Thread

1/ I DIDN'T SEE SOMETHING UNTIL NOW. Often I've spoken about paper assets creating a fake supply that satisfies real demand, & that (all else equal) this causes an asset's price to fall. Most recently this came up in a debate with @timevalueofbtc abt using #MVRV to value #bitcoin

2/ The issue? RV isn't an accurate number bc it's impacted by all the paper #bitcoin issued by intermediaries. If all intermediaries always held 100% bitcoin reserves to back the bitcoin claims they issue, then RV would be reliable. But many intermediaries likely run fractional.

3/ I'm not saying RV isn't an observable # (of course it's observable). What I'm really saying is that RV isn't accurate--bc it's influenced by paper claims to #bitcoin being issued to satisfy demand for the real thing. You may have heard me talk about the 2017 Dole Food lawsuit.

4/ In that instance, people submitted to a Delaware court valid brokerage statements showing claims to Dole shares that added up to 1/3 MORE CLAIMS to Dole shares than real Dole shares existed. I've always pointed out that Mom&Pop investors had their pockets picked by this. Why?

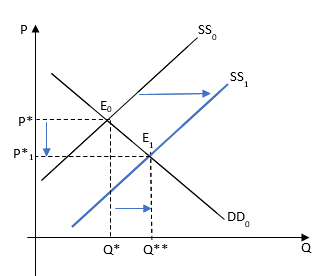

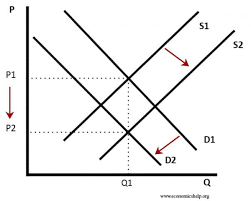

5/ bc fake supply satisfied real demand, causing the price of Dole shares to fall. Think supply & demand curves: holding demand constant, anytime supply increases the price falls. Owners of Dole had their pockets picked--the true price of Dole shares was higher than its mkt price

6/ Turning back to #bitcoin. The same thing is happening--there exist more paper claims to bitcoin than real, on-chain bitcoins; thus the true owners of on-chain bitcoin are having our pockets picked bc bitcoin's true price is higher than its mkt price. Again, the biggest...

7/ ...diff btwn today's #bitcoin bull mkt & its prior 3 bull mkts is all the leverage that exists today (in all of its many forms--fractional-reserve lending by intermediaries, #rehypothecation, leveraged futures, collateral substitution etc). It's impossible to measure how much.

8/ OK, so far I haven't said much new in this🧵. But here's what I didn't see before: the price drops not just because supply increases with fakes entering the market, but ALSO bc the existence of fakes causes demand for the real thing to drop--causing its price to drop EVEN MORE

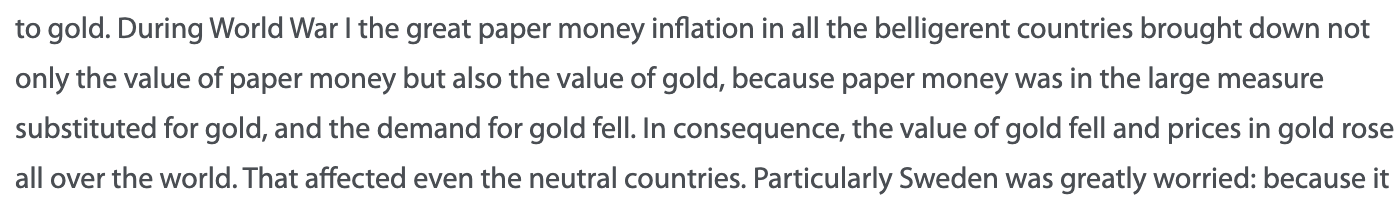

9/ In other words--the phenomenon isn't just increased supply, but also lower demand for the real thing. It was reading a 1977 speech by Hayek today (h/t JP) that made me re-think this, in which Hayek made this very point: mises.org/library/free-market-monetary-system

10/ Paraphrasing Hayek to apply it to #bitcoin today: "...because paper bitcoin was in large measure substituted for bitcoin, and the demand for bitcoin fell."

Hayek was talking about paper money vs gold in the post World War I era, but the point is the same.

Hayek was talking about paper money vs gold in the post World War I era, but the point is the same.

11/ Paper versions of a thing cause the price of the real thing to drop--it's not just a supply phenomenon, but it's also a demand one (as people substitute demand for the real thing with demand for the paper version)

So, the true RV for #bitcoin is higher than the observable RV

So, the true RV for #bitcoin is higher than the observable RV

12/ It's impossible to measure how undervalued #bitcoin is vs its pure price, & thus what the true RV for bitcoin is. Many are observing that BTC is lagging its price implied by @100trillionUSD's stock-to-flow model during this bull mkt--it is, & I believe all the leverage is why

13/ Will we ever be able to observe the true RV for #bitcoin? Yes, I believe so. It will happen someday when there's a run in the market & some intermediaries fail, so that only the fully-reserved intermediaries survive it.

14/ @TraceMayer used to say that #bitcoin will someday demonstrate itself to be the apex predator of finance, bc anyone running fractional (ie, leveraged) will fail when their customers redeem paper bitcoin IOUs for real on-chain bitcoins. Such a mkt-wide test hasn't happened yet

15/ No one knows when it will--but I believe it's when, not if. When it does, then #bitcoin's true RV will become known. Remember--liquid markets don't mean accurate prices. It's only when the mkt starts distinguishing the price of real vs paper that true price discovery occurs.

16/ Final thought--wow, did Hayek ever see #bitcoin coming in the 1970s. Unbelievable prescience. If you're looking for holiday reading, I'd recommend it. Good luck out there and remember: #notyourkeysnotyourcoins🔑🤠

P.S. — Q&A about this thread available here. Thanks for all the engagement!