Thread by Luis Garicano 🇪🇺🇺🇦

- Tweet

- May 22, 2023

- #Business #Productivity #Laboureconomics

Thread

We have seen much about Bob Lucas' macro contributions these days, but he also had a highly influential contribution to the theory of the firm: the "assigment theory of the firm", which explains, for instance, why Musk earns so much (and controls so many resources).

THREAD

THREAD

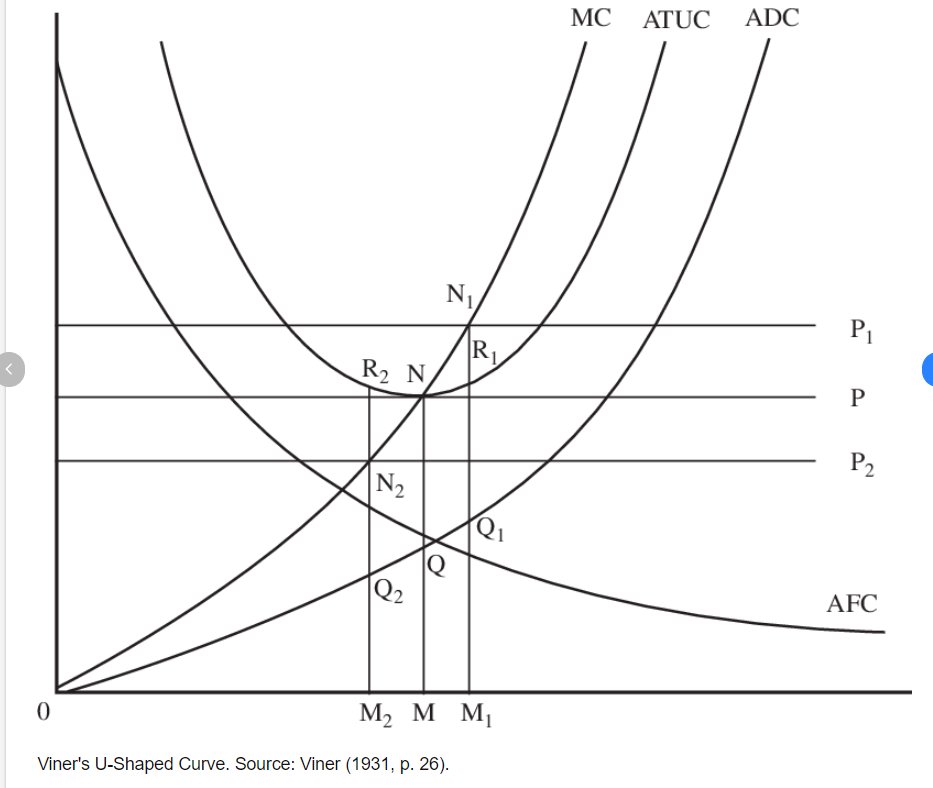

Before Lucas 1978, we had Marshall-Viner: individual firms have U-shaped long-run average cost functions. In equilibrium, each firm produces at the minimum point of this curve, with firm entry or exit adapting to get aggregate production. Resonable for plants, but not for firms!

The size distribution which emerges is a solution to the problem: allocate production over firms to minimize total cost.

It goes without saying that this is counterfactual for firm size.

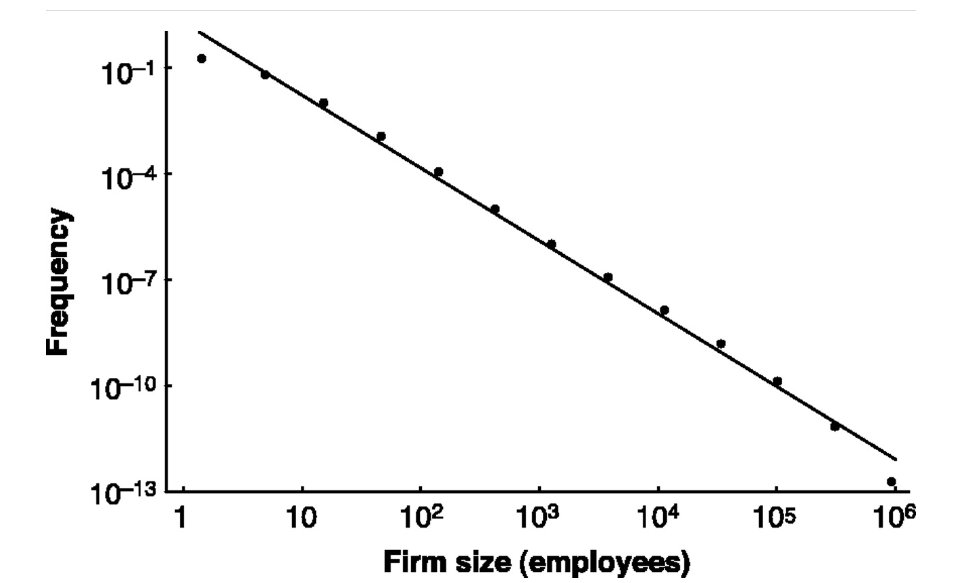

Here is the actual firm size distribution (Axtell, Science 2001).

It goes without saying that this is counterfactual for firm size.

Here is the actual firm size distribution (Axtell, Science 2001).

Lucas aims to implement Henry G. Manne (JPE 1965) suggestion that the market assigns more resources to better managers: "the observed size distribution is a solution to the problem: allocate productive factors over managers of different ability so as to maximize output."

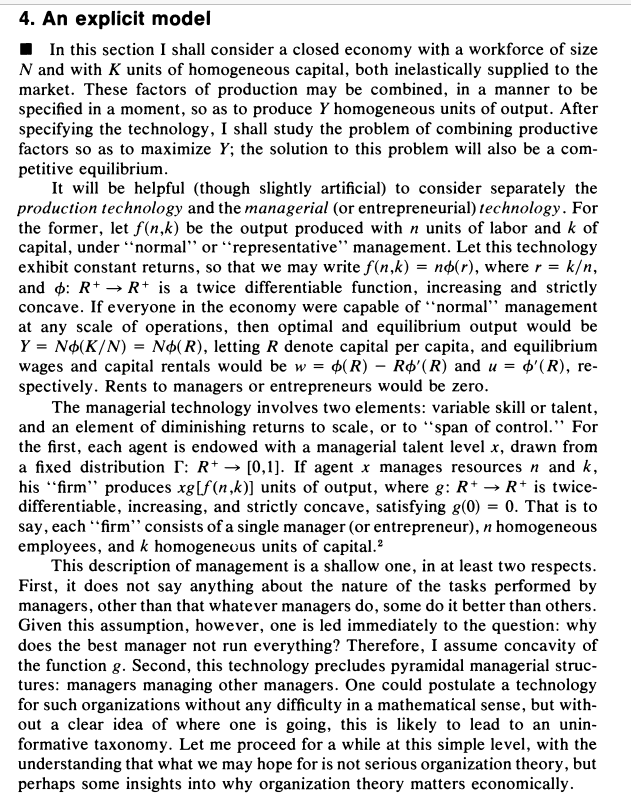

Lucas starts from an economy with a given amount of capital and labor.

All agents have a level of managerial talent. Talent raises the productivity of the supervised bundle of labor and capital

A firm is one manager, together with the capital and labor under her control.

All agents have a level of managerial talent. Talent raises the productivity of the supervised bundle of labor and capital

A firm is one manager, together with the capital and labor under her control.

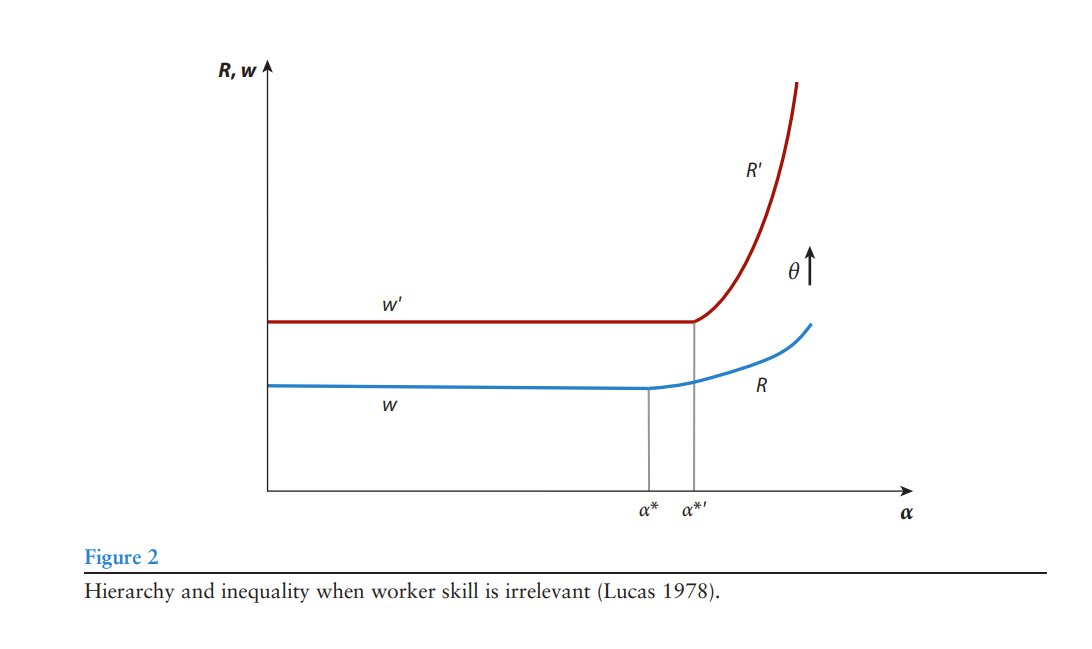

The key implication is the "scale of operations effect" : more talented managers can run larger firms more efficiently and earn higher profits, which leads to a positive correlation between firm size and earnings.

Earnings grow more than proportionally with talent.

Earnings grow more than proportionally with talent.

Now think dynamically about firm growth

Gibrat law: A well-known feature of observed patterns in firm growth, however, is the independence of firm growth and size.

Lucas: to obey Gibrat's law a necessary and sufficient condition is for the span function to be a power funct.

Gibrat law: A well-known feature of observed patterns in firm growth, however, is the independence of firm growth and size.

Lucas: to obey Gibrat's law a necessary and sufficient condition is for the span function to be a power funct.

The model "predicts" the full size distribution of firms, but only given a distribution of managerial talent.

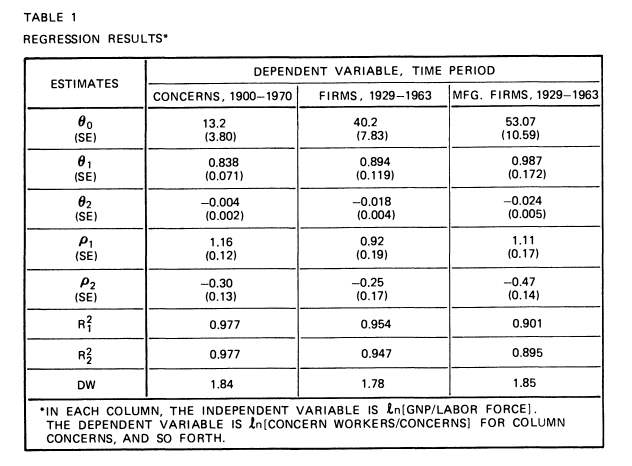

Lucas proceeds to test it empirically and finds that

as the model predicts there is a systematic effect of GNP on firm size (first row)

Lucas proceeds to test it empirically and finds that

as the model predicts there is a systematic effect of GNP on firm size (first row)

Lucas argues his model has two main holes: homogenous workers, only one layer.

Sherwin Rosen (1982), another (sadly deceased too early) @uchicago economist (and inspiration of much of my work), set to solve these problems.

Sherwin Rosen (1982), another (sadly deceased too early) @uchicago economist (and inspiration of much of my work), set to solve these problems.

Rosen had invented in 1981 the idea of superstar markets. Think of Messi, Ronaldo, Taylor Swift, Le Bron James:

1) close connection between personal rewards and the size of one's market;

2) both market size and reward are skewed toward the most talented in the activity.

Why?

1) close connection between personal rewards and the size of one's market;

2) both market size and reward are skewed toward the most talented in the activity.

Why?

The key input to explain these facts is the limited substitution between the talent of different artists, doctors etc. "hearing a succession of mediocre singers does not add up to a single outstanding performance. "

The reward function raises with the size of the market-- fast!

The reward function raises with the size of the market-- fast!

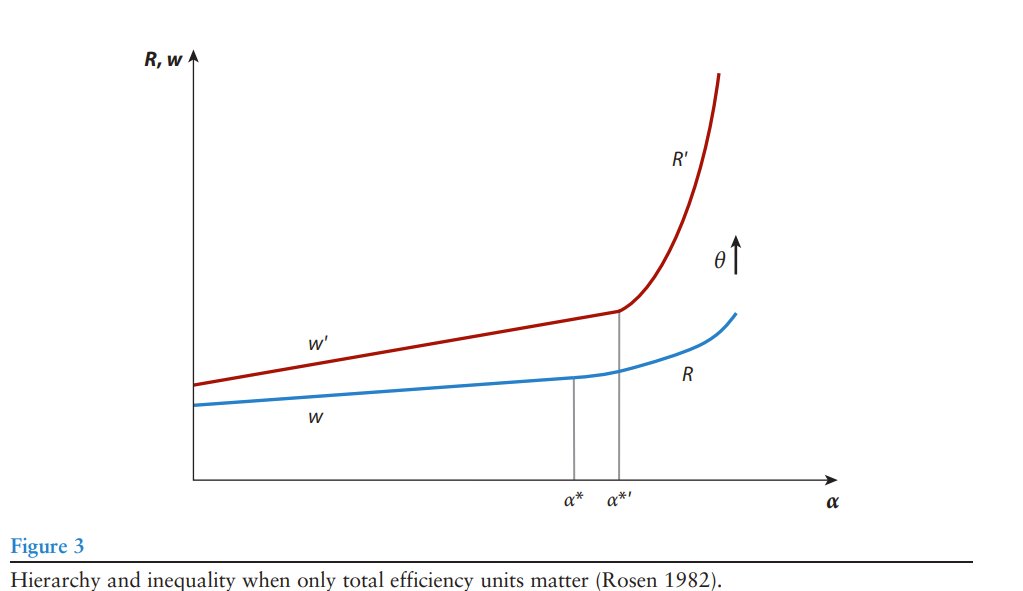

In 1982, Rosen turns to superstar firms by expanding on Lucas' model. Crucially, he includes multiple layers of hierarchy. It is a multiplicative technology, where the talent of one layer increases the value of those in the layer below.

Two factors:

- Management involves discrete and indivisible choices (such as which goods to produce, in what varieties and volume)--a strong scale economy

- a supervisory activity that congests management scale economies and produces determinate firm size

- Management involves discrete and indivisible choices (such as which goods to produce, in what varieties and volume)--a strong scale economy

- a supervisory activity that congests management scale economies and produces determinate firm size

These two factors explain the puzzle:

- The scale economy of management requires that the most able personnel be assigned to top level positions in large firms.

- The diseconomy of direct supervision binds firm size, that can be relaxed by subordinating many hierarchical layers

- The scale economy of management requires that the most able personnel be assigned to top level positions in large firms.

- The diseconomy of direct supervision binds firm size, that can be relaxed by subordinating many hierarchical layers

So now we have in firms something like the superstar markets:

- Equilibrium assignment of more talented people to top control positions in largest firms

- Multiplicative productivity interactions mean distribution of control and income more skewed than the talent distribution.

- Equilibrium assignment of more talented people to top control positions in largest firms

- Multiplicative productivity interactions mean distribution of control and income more skewed than the talent distribution.

Hence talent of workers matters, and hierarchies have many layers.

But Rosen takes a short cut. Workers and managers are linear substitutes in "efficiency units" (talent is proportional).

But Rosen takes a short cut. Workers and managers are linear substitutes in "efficiency units" (talent is proportional).

Rosen argues that it is necessary to introduce true complementarities between worker and manager talent.

@HansbergRossi and I do that in our QJE (2006) paper

@HansbergRossi and I do that in our QJE (2006) paper

Workers benefit from having good managers (they solve more problems and make their own time more productive), and managers benefit from having good workers (they need less help and allow managers to have a larger team).

Hence unlike in all previous literature, there is a one to one "marriage" between workers and managers.

Our framework allows us to have predictions on communication technology (makes organizations larger, deeper, deskills workers), and IT(shorter organizations, empowers workers.

Our framework allows us to have predictions on communication technology (makes organizations larger, deeper, deskills workers), and IT(shorter organizations, empowers workers.

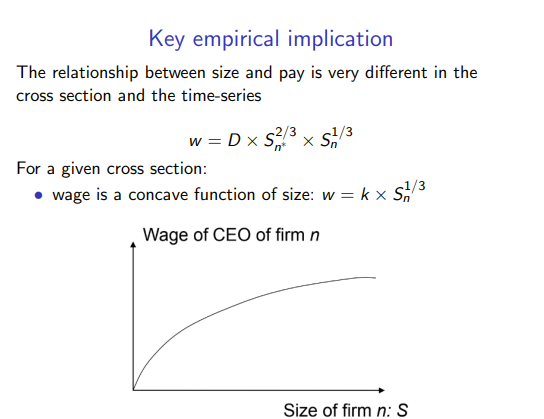

.@xgabaix and @augustinlandier take Lucas' theory in a different direction. They calibrate it to study whether recent changes in CEO Pay may be related, as the model predicts, to firm size changes.

Does a marriage of talent with size explain the evolution of the size to wage relation, as well as the cross-sectional evidence on CEO pay?

Yes. The basic Lucas style model predicts

- Concavity of wage in size in the cross section

- Linearity of wage in size in the time series

This is what we see in the time series and in the cross section.

22/25

- Concavity of wage in size in the cross section

- Linearity of wage in size in the time series

This is what we see in the time series and in the cross section.

22/25

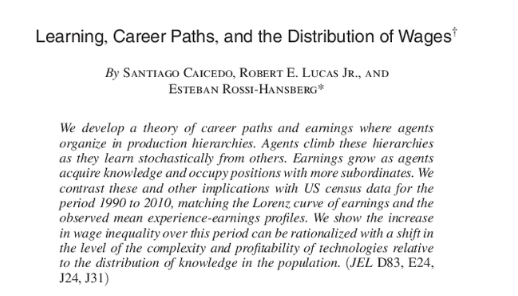

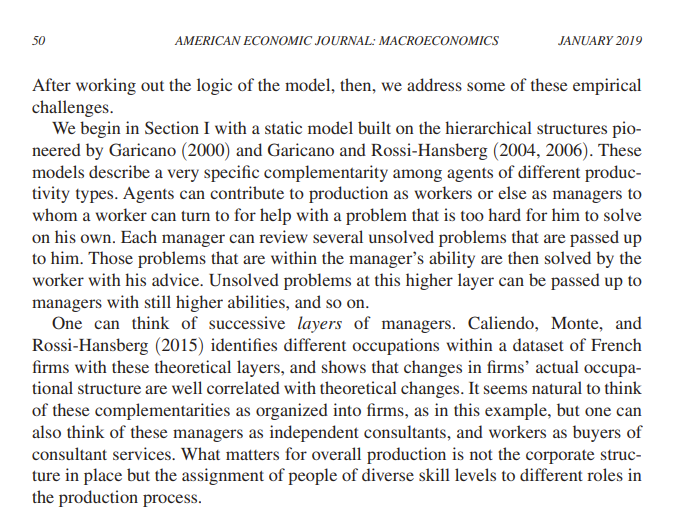

Lucas himself would come back, at the end of his career. to these problems.

In 2019 he built a dynamic version of the model that @hansbergrossi and I had developed to study careers in firms. This is one of his last published pieces.

In 2019 he built a dynamic version of the model that @hansbergrossi and I had developed to study careers in firms. This is one of his last published pieces.

In a trademark Lucas' phrase the paper says

"a distinctive feature of the model is that all knowledge in the economy is held by the individual people who comprise it: there is no abstract technology hovering above them in the ether".

24/25

"a distinctive feature of the model is that all knowledge in the economy is held by the individual people who comprise it: there is no abstract technology hovering above them in the ether".

24/25

And this is it for my brief summary of the "Assignment view of the firm," which was born out of Lucas' and, as Atalay, @aliHortacsu and @chadSyverson have argued, has the potential to explain other important equilibrium patterns about firms. 25/25