Thread

All NFTs in their current form will eventually trend to zero.

Here's why you shouldn't over-commit your portfolio within this asset class.🧵(1/15)

Here's why you shouldn't over-commit your portfolio within this asset class.🧵(1/15)

NFTs are valued based on their inherent benefits.

🔸NFT: Is a "Digital Asset".

🔹Digital: Software code.

🔹Asset: A resource controlled by the holder with the expectation of an inflow of future economic benefits.

How those economic benefits are embodied is subjective.

/2

🔸NFT: Is a "Digital Asset".

🔹Digital: Software code.

🔹Asset: A resource controlled by the holder with the expectation of an inflow of future economic benefits.

How those economic benefits are embodied is subjective.

/2

It's important to distinguish this from fair value (FV).

FV is the price that the market is willing to pay.

NFT FV is consistent with market sentiment & is incredibly volatile & hypersensitive to market news.

More mature markets have a more stable FV.

/3

FV is the price that the market is willing to pay.

NFT FV is consistent with market sentiment & is incredibly volatile & hypersensitive to market news.

More mature markets have a more stable FV.

/3

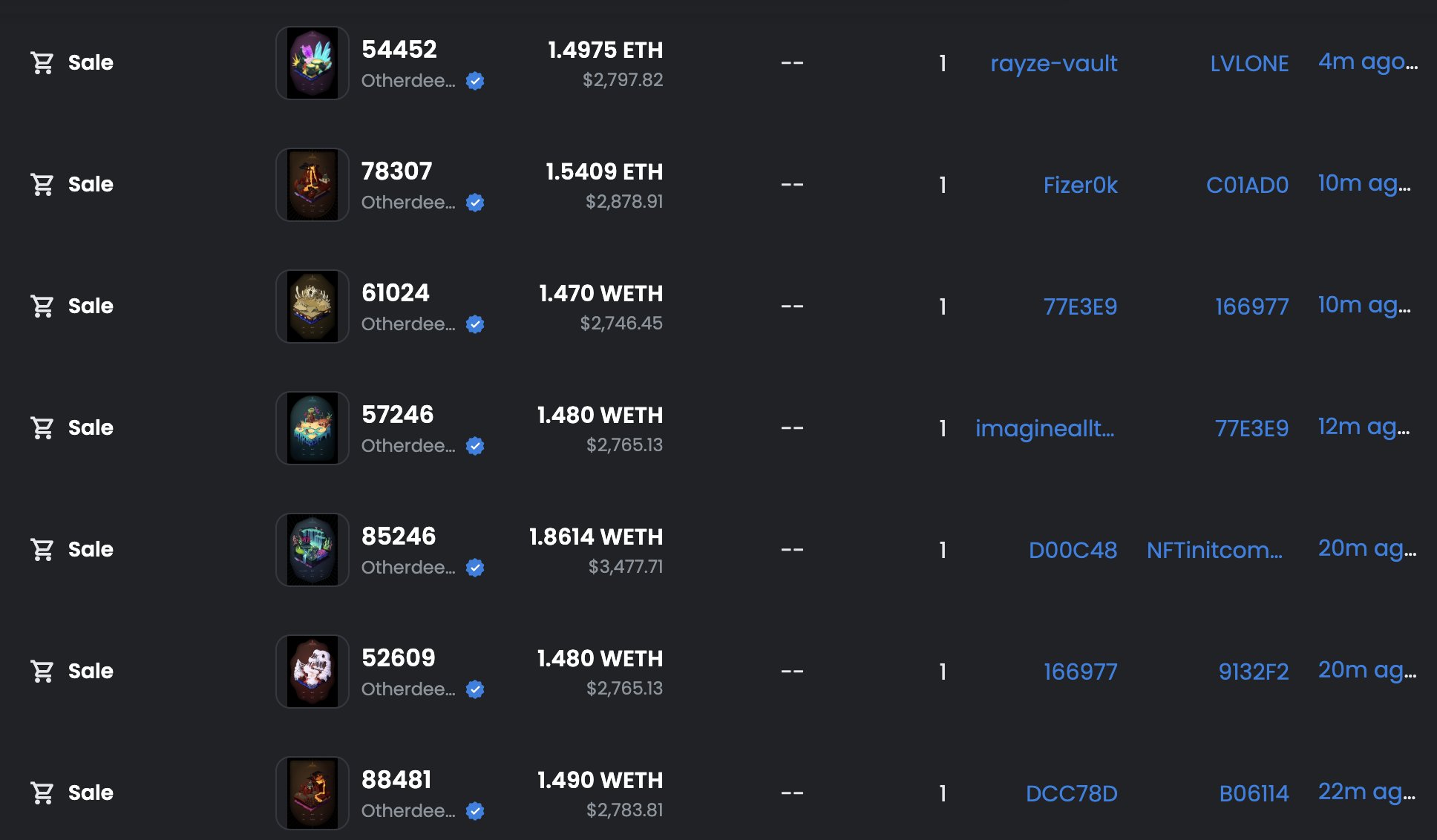

Case Study 1: Yuga's Otherdeed

What use has the Otherdeed provided to date? Limited gameplay.

The digital land is expected to provide holders with benefits within the Otherside.

The FV of these is 1.5 ETH ($2.8k).

What if Yuga ceased its Metaverse development?

Meta did.

/4

What use has the Otherdeed provided to date? Limited gameplay.

The digital land is expected to provide holders with benefits within the Otherside.

The FV of these is 1.5 ETH ($2.8k).

What if Yuga ceased its Metaverse development?

Meta did.

/4

It would be catastrophic for the price.

But, the likelihood of this happening is VERY low.

Yuga is a well-funded company focused on this market.

It employed Daniel Alegre (former CEO Activision).

The risk is low, hence why the floor price for 100k items has held up.

/5

But, the likelihood of this happening is VERY low.

Yuga is a well-funded company focused on this market.

It employed Daniel Alegre (former CEO Activision).

The risk is low, hence why the floor price for 100k items has held up.

/5

Case Study 2: Nakamigos

The current floor is 0.7 ETH ($1.3k USD).

Most of the value is speculative.

We don't know who the artist is.

Beeple has done 2 pieces on the project & rumors of 10KTF involvement.

But what happens when it's revealed?

/6

The current floor is 0.7 ETH ($1.3k USD).

Most of the value is speculative.

We don't know who the artist is.

Beeple has done 2 pieces on the project & rumors of 10KTF involvement.

But what happens when it's revealed?

/6

The speculative premium is removed.

Unless that announcement is beyond the expectations of the holders' current predictions then gravity will take hold.

This is the age-old "Sell the news".

However, if the news is accurate AND announcement of future utility arrives then 📈

/7

Unless that announcement is beyond the expectations of the holders' current predictions then gravity will take hold.

This is the age-old "Sell the news".

However, if the news is accurate AND announcement of future utility arrives then 📈

/7

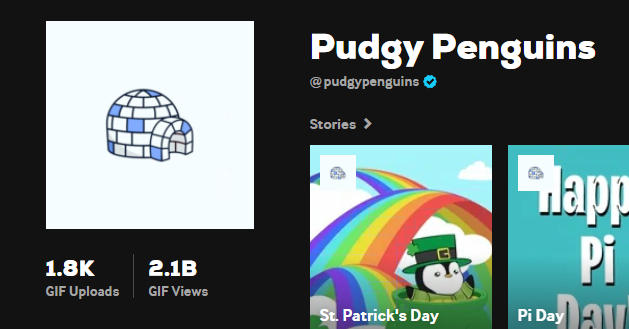

Case Study 3: Pudgy

Pudgy is piloting a physical toy line.

It's trailblazing with its Instagram & Giphy presence.

There is potential here for real revenues that can be reliably measured.

The speculative premium is lower within this collection.

/8

Pudgy is piloting a physical toy line.

It's trailblazing with its Instagram & Giphy presence.

There is potential here for real revenues that can be reliably measured.

The speculative premium is lower within this collection.

/8

What do all these have in common?

Good expectation mgmt.

Those projects that manage expectations well will likely perform well.

Sustainable & consistent news will usually help the project perform well financially.

However, there have to be real benefits at some point.

/9

Good expectation mgmt.

Those projects that manage expectations well will likely perform well.

Sustainable & consistent news will usually help the project perform well financially.

However, there have to be real benefits at some point.

/9

What do I mean by this?

Well, most of the above are based on high levels of speculation.

AKA: A speculative asset.

For projects to become more stable we need these speculative assets to convert to productive assets.

/10

Well, most of the above are based on high levels of speculation.

AKA: A speculative asset.

For projects to become more stable we need these speculative assets to convert to productive assets.

/10

A productive asset is one where the revenue or utility can be reliably measured.

This is FINALLY coming to fruition.

The recent Avengers Sevenfold NFT allowed its holders to gain access to the tickets for face value.

So the reliable valuation = (FV - face value).

/11

This is FINALLY coming to fruition.

The recent Avengers Sevenfold NFT allowed its holders to gain access to the tickets for face value.

So the reliable valuation = (FV - face value).

/11

We've had primitive "tangible benefits" before.

But paying >100 ETH for an NFT only to receive a care package containing a hoody is a gross misalignment of holder value accretion.

Times are changing for the better.

Ticketing, loyalty rewards, PBT.

/12

But paying >100 ETH for an NFT only to receive a care package containing a hoody is a gross misalignment of holder value accretion.

Times are changing for the better.

Ticketing, loyalty rewards, PBT.

/12

These benefits are now solving real-world problems.

We are on the cusp of optimizing the UI/UX.

Reddit, WaaS, ERC-4337, zkEVM are all compounding to an optimal user experience.

They won't even know they're adopting web3.

/13

We are on the cusp of optimizing the UI/UX.

Reddit, WaaS, ERC-4337, zkEVM are all compounding to an optimal user experience.

They won't even know they're adopting web3.

/13

What did I mean by "Eventually trend to zero"?

Nothing is up only.

The market will price speculative assets based on the information available.

If that's the only thing it's priced on then it could be valued at nil overnight.

But when NFTs become productive assets...

/14

Nothing is up only.

The market will price speculative assets based on the information available.

If that's the only thing it's priced on then it could be valued at nil overnight.

But when NFTs become productive assets...

/14

That volatility & liquidity will improve.

Different valuation models will be used.

Discounted Cash Flow (DCF) models will more reliably measure the holder value accretion.

Regulators will step in - But that's necessary for the market to mature.

/15

Different valuation models will be used.

Discounted Cash Flow (DCF) models will more reliably measure the holder value accretion.

Regulators will step in - But that's necessary for the market to mature.

/15

Keen to hear your thoughts! 👇

If you found this🧵useful please hit RT on the first tweet to spread awareness.

Thanks for reading. 🙏

If you found this🧵useful please hit RT on the first tweet to spread awareness.

Thanks for reading. 🙏

Mentions

See All

apix @apixtwts

·

Apr 9, 2023

Great thread