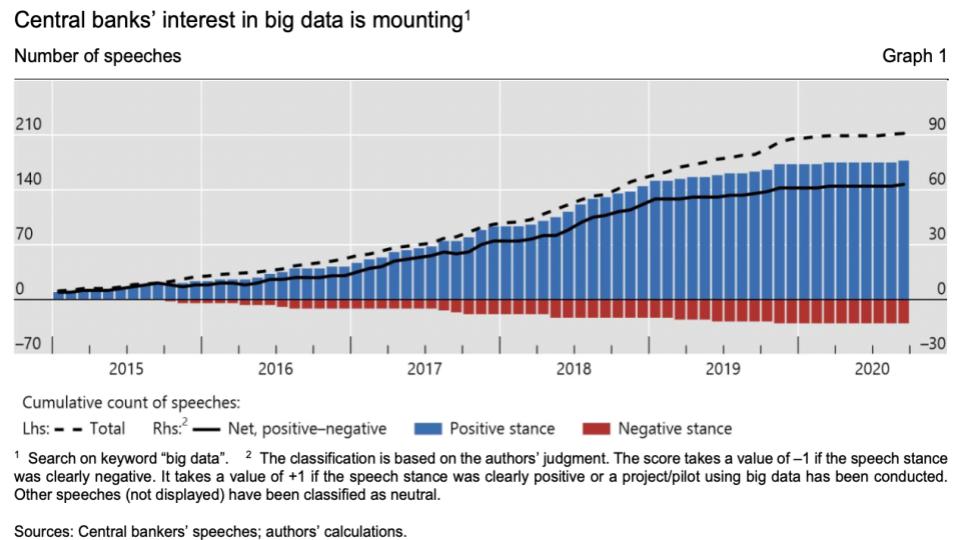

80% of CBs now use big data, up from 30% in 2015.

“Citizens might feel uncomfortable with the idea that CBs...are scrutinizing their search histories, social media postings or listings on market platforms.”

Nailed it! But CBs want your data anyway.

80% of CBs now use big data, up from 30% in 2015.

“Citizens might feel uncomfortable with the idea that CBs...are scrutinizing their search histories, social media postings or listings on market platforms.”

Nailed it! But CBs want your data anyway.

5.) www.bis.org/publ/work951.pdf

This paper found investors who own “crypto” are younger, educated, digitally native males who hold their investments for longer periods of time 😂. yes...HODL!

The conclusion of the paper recommends automatic “embedded surveillance” in crypto🖕

This paper found investors who own “crypto” are younger, educated, digitally native males who hold their investments for longer periods of time 😂. yes...HODL!

The conclusion of the paper recommends automatic “embedded surveillance” in crypto🖕

6.) www.bis.org/publ/work947.pdf

In a paper titled “What Lessons China Can Teach the World” (oof),

They write how credit scores appear to be useful, “especially the rich information backing the scoring can also act as a disciplinary device.”

They then share a story from China...

In a paper titled “What Lessons China Can Teach the World” (oof),

They write how credit scores appear to be useful, “especially the rich information backing the scoring can also act as a disciplinary device.”

They then share a story from China...

...how the names of citizens who defaulted on loans were released, & they were blacklisted from thousands of other merchants/activities, aka they were restricted and shamed.

This forced ~5.3k people to "voluntarily" pay off their debts.

The BIS found this story…interesting.

This forced ~5.3k people to "voluntarily" pay off their debts.

The BIS found this story…interesting.

7.) www.bis.org/publ/work976.pdf

This paper was an in-depth exploration into CBDCs and actually identified the inevitable outcome. 👇

This paper was an in-depth exploration into CBDCs and actually identified the inevitable outcome. 👇

8.) www.bis.org/publ/work941.pdf

In this paper they explore “CBDCs in a Cashless Society”:

- “In a cashless society, the general public does not have access to public money.”

- “CBDC would open up a direct channel by which monetary policy could be transmitted to the public.”

In this paper they explore “CBDCs in a Cashless Society”:

- “In a cashless society, the general public does not have access to public money.”

- “CBDC would open up a direct channel by which monetary policy could be transmitted to the public.”

What they are effectively saying here is, “CBs would have the ability to have total control and implement any policies they want in a cashless world."

Bring on negative interest rates and control over how people spend their own money!

Don’t like it?!...you’re shit out of luck.

Bring on negative interest rates and control over how people spend their own money!

Don’t like it?!...you’re shit out of luck.

9.) www.bis.org/publ/bppdf/bispap115.pdf

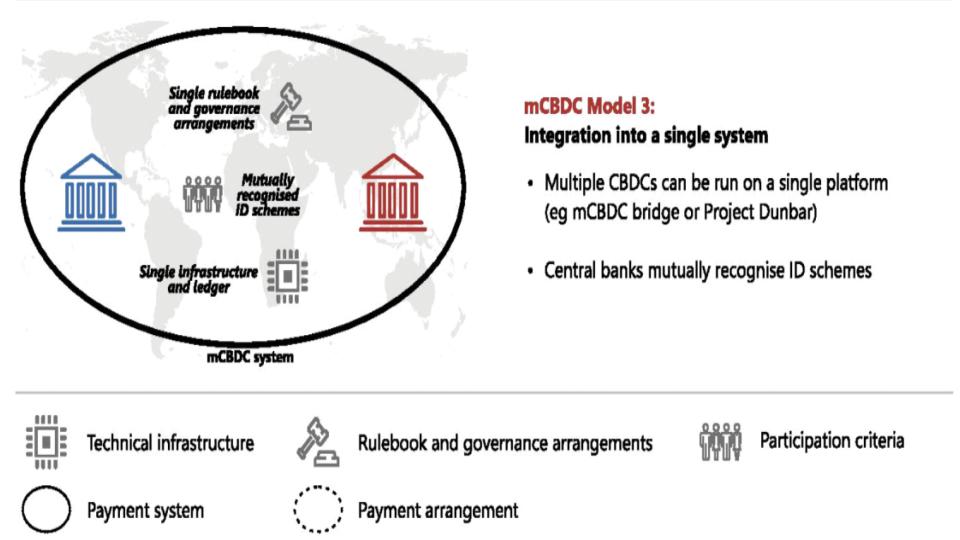

This paper explored the idea of Multi-CBDCs. This is where 1 global CBDC platform is designed and governed by...I guess a cohort of central bankers?

This would lead to 1 global platform that has a “single rulebook” and “mutually recognized ID schemes”

This paper explored the idea of Multi-CBDCs. This is where 1 global CBDC platform is designed and governed by...I guess a cohort of central bankers?

This would lead to 1 global platform that has a “single rulebook” and “mutually recognized ID schemes”

10.) www.bis.org/publ/bppdf/bispap116.pdf

To go off the last tweet…in this survey from June 2021, 28% of the CBs surveyed supported the idea of a “Multi-CBDC Arrangement".

It appears central banks are warming up to the idea of teaming up to form a global digital ID and CBDC system.

To go off the last tweet…in this survey from June 2021, 28% of the CBs surveyed supported the idea of a “Multi-CBDC Arrangement".

It appears central banks are warming up to the idea of teaming up to form a global digital ID and CBDC system.

To summarize the BIS in 2021, they focused on the trend of increasing financial surveillance tools, surveyed CBs on the potential for global digital ID schemes, took lessons from China on how credit scores can be used to enforce discipline on misbehaving citizens…

…and of course, they loved CBDCs and the power they enable. Mainly CBDCs enable CBs the ability to gather private data, enforce any monetary policy at will, and remove "dirty" cash from society.

Naturally, they also focused on how to surveil and regulate Bitcoin in 2021 too.

Naturally, they also focused on how to surveil and regulate Bitcoin in 2021 too.

From their own publications, one can infer that the BIS wants to bind all of the worlds’ citizens on a single CBDC and digital ID platform, consolidate more power into the hands of CBs, and build a draconian world of more surveillance, social credit systems, and less freedom.

The true enemies of freedom are CBDCs and their proponents

Even the BIS seems to recognize the risks CBDCs pose to privacy & freedom, but they're going along with their plans anyway.

This is why I Bitcoin - to help build an alternative for people to escape from this dark future

Even the BIS seems to recognize the risks CBDCs pose to privacy & freedom, but they're going along with their plans anyway.

This is why I Bitcoin - to help build an alternative for people to escape from this dark future

Thank you for reading 🙏

In the future, I plan to continue to dig into the publications of organizations like this.

I’ll leave you with this horrific video with the General Manager of the BIS on CBDCs and the complete control and power they give CBs...

In the future, I plan to continue to dig into the publications of organizations like this.

I’ll leave you with this horrific video with the General Manager of the BIS on CBDCs and the complete control and power they give CBs...

This blew up.

The best way to combat this is to take your wealth out of a system they control and into a system no one controls, Bitcoin.

Best place to buy is @SwanBitcoin (I work there)

The VERY best way is through my referral link 😂 Happy holidays! www.swanbitcoin.com/samcallahan

The best way to combat this is to take your wealth out of a system they control and into a system no one controls, Bitcoin.

Best place to buy is @SwanBitcoin (I work there)

The VERY best way is through my referral link 😂 Happy holidays! www.swanbitcoin.com/samcallahan