Thread

Are you sick of inflation?

Here's how you can trade directly against it:

Here's how you can trade directly against it:

As long as the markets have existed, investors have wrestled with how to bet on or hedge against inflation.

Unfortunately, there's never been a way to do so that was free from financial noise--until now.

This thread will explain how to use Kalshi's CPIR1 market to do just that:

Unfortunately, there's never been a way to do so that was free from financial noise--until now.

This thread will explain how to use Kalshi's CPIR1 market to do just that:

What is Kalshi's CPIR1 market?

This market tracks the change in the Consumer Price Index (CPI) on three thresholds.

The current thresholds are 0.3%, 0.4%, and 0.5%.

Using this market, you can take a position on where the change in CPI announced this Wednesday will shake out.

This market tracks the change in the Consumer Price Index (CPI) on three thresholds.

The current thresholds are 0.3%, 0.4%, and 0.5%.

Using this market, you can take a position on where the change in CPI announced this Wednesday will shake out.

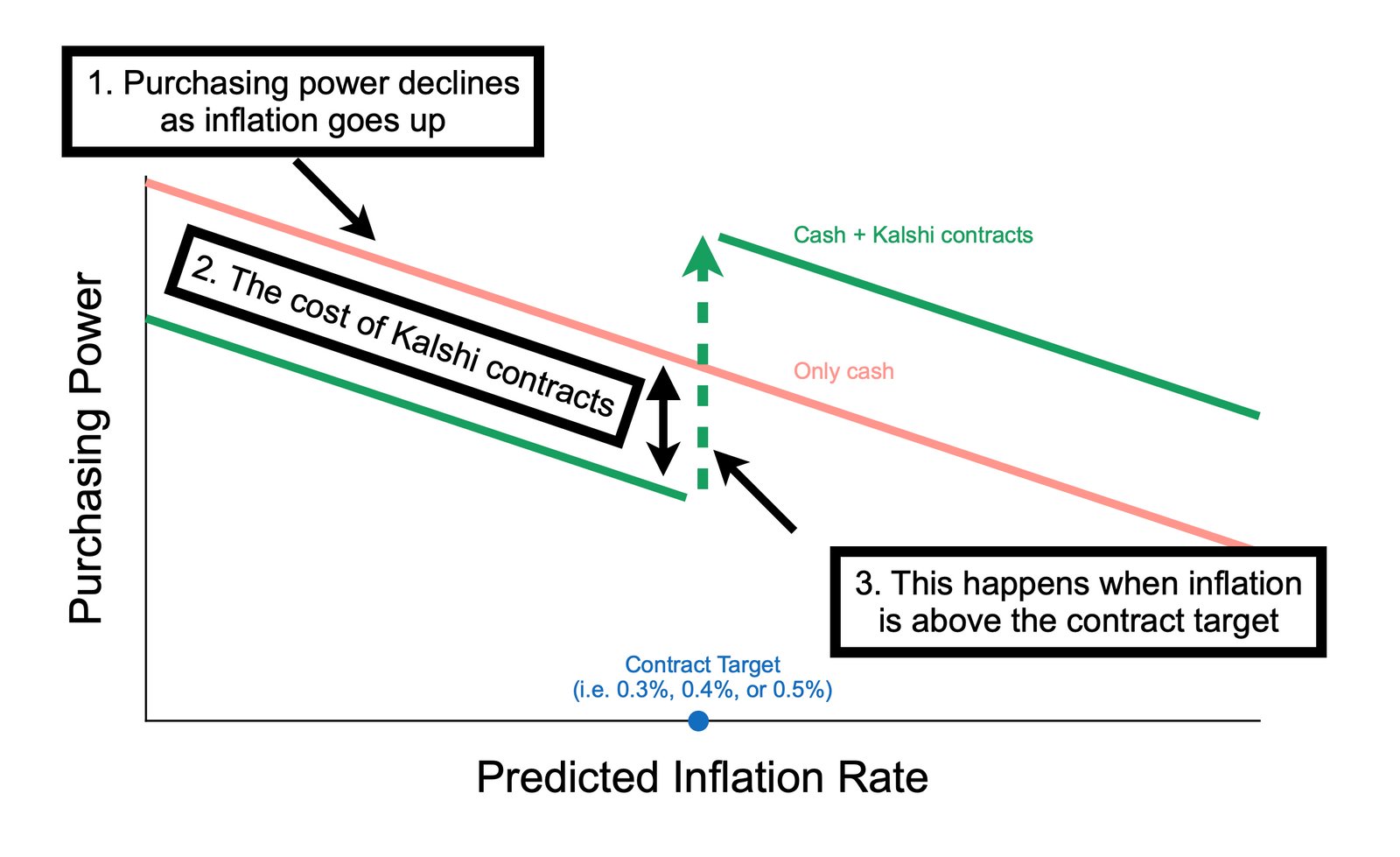

Imagine two portfolios: one in cash, and one in cash + Kalshi "Yes" inflation contracts.

As inflation increases, the purchasing power of the cash-only portfolio declines.

With the Kalshi contracts, if your predicted inflation rate is exceeded, you have an effective hedge.

As inflation increases, the purchasing power of the cash-only portfolio declines.

With the Kalshi contracts, if your predicted inflation rate is exceeded, you have an effective hedge.

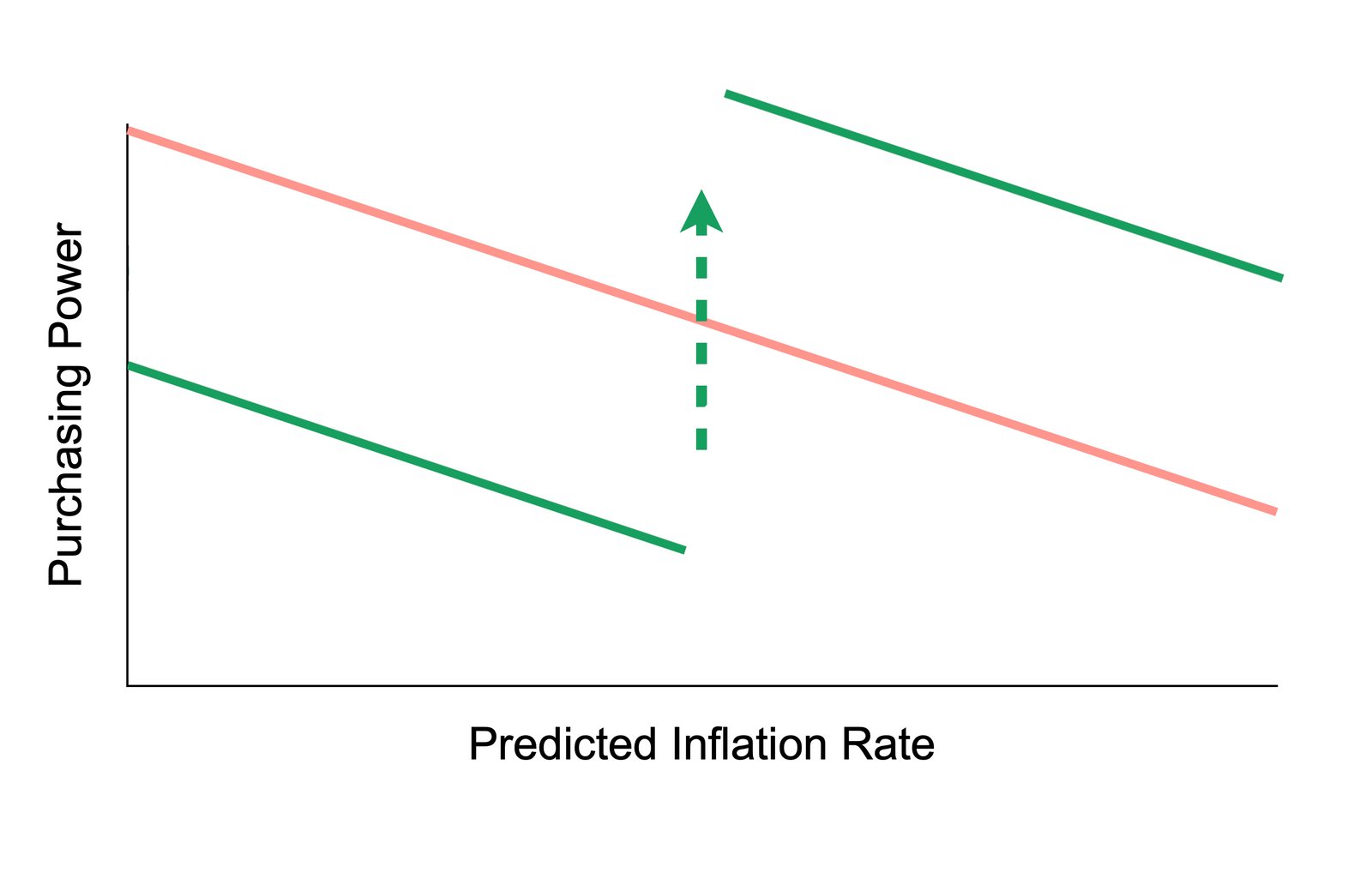

Purchasing more "Yes" contracts will increase the deviation from the cash-only portfolio.

This means you increase your risk (cost of contracts) and return (payoff from contracts).

Simply, this widens the distance between the portfolios.

This means you increase your risk (cost of contracts) and return (payoff from contracts).

Simply, this widens the distance between the portfolios.

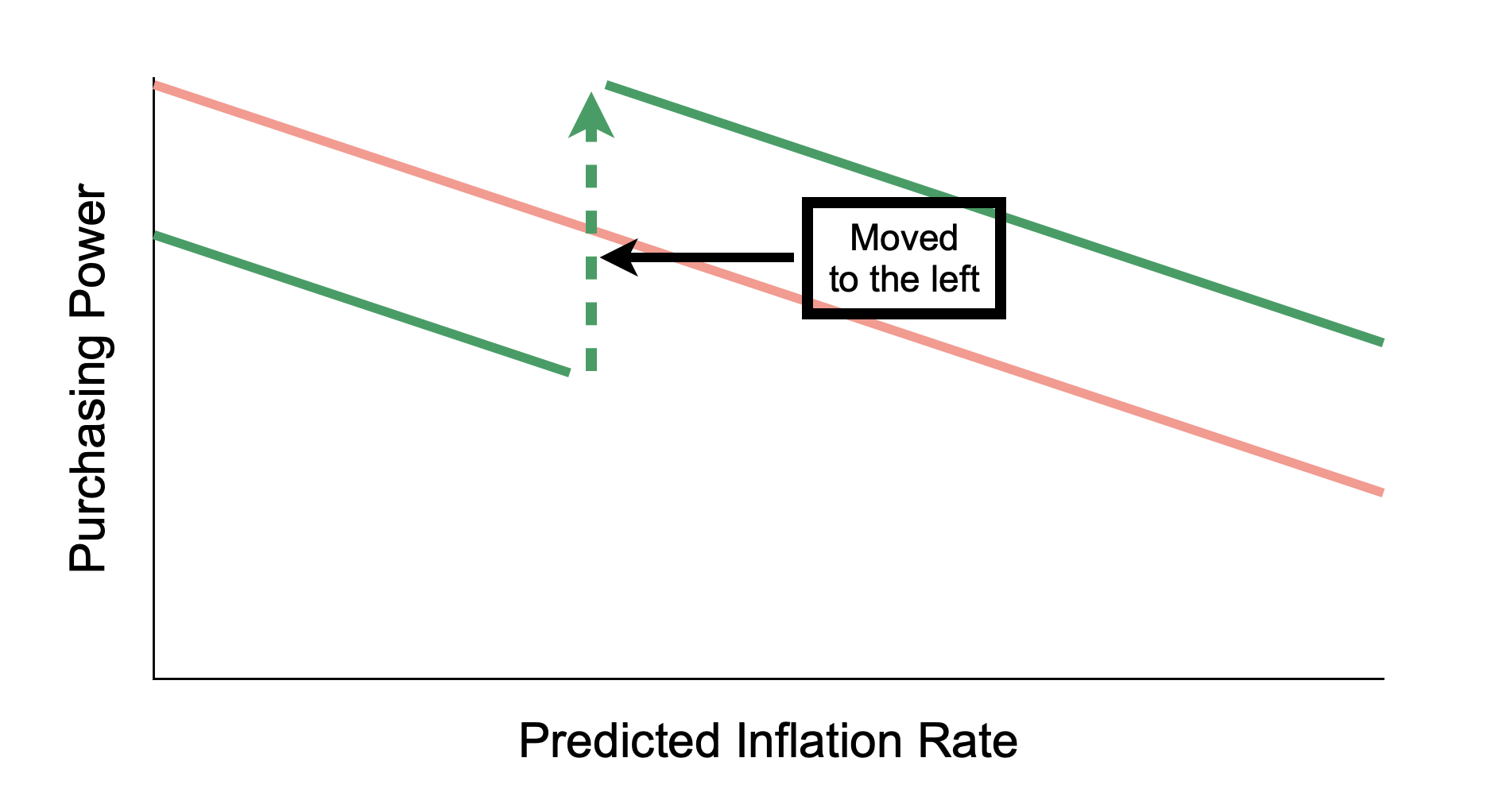

When we select a lower contract target inflation rate, the threshold shifts to the left.

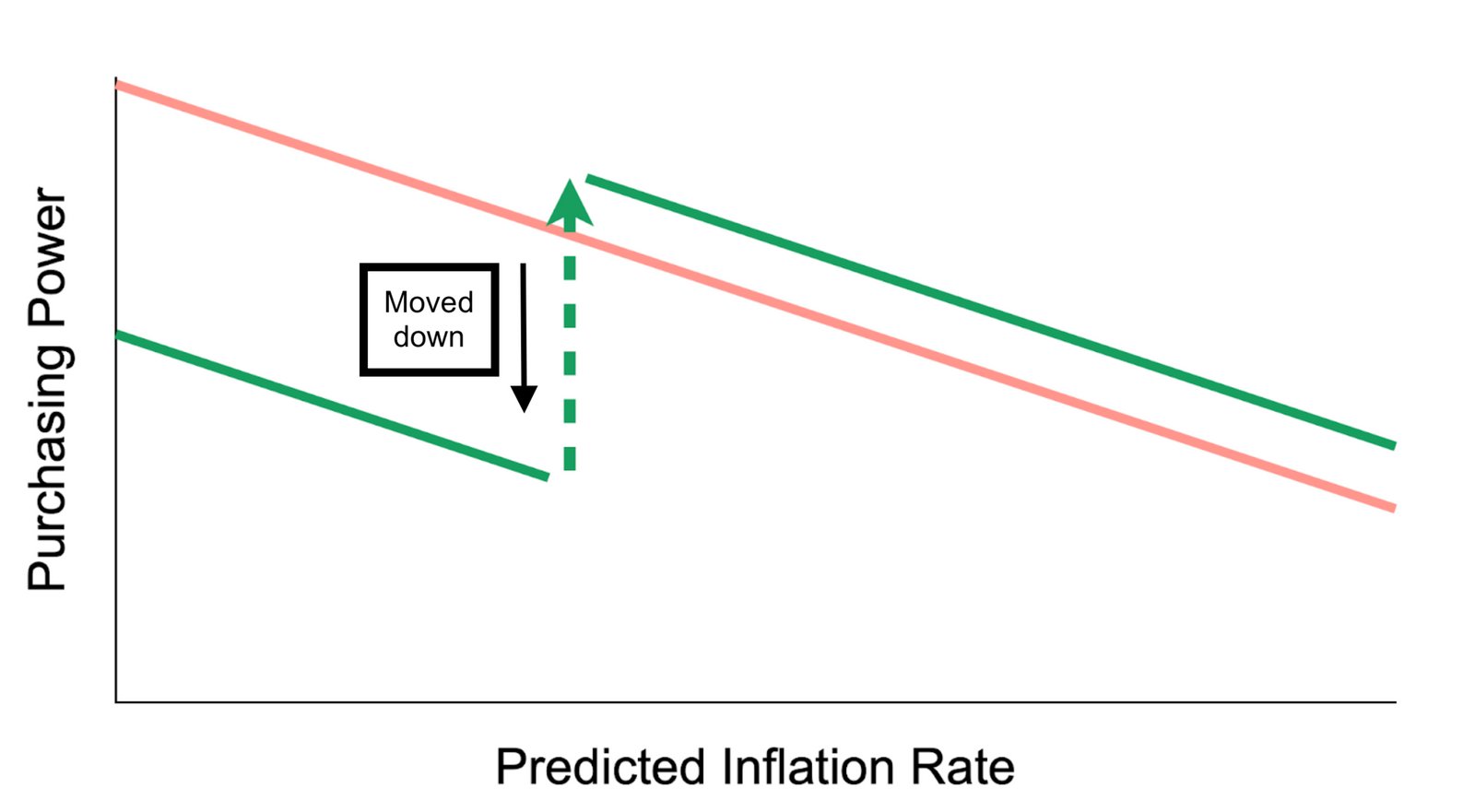

When the contract is more expensive (i.e. the "Yes" price is higher), the Kalshi portfolio lowers in the graph.

When the contract is more expensive (i.e. the "Yes" price is higher), the Kalshi portfolio lowers in the graph.

All investors should care about inflation.

Gold and bitcoin can be helpful as part of a diversified portfolio, but are indirect hedges.

Check out Kalshi's CPIR1 market for a direct, noise-free approach to managing inflation risk.

CPIR1 kalshi.com/market-groups/CPIR1

Gold and bitcoin can be helpful as part of a diversified portfolio, but are indirect hedges.

Check out Kalshi's CPIR1 market for a direct, noise-free approach to managing inflation risk.

CPIR1 kalshi.com/market-groups/CPIR1

I'll be posting more trades/hedges like this in the future.

For a more detailed look at using @Kalshi as an inflation hedge, check out this article below written by the incredible @GhiamKamyar kalshi.com/news/inflation

For a more detailed look at using @Kalshi as an inflation hedge, check out this article below written by the incredible @GhiamKamyar kalshi.com/news/inflation