Thread by 0xShinChan

- Tweet

- Apr 1, 2023

- #DecentralizedFinance #Cryptocurrency

Thread

1/ Could flatcoins be the next hottest DeFi narrative, as mentioned in @BuildOnBase's recent publication?

Here's everything you need to know about flatcoins, its TradFi relevance and DeFi adoption.

Let's get started with this 8-min read🧵

Here's everything you need to know about flatcoins, its TradFi relevance and DeFi adoption.

Let's get started with this 8-min read🧵

2/ In this thread, I'll cover

1️⃣ Background on flatcoins

2️⃣ What are flatcoins and why flatcoins?

3️⃣ Tradfi relevance

4️⃣ DeFi adoption

5️⃣ Debut of @NuonFinance

1️⃣ Background on flatcoins

2️⃣ What are flatcoins and why flatcoins?

3️⃣ Tradfi relevance

4️⃣ DeFi adoption

5️⃣ Debut of @NuonFinance

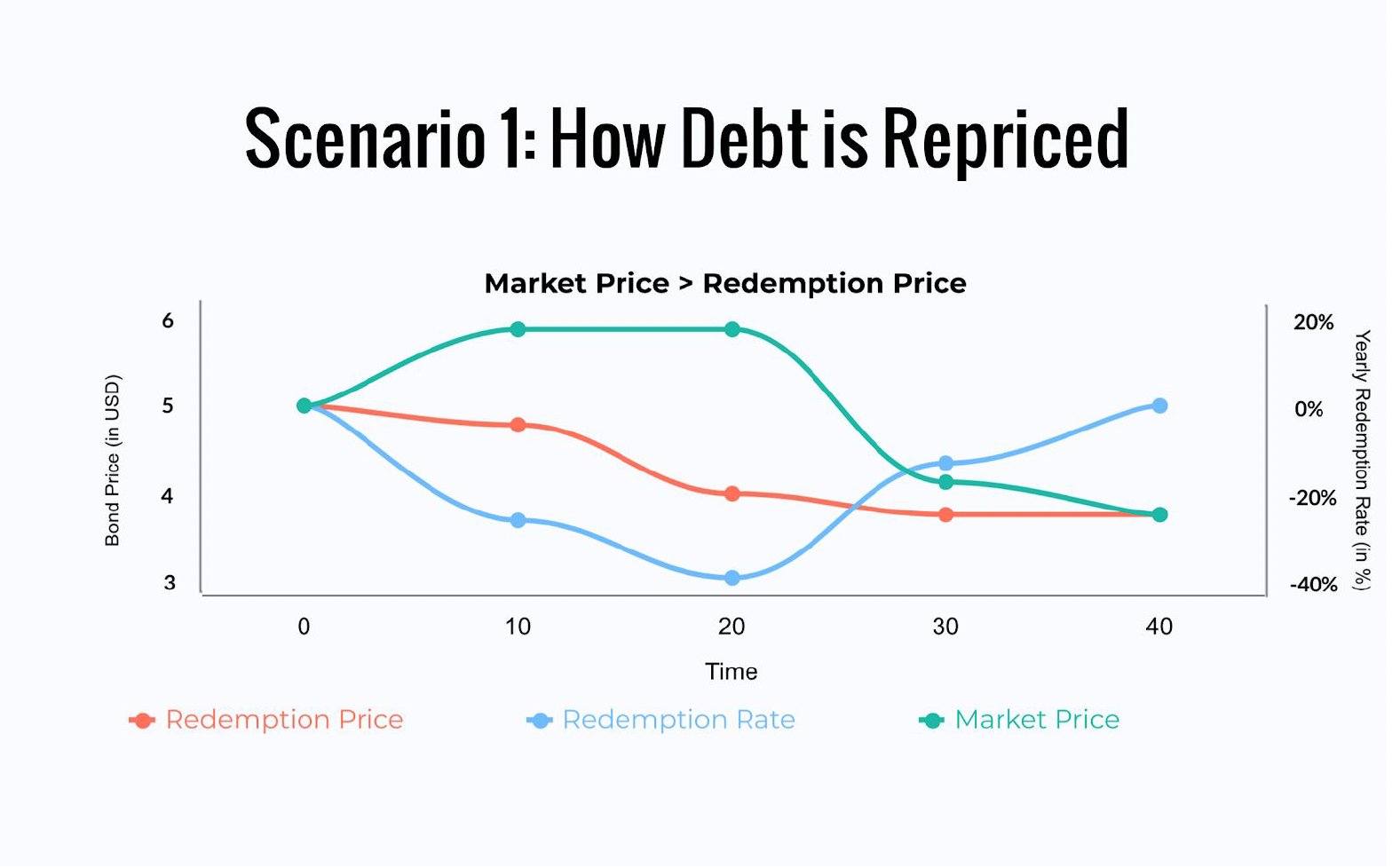

3/ 1️⃣ Background on flatcoins

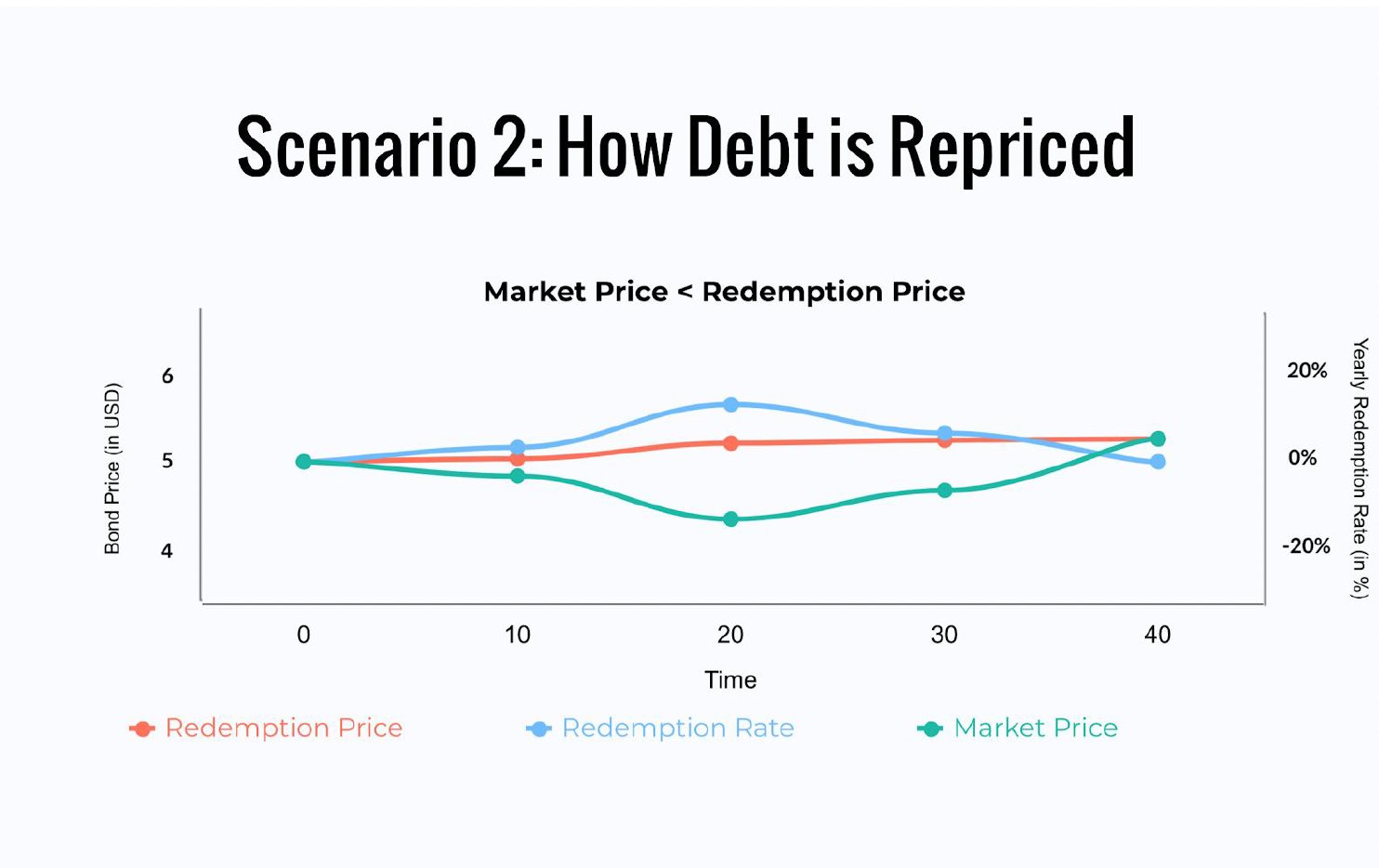

According to @BuildOnBase, it is exploring flatcoins—decentralized stablecoins tracking inflation rates to offer stability in purchasing power & resilience against economic uncertainty.

According to @BuildOnBase, it is exploring flatcoins—decentralized stablecoins tracking inflation rates to offer stability in purchasing power & resilience against economic uncertainty.

4/ They're eyeing non-fiat pegged options to fill the gap between fiat-pegged coins & volatile crypto assets.

5/ 2️⃣ What are flatcoins and why flatcoins?

Unlike traditional stablecoins, such as $USDT, flatcoins are not pegged to any fiat currency, but rather to a basket of assets or indices.

Unlike traditional stablecoins, such as $USDT, flatcoins are not pegged to any fiat currency, but rather to a basket of assets or indices.

6/ This provides greater stability in the long run, as fiat currencies can lose value over time due to inflation.

7/ Reason why we need flatcoins is that inflation can adversely affect the time value of money by eroding the purchasing power of a dollar over time.

The concept of time value of money elucidates that the present value of money is greater than its future value.

The concept of time value of money elucidates that the present value of money is greater than its future value.

8/ Here's a real-life example.

In my childhood, I used to buy a McDonald's soft serve cone for 0.25 USD in Hong Kong.

But with the same 0.25 USD today, I wouldn't be able to afford any food at McDonald's.

This is how inflation affects everyone.

In my childhood, I used to buy a McDonald's soft serve cone for 0.25 USD in Hong Kong.

But with the same 0.25 USD today, I wouldn't be able to afford any food at McDonald's.

This is how inflation affects everyone.

9/ Enter flatcoins.

Flatcoins aim to maintain their value by tracking inflation rates.

Instead of being pegged to a single currency, they follow a basket of assets, making them less vulnerable to market fluctuations.

Flatcoins aim to maintain their value by tracking inflation rates.

Instead of being pegged to a single currency, they follow a basket of assets, making them less vulnerable to market fluctuations.

10/ The idea is simple: if a flatcoin can maintain its purchasing power over time, users won't have to worry about losing value due to inflation.

This makes flatcoins a more resilient and reliable store of value for the future.

This makes flatcoins a more resilient and reliable store of value for the future.

11/ 3️⃣ Tradfi relevance

Are "flatcoins" solely a DeFi concept?

Not necessarily.

There are examples in institutional adoption that bear similarities.

Are "flatcoins" solely a DeFi concept?

Not necessarily.

There are examples in institutional adoption that bear similarities.

12/ Singapore's NEER policy focuses on managing the value of the Singapore dollar (SGD) by comparing it to a group of other currencies. This group of currencies represents the countries Singapore trades with the most.

13/ By doing this, they create a sort of "average" exchange rate, which helps to balance out the ups and downs of individual currencies.

14/ Now, when there's inflationary pressure, it means that the general price level of goods and services is rising, and the purchasing power of money is decreasing.

15/ By controlling the value of the SGD in relation to this "average" exchange rate, Singapore's central bank, the Monetary Authority of Singapore (MAS), can make sure the value of SGD doesn't rise or fall too much in response to inflation.

16/ In simpler terms, imagine you're on a see-saw with a friend. If one of you weighs much more than the other, the see-saw will tilt dramatically.

But if you both weigh about the same, the see-saw will be more balanced.

But if you both weigh about the same, the see-saw will be more balanced.

17/ 4️⃣ DeFi adoption

Any flatcoins in DeFi yet?

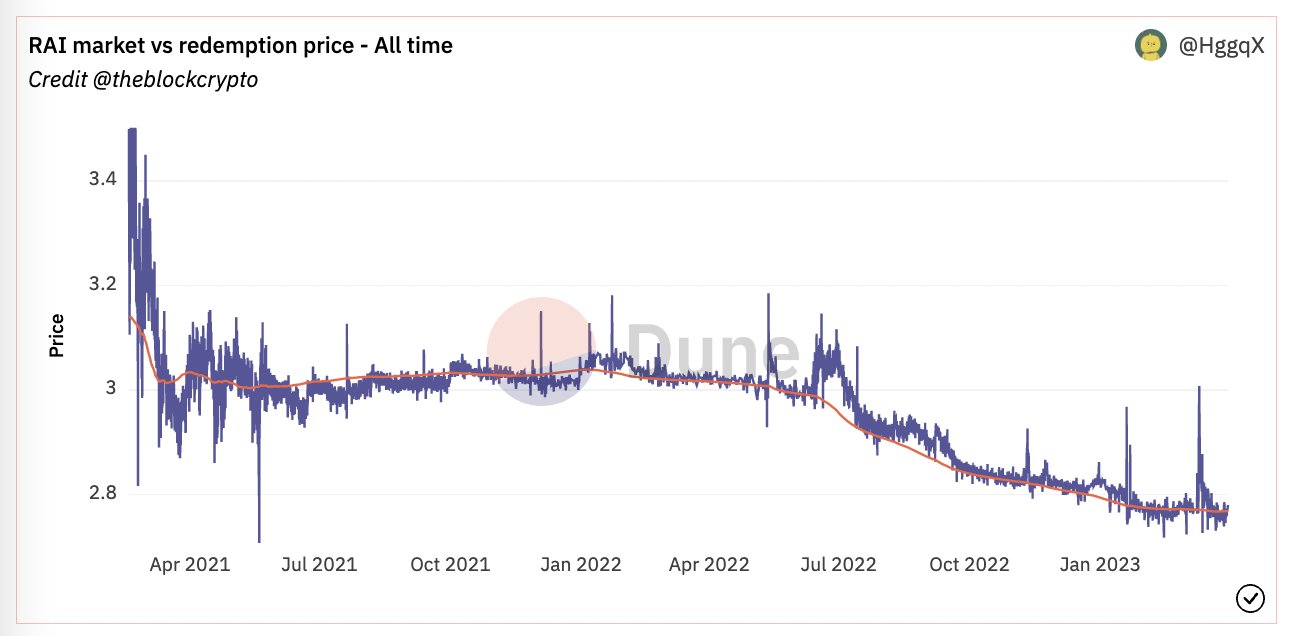

@reflexerfinance's $RAI token is a prime example since Feb 2021. Even @VitalikButerin considers it the "ideal" stablecoin type.

But let's talk about why it's only ideal, not practical.

Any flatcoins in DeFi yet?

@reflexerfinance's $RAI token is a prime example since Feb 2021. Even @VitalikButerin considers it the "ideal" stablecoin type.

But let's talk about why it's only ideal, not practical.

18/ $RAI is collateralized by $ETH, serving as the foundation for its value stability.

Users deposit their $ETH to mint $RAI, borrowing against their $ETH holdings. To retrieve their collateral, users repay the borrowed $RAI.

Over-collateralization helps ensures its solvency.

Users deposit their $ETH to mint $RAI, borrowing against their $ETH holdings. To retrieve their collateral, users repay the borrowed $RAI.

Over-collateralization helps ensures its solvency.

19/ Unlike most stablecoins that are pegged to a specific fiat currency like the USD, RAI doesn't have a fixed price target. It's an "ungoverned" and "decentralized" stablecoin, meaning no central authority controls it.

20/ RAI achieves stability through a mechanism called "redemption price."

This price adjusts dynamically based on market conditions & user actions. It encourages people to buy or sell RAI to stabilize its value.

This price adjusts dynamically based on market conditions & user actions. It encourages people to buy or sell RAI to stabilize its value.

21/ If $RAI's price > the redemption price, users are incentivized to sell their $RAI to capture arbitrage opportunities, bringing its price closer to the target.

22/ If $RAI's price < the redemption price, users are encouraged to buy $RAI, as it's undervalued, which helps align its price with the redemption price. This mechanism balances supply and demand in the market.

23/ $RAI has experienced moderate success at launch, but hasn't quite reached the popularity of other stables.

Despite its governance-free, decentralized pegged token, its adoption remains somewhat limited.

This positions $RAI as an "ideal" example of an alternative stablecoin

Despite its governance-free, decentralized pegged token, its adoption remains somewhat limited.

This positions $RAI as an "ideal" example of an alternative stablecoin

24/ The trust is that stablecoins with non-fiat pegs often face reduced acceptance due to their less predictable and fluctuating value.

25/ The absence of a fixed price target complicates their use in everyday transactions, creating obstacles to widespread adoption.

$RAI's reliance on $ETH as its sole collateral also limits its scalability.

$RAI's reliance on $ETH as its sole collateral also limits its scalability.

26/ In May 2022, a wave of collapses hit the market: $UST and $LUNA crashed, Celsius went bankrupt, and more. This resulted in $ETH plummeting from $3580 to as low as $890 in June 2022.

27/ This led to:

(i) heightened liquidation risk for $RAI holders because of the sharp drop in $ETH price; and

(ii) market price and redemption price divergence due to the absence of arbitragers.

(i) heightened liquidation risk for $RAI holders because of the sharp drop in $ETH price; and

(ii) market price and redemption price divergence due to the absence of arbitragers.

28/ @reflexerfinance's $RAI exemplifies an innovative adaptive autonomous mechanism backed by $ETH, but its adoption is limited.

29/ And there's a new player in town: @NuonFinance.

Nuon offers a differentiated approach compared to $RAI, with a focus on an inflation peg.

Nuon offers a differentiated approach compared to $RAI, with a focus on an inflation peg.

30/ Nuon is a decentralized flatcoin that tracks inflation rates, enabling users to maintain their purchasing power.

It relies on the independent inflation index oracle, Truflation, to calculate the Nuon peg daily.

It relies on the independent inflation index oracle, Truflation, to calculate the Nuon peg daily.

31/ Nuon flatcoins are soft-pegged to the value of a basket of goods costing $1 on launch, per the Truflation index. Daily, the Truflation oracle provides Nuon with an inflation-adjusted target peg, ensuring holders' purchasing power is maintained.

32/ (ii) Zero Interest Loans

Nuon offers borrowers zero percent interest rates on their loans, as long as they maintain the required collateral ratio.

RAI has a fixed borrowing rate of 2% per annum.

Nuon offers borrowers zero percent interest rates on their loans, as long as they maintain the required collateral ratio.

RAI has a fixed borrowing rate of 2% per annum.

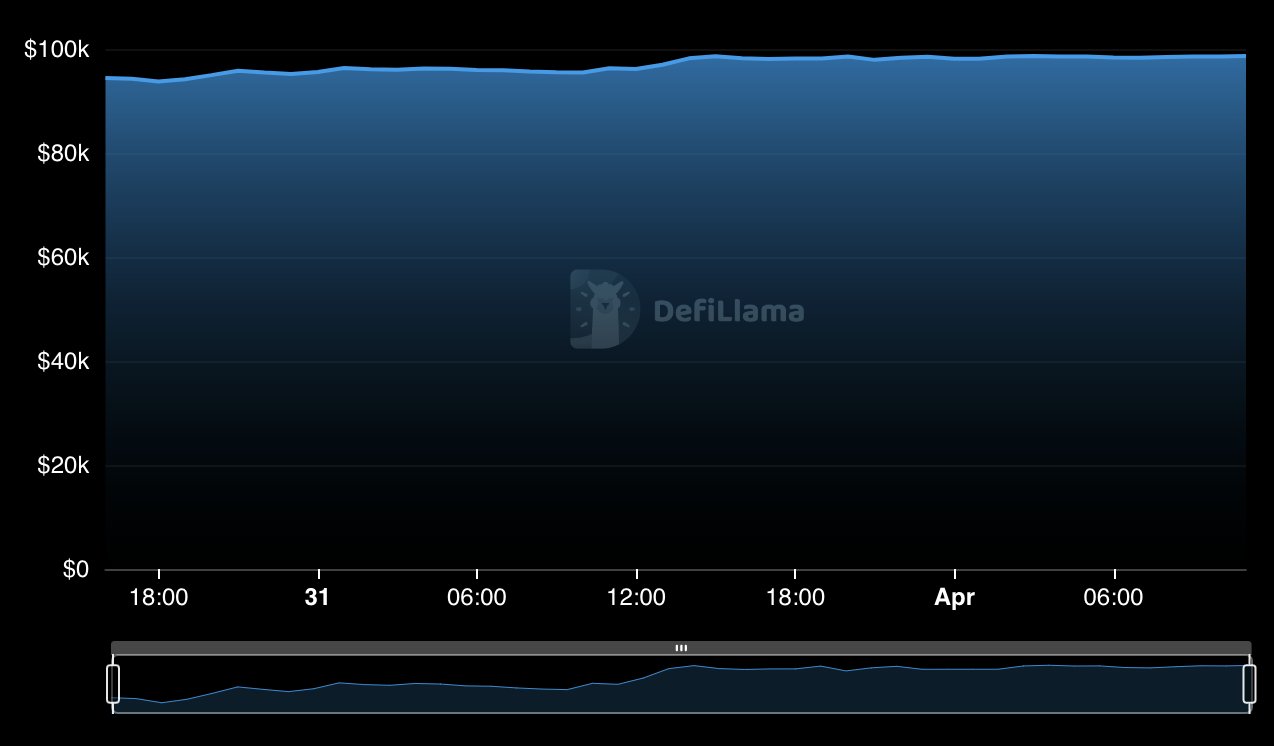

33/ Nuon's mainnet launched on @arbitrum, but its TVL was less than 10K according to @DefiLlama.

While it highlights a trend for inflation-hedging assets, its adoption again remains limited, being more visionary and missionary than practical.

While it highlights a trend for inflation-hedging assets, its adoption again remains limited, being more visionary and missionary than practical.

34/ That's it for today!

Please let me know if you spot any inaccuracies in my content. I want to ensure that my information is reliable and trustworthy for my audience.

Please let me know if you spot any inaccuracies in my content. I want to ensure that my information is reliable and trustworthy for my audience.

35/ Tagging my CT frens who are absolute geniuses when it comes to DeFi and all things crypto!

@arndxt_xo

@Slappjakke

@rektdiomedes

@DegenCamp

@DeFiMinty

@CryptoShiro_

@schizoxbt

@DAdvisoor

@Louround_

@FungiAlpha

@monosarin

@0xTindorr

@schizoxbt

@thelearningpill

@DegenCamp

@arndxt_xo

@Slappjakke

@rektdiomedes

@DegenCamp

@DeFiMinty

@CryptoShiro_

@schizoxbt

@DAdvisoor

@Louround_

@FungiAlpha

@monosarin

@0xTindorr

@schizoxbt

@thelearningpill

@DegenCamp