Thread

Savvy traders accurately predicted (and profited from) Jerome Powell’s renomination.

A thread on thinking in Bayesian terms and reading the news with skepticism:

A thread on thinking in Bayesian terms and reading the news with skepticism:

Pres. Biden announced that he'd renominate Powell--“the most powerful person in DC”--for the position of Fed Chair.

Pandemic-induced econ crisis, rising inflation, accusations of unethical trading by Fed officials, Progressives' opposition... made Powell’s prospects uncertain.

Pandemic-induced econ crisis, rising inflation, accusations of unethical trading by Fed officials, Progressives' opposition... made Powell’s prospects uncertain.

All this noise led some to short our friend JPow.

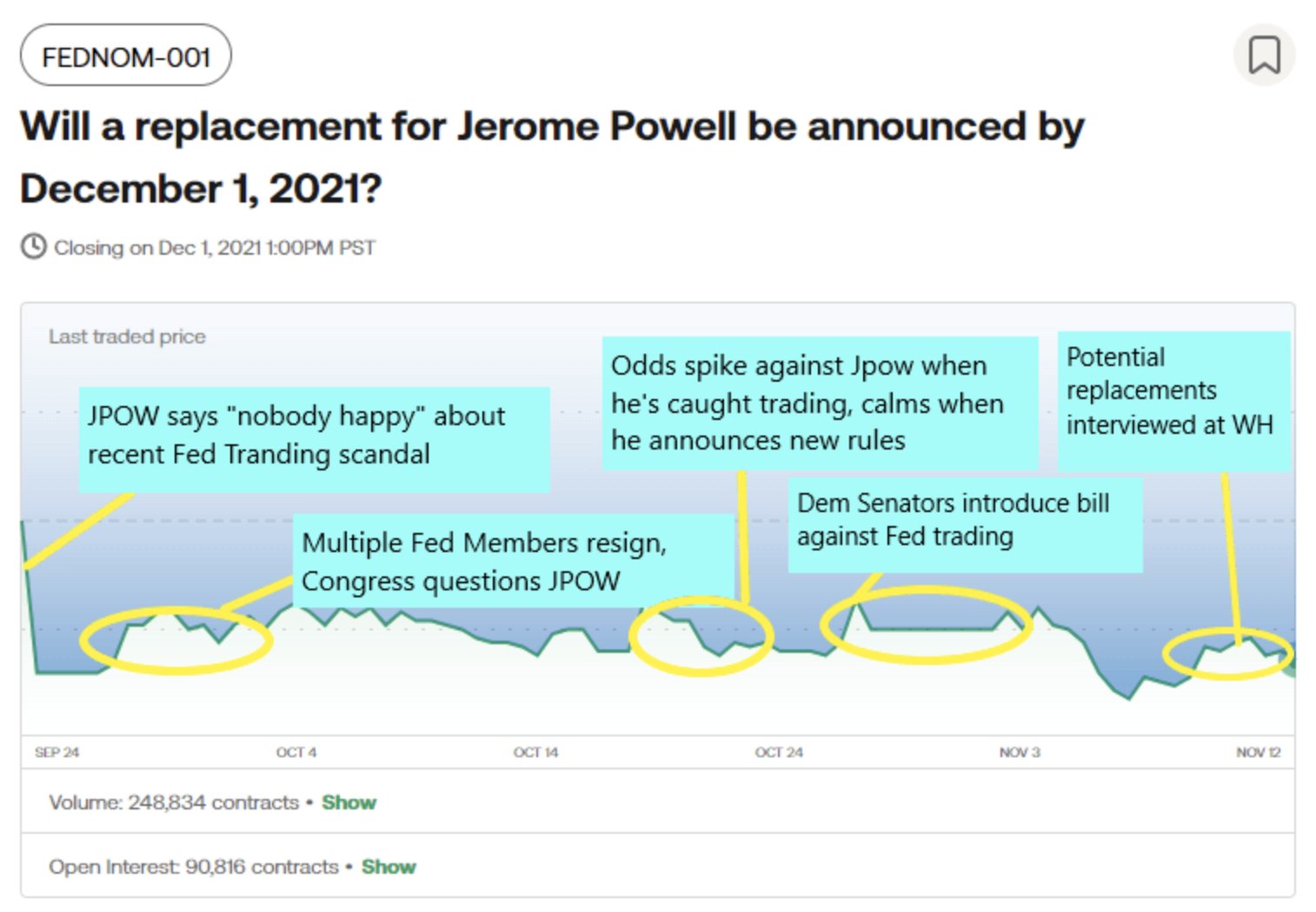

However, if you followed Kalshi’s FEDNOM-001 market, you would have been pretty confident that Biden would never let go of Powell: the probability of him getting replaced never rose above 32%. kalshi.com/markets/FEDNOM-001

However, if you followed Kalshi’s FEDNOM-001 market, you would have been pretty confident that Biden would never let go of Powell: the probability of him getting replaced never rose above 32%. kalshi.com/markets/FEDNOM-001

Why were our traders accurate?

They think in Bayesian terms. As news came in, traders responded to new data quickly, but cautiously, while remembering prior data.

They think in Bayesian terms. As news came in, traders responded to new data quickly, but cautiously, while remembering prior data.

Some snippets from the timeline.

9/28: Sen. Warren said that she would not support Powell. The probability of replacement gains 5%.

10/27: Congress introduces a law to tighten ethics rules around trading by Federal Reserve employees. The probability of replacement gains 10%.

9/28: Sen. Warren said that she would not support Powell. The probability of replacement gains 5%.

10/27: Congress introduces a law to tighten ethics rules around trading by Federal Reserve employees. The probability of replacement gains 10%.

11/8: Lael Brainard is interviewed by President Biden as potential pick for Fed Chair. The probability of replacement gains 7%.

11/10: October Inflation numbers are released, coming in far above expectations at 0.9%. The probability of replacement gains 3%.

11/10: October Inflation numbers are released, coming in far above expectations at 0.9%. The probability of replacement gains 3%.

In the midst of the chaos, news reports created a sense that Powell was in serious trouble.

If you just looked at headlines, you'd be forgiven for thinking that Powell might be ousted.

The headlines tend to overshoot: they fit new data without remembering prior data.

If you just looked at headlines, you'd be forgiven for thinking that Powell might be ousted.

The headlines tend to overshoot: they fit new data without remembering prior data.

FEDNOM-001 was a far superior source of information:

Our traders were intaking new data and adjusting their priors, without forgetting those priors.

Said more simply: they were calmly revising probabilities while journalists were panicking (or trying to make you panic).

Our traders were intaking new data and adjusting their priors, without forgetting those priors.

Said more simply: they were calmly revising probabilities while journalists were panicking (or trying to make you panic).

Why does this matter?

Knowing who’ll be in charge signals the future course of monetary policy, which can affect stock prices, unemployment levels, and changes in inflation.

All of this rebounds back to a large potential effect on your wallet.

Knowing who’ll be in charge signals the future course of monetary policy, which can affect stock prices, unemployment levels, and changes in inflation.

All of this rebounds back to a large potential effect on your wallet.

So, what’s next?

Look out for Kalshi's market on whether JPow will be confirmed.

It's not a done deal as Progressive Democrats and hawkish-Rs have voiced their concerns about another term.

Look out for Kalshi's market on whether JPow will be confirmed.

It's not a done deal as Progressive Democrats and hawkish-Rs have voiced their concerns about another term.

There’s sure to be a lot of news, and noise, surrounding the confirmation hearing, but you can always find unbiased information and forecasts on Kalshi. kalshi.com

Mentions

See All

Sahil Bloom @SahilBloom

·

Nov 23, 2021

This is an awesome thread.