Thread by MRodriguezValladares

- Tweet

- Apr 28, 2023

- #Finance

Thread

@federalreserve report on SVB www.federalreserve.gov/supervisionreg/silicon-valley-bank-review-supervisory-materials.htm

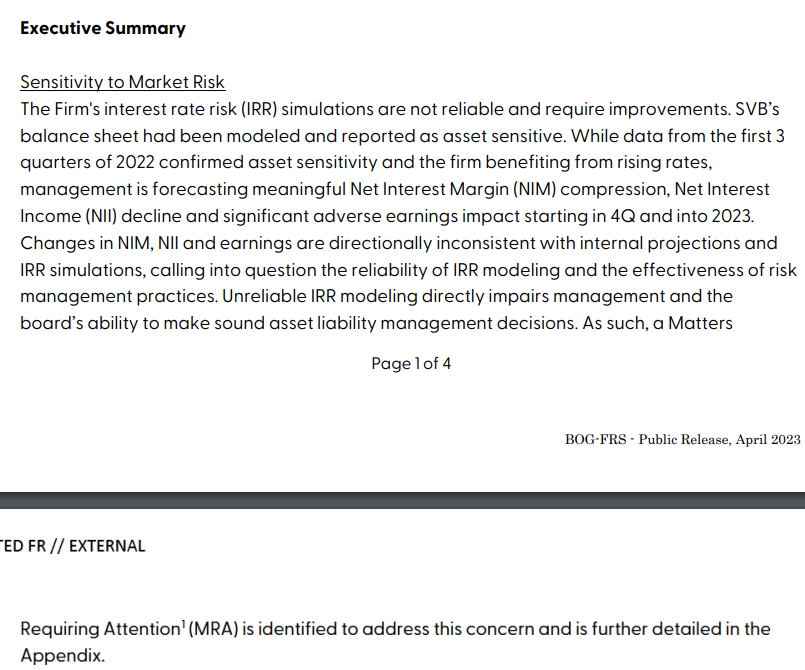

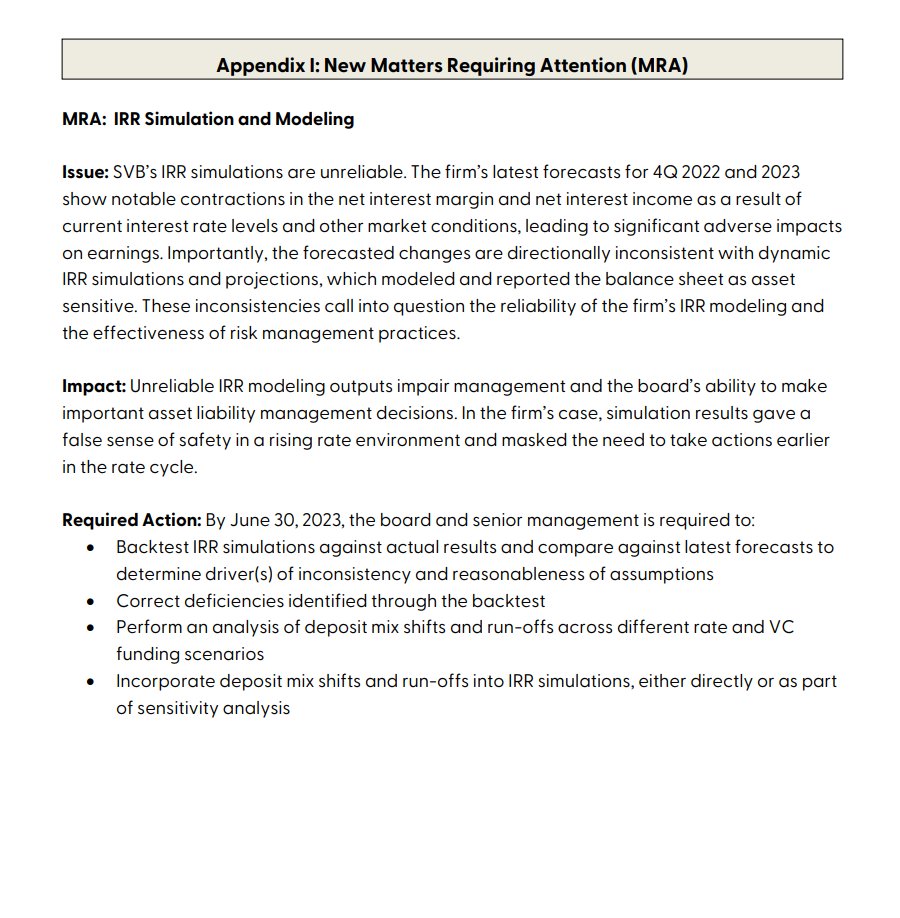

No surprise. SVB's interest rate risk simulations were not reliable. #Banking101 www.federalreserve.gov/supervisionreg/files/svb-2022-camels-examination-supervisory-letter-20221115.p...

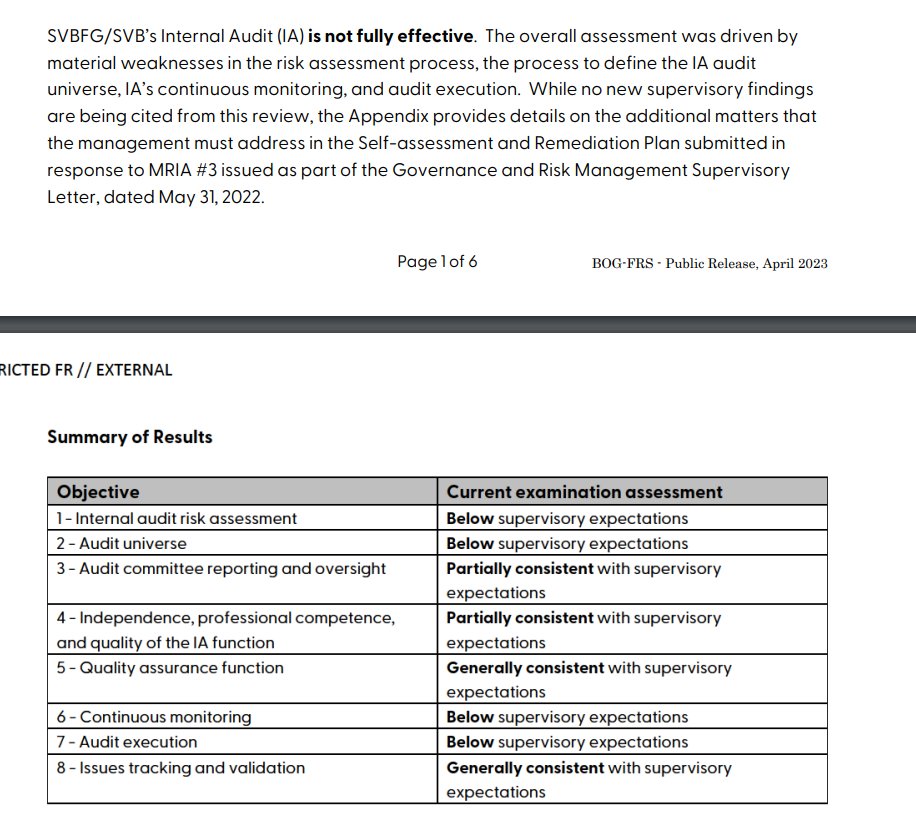

Risk management and measurement problems cited in 2020. #SVB (5)

Internal audit & CECL problems were also highlighted in 2022. (6) #SVB

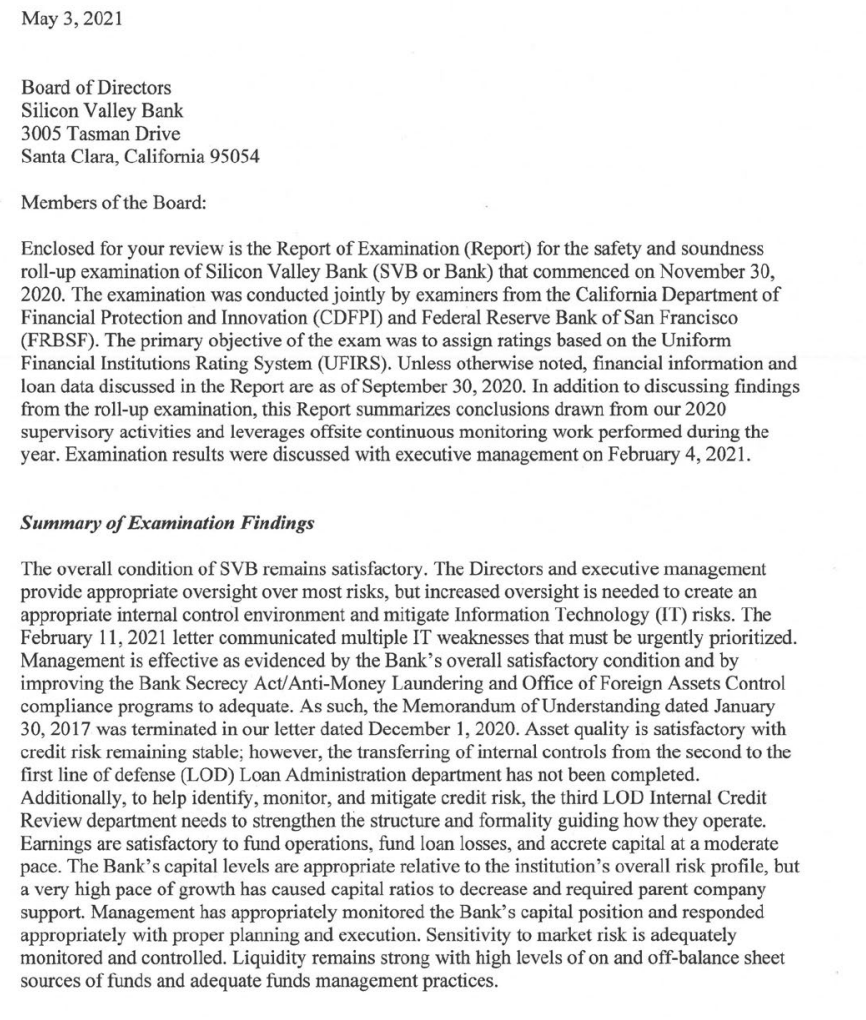

So in 2017, the California Department of Financial Institutions & the SF Fed saw problems with SVB's BSA/AML compliance functions & internal control deficiencies!! This is serious. This is not just weak interest rate risk management. Was this bank even a bank? (7)

TWO Matters Requiring IMMEDIATE Attention related to BSA/AML issued in 2016 to #SVB (8)

In June 2017, the SF Fed also found problems with the SVB's compliance with the #VolckerRule. (9)

A number of SVB's banks were cited in 2016 by SF Fed #BSA/AML & #IT were less than satisfactory. (10)

In addition to BSA/AML internal control weaknesses, several regulators knew that SVB had #model risk management weaknesses in 2016. (11)

June 2017 about SVB's BSA/AML and model risk governance problems identified in 2016 was sent by SF Fed to SVB and to other regulators: California Dept Business Oversight, FDIC, and CFPB. (12)

#LiquidityRisk #SVB In Nov 2021, SF Fed told Greg Becker that SVB's liquidity risk management's were poor. 2021 was EVEN before interest rates were rising. (13)

The SF Fed was pretty specific & detailed about all of SVB's liquidity risk management deficiencies in its November 2021 letter to Greg Becker. bit.ly/449lpfs (14)

And a year later on Nov 2022, SF Fed told Becker that SVB had to submit a variety of liquidity risk management documents to the Fed before an upcoming review. So SVB's liquidity risk management deficiencies have been known to the SF Fed since 2021. (15) www.federalreserve.gov/supervisionreg/files/svbfg-2023-lfbo-horizontal-liquidity-review-entry-letter-...

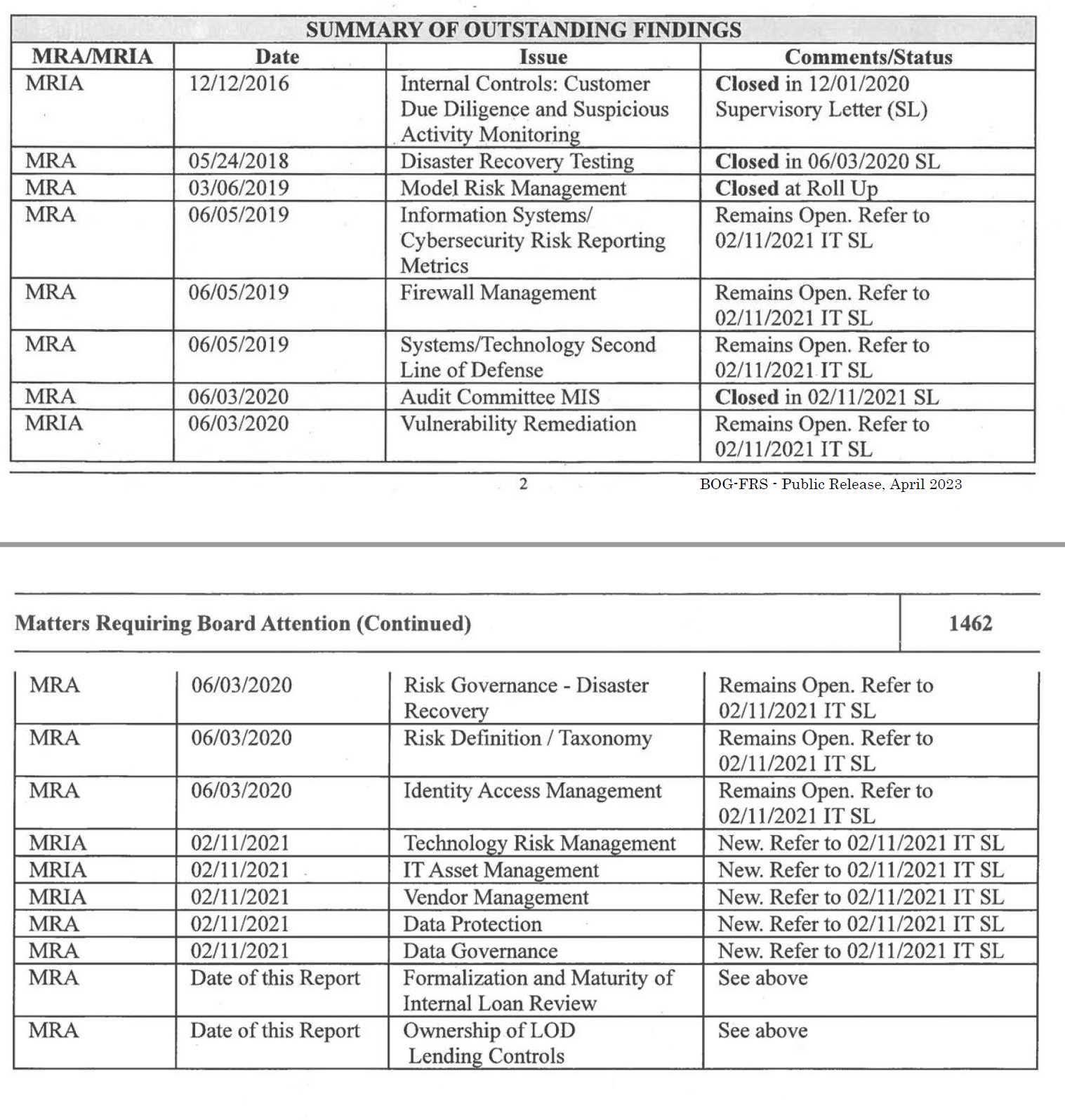

So by 2021, compliance on BSA/AML weaknesses at SVB were resolved, but all these model risk, IT, data, risk definition, governance & loan review problems were still outstanding. Some had been open since 2016! (17)

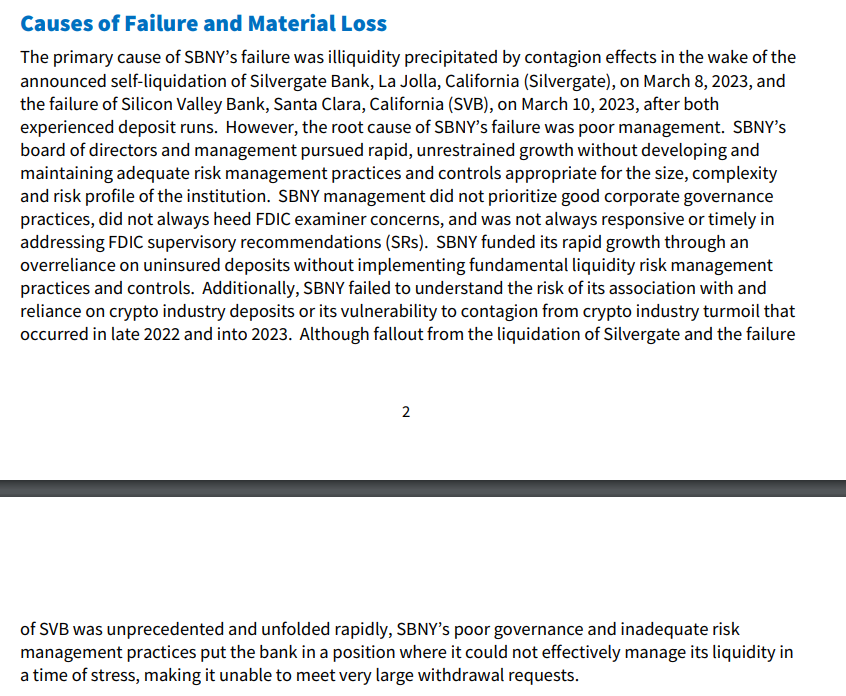

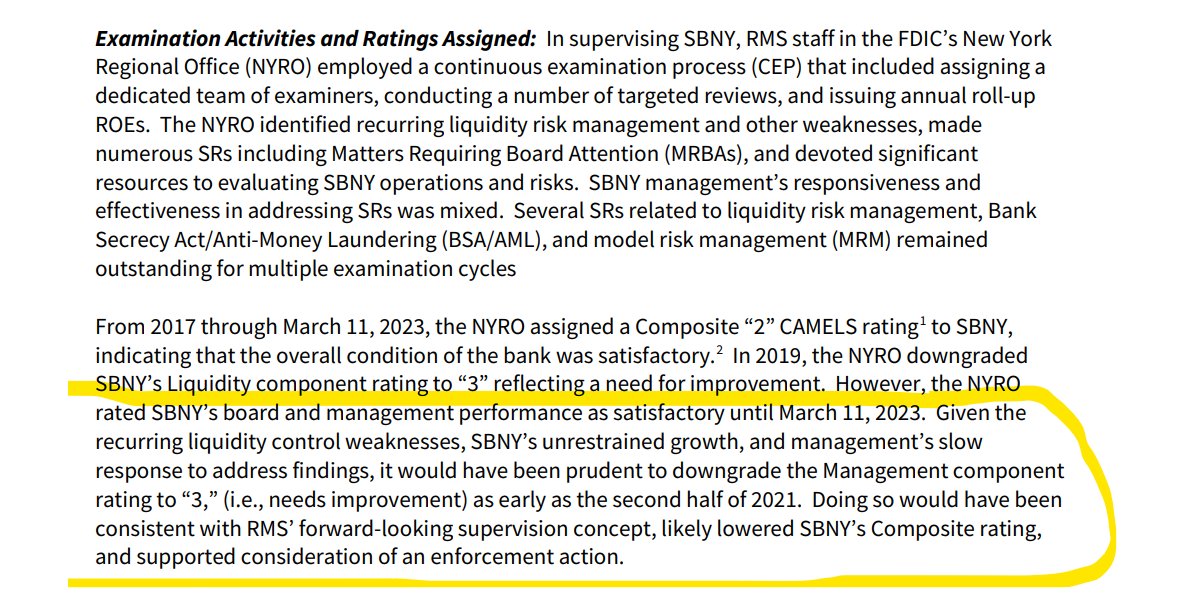

And @FDIC's report on Signature Bank is now out. www.fdic.gov/news/press-releases/2023/pr23033a.pdf?source=govdelivery&utm_medium=email&utm_source=gov...)

#SignatureBank (19)

Signature #FDIC (20)

Staffing challenges & shortages

@FDICgov

were a big problem. No surprise there. Politicians love to criticize bank regulators, but WHERE are the resources so that they can do their job well? (22)

@FDICgov

were a big problem. No surprise there. Politicians love to criticize bank regulators, but WHERE are the resources so that they can do their job well? (22)

We have yet to hear from the responsible actors in this saga: Silicon Valley Bank’s former Chief Executive Officer Greg Becker and SVB’s Board of Directors. (23) bit.ly/41NlkfI