Thread by Big Backend Bandit

- Tweet

- Apr 14, 2023

- #Non-FungibleToken

Thread

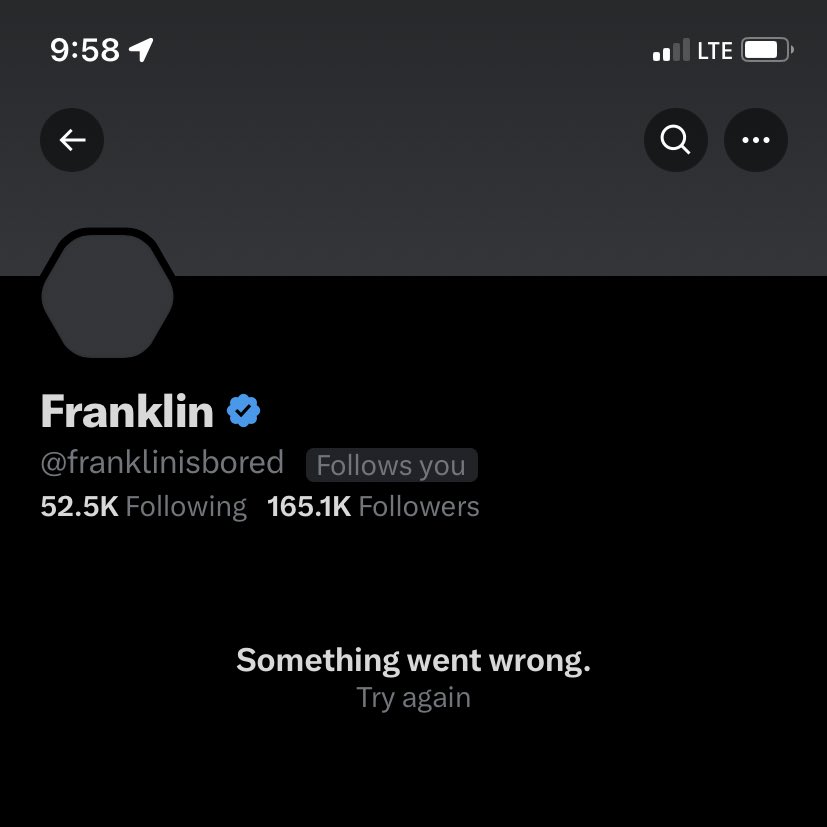

Yesterday, the NFT scene was rocked with the news of @franklinisbored's abrupt retirement.

His vague announcement fueled lots of speculation.

So, what really happened? 🧵

His vague announcement fueled lots of speculation.

So, what really happened? 🧵

To understand this series of events, we need context.

This helps us realize where things started to go wrong.

For those who don't know, Franklin is a @BoredApeYC whale who got famous for flexing his big bags.

This helps us realize where things started to go wrong.

For those who don't know, Franklin is a @BoredApeYC whale who got famous for flexing his big bags.

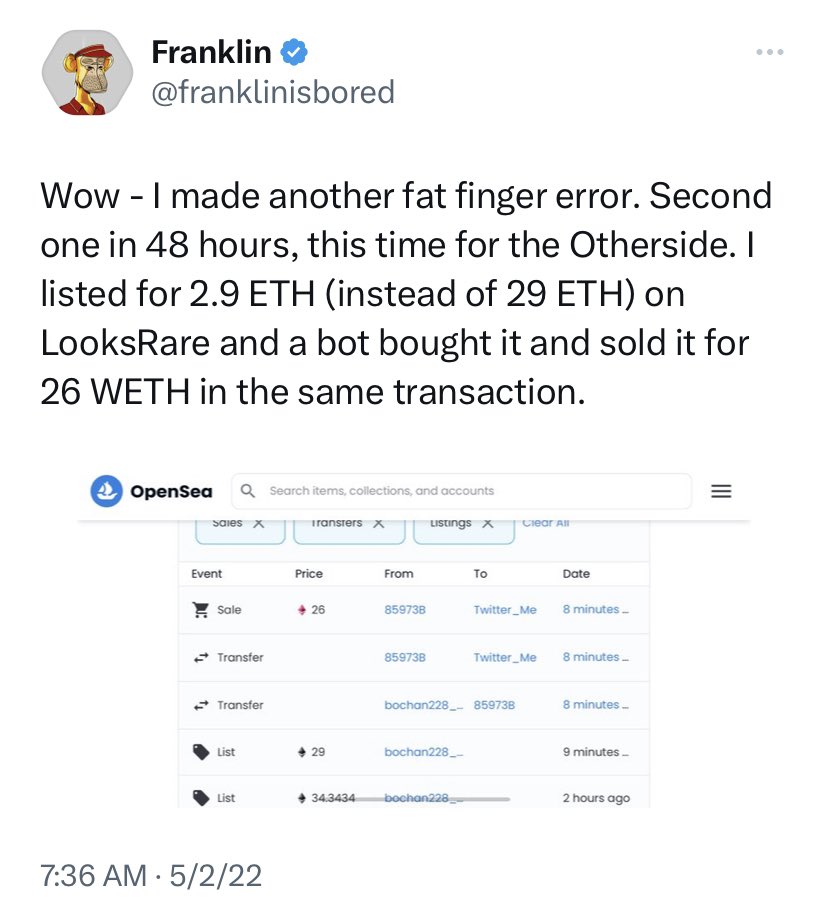

Franklin was also (in)famous for his fat fingers.

Several times, he posted huge losses on trades due to small mistakes.

Perhaps the most memorable one was this incident with an ENS name.

His attempted troll cost 100 eth. Now, that's an expensive joke.

Several times, he posted huge losses on trades due to small mistakes.

Perhaps the most memorable one was this incident with an ENS name.

His attempted troll cost 100 eth. Now, that's an expensive joke.

More fat finger trades.

Don't lose the plot, though.

Some context is necessary to understand the trading psychology at work here.

OK, let's get back to the topic.

Don't lose the plot, though.

Some context is necessary to understand the trading psychology at work here.

OK, let's get back to the topic.

So how does one stay afloat while losing hundreds of ETH to noob mistakes?

For Franklin, it appeared quite simple.

Sell more NFTs. Use more leverage. Farm more airdrops. Communities and floor prices be damned.

For Franklin, it appeared quite simple.

Sell more NFTs. Use more leverage. Farm more airdrops. Communities and floor prices be damned.

Franklin's tweet above (quoted) has a very interesting choice of words.

He openly admits to market manipulation with a heartfelt apology "if that hurts the community."

So lessons were learned in July 2022. No more whale games for Franklin, right?

He openly admits to market manipulation with a heartfelt apology "if that hurts the community."

So lessons were learned in July 2022. No more whale games for Franklin, right?

Wrong.

Franklin continues to build a reputation as a "market maker" on the NFT trading scene.

This epic thread by @k2_nft is a must-read.

It shows Franklin and @machibigbrother using Blur bids to brazenly manipulate the floor prices of several collections.

Franklin continues to build a reputation as a "market maker" on the NFT trading scene.

This epic thread by @k2_nft is a must-read.

It shows Franklin and @machibigbrother using Blur bids to brazenly manipulate the floor prices of several collections.

Now, let's zoom out and examine the story so far.

✦ Franklin stacked lots of BAYC early.

✦ He's prone to making costly mistakes while trading.

✦ He covered his losses by any means necessary.

But there's a final piece of the puzzle.

✦ Franklin stacked lots of BAYC early.

✦ He's prone to making costly mistakes while trading.

✦ He covered his losses by any means necessary.

But there's a final piece of the puzzle.

✨ Gambling ✨

Franklin pumped an obscene amount of ETH into @rollbitcom.

The only predicable element of gambling is that the house always wins.

And it won 650 ETH from him.

But if this didn't trigger his sudden liquidation, what did?

Franklin pumped an obscene amount of ETH into @rollbitcom.

The only predicable element of gambling is that the house always wins.

And it won 650 ETH from him.

But if this didn't trigger his sudden liquidation, what did?

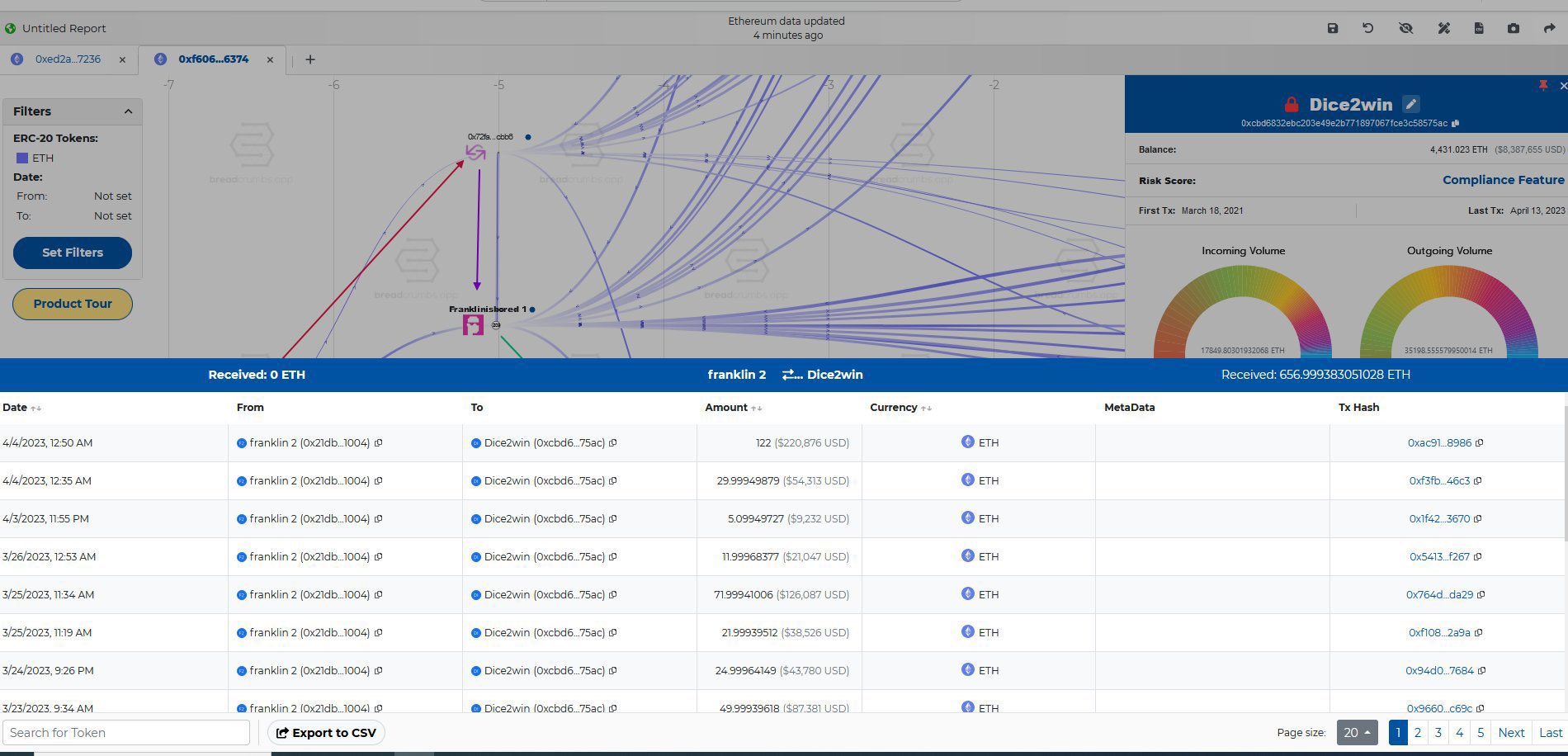

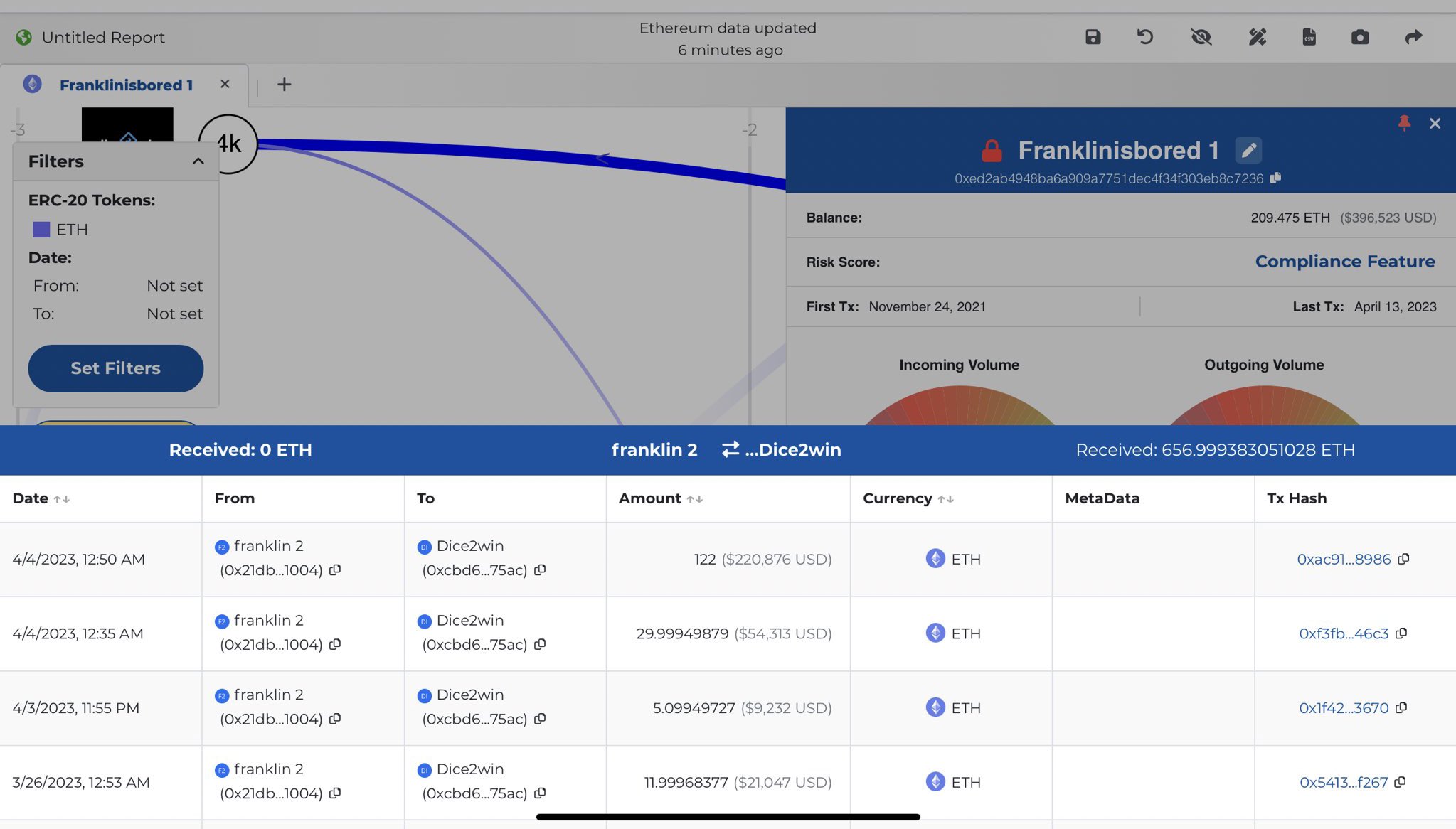

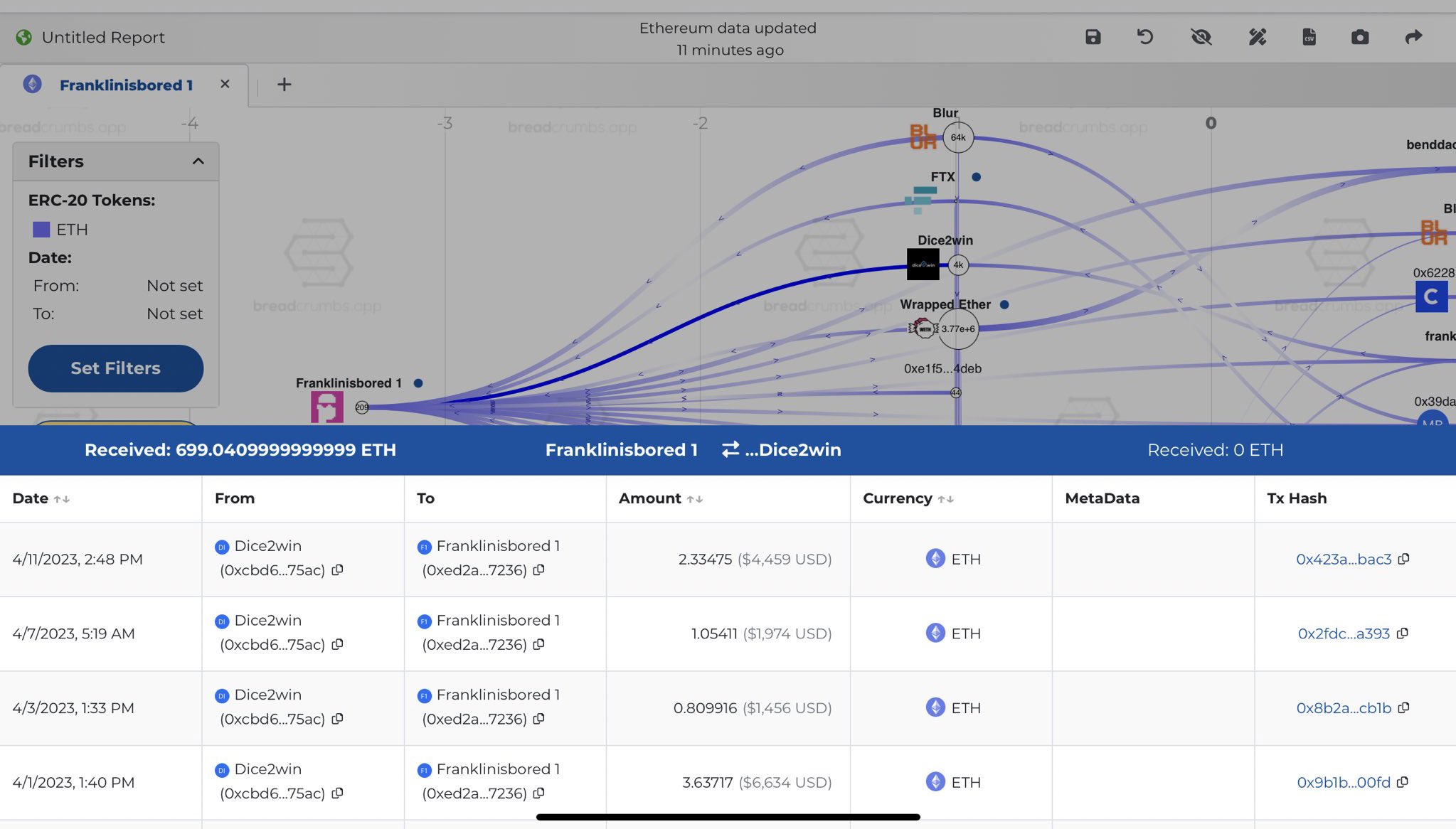

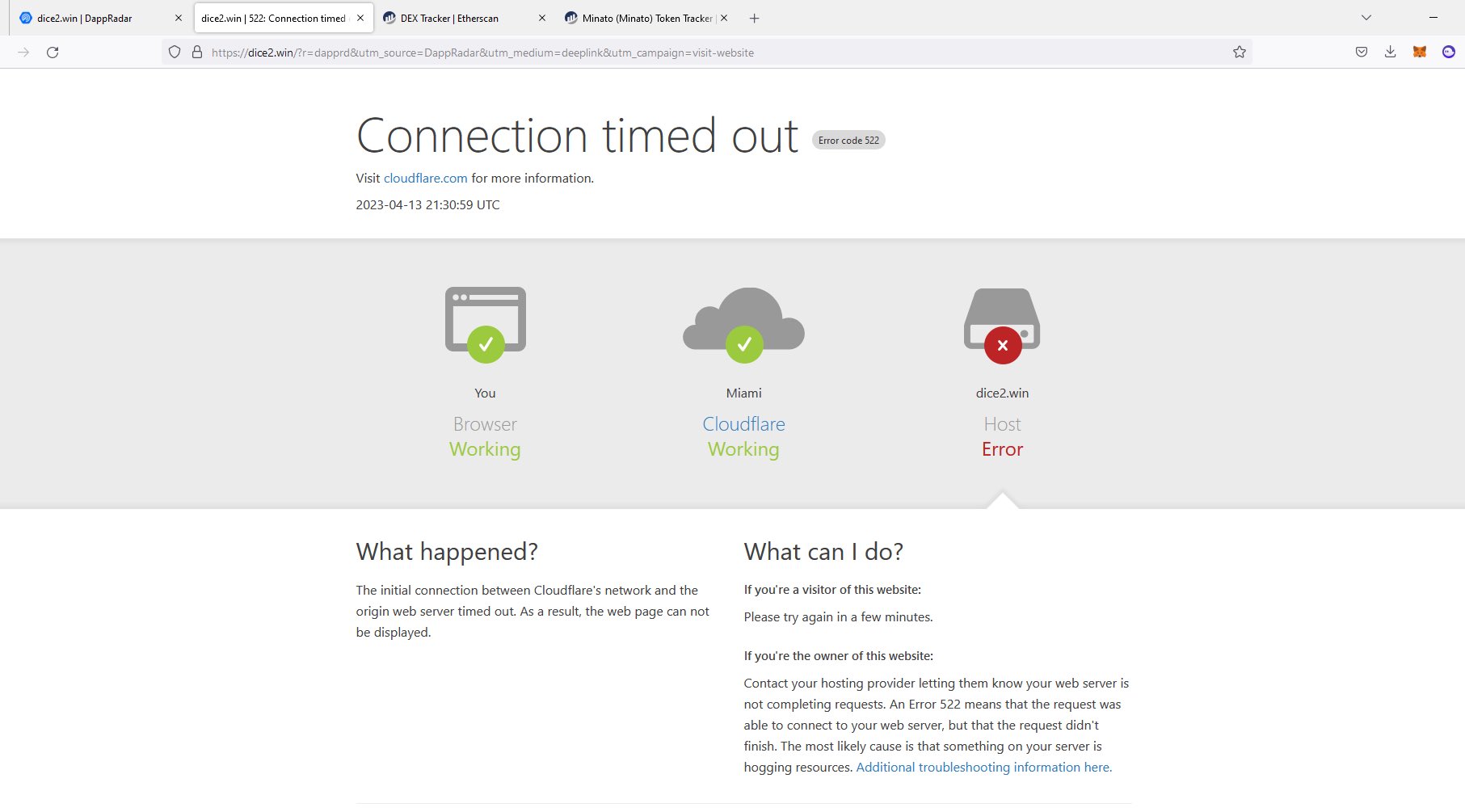

Enter, Dice2Win.

Franklin has never mentioned this online casino publicly.

But did you know that he recently pumped ~ 1,355 ETH into the platform?

What's more? The website is down.

(Credit to @solminingpunk for the sleuth work)

Franklin has never mentioned this online casino publicly.

But did you know that he recently pumped ~ 1,355 ETH into the platform?

What's more? The website is down.

(Credit to @solminingpunk for the sleuth work)

This raises a lot of questions.

✦ Why would Franklin pump ~ $3m into an obscure online casino?

✦ Why has he never mentioned this publicly, even after the site got rugged?

Franklin tweets about 0.1 ETH flips. It's extremely out of character to stay silent on this.

✦ Why would Franklin pump ~ $3m into an obscure online casino?

✦ Why has he never mentioned this publicly, even after the site got rugged?

Franklin tweets about 0.1 ETH flips. It's extremely out of character to stay silent on this.

But here's the most pressing question:

You've lost hundreds of ETH to fat fingers, lost more to Blur bids, (literally) gambled away 650 ETH, and pumped 1.3K ETH into a defunct casino.

Why quit after a single rug, if that's the full story?

What is Franklin hiding? 🤔

You've lost hundreds of ETH to fat fingers, lost more to Blur bids, (literally) gambled away 650 ETH, and pumped 1.3K ETH into a defunct casino.

Why quit after a single rug, if that's the full story?

What is Franklin hiding? 🤔

Franklin said he lost ~2000 ETH to a lone bad actor.

He purportedly "invested" almost $4m because he saw other people putting money into the venture.

Even knowing his pattern of poor trading practices, it's still a bizarre amount of money to commit without due diligence.

He purportedly "invested" almost $4m because he saw other people putting money into the venture.

Even knowing his pattern of poor trading practices, it's still a bizarre amount of money to commit without due diligence.

The aim of this thread isn't to dunk on a man who fumbled generational wealth.

But the NFT trading scene idolizes toxic behaviors like gambling, market manipulation and personality cults.

We need to re-evaluate the platforms and ideas that we promote.

But the NFT trading scene idolizes toxic behaviors like gambling, market manipulation and personality cults.

We need to re-evaluate the platforms and ideas that we promote.

This will definitely bother some people. As it should.

The uncomfortable truth is that WAGMI is a lie.

Even whales get rekt.

No matter how much the tech improves, mass adoption will not happen without a paradigm shift.

So, what can we do about it? 🤔

The uncomfortable truth is that WAGMI is a lie.

Even whales get rekt.

No matter how much the tech improves, mass adoption will not happen without a paradigm shift.

So, what can we do about it? 🤔

As industry leaders gather in #NFTNYC23 to discuss how to improve the NFT space, it's the perfect time for this conversation.

Let's talk about ethics.

How are fundamental blockchain principles reflected in the way we operate?

Let's talk about ethics.

How are fundamental blockchain principles reflected in the way we operate?

Decentralization is a small part of a huge machine.

My recommendations:

✦ Accountability must improve.

✦ More emphasis on due diligence.

✦ Investment in mass education is a no-brainer (shoutout @BoringSecDAO).

What else would you change? Tell me in the comments!

My recommendations:

✦ Accountability must improve.

✦ More emphasis on due diligence.

✦ Investment in mass education is a no-brainer (shoutout @BoringSecDAO).

What else would you change? Tell me in the comments!

Mentions

See All

Kouk.eth @kouk_web3

·

Apr 14, 2023

Great thread Fren thanks for sharing!!