Thread

Here are 10 reasons to expect stocks to continue to surprise to the upside.

Yes, things aren't perfect, but there really are some positives out there.

Yes, things aren't perfect, but there really are some positives out there.

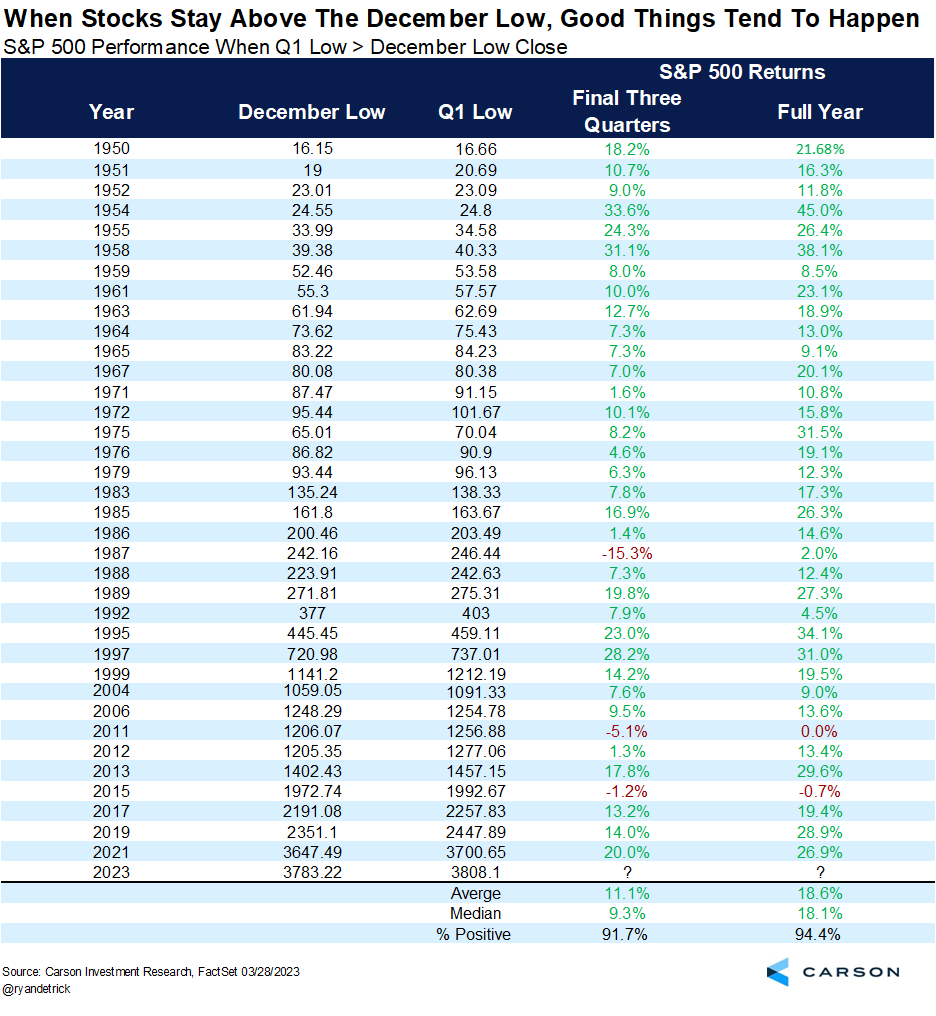

When the S&P 500 stays above the December low in Q1 (like this year)?

Rest of year higher 92% of the time and up 11.1% on avg.

4/10

Rest of year higher 92% of the time and up 11.1% on avg.

4/10

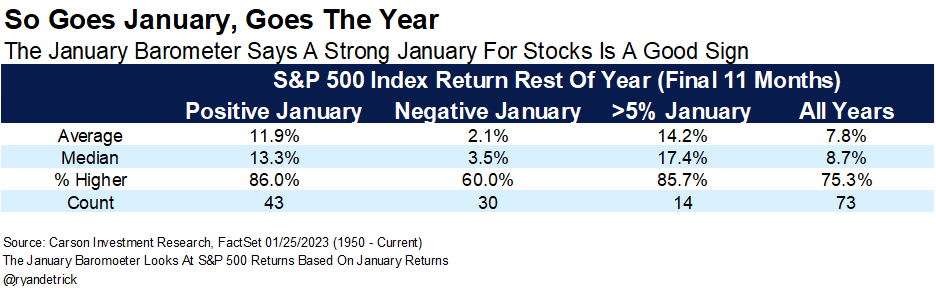

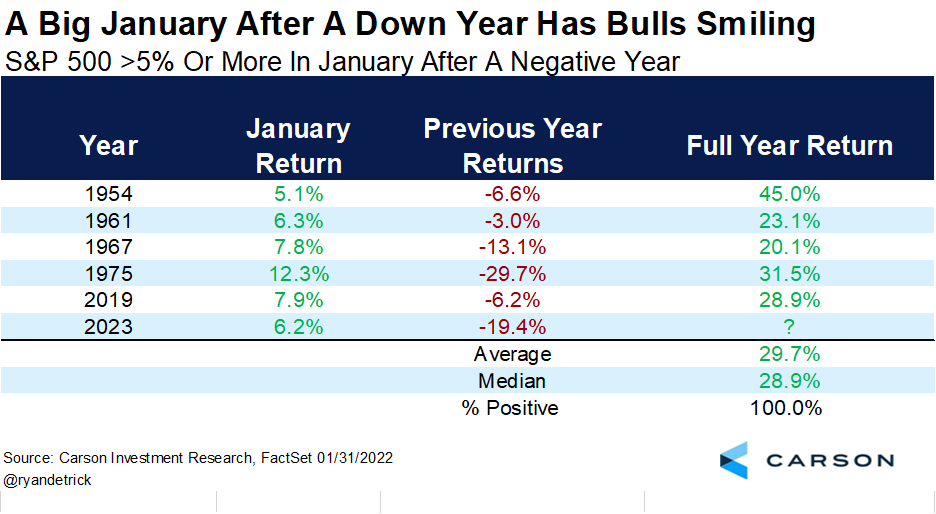

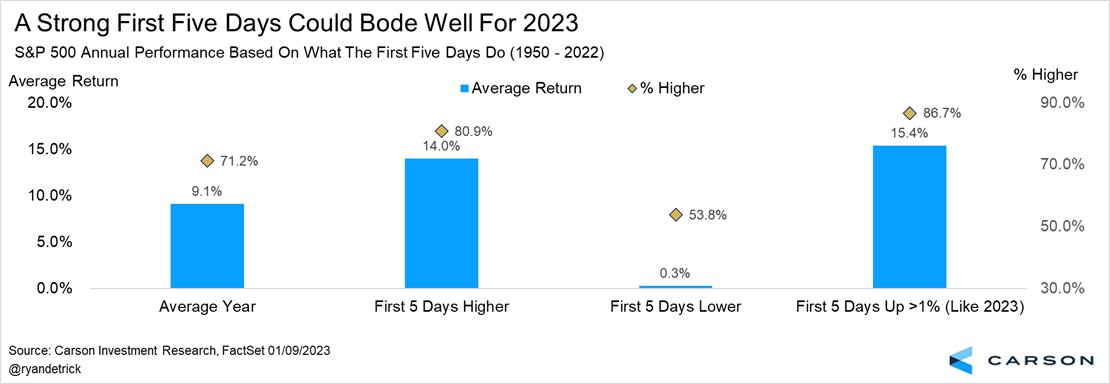

S&P 500 up more than 1% the first five days (like '23)?

Full year higher 15.4% on avg and up 87% of the time.

6/10

Full year higher 15.4% on avg and up 87% of the time.

6/10

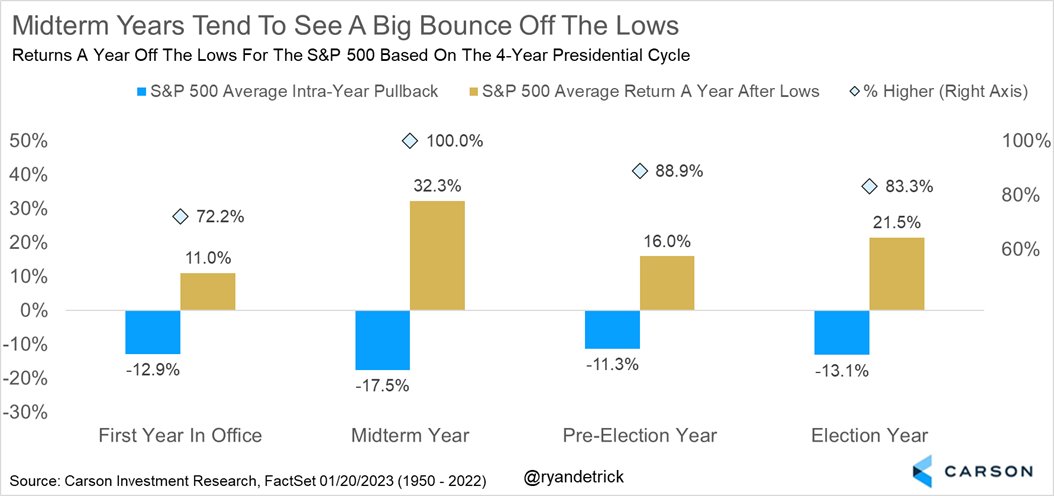

Weakness in midterm years is normal for stocks.

The good news is strength off the midterm year low is also normal.

S&P 500 up 32.3% off the midterm yr low (so Oct 12, 2022 in this case) and never lower a year later.

7/10

The good news is strength off the midterm year low is also normal.

S&P 500 up 32.3% off the midterm yr low (so Oct 12, 2022 in this case) and never lower a year later.

7/10

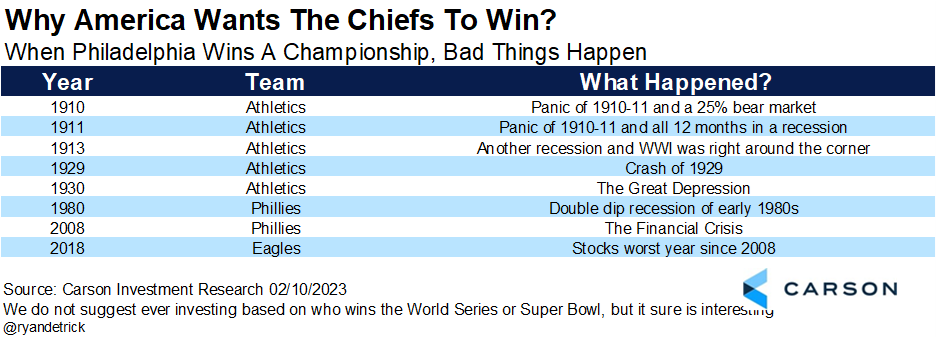

A team from Philadelphia didn't win it all.

When the City of Brotherly love wins a World Series or Super Bowl, bad things happen.

8/10

When the City of Brotherly love wins a World Series or Super Bowl, bad things happen.

8/10

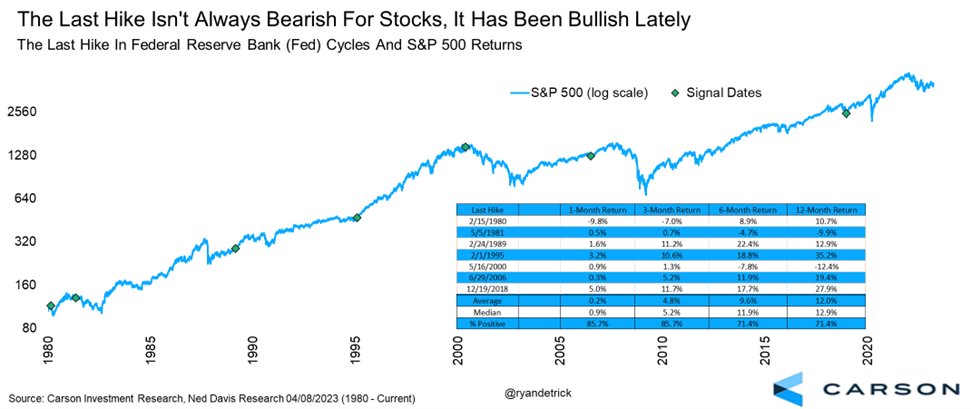

The Fed is likely closing in on their last hike in this cycle.

The avg a year later for the S&P 500 is 12.0% and higher 5 of 7 times.

9/10

The avg a year later for the S&P 500 is 12.0% and higher 5 of 7 times.

9/10

Here's a few more since I'm on a roll.

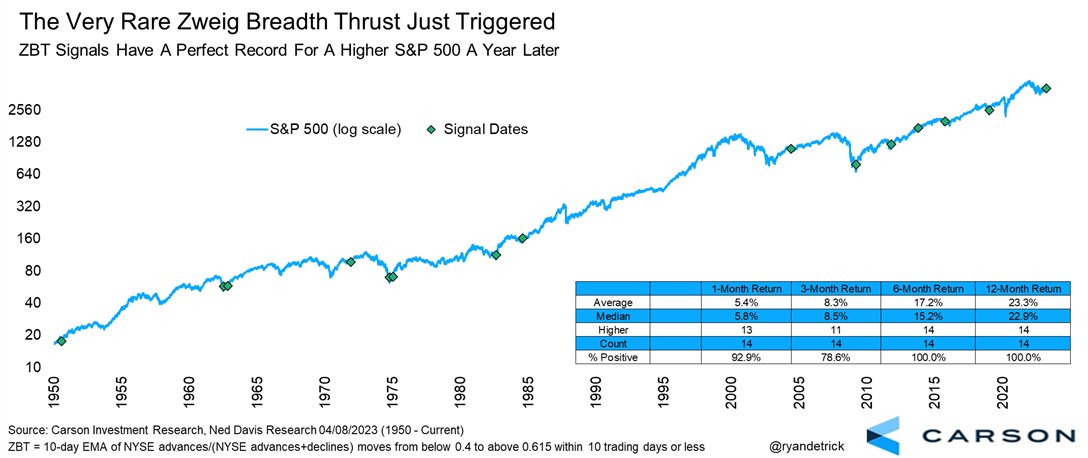

Had a rare Zweig Breadth Thrust recently.

S&P 500 higher a yr later 14 out of 14 times and up more than 23% on avg.

Bonus 1 of 3.

Had a rare Zweig Breadth Thrust recently.

S&P 500 higher a yr later 14 out of 14 times and up more than 23% on avg.

Bonus 1 of 3.

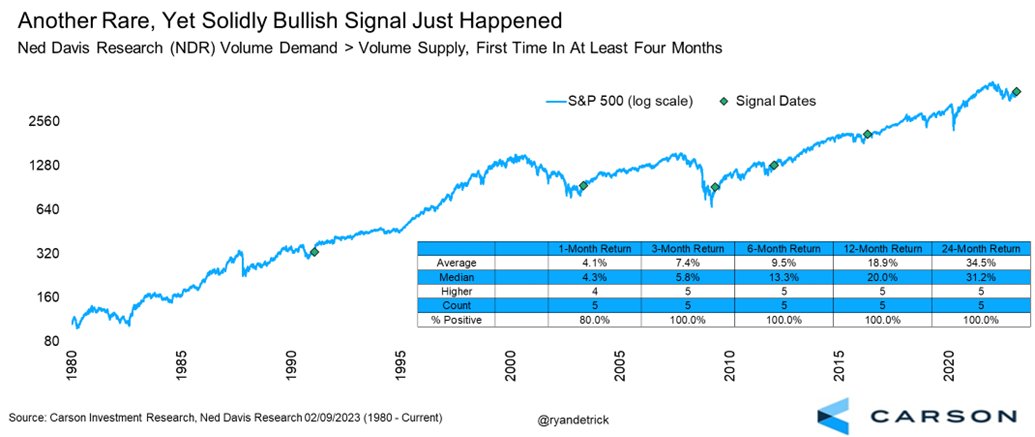

More than 93% of all stocks recently above their 10-day MA.

This was another rare breadth thrust.

S&P 500 higher a year later 23 of 24 times and up 18.4% on avg.

Bonus 2 of 3.

This was another rare breadth thrust.

S&P 500 higher a year later 23 of 24 times and up 18.4% on avg.

Bonus 2 of 3.

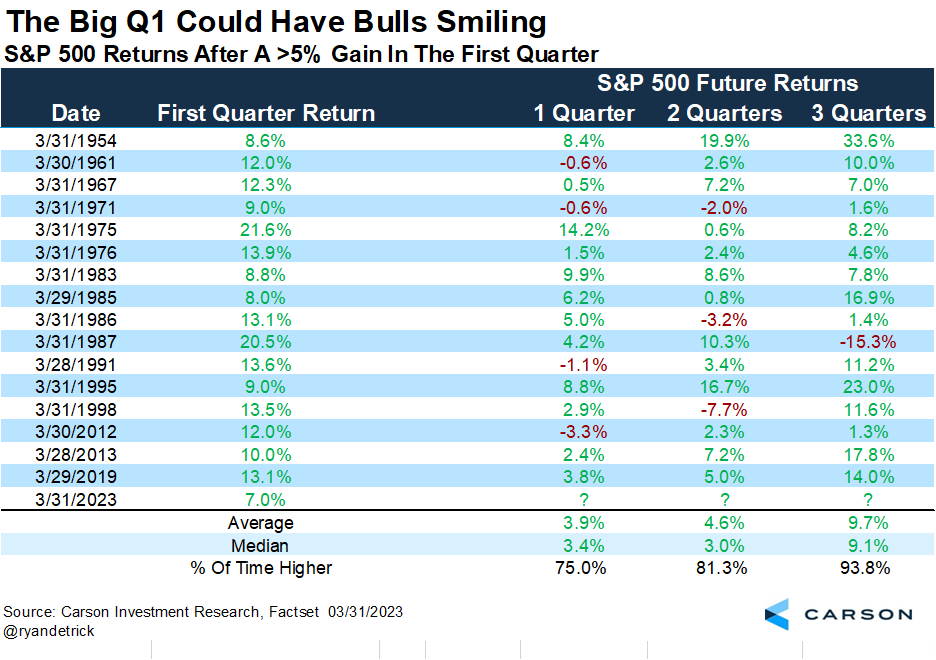

Last one.

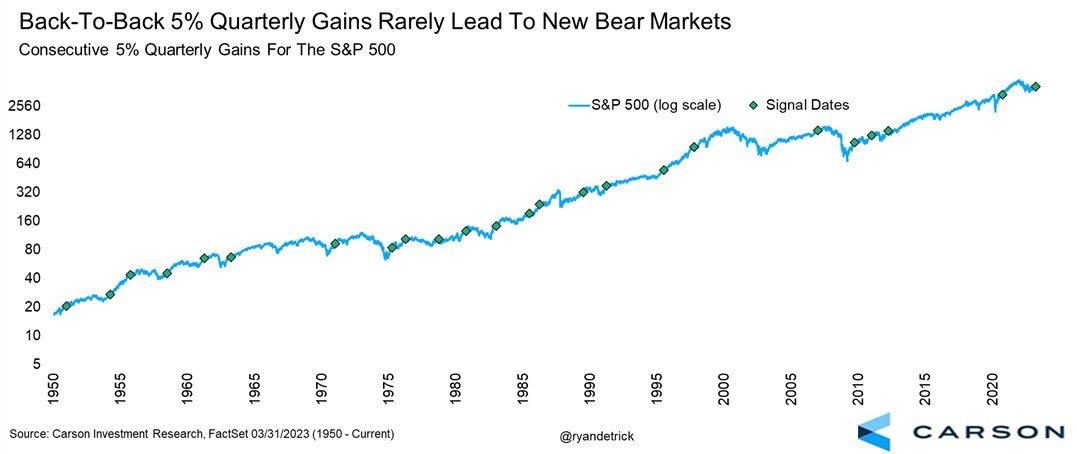

S&P 500 up more than 5% in Q1?

Rest of year higher 15 out of 16 times and up close to 10% avg return.

Bonus 3 of 3.

S&P 500 up more than 5% in Q1?

Rest of year higher 15 out of 16 times and up close to 10% avg return.

Bonus 3 of 3.

Yes, any one of these by themselves could be random and not mean much.

But when you stack them all on top of each other, my take is they are very meaningful.

But when you stack them all on top of each other, my take is they are very meaningful.

Mentions

See All

Dan Tapiero @DanTapiero

·

Apr 17, 2023

Great thread!