Thread by Patrick Saner

- Tweet

- May 17, 2023

- #CentralBank #Finance

Thread

Fed funds futures are pricing in about 60bps of rate cuts until the end of the year. Meanwhile, US core CPI is running at 5.5% YoY currently. How is this possible?

When will/can the Fed start cutting rates? Some historical evidence that can serve as a yardstick 👇

When will/can the Fed start cutting rates? Some historical evidence that can serve as a yardstick 👇

First, rate cuts in the immediate future are very unlikely. The inflation backdrop is simply too severe. By year-end, however, the story might look different. Most econometric models as well as market pricing from CPI swaps suggest inflation to be between 3-3.5% by YE.

The issue with rate cuts is that the labor market is extremely tight, which supports inflation. As I've mentioned several times before, solving inflation will ultimately likely mean addressing labor market tightness.

Historically, the Fed can and has eased monetary policy once unemployment began to decline, whilst inflation was a reasonably low levels (which 3-3.5% would constitute by YE).

Chart from Phil Suttle

Chart from Phil Suttle

Some nuance to avoid a data head-fake: in 7 of the 10 easings since 1983, the unemployment rate has moved down (!!) in the 6m ahead of easing (chart above). It is evolution of the unemployment rate that

differentiates a modest easing process from a extended recession-driven one.

differentiates a modest easing process from a extended recession-driven one.

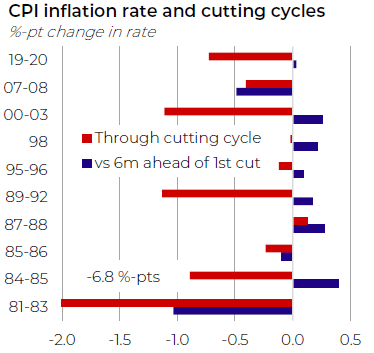

Furthermore and perhaps counter intuitively, for the Fed, the LEVEL is more important than the inflation dynamic to cut rates. In 7 out of 10 easing cycles, inflation has moved up in the 6m before easing.

Chart from Phil Suttle

Chart from Phil Suttle

All told, rate cuts for the next meetings have too high an economic/inflation bar to materialize imo. By YE, though, the inflation backdrop will look different and IF the economy and labor markets turn in a significant way, the Fed may well cut even if CPI is still slightly >3%.