Thread by Joe Consorti ⚡

- Tweet

- Mar 28, 2023

- #Finance #Banking #RealEstate

Thread

Elevated rates, vacant properties, and now lenders are going belly up — the noose around commercial real estate is tightening.

Commercial real estate is the next victim of the credit crunch 🧵👇

Commercial real estate is the next victim of the credit crunch 🧵👇

Banks take in deposits and lend to property developers that show promise of generating a return on capital.

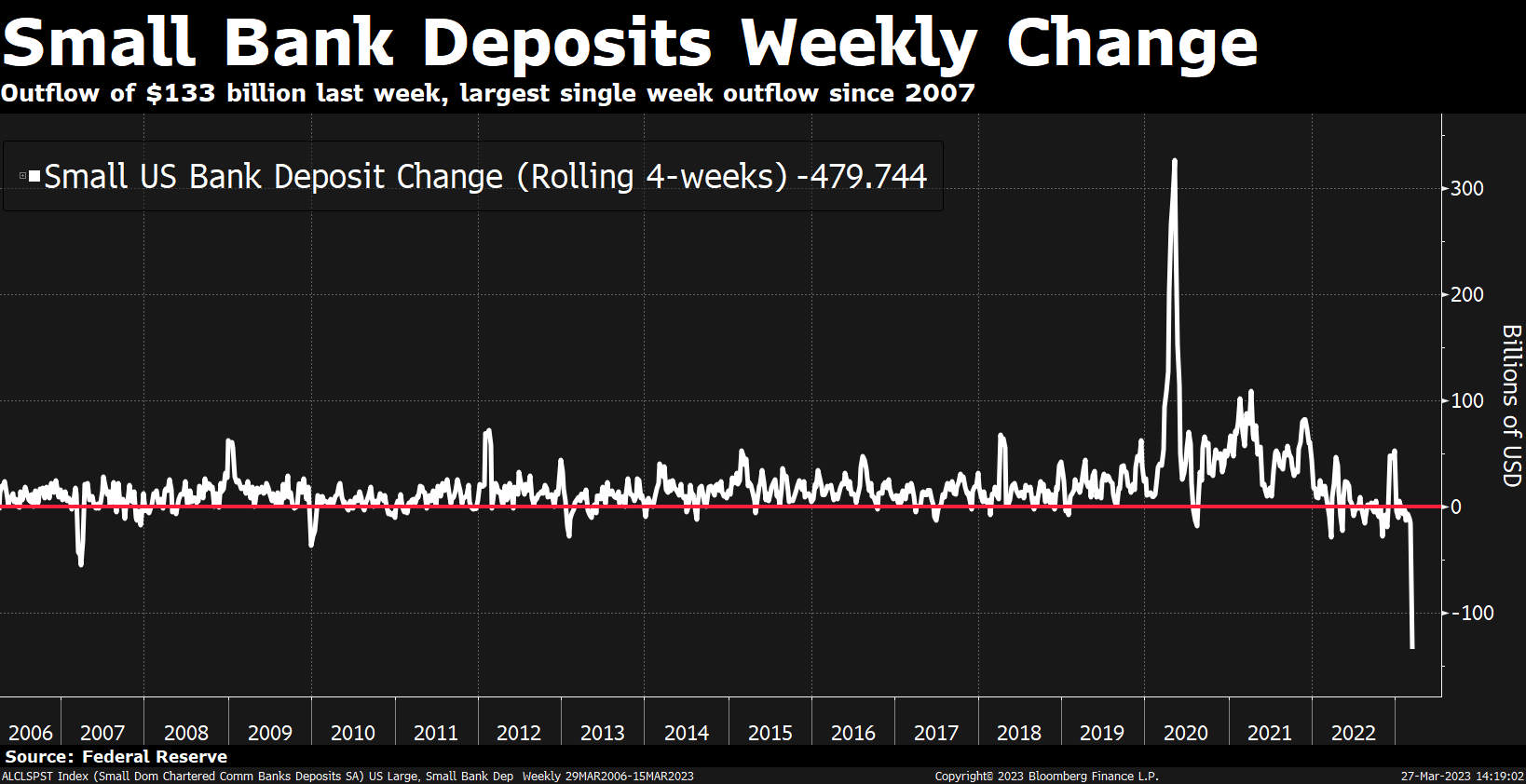

As banks lose deposits, their ability to fund real estate falls—small banks just had the largest week of deposit outflows since 2007.

A huge headwind for loan creation:

As banks lose deposits, their ability to fund real estate falls—small banks just had the largest week of deposit outflows since 2007.

A huge headwind for loan creation:

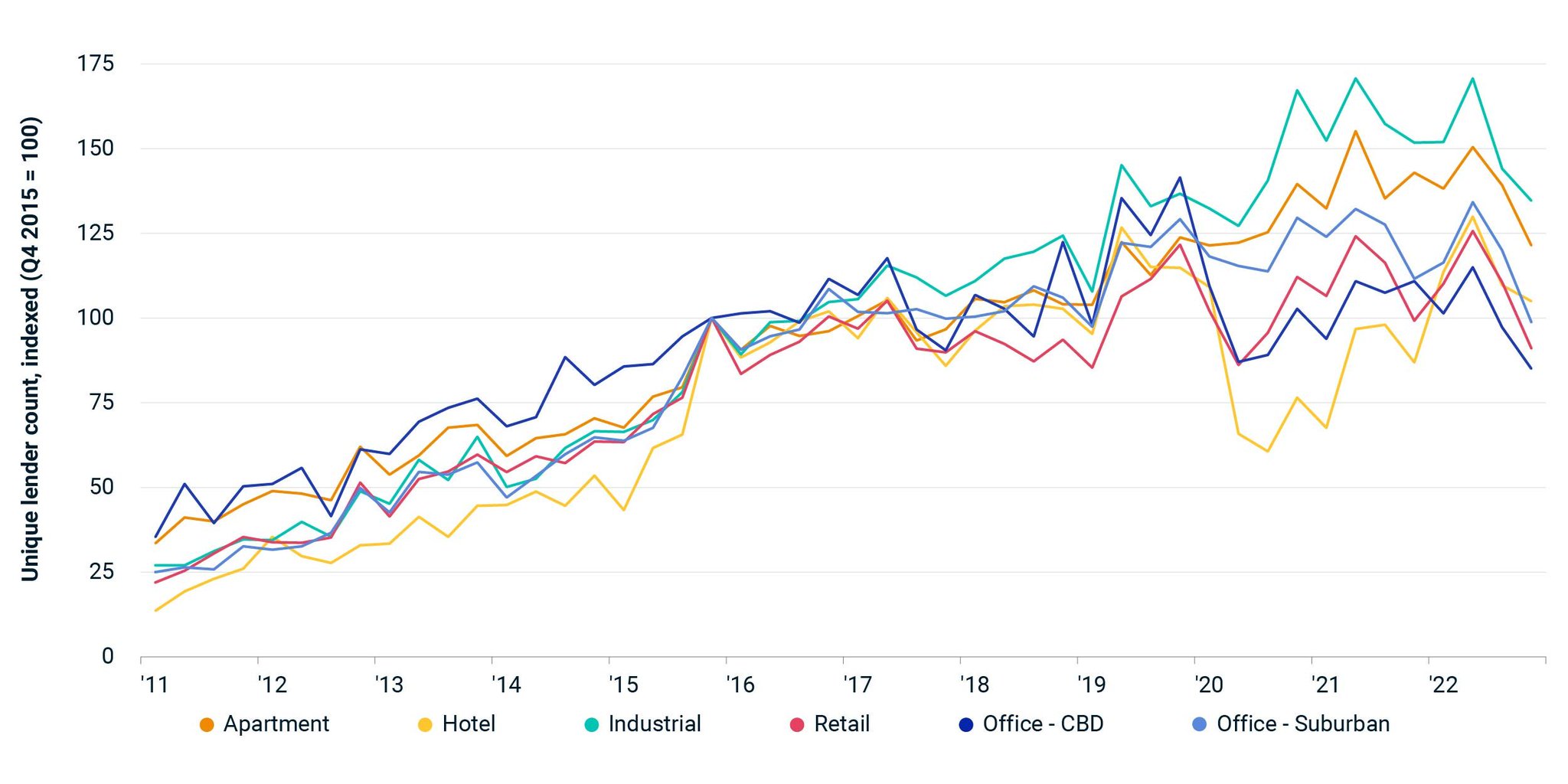

Commercial real estate (CRE) lending is projected to decline by as much as 40% this year—banks have already begun reducing their lending:

This time, the banks most at risk are not the behemoths like in '08.

Commercial real estate (CRE) loan exposure is largely concentrated within small and midsize banks.

Commercial real estate (CRE) loan exposure is largely concentrated within small and midsize banks.

These are the SAME BANKS that are already experiencing depositor flight and failing.

They'd bear a disproportionate amount of damage from defaults on CRE loans.

Of the $2.925 trillion in total outstanding CRE loans, small US banks hold ~70% of them:

They'd bear a disproportionate amount of damage from defaults on CRE loans.

Of the $2.925 trillion in total outstanding CRE loans, small US banks hold ~70% of them:

To add insult to injury — not only is funding stress soaring as the main CRE lenders fail, but there's also a widening revenue hole as vacancies rise.

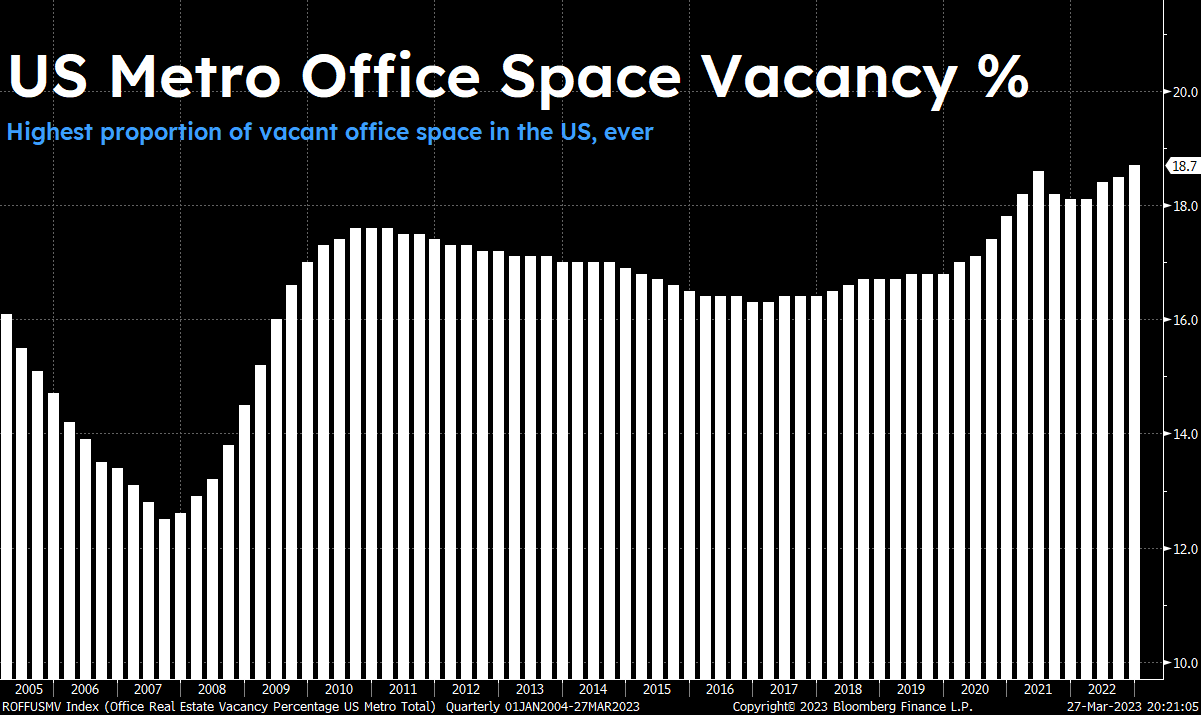

Office vacancies in US cities have continued to rise after COVID rather than normalize — nobody is returning to work.

Vacant office space in the US cities is at its highest level ever of 18.7%—no rent is being paid on roughly 1/5th of all US office space:

Vacant office space in the US cities is at its highest level ever of 18.7%—no rent is being paid on roughly 1/5th of all US office space:

Revenue is in the toilet, rates are through the stratosphere, and refinancing approaches.

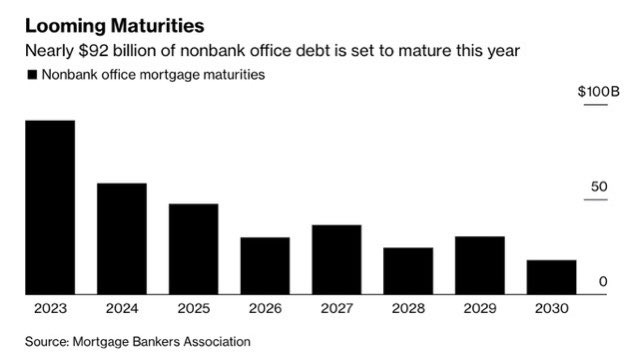

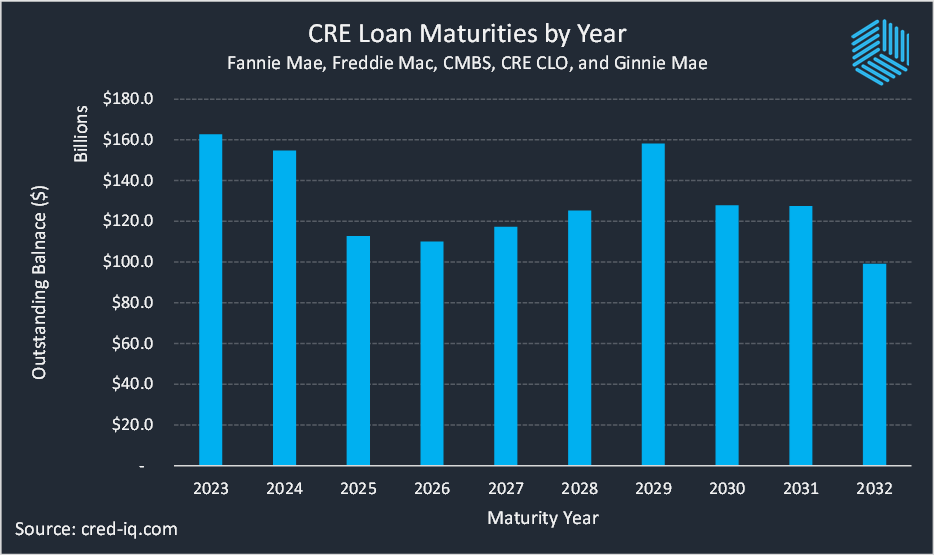

There is $92 billion of office debt set to mature this year that will need to be rolled at a ~750+ bps wider spread.

Many developers will choose to sell or default on their obligations:

There is $92 billion of office debt set to mature this year that will need to be rolled at a ~750+ bps wider spread.

Many developers will choose to sell or default on their obligations:

In total, $317 billion in CRE debt is maturing through the end of 2024.

The average debt service ratio here is 1.25x—revenue from properties is barely enough to cover loan payments, let alone the expenses of owning huge office buildings.

The path of least resistance is default:

The average debt service ratio here is 1.25x—revenue from properties is barely enough to cover loan payments, let alone the expenses of owning huge office buildings.

The path of least resistance is default:

This has already started happening.

Billions of dollars in loan payments are already past due.

Of the $162 billion commercial real estate debt that matures in 2023, $𝟯𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝗼𝗳 𝗶𝘁 𝗶𝘀 𝗽𝗮𝘀𝘁 𝗱𝘂𝗲.

Billions of dollars in loan payments are already past due.

Of the $162 billion commercial real estate debt that matures in 2023, $𝟯𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝗼𝗳 𝗶𝘁 𝗶𝘀 𝗽𝗮𝘀𝘁 𝗱𝘂𝗲.

What’s more, the collateral for 25% of CRE debt is the office buildings and the assets inside of them.

As more property owners default, it could create a domino effect if banks force CRE entities to liquidate assets—violent selling of vacant property at deeply discounted prices.

As more property owners default, it could create a domino effect if banks force CRE entities to liquidate assets—violent selling of vacant property at deeply discounted prices.

There’s $2.925 trillion of CRE debt outstanding for the $20 trillion commercial real estate market; forced selling could cause serious impairment:

If defaults occur, who are the most prominent lenders?

Regional banks, the ones already experiencing bank runs and failing, accounted for 27% of new CRE lending in 2022.

Their debt assets would be made worthless and more bank failures would ensue.

Regional banks, the ones already experiencing bank runs and failing, accounted for 27% of new CRE lending in 2022.

Their debt assets would be made worthless and more bank failures would ensue.

Commercial real estate loan default begets small bank failures, which leads to further tightening of loan standards, further CRE loan default, and further small bank failures.

A proper doom loop.

A proper doom loop.

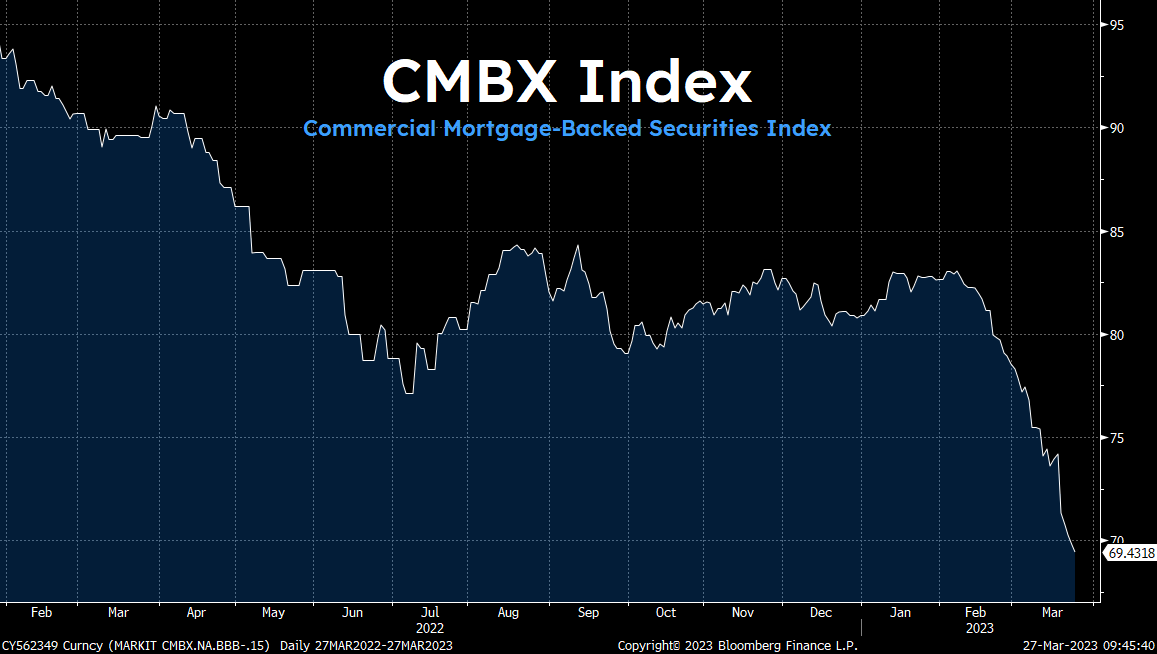

Traders are betting against the commercial real estate market—the BBB- tranche of CMBX, an index of commercial mortgage-backed securities, has sold off to .69 cents on the dollar:

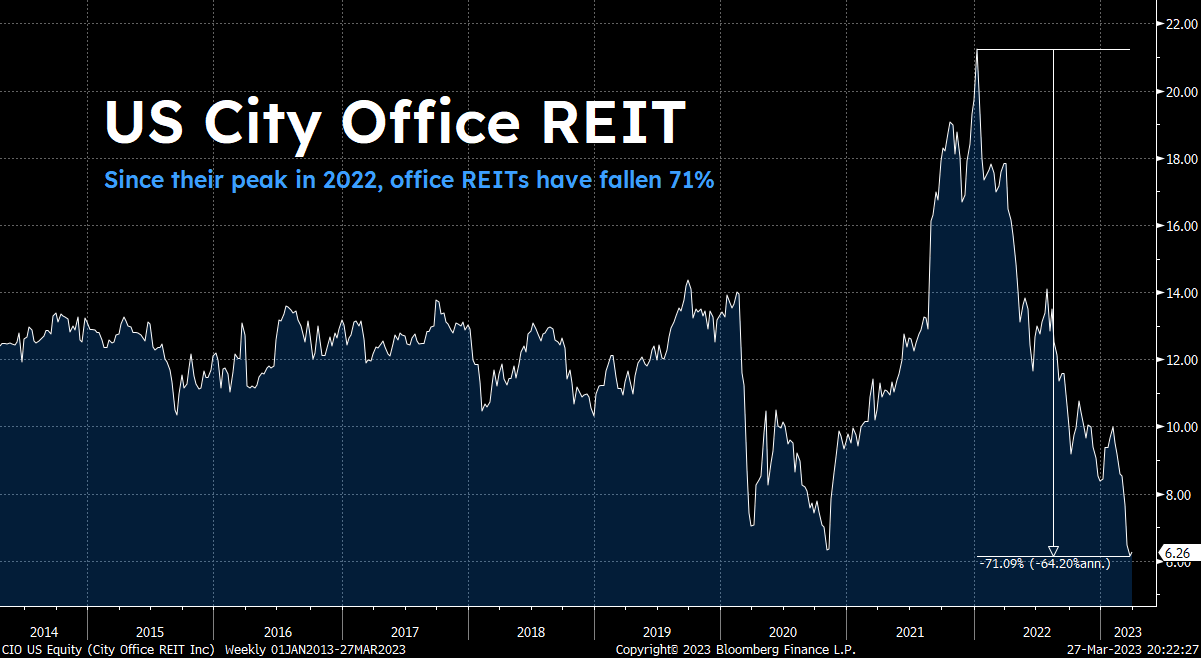

Office REITs have plunged 71% in the last year as the risks associated with office space have become widely known and investors seek to cut their exposure:

Credit markets are entering a phase of contraction. As of right now, we have yet to witness the full effect of the Fed’s cumulative tightening—but the recent bank failures indicate that the impact that higher rates have on lending is beginning to creep into financial markets.

Property developers seeking debt service will be forced to abandon projects, sell existing properties, or default.

Credit contraction is a deflationary force, the speed and severity of which will frame how swiftly the Fed changes course to cuts and easing when the time comes.

Credit contraction is a deflationary force, the speed and severity of which will frame how swiftly the Fed changes course to cuts and easing when the time comes.

As —

• bank failures tighten loan standards

• rising office vacancies slash revenue

• a maturity wall forces commercial mortgages into much wider spreads —

the stage is set for a crash in America’s commercial real estate market, again.

Read It All 📩

thebitcoinlayer.substack.com/p/commercial-real-estate-is-next-victim

• bank failures tighten loan standards

• rising office vacancies slash revenue

• a maturity wall forces commercial mortgages into much wider spreads —

the stage is set for a crash in America’s commercial real estate market, again.

Read It All 📩

thebitcoinlayer.substack.com/p/commercial-real-estate-is-next-victim