Thread by Matthew Pines

- Tweet

- Sep 21, 2022

- #Economics #MonetaryPolicy

Thread

US national security & monetary policy seem to be increasingly working at cross-purposes.

Now, we see the Fed & Treasury driving the USD up even as the WH/Congress push industrial policy & the Pentagon is increasingly focused on rebuilding the defense industrial base (DIB).

🧵

Now, we see the Fed & Treasury driving the USD up even as the WH/Congress push industrial policy & the Pentagon is increasingly focused on rebuilding the defense industrial base (DIB).

🧵

It's very clear that a strong USD policy was partly motivated to put PBoC into a corner, using JPY as a ccy war stalking horse.

Not only does this risk triggering a BoJ YCC break and/or a shock CNY deval (& associated global financial crisis), but it makes reshoring impossible.

Not only does this risk triggering a BoJ YCC break and/or a shock CNY deval (& associated global financial crisis), but it makes reshoring impossible.

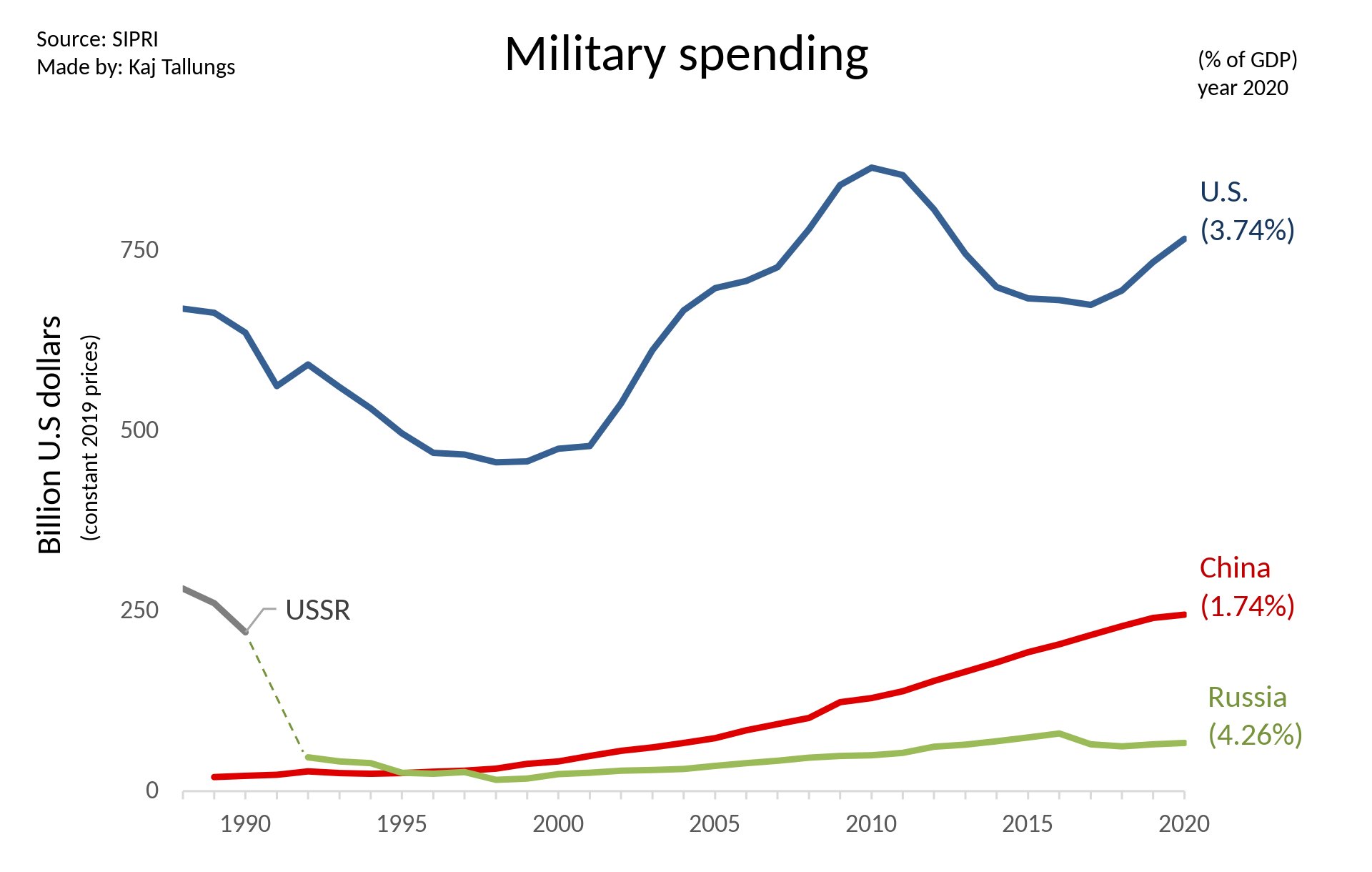

Moreover, there is a growing sense of concern among DoD officials that 1) a war w/ China is increasingly likely this decade, 2) U.S. DIB is woefully inadequate to support warfighting needs, & 3) increasing Chinese capabilities make U.S. victory in such a war a coin-flip at best.

There is some dispute over (1), most but not all accept (3), but it seems everyone (including the DoD itself) recognizes (2) as a critical problem.

"In recent years... the number of companies within the defense industrial base has shrunk dramatically."

www.defense.gov/News/News-Stories/Article/Article/2937898/dod-report-consolidation-of-defense-industr...

"In recent years... the number of companies within the defense industrial base has shrunk dramatically."

www.defense.gov/News/News-Stories/Article/Article/2937898/dod-report-consolidation-of-defense-industr...

"Trends are actually pretty disturbing... Over the last 10 yrs DoD spend is up 23%, but the number of small businesses involved w/ the DoD is down 43%, at large biz it's down 7%. We've completely lost the middle of the industrial base."

- Fmr. Under Secretary of the Navy Geurts

- Fmr. Under Secretary of the Navy Geurts

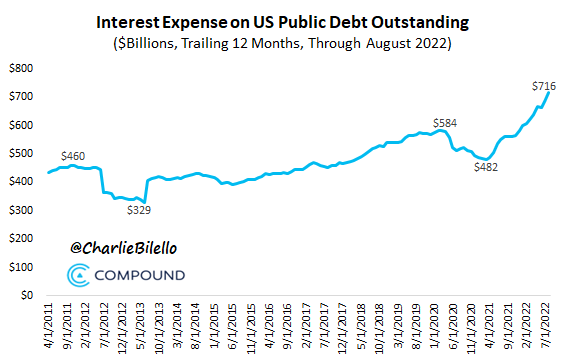

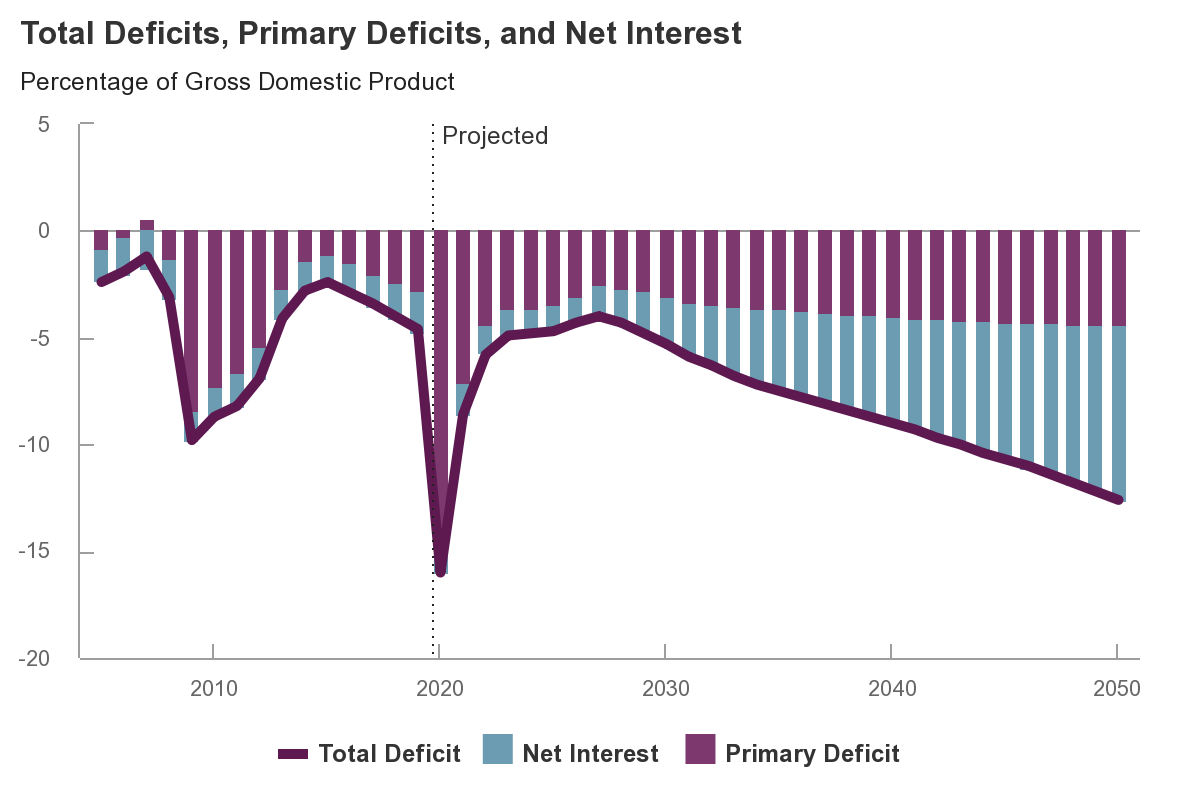

We're finding that a larger & larger defense budget (requiring more & more debt issuance & higher interest costs from rising rates) is going to a smaller & smaller number of performers...even as our defense leaders desire to radically transform a sclerotic & oligopolistic DIB.

👇

👇

👇

"A country must either have the manufacturing capacity to build massive quantities of ammunition or have other manufacturing industries that can be rapidly converted to ammunition production. Unfortunately, the West no longer seems to have either."

www.rusi.org/explore-our-research/publications/commentary/return-industrial-warfare

"A country must either have the manufacturing capacity to build massive quantities of ammunition or have other manufacturing industries that can be rapidly converted to ammunition production. Unfortunately, the West no longer seems to have either."

www.rusi.org/explore-our-research/publications/commentary/return-industrial-warfare

"The winner in a prolonged war between two near-peer powers is still based on which side has the strongest industrial base."

"In a recent war game involving US, UK and French forces, UK forces exhausted national stockpiles of critical ammunition after eight days."

Not great.

"In a recent war game involving US, UK and French forces, UK forces exhausted national stockpiles of critical ammunition after eight days."

Not great.

Lockheed Martin produces about 2100 Javelins/yr, could ramp up to 4K, but Ukraine claimed to be firing up to 500/day.

Such warfare just eats through massive amounts of munition:

"In three months of combat, Russia has burned through four times the US annual missile production."

Such warfare just eats through massive amounts of munition:

"In three months of combat, Russia has burned through four times the US annual missile production."

Moreover, scaling up or turning shuddered production lines back on is very difficult for two reasons:

1. These armaments require skilled (aging) labor in scarce supply w/ a long training time.

2. Supply chain for subcomponents is very thin, w/ overseas (China😬) dependencies.

1. These armaments require skilled (aging) labor in scarce supply w/ a long training time.

2. Supply chain for subcomponents is very thin, w/ overseas (China😬) dependencies.

The US still has the most advanced, exquisite tech... but quantity has a quality all its own, & the shiniest toys may not bring a decisive advantage in many China conflict scenarios.

After all, the Death Star (a nominally decisive weapon) was taken down by a single X-wing...

After all, the Death Star (a nominally decisive weapon) was taken down by a single X-wing...

And yet, just as the sense of urgency rises among Pentagon folks trying to re/friend-shore critical manufacturing... Powell & Yellen are full steam ahead prosecuting an dollar war they hope will sufficiently damage China & deter any military ambitions...

This seems incoherent as a matter of national security strategy, and risks courting both economic disaster and military defeat...

And time's getting short to get this sorted out...

@LukeGromen @JacobShap @adam_tooze @ElbridgeColby @Geo_papic @DrPippaM @Halsrethink @profplum99

And time's getting short to get this sorted out...

@LukeGromen @JacobShap @adam_tooze @ElbridgeColby @Geo_papic @DrPippaM @Halsrethink @profplum99

Mentions

See All

Luke Gromen @lukegromen

·

Sep 21, 2022

Great thread 👇