Thread

1/13 #OPNX offering trades of crypto bankruptcy claims from FTX, Celsius, etc is a big deal. Making illiquid claims liquid in advance of any future repayments is a huge win for millions of crypto users. @OPNX_Official

So here’s a further riff 🧵👇on this idea using ERC-3525

So here’s a further riff 🧵👇on this idea using ERC-3525

2/13 As a fun thought experiment, what if crypto bankruptcy claims were tokenized/wrapped using the ERC-3525 standard and tradable on exchanges? How could it work? Let’s walk thru it….

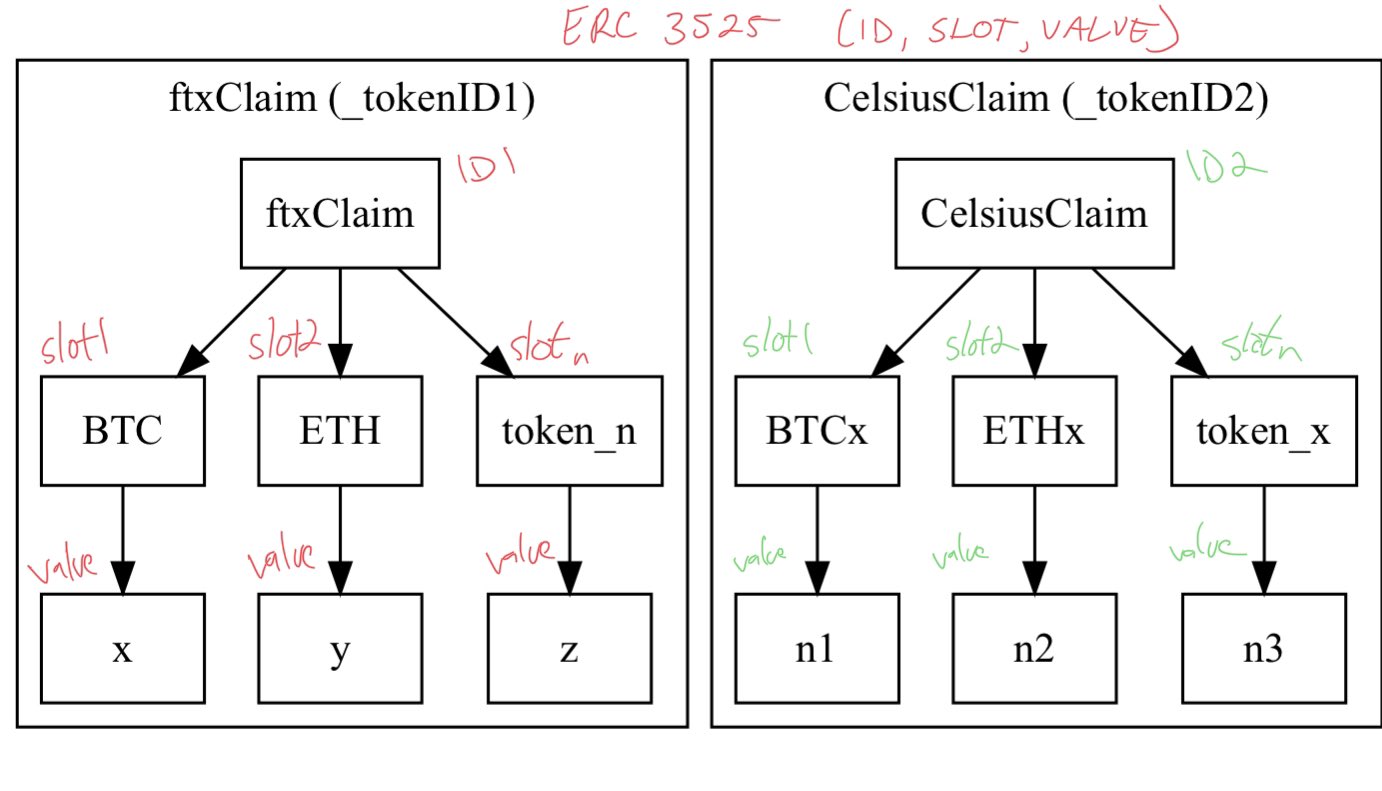

3/13 First, why use a #SemiFungibleTokens standard like #ERC3525 to represent crypto company bankruptcy claims? Simple: the <ID, SLOT, VALUE> data structure, compatible with ERC721 + ERC20.

Props to @myanTokenGeek @RyanChow_DeFI @SolvProtocol

Props to @myanTokenGeek @RyanChow_DeFI @SolvProtocol

4/13 Each crypto company debtor has a different ability to repay given its unique finances. Thus, “repayment capability / credit quality” is unique to each debtor and can be represented as an NFT (_tokenID).

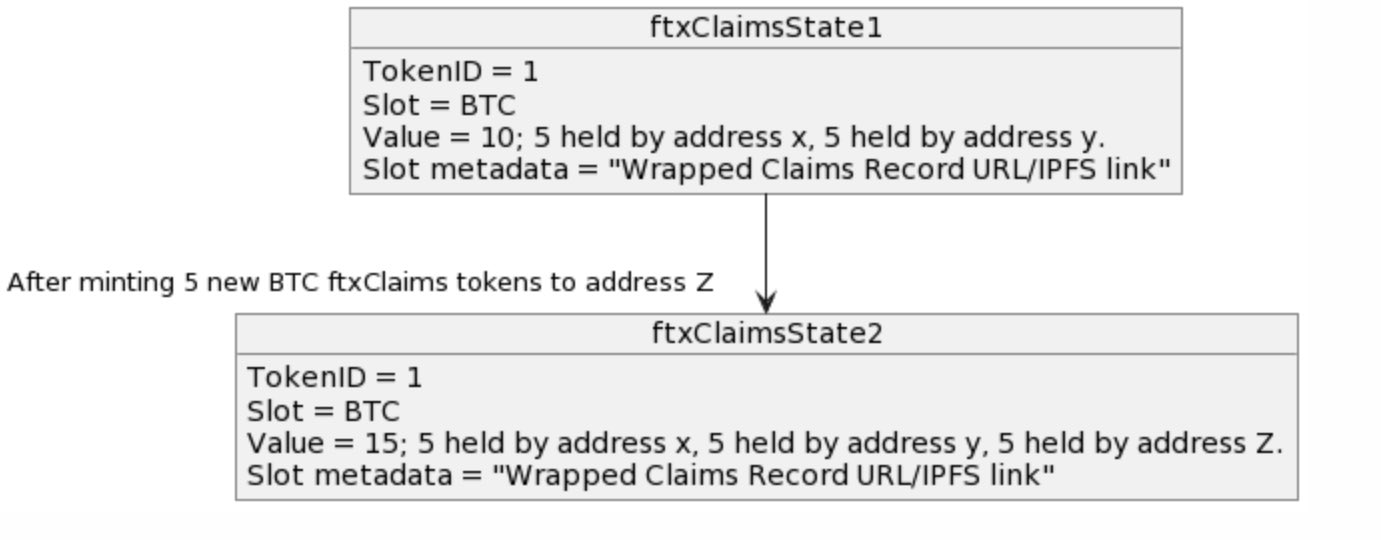

5/13 Each individual claim contains fungible assets. BTC held by creditor A with debtor A should be fungible with BTC held by creditor B with debtor A. Thus, “claim tokens” are fungible and can be represented as fungible tokens grouped by token type (_slot, _value).

6/13 You’re fractionalizing each crypto debtor claim into fungible units of the same asset/class. Units of different assets/classes are not fungible. Between different claims, units of same class are not fungible with units from same class, eg debtor A’s BTC != debtor B’s BTC.

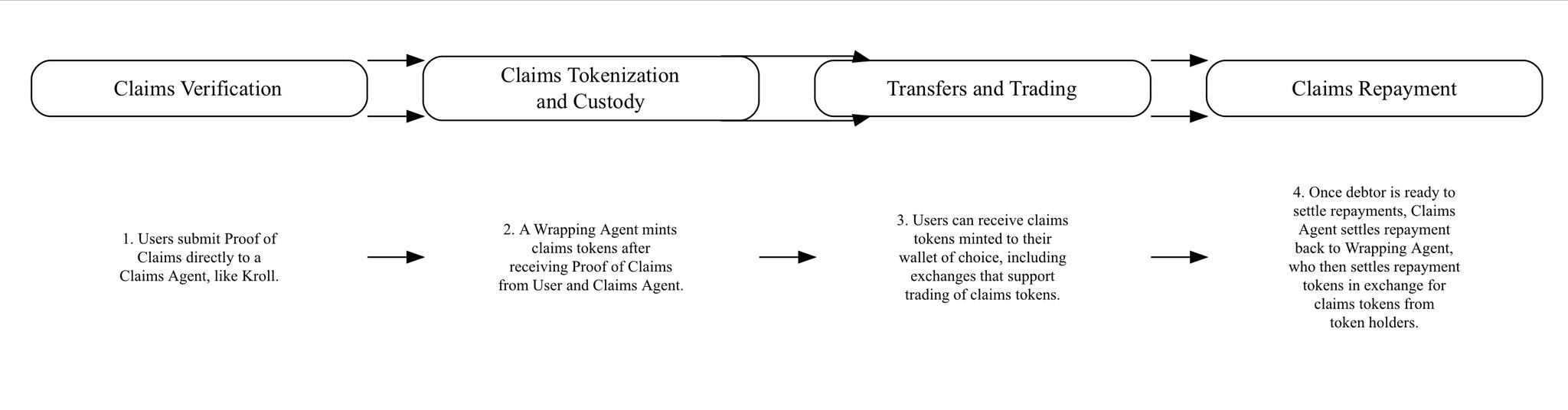

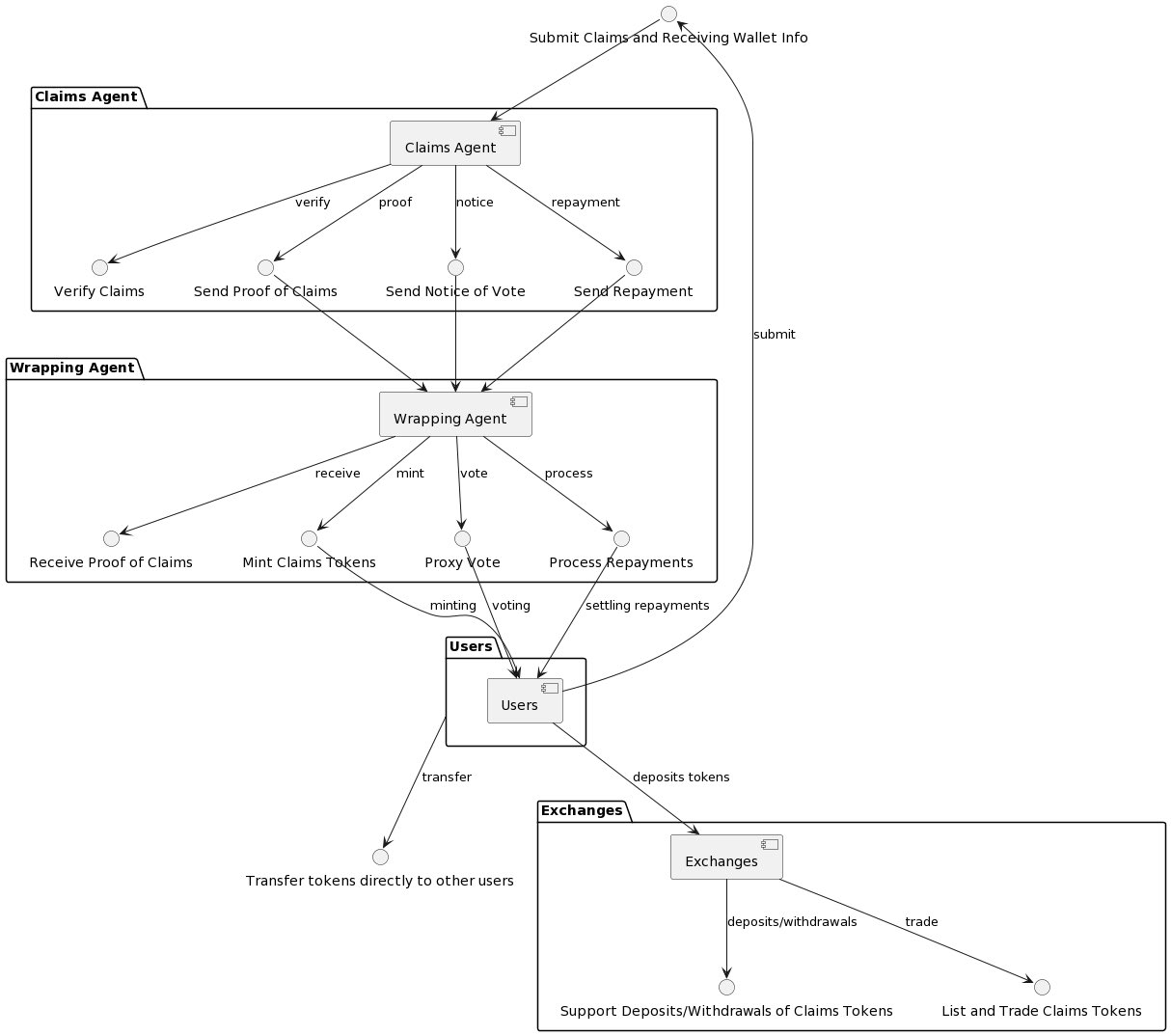

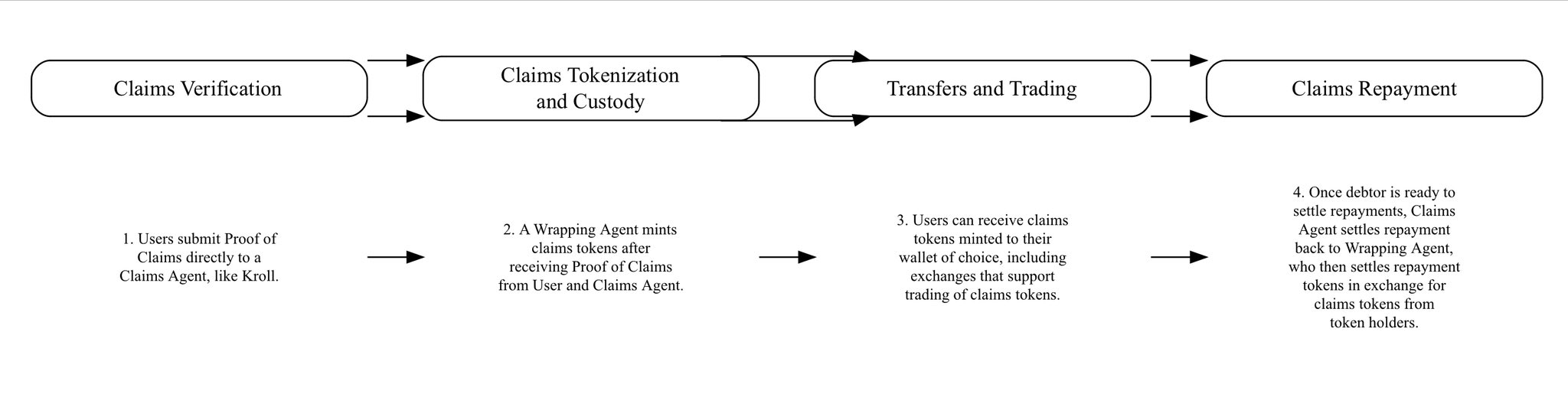

7/13 Next, how could the overall minting/repayment lifecycle work? It starts with users submitting claims to a claims agent (like Kroll) who verifies the claim.

8/13 Claims agent is an off-chain entity (e.g. Kroll) that verifies claims, and sends proof of claims, voting notices, and repayment notices to Wrapping Agent.

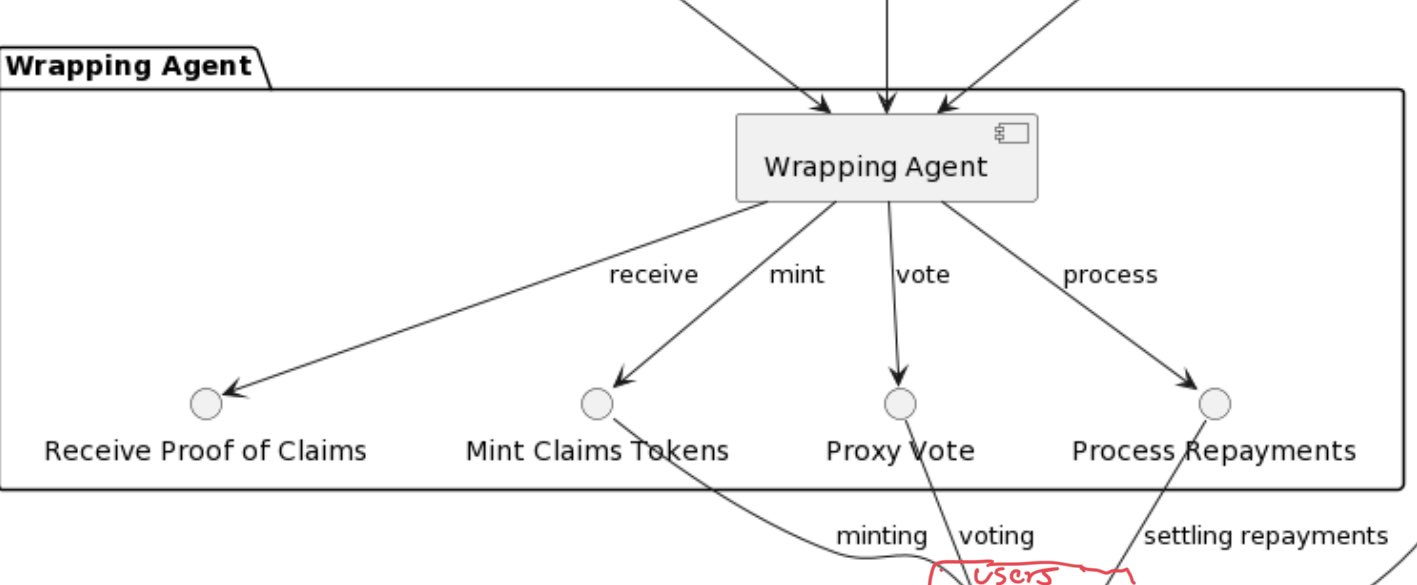

9/13 Wrapping agent is a technology services provider that receives Proof-of-Claims data (ClaimsIDs and document hashes), mints wrapped claims tokens to users’ wallets, processes value-weighted average voting, and processes repayments for users.

10/13 Note: ERC-3525 slot metadata could point to a “Wrapped Claims Record” - a simple off-chain database updated by the Wrapping Agent that records minting by mapping ClaimIDs and hashed Proof-of-Claims docs provided by Claims Agent

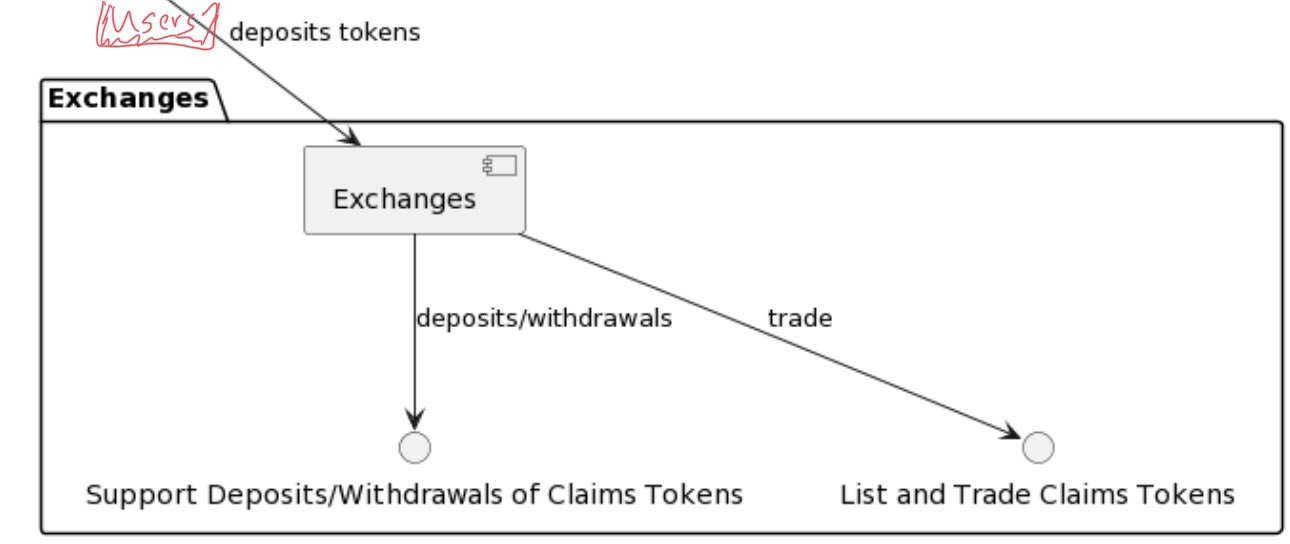

11/13 Exchanges could support trading of the fungible claims tokens; the non-fungible tokenID would instead be held by the Wrapping Agent to facilitate efficient repayment redemptions in the future.

12/13 Quick review of the lifecycle process: claims verification, claims tokenization/wrapping, claims trading, repayments.

13/13 Thanks to @MarkDavidLamb, @zhusu, @therealleslamb0, @KyleLDavies for sparking this thinking on tokenized/wrapped crypto bankruptcy claims