Thread by Brooke R. Stoddard

- Tweet

- Jan 12, 2020

- #Bitcoin

Thread

This Is Why I Invest in Bitcoin

Part 1 – Introduction

1) In college I studied history, and I am interested in the evolution of money. When I was introduced to bitcoin in 2015, I viewed it as the next logical version of money.

Part 1 – Introduction

1) In college I studied history, and I am interested in the evolution of money. When I was introduced to bitcoin in 2015, I viewed it as the next logical version of money.

Over thousands of years, money has taken the form of barter, items (i.e. shells, beads), metal, coins, paper, digital payments, and recently, natively digital money (i.e. bitcoin).

Over time, I believe that people will adopt natively digital money. Further, I believe that investing in bitcoin is a way to express (and profit from) this view. en.wikipedia.org/wiki/History_of_money

2) When I was introduced to bitcoin, I was becoming interested in venture capital investments in fintech companies. However, many VC investments are only available to accredited investors, and I wasn’t one. But anyone can invest in bitcoin.

I viewed bitcoin as a VC-like investment in a new, financial technology, one that might produce returns beyond what was possible in public markets. www.wsj.com/articles/bitcoin-rebounded-in-2019-but-challenges-loom-11577828486

Part 2 – Why Bitcoin Has Value

When I speak with investors, we have to answer the following question: “Why does bitcoin have value?” I believe in the following five arguments:

When I speak with investors, we have to answer the following question: “Why does bitcoin have value?” I believe in the following five arguments:

1) Bitcoin is an invention (i.e. like the light bulb, automobile, or internet) that moves society forward. It is a new, peer-to-peer money transfer system that does not rely on banks or governments.

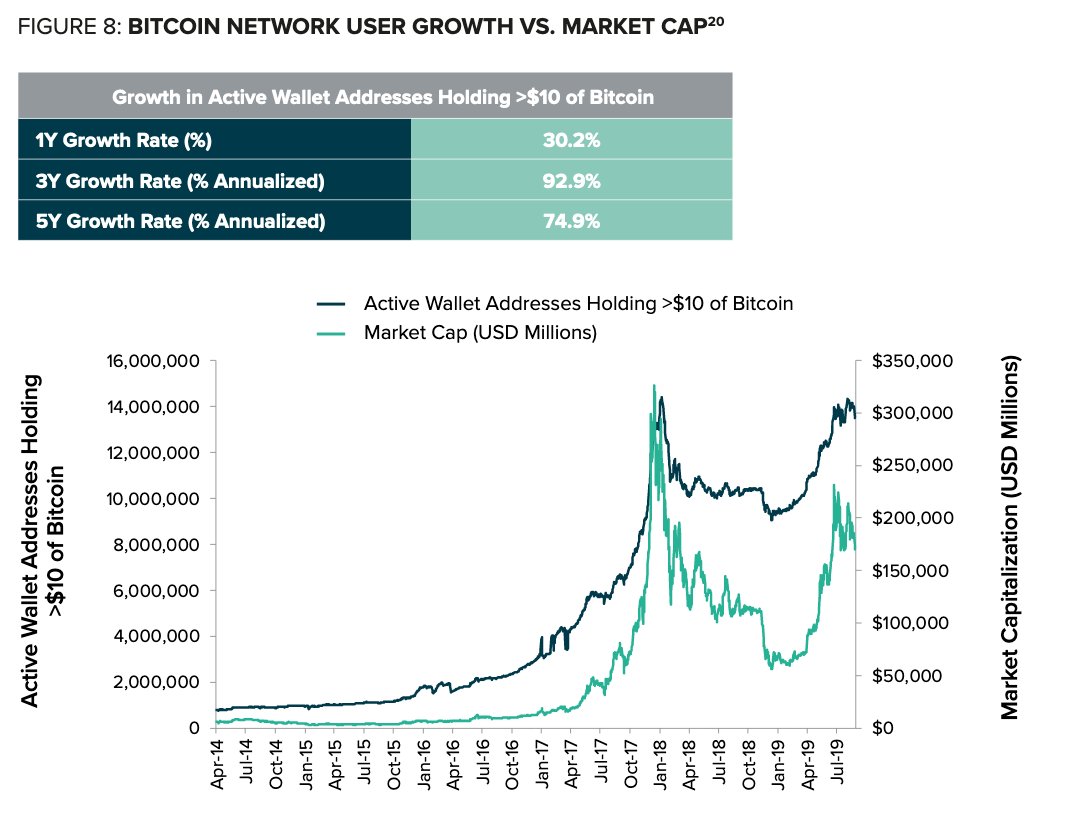

2) Bitcoin adoption is accelerating. The website below shows bitcoin daily transaction values of over $3 billion. The chart below shows annual growth in the number of bitcoin wallets. coinmetrics.io/charts/

3) Bitcoin has a predetermined, mathematically fixed supply. I can look at this website and know that over 18.1 million bitcoin have already been created. coinmetrics.io/charts/

Every ~10 minutes, an additional 12.5 bitcoin are created. In total, there will ever only be 21 million bitcoin. Bitcoin demand is hard to measure, but bitcoin supply is certain.

4) Bitcoin is digital gold. Bitcoin and gold are borderless, decentralized, and verifiable. Both are worth something; they store value. But bitcoin is easier to transfer, divide, and harder to counterfeit.

In other words, bitcoin might be better equipped than gold to meet the challenges of our tech-driven, modern world. grayscale.co/insights/bitcoin-the-rise-of-digital-gold/

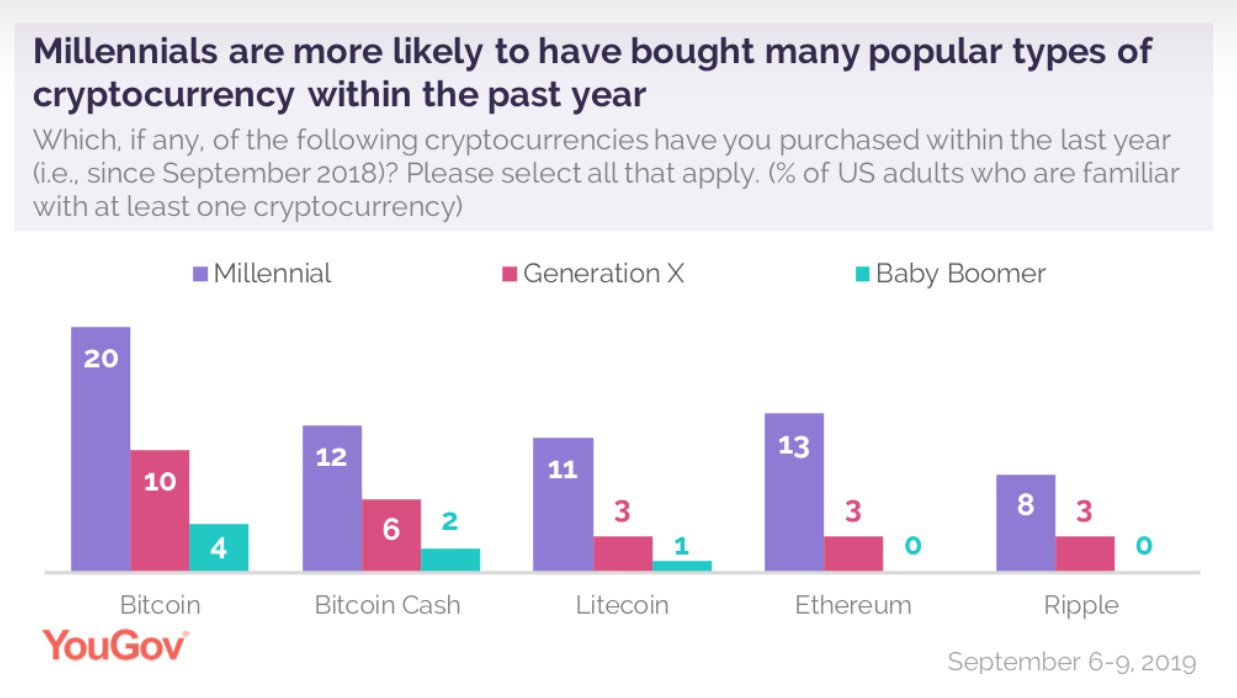

5) In the next 25 years, baby boomers will transfer $68 trillion in wealth to millennials. Millennials are already buying bitcoin, and they will continue to buy bitcoin. In this survey of adults familiar with cryptocurrency, 20% of millennials purchased bitcoin in the past year.

Part 3 – Bitcoin & Portfolio Management

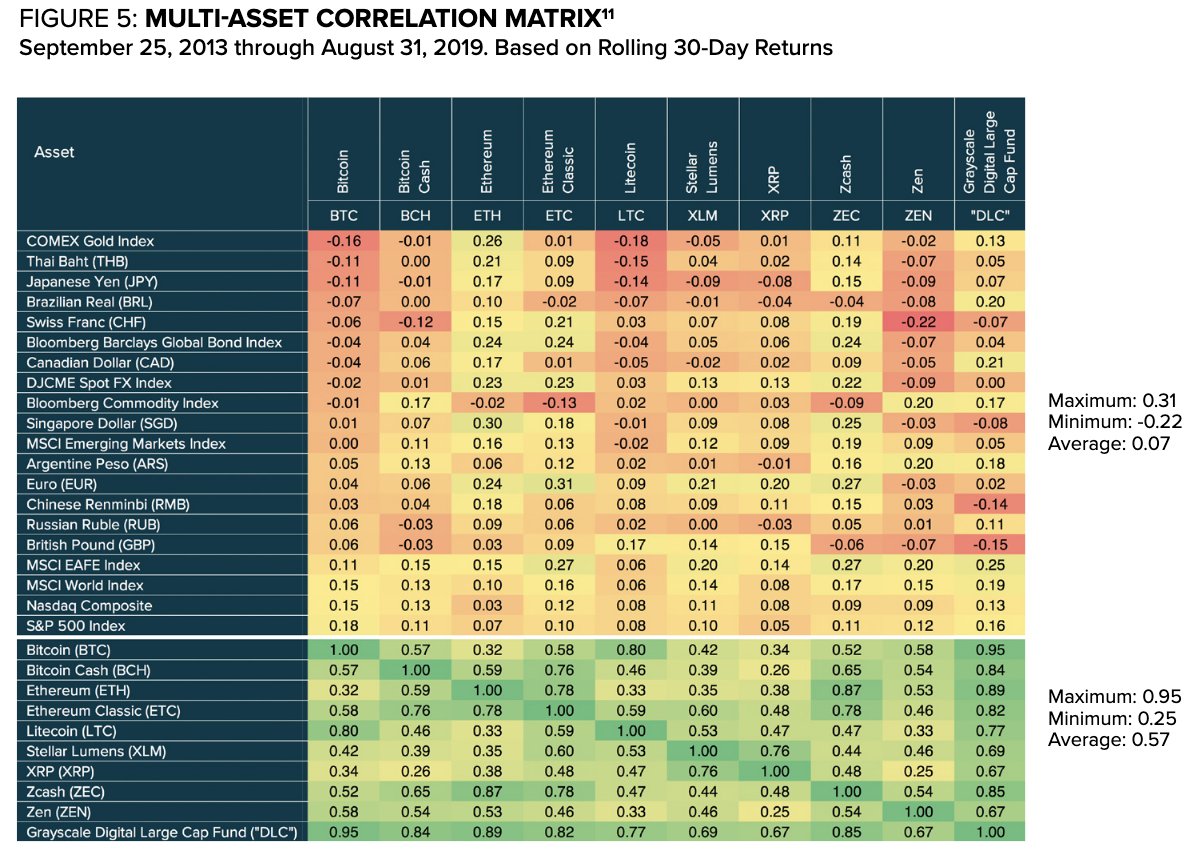

1) Bitcoin is uncorrelated to traditional asset classes, and it deserves a place in diversified portfolios. The chart below tracks the performance of bitcoin and traditional asset classes from 2013-2019.

1) Bitcoin is uncorrelated to traditional asset classes, and it deserves a place in diversified portfolios. The chart below tracks the performance of bitcoin and traditional asset classes from 2013-2019.

The data shows that bitcoin returns were uncorrelated (or quite weakly correlated) to the returns of all major asset classes over the past six years. grayscale.co/wp-content/uploads/2019/10/Grayscale-A-New-Frontier-September-2019.pdf

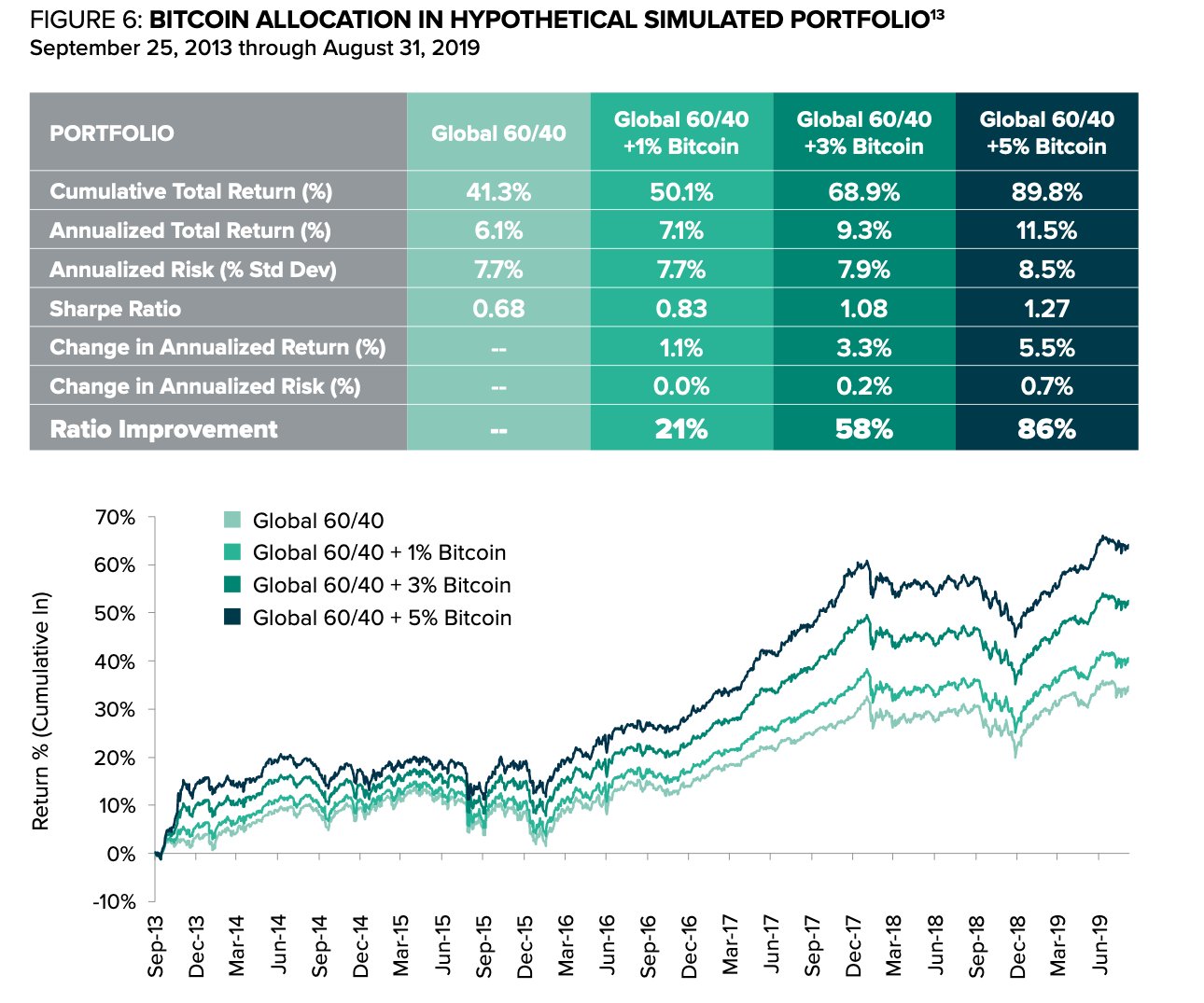

2) Adding a 1% allocation to bitcoin in a 60/40 portfolio improves the Sharpe ratio. The table below shows that a generic portfolio of global stocks (60%) and global bonds (40%) generated an annualized total return of 6.1% from Sept 2013 – August 2019.

When a 1% allocation to bitcoin was added to the portfolio, the annualized total return increased to 7.1%. You might think that the 1% allocation to bitcoin would have increased the volatility of the portfolio. In fact, volatility decreased by 0.04%. grayscale.co/wp-content/uploads/2019/10/Grayscale-A-New-Frontier-September-2019.pdf

Part 4 – The Past & Future of Bitcoin

1) Major financial institutions have already created bitcoin-related services. In 2018, Intercontinental Exchange (the parent company of @NYSE) created @Bakkt, which offers bitcoin futures and bitcoin options contracts to investors.

1) Major financial institutions have already created bitcoin-related services. In 2018, Intercontinental Exchange (the parent company of @NYSE) created @Bakkt, which offers bitcoin futures and bitcoin options contracts to investors.

@NYSE @Bakkt The @CMEGroup is offering similar products. @Fidelity is building bitcoin custody services for institutional clients. @etrade and @TDAmeritrade reportedly considered bitcoin trading services for customers. @RobinhoodApp and @SoFi already offer them. www.wsj.com/articles/fidelitys-digital-currency-business-gets-green-light-from-new-york-state-1157418...

@NYSE @Bakkt @CMEGroup @Fidelity @etrade @TDAmeritrade @RobinhoodApp @SoFi 2) Facebook’s Libra (very different from bitcoin) showed us that corporations and countries are already developing digital currencies. The People’s Bank of China is developing a digital yuan. Do you think the U.S. will want to be left behind?

@NYSE @Bakkt @CMEGroup @Fidelity @etrade @TDAmeritrade @RobinhoodApp @SoFi As billions of people globally begin to use digital currency, I believe that investors will increasingly view bitcoin as an investment they want to buy, own, and hold. www.wsj.com/articles/the-coming-currency-war-digital-money-vs-the-dollar-11569204540

@NYSE @Bakkt @CMEGroup @Fidelity @etrade @TDAmeritrade @RobinhoodApp @SoFi 3) The cryptocurrency bubble from 2017 – 2018 is over, and bitcoin survived. Bitcoin has overcome tremendous adversity and negative press over the past 11 years since its origin.

@NYSE @Bakkt @CMEGroup @Fidelity @etrade @TDAmeritrade @RobinhoodApp @SoFi In its brief history, it has evolved from a niche currency for computer programmers to an investment used by the largest financial institutions in the world. Imagine what bitcoin will become over the next 11 years.

@NYSE @Bakkt @CMEGroup @Fidelity @etrade @TDAmeritrade @RobinhoodApp @SoFi Just as the automobile, internet, and cell phones were once new and now are everywhere, digital currency is new today but will one day be everywhere. I invest in bitcoin as a way to invest in that future.

Mentions

See All- Curated in Top Bitcoin Threads