Thread

R&D spending must not be cut in the Autumn Statement or there is a risk of limiting economic growth. 🚨

Instead the Government should reduce complexity and tackle fraud to make the system work better.

www.ukonward.com/reports/incentivising-innovation-tax-credits/

Instead the Government should reduce complexity and tackle fraud to make the system work better.

www.ukonward.com/reports/incentivising-innovation-tax-credits/

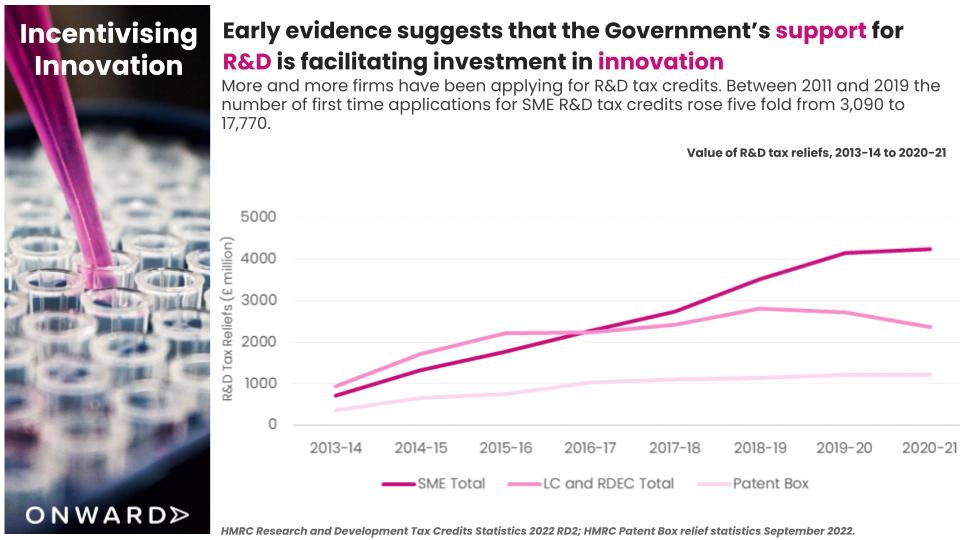

Evidence suggests that two decades of Government R&D support is facilitating investment in innovation.🧪

Individual claims are also getting larger. From 2016-2021 the number of SME claims with a value of up to £100,000 increased by 70%, while the number of claims worth over £100,000 increased by 116%.

However, the tax credit system is very expensive - costing the Treasury £9 billion each year - more than any other form of R&D investment.

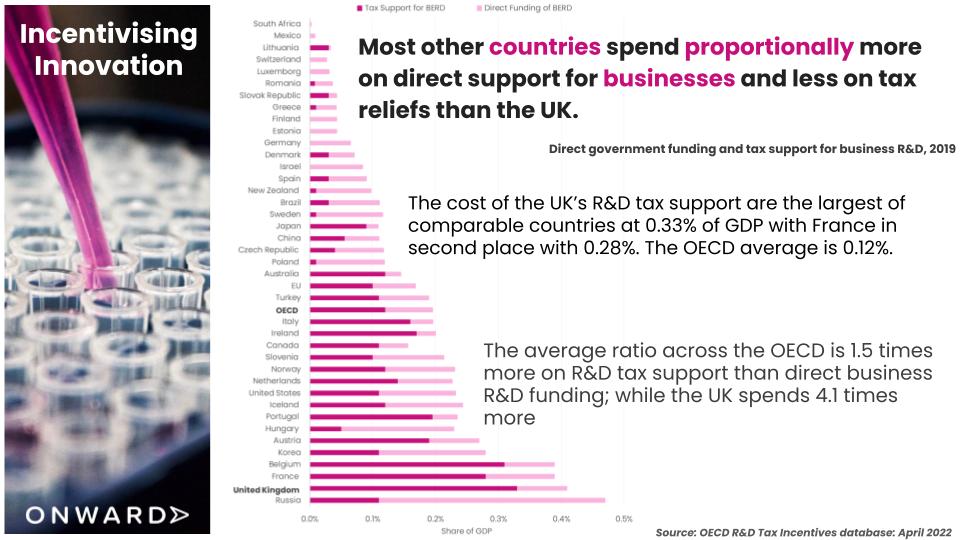

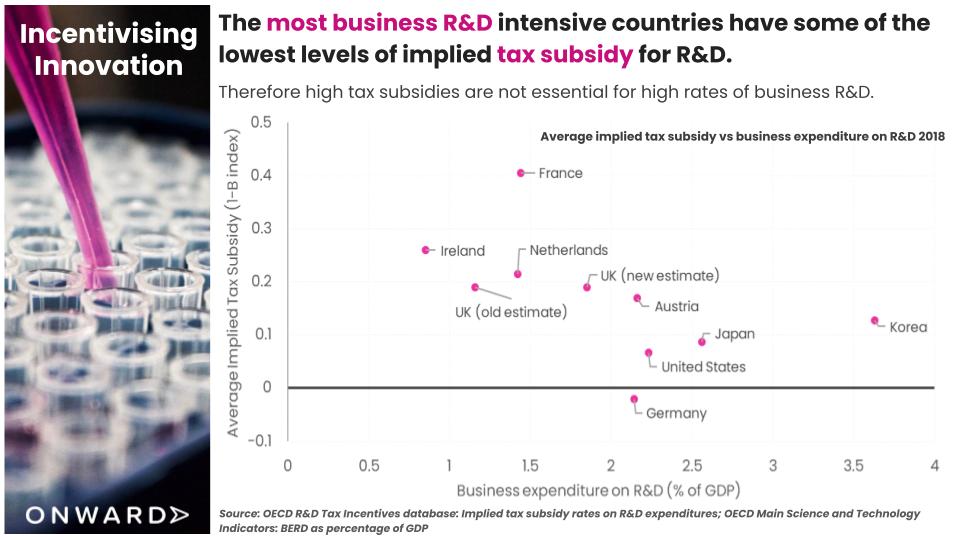

And proportionately, the UK spends more than other countries on tax credits than other forms of R&D investment.

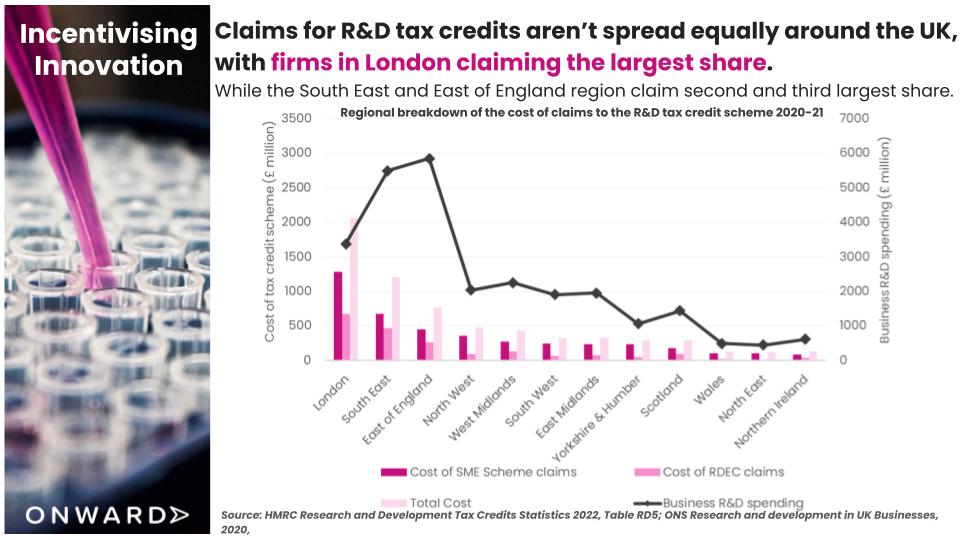

Firms in London, the South East and East of England dominate applications for tax credits: 61% of all claims come from businesses in these regions.

Evidence suggests that UK R&D tax reliefs suffer from high levels of fraud and leakage. The latest HMRC estimates of R&D tax credit ‘rate of error and fraud’ are 7.3% for the SME scheme and 1.1% for the RDEC scheme.

And a vague definition of R&D makes it difficult for firms to know what they can claim for, and difficult for the Government to prosecute borderline claims.

Despite these issues, the Government must not be tempted to pull funding now.

Boosting R&D spending and innovation will be vital for growing the UK economy amid the difficult downturn ahead.

Boosting R&D spending and innovation will be vital for growing the UK economy amid the difficult downturn ahead.

Instead, the Government should reform the system to crack down on potential fraud and deliver better value for money for the taxpayer.

We set out 5 ways of doing this.

We set out 5 ways of doing this.

1⃣ Improving the transparency of R&D tax credit claims.

2⃣ Providing businesses with clearer guidance on R&D definitions

3⃣ Expanding capital spending benefits to loss-making firms

4⃣ Making the benefits of R&D tax credits more predictable and clearer for firms

5⃣ Better regulating tax consultants.

For the full report and recommendations click here:

www.ukonward.com/reports/incentivising-innovation-tax-credits/

www.ukonward.com/reports/incentivising-innovation-tax-credits/