Thread

I bought this building for $450k and sold it two years later for $1,167,000.

Here's the story and the lessons I learned along the way:

Here's the story and the lessons I learned along the way:

At the time I was 3 years into brokerage, however, I did not have a ton of cash and was still getting on my feet in the business.

I had been in contact with these owners over several years and they called to tell me the tenant is vacating and they wanted to sell asap.

I had been in contact with these owners over several years and they called to tell me the tenant is vacating and they wanted to sell asap.

I knew enough to be dangerous in #cre but definitely not enough to take this down myself.

So I asked my leasing broker friend who had 10 years of experience if he wanted to buy this with me. Absolutely he said.

So I asked my leasing broker friend who had 10 years of experience if he wanted to buy this with me. Absolutely he said.

Lesson 1: If you find the deal but don't know how to do it. Get control and then ask an expert in the field to go in with you. If it's a deal 99% of the time they will be more than happy.

We wrote an offer of $450k, 60 day due diligence with a 30 day close.

They accepted and struck the earnest money line. When I asked why they said they didn't need any earnest money from us.

They accepted and struck the earnest money line. When I asked why they said they didn't need any earnest money from us.

Once the property was under contract my friend began marketing the property for lease.

In 30 days we had 6 offers from tenants who wanted to lease the property. All with varying degrees of rents and tenant improvement allowances.

In 30 days we had 6 offers from tenants who wanted to lease the property. All with varying degrees of rents and tenant improvement allowances.

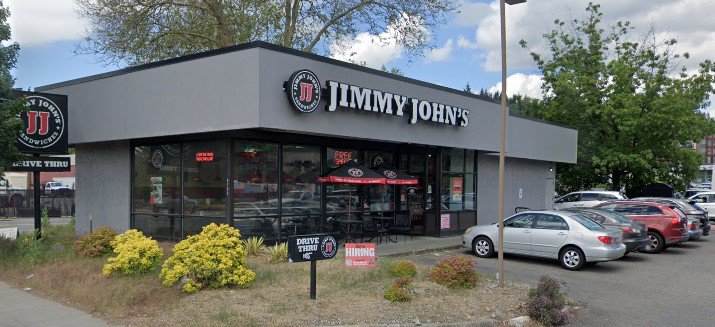

We agreed to a "as is" deal with a strong Jimmy John's franchisee for a 10 year lease. Starting rent of 49k a year.

They would put in roughly 400k into the building and make it suitable to their use.

They would put in roughly 400k into the building and make it suitable to their use.

Lesson 2: If I was to do it over again I would give some Tenant Improvement money so that the starting rent/NOI is higher.

Why?

Every 1k extra NOI capitalized at a 4.5% CAP is 22k in purchase price.

Why?

Every 1k extra NOI capitalized at a 4.5% CAP is 22k in purchase price.

While my friend was working on leasing the property I was reaching out to local lenders.

Luckily I found a local bank who would loan us 75% of purchase price with a signed LOI from the tenant with the caveat that we needed a signed lease within 6 month of closing.

Luckily I found a local bank who would loan us 75% of purchase price with a signed LOI from the tenant with the caveat that we needed a signed lease within 6 month of closing.

No big deal, right?

Well.. Insert Lesson #3:

It can easily take 6+ months to negotiate a lease once attorneys get involved.

So Lesson #3 - Make sure you have a responsive attorney who is specifically familiar with retail leases.

If you don't life will be hell.

Well.. Insert Lesson #3:

It can easily take 6+ months to negotiate a lease once attorneys get involved.

So Lesson #3 - Make sure you have a responsive attorney who is specifically familiar with retail leases.

If you don't life will be hell.

While all this is happening a few other check lists:

Talk to the city and make sure they will approve the usage of future tenant.

Walk the property with the tenant and whoever will be doing their construction.

Check the amount of power available on site and suitable for tenant

Talk to the city and make sure they will approve the usage of future tenant.

Walk the property with the tenant and whoever will be doing their construction.

Check the amount of power available on site and suitable for tenant

Only remaining item is the lease...

2 weeks out from closing I can't sleep because the lease isn't done. What if the tenant bails? What if the bank asks for more $$ I don't have? Etc, etc.

I tell my friend I'm not sure I can do the deal...

2 weeks out from closing I can't sleep because the lease isn't done. What if the tenant bails? What if the bank asks for more $$ I don't have? Etc, etc.

I tell my friend I'm not sure I can do the deal...

Lesson 4: The right business partner can make or break you.

He sat me down and told me if I don't buy this with him #1 he will buy it himself and #2 I will regret it the rest of my life.

My ego couldn't let him buy it himself so I said screw it and jumped in.

He sat me down and told me if I don't buy this with him #1 he will buy it himself and #2 I will regret it the rest of my life.

My ego couldn't let him buy it himself so I said screw it and jumped in.

We closed and 2 weeks later had a signed lease by the tenant.

I could finally sleep.

6 months later the building looked like this.

I could finally sleep.

6 months later the building looked like this.

Two years later we both agreed to sell and 1031 our funds into an apartment building in Seattle.

Lesson 5: I would have sold at 12 months of ownership. This would allow us to complete an 1031 exchange and get another year of added value from a larger property.

Lesson 5: I would have sold at 12 months of ownership. This would allow us to complete an 1031 exchange and get another year of added value from a larger property.

You really are one deal away from changing the trajectory of your life.

This one deal allowed my friend and I to go on to purchase 4 other properties over a 7 year period.

Scary to think where I would be if I never did this deal... Feel the fear and do it anyways. #retwit

This one deal allowed my friend and I to go on to purchase 4 other properties over a 7 year period.

Scary to think where I would be if I never did this deal... Feel the fear and do it anyways. #retwit