Thread

/1 Where are the Bulls’ Balls? A thread on the cryptocurrency markets over the last month and into the end of the year:

/2 First, a look at how we got to where we are — torrid rallies took BTC and ETH to all time highs again in November, one primarily driven by a futures ETF, the other by EIP 1559 emission reductions and adoption.

/3 Yet as people were maximally bullish, momentum flagged, price failed to continue, and then came back below the high.

/4 Objective observers’ caution turned into derisking, and those not swept up in the euphoria of new highs sold billions upon billions of inventory in the $60,000s on BTC.

/5 With momentum exhausted, the market had to justify buying not for momentum but instead under a value framework. The majority of participants were not willing to accept prices at those levels as a value range.

/6 Instead, after the year of years that was 2021 for funds everywhere, eyes turned to protecting annual bonuses, selling to harvest 20% carries, and covering redemptions from LPs looking to take some off the table.

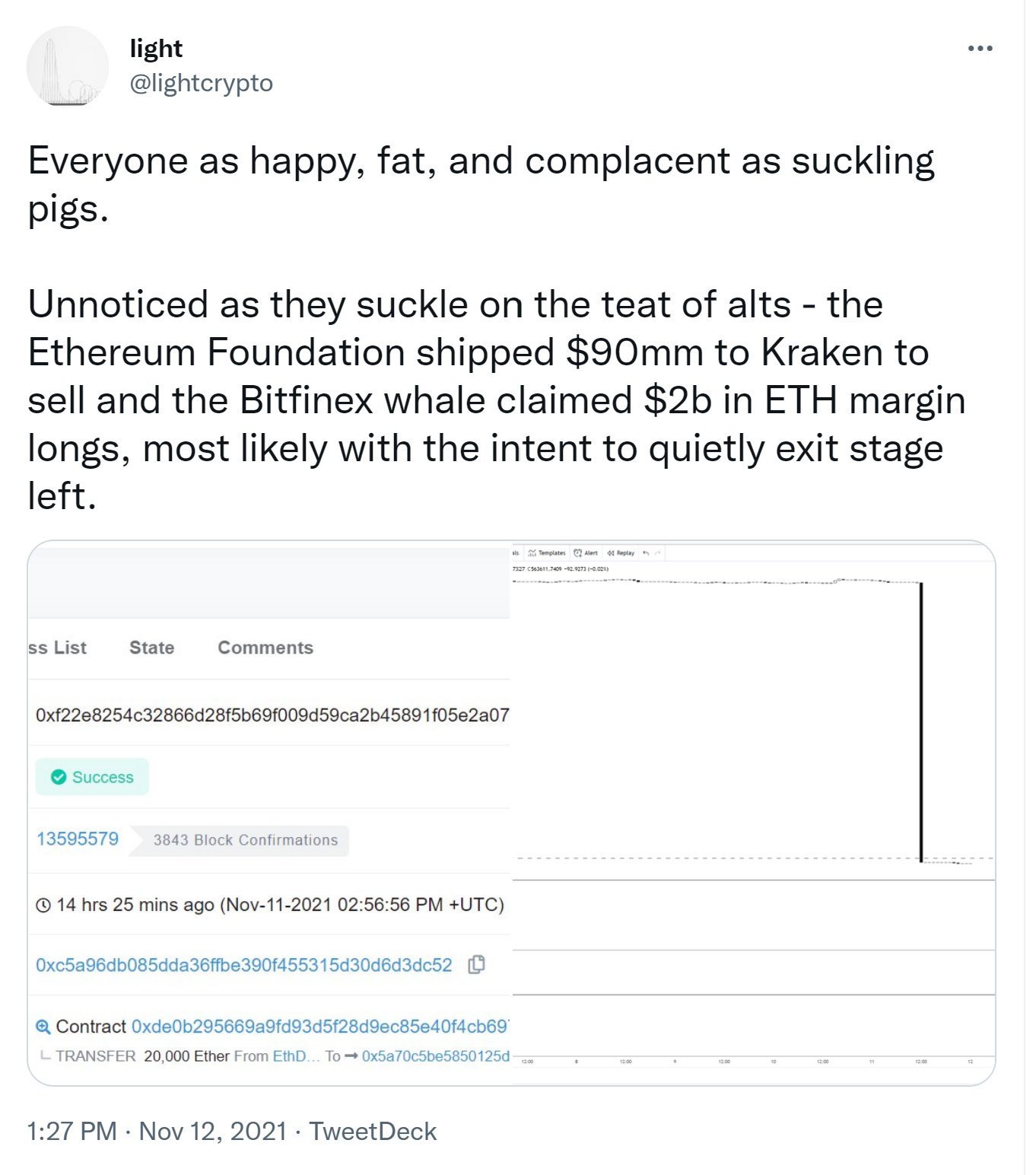

/7 We have seen this behavior in programmatic selling hitting the market in the last few weeks, and it was entirely expected.

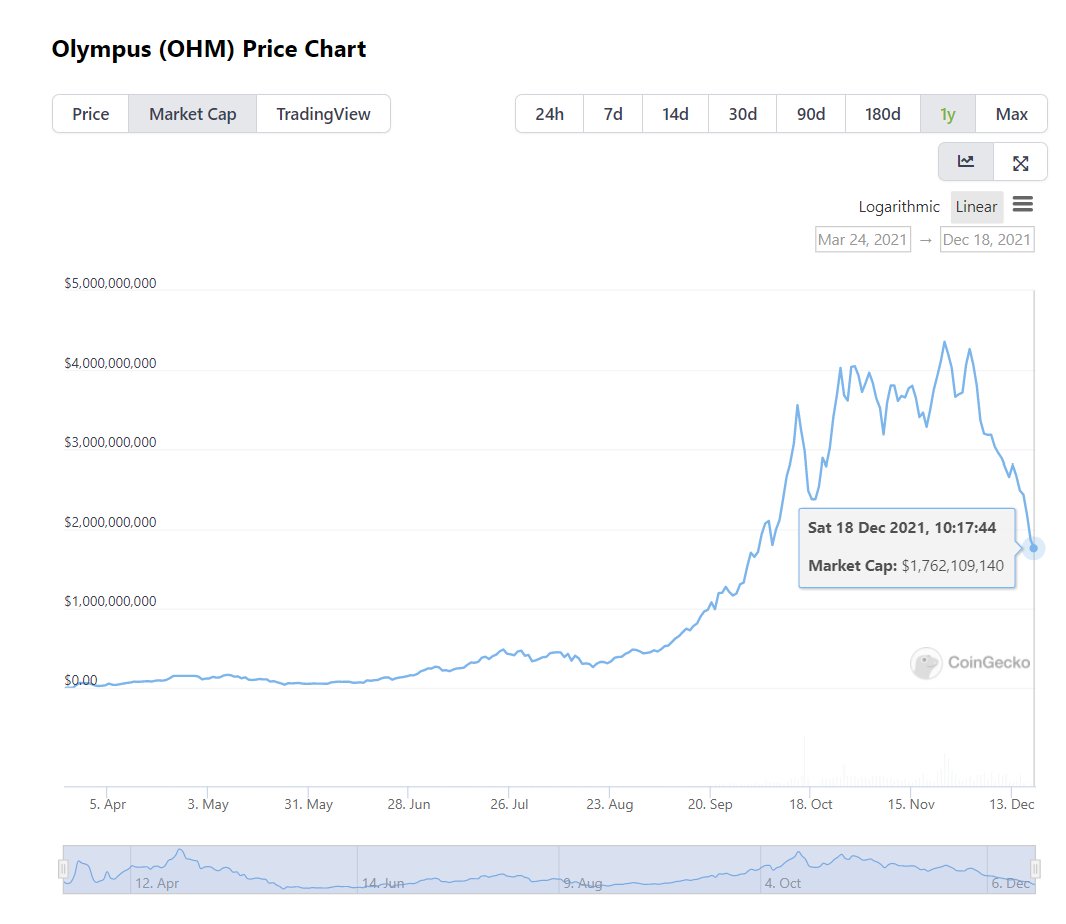

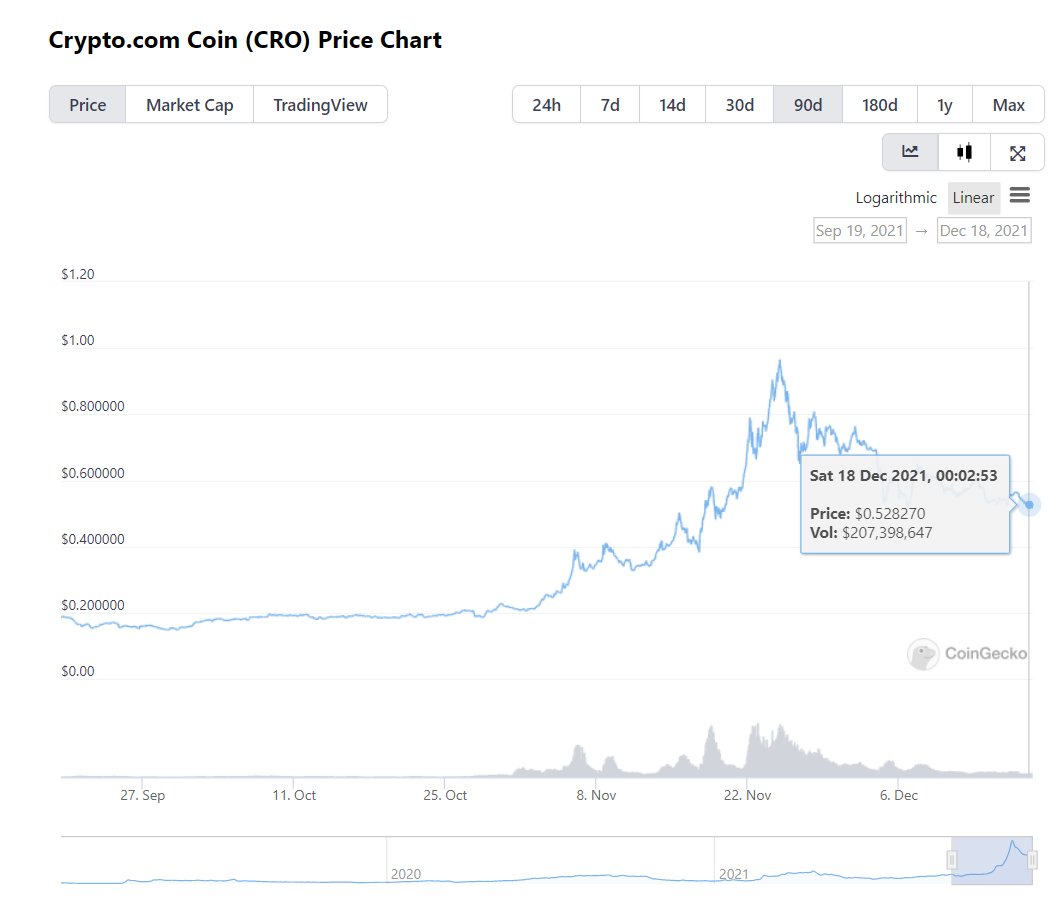

/8 This selling weighed on an already sagging market. Meanwhile, retail participants had spread out in parabolic alts, which eventually broke catastrophically, leaving losses and eventually contagion in the entire crypto complex.

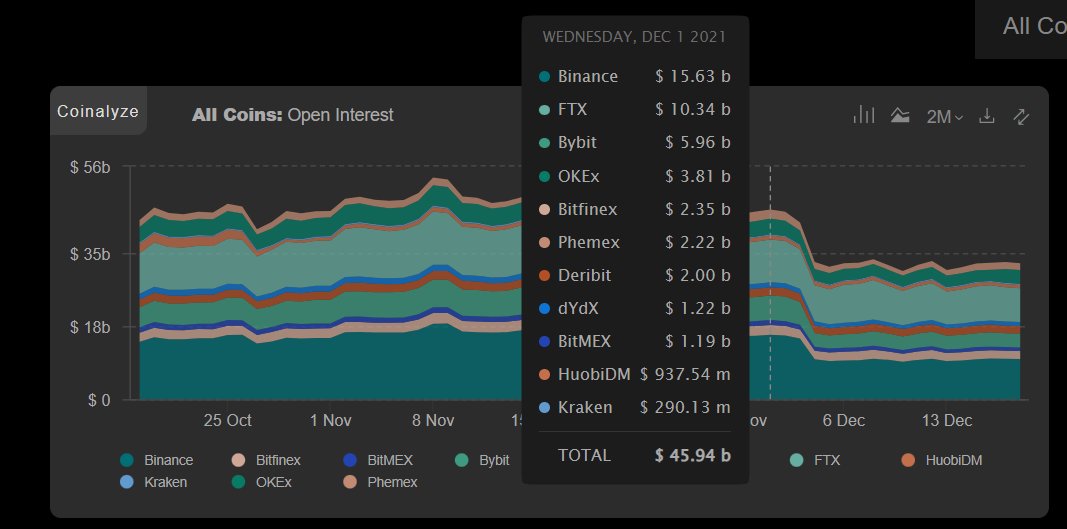

/9 Liquidity deteriorated, and finally a trivially predictable 25% cascade down in BTC put the fear of god in an overleveraged market:

/10 25% of derivatives OI was closed or liquidated. Billions upon billions lost. If people were cautious before, they were now properly risk averse. Those who did not take heed of the market’s message a month before, now began to panic in an accelerating fashion.

/11 This week, the market took a hawkish FOMC statement and dovish Powell conference in stride, before collapsing on a slew of surprise rate hikes and earlier-than-expected tapers by central banks. And uncertainty in the market has been amplified by Omicron.

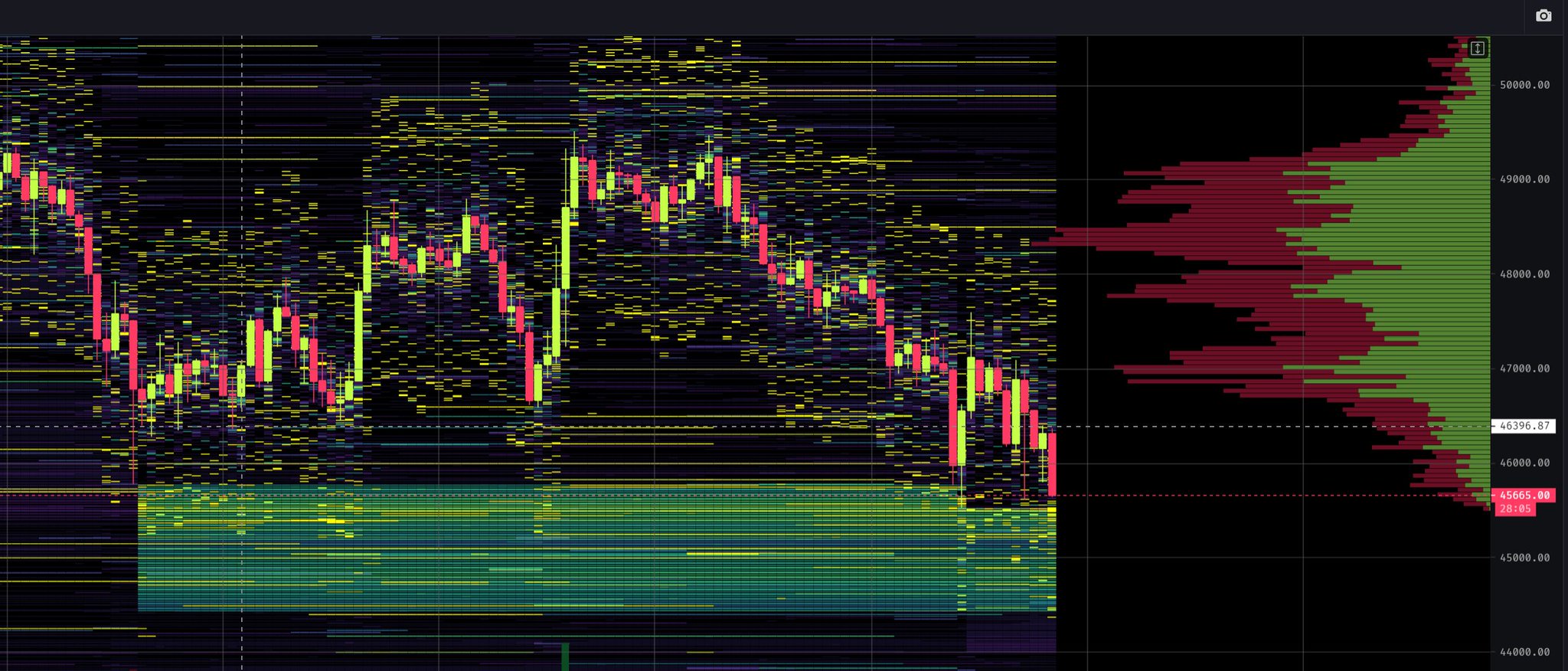

/12 Whereas bulls have been cautious, bears have taken to aggression, pushing perpetuals basis negative on some venues and building OI, while the large players who derisked in the $60k area have reversed course and begun to absorb panic- and short-selling.

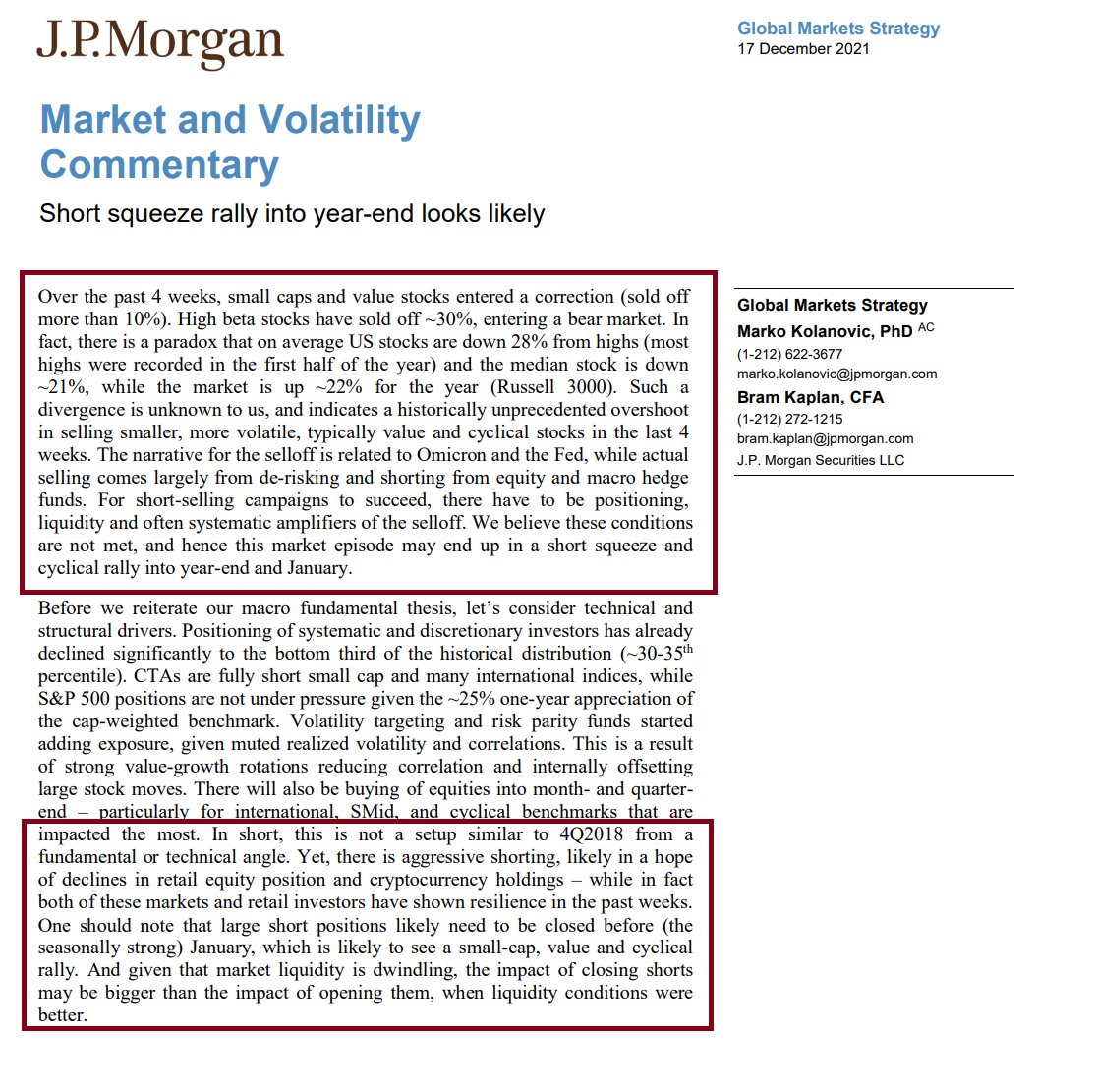

/13 Worth noting, bears’ Grinch-like behavior is not isolated to crypto. JPM’s Kolanovic on equities:

/14 Aggressive short-selling into an illiquid market absent fundamental justifications, pyramiding prior gains on leverage, being met by large cash-rich players directly prior to days that are incredibly kind seasonality-wise to bulls.

/15 Funds are likely done (or close to it) with structural sell flows, are cashed-up, and will now consider frontrunning the other way, namely, incoming buy flows in January.

/16 And more broadly, BTC has pulled back 35%, reaching a historical value area, while leverage has returned to constructive levels, and participants once again have cash. It’s the bears that will likely turn out to be stoneless soon enough.

/17 Best maybe to end with this caveat — the alt world is, for the most part, in distribution mode. This can weigh strong assets for some time. But a lot of froth has been taken out in the last month, and retail has been, for the most part, eviscerated to the tune of 50% or more.

/18 Or not; some catalysts: Asia selling has driven market, which will ease after eoy when Huobi/OKex have removed majority of mainland users (12/31 futures were already force majeured). Li Lin stepping down fits with this. Eoy and then blue skies.

Mentions

See All

Anthony Pompliano @AnthonyPompliano

·

Dec 18, 2021

This is a fantastic thread.