Thread

Here are 18 simple tips, tricks, and misconceptions about money:

Tip: Use active income to buy passive income

Generate active income from a day job or service business.

Then use that income to invest in assets that’ll earn passive income.

Generate active income from a day job or service business.

Then use that income to invest in assets that’ll earn passive income.

Trick: How to convert your hourly wage to an annual salary

To convert an hourly rate into a full-time hourly salary simply double it and add 3 zeros.

$40/hr becomes $80k per year.

The reverse works as well.

$100k per year is about $50/hr at 40 hrs/week.

To convert an hourly rate into a full-time hourly salary simply double it and add 3 zeros.

$40/hr becomes $80k per year.

The reverse works as well.

$100k per year is about $50/hr at 40 hrs/week.

Misconception: Banks front-load interest on mortgages

Reality: In the early years, you pay more in interest because you owe a lot more!

Let's run through an example:

Reality: In the early years, you pay more in interest because you owe a lot more!

Let's run through an example:

You take out a 30-year, $500k mortgage with 5% interest.

At first, you owe the bank $500k, so you pay 5% of what you owe; $25k.

As you pay down more principal, you’ll pay less in interest.

In the future, let’s say you owe $100k, so you pay 5% of what you owe; $5k.

At first, you owe the bank $500k, so you pay 5% of what you owe; $25k.

As you pay down more principal, you’ll pay less in interest.

In the future, let’s say you owe $100k, so you pay 5% of what you owe; $5k.

Tip: Avoid lifestyle creep

When most people start making more money, they start spending more.

They buy the new car or an expensive wardrobe.

Instead, consider reinvesting that money.

Wealth creation > lifestyle inflation.

When most people start making more money, they start spending more.

They buy the new car or an expensive wardrobe.

Instead, consider reinvesting that money.

Wealth creation > lifestyle inflation.

Trick: Climb the Ladders of Wealth Creation

Every career starts in the bottom left and works through each ladder over time.

The higher you climb, the more you earn, but the more skills and experience you need to acquire.

Every career starts in the bottom left and works through each ladder over time.

The higher you climb, the more you earn, but the more skills and experience you need to acquire.

For more on The Ladders of Wealth Creation, check out this thread:

Misconception: Donating $1 will save you $1 on taxes.

Reality: Every dollar you donate offsets a dollar of income, decreasing your taxes by your marginal rate.

For example:

For many people, donating $1 will save ~$0.25 in taxes.

Reality: Every dollar you donate offsets a dollar of income, decreasing your taxes by your marginal rate.

For example:

For many people, donating $1 will save ~$0.25 in taxes.

Tip: Identify what shaped your relationship with money

Ask yourself…

“What early memory shaped my relationship with money?”

The answer might surprise you.

A lot of your money decisions are driven by those early experiences.

Ask yourself…

“What early memory shaped my relationship with money?”

The answer might surprise you.

A lot of your money decisions are driven by those early experiences.

Trick: Automate your finances.

Personal finance can get confusing.

Especially when you have a full-time job and a few side hustles!

Build systems that automatically:

1. Pay your rent/mortgage

2. Pay your bills

3. Puts money in your savings

4. Invests money for retirement

Personal finance can get confusing.

Especially when you have a full-time job and a few side hustles!

Build systems that automatically:

1. Pay your rent/mortgage

2. Pay your bills

3. Puts money in your savings

4. Invests money for retirement

Misconception: You need an LLC to take tax deductions

Reality: If you’re a 1099 employee, there are a TON of tax deductions you can make!

• Mileage

• Contract labor

• Software & apps

• Phone & internet

• Educational expenses

• Home office expenses

• Bank & payment fees

Reality: If you’re a 1099 employee, there are a TON of tax deductions you can make!

• Mileage

• Contract labor

• Software & apps

• Phone & internet

• Educational expenses

• Home office expenses

• Bank & payment fees

Tip: Teach your kids about money

When raising kids the opposite of spoiled isn’t poor, it’s grateful.

• Live frugally

• Teach them to save

• Give them an allowance

• Speak openly about money

• Create a culture of gratitude

• Encourage them to start a business

When raising kids the opposite of spoiled isn’t poor, it’s grateful.

• Live frugally

• Teach them to save

• Give them an allowance

• Speak openly about money

• Create a culture of gratitude

• Encourage them to start a business

Trick: Set aside 25-30% of income as a freelancer

Freelancers have to pay self-employment taxes & income taxes.

• Self-employment tax is 15.3%

• Income tax is obviously variable

Periodically putting money aside will ensure you have enough to pay when tax time comes around.

Freelancers have to pay self-employment taxes & income taxes.

• Self-employment tax is 15.3%

• Income tax is obviously variable

Periodically putting money aside will ensure you have enough to pay when tax time comes around.

Misconception: Life insurance > disability insurance

Reality: Disability insurance is more important than life insurance.

If you become disabled you lose income, may require care, & still have to save to retire!

Disability insurance supplements your income when you can’t work.

Reality: Disability insurance is more important than life insurance.

If you become disabled you lose income, may require care, & still have to save to retire!

Disability insurance supplements your income when you can’t work.

Tip: Making money is a skill. Learn it.

Making money is like learning to play the piano.

You’re not going to sit down at the keys for the first time and play a concerto.

But over time, you’ll get better and better.

The same is true with making money.

Making money is like learning to play the piano.

You’re not going to sit down at the keys for the first time and play a concerto.

But over time, you’ll get better and better.

The same is true with making money.

Trick: Donate appreciated stock

You can save a significant amount on taxes if you donate appreciated stock rather than selling stocks and donating cash.

In fact, you can donate the stock, then rebuy it to have a higher cost basis.

You can save a significant amount on taxes if you donate appreciated stock rather than selling stocks and donating cash.

In fact, you can donate the stock, then rebuy it to have a higher cost basis.

Misconception: You can't access your 401k before 59 ½ without penalty.

Reality: There are two ways to access your 401k early without penalty:

1. Roth Conversion Ladder

2. Rule 72t

These strategies are complicated, but they are possible with the help of a tax professional.

Reality: There are two ways to access your 401k early without penalty:

1. Roth Conversion Ladder

2. Rule 72t

These strategies are complicated, but they are possible with the help of a tax professional.

Tip: Pay yourself first

Once you get paid, immediately save and invest, before spending.

You can easily do this by setting up an automation to transfer your money to a savings account, brokerage account, or retirement account immediately after you get paid.

Once you get paid, immediately save and invest, before spending.

You can easily do this by setting up an automation to transfer your money to a savings account, brokerage account, or retirement account immediately after you get paid.

Trick: How to contribute to a Roth IRA after you’ve exceeded the income limit

Most think you can’t contribute to a Roth IRA once you hit the income limit:

• $144k for single

• $214k for married

But there’s a way to fund a Roth IRA even when you exceed the income limit…

Most think you can’t contribute to a Roth IRA once you hit the income limit:

• $144k for single

• $214k for married

But there’s a way to fund a Roth IRA even when you exceed the income limit…

Introducing the Backdoor Roth IRA.

Here’s how it works:

• Put your $ into a traditional IRA

• Convert your contribution to a Roth IRA

• Pay taxes on the conversion

Here’s how it works:

• Put your $ into a traditional IRA

• Convert your contribution to a Roth IRA

• Pay taxes on the conversion

Misconception: Earning more money is bad because you’ll pay more in taxes

Reality: Earning more is always better, except if it means losing eligibility for a government subsidy.

Let’s run through a quick example…

Reality: Earning more is always better, except if it means losing eligibility for a government subsidy.

Let’s run through a quick example…

In year one you earn $80k.

This puts you in the 22% tax bracket.

You pay 10% of $9,950, 12% of ($40,525 - $9,951), and 22% of ($80,000 - $40,526).

This comes out to $13,349 in taxes.

This puts you in the 22% tax bracket.

You pay 10% of $9,950, 12% of ($40,525 - $9,951), and 22% of ($80,000 - $40,526).

This comes out to $13,349 in taxes.

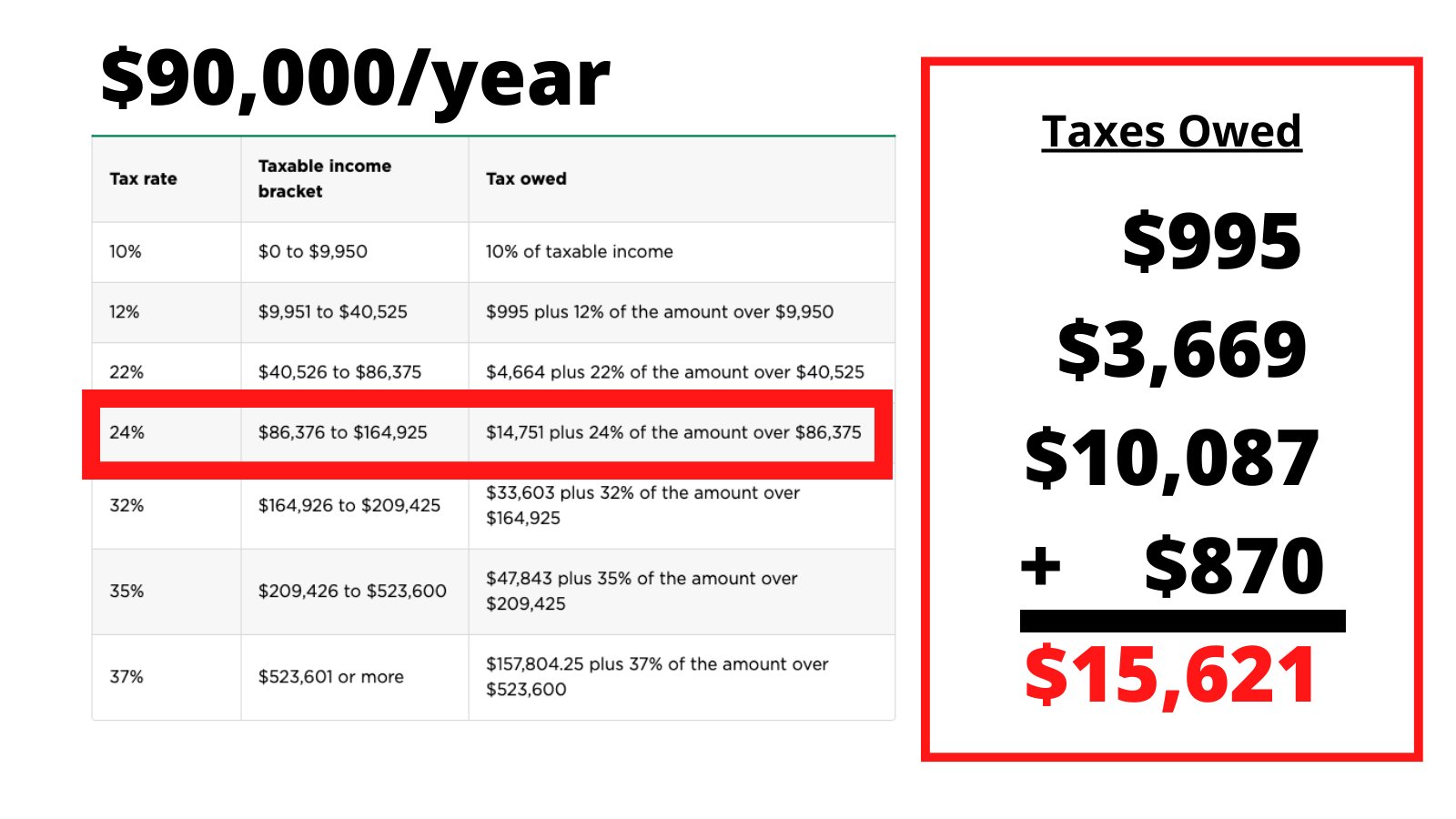

In year two you earn $90k.

This puts you in the 24% tax bracket.

(Oh no! More taxes!)

You pay 10% of $9,950, 12% of ($40,525 - $9,951), 22% of ($86,375 - $40,526), and 24% of ($90,000 - $86,376).

This comes out to $15,621 in taxes.

This puts you in the 24% tax bracket.

(Oh no! More taxes!)

You pay 10% of $9,950, 12% of ($40,525 - $9,951), 22% of ($86,375 - $40,526), and 24% of ($90,000 - $86,376).

This comes out to $15,621 in taxes.

TL;DR:

By earning $10,000 more in income, you only have to pay $2,272 more in taxes.

You still get to pocket $7,728!

Earning more is always better, unless it means losing eligibility to a government subsidy.

By earning $10,000 more in income, you only have to pay $2,272 more in taxes.

You still get to pocket $7,728!

Earning more is always better, unless it means losing eligibility to a government subsidy.

Those are 18 tips, tricks, and misconceptions about money.

If you enjoyed this thread:

1) Follow me @nathanbarry for more threads like this one.

2) Retweet the first tweet to teach your friends these money lessons:

If you enjoyed this thread:

1) Follow me @nathanbarry for more threads like this one.

2) Retweet the first tweet to teach your friends these money lessons:

Mentions

See All

Sahil Bloom @SahilBloom

·

May 28, 2022

Nathan’s whole thread was so good.