Thread

Sam Walton died with a net worth over $25 billion.

But years earlier, an unforeseen threat left him with NOTHING.

Here's how to identify & neutralize risks coming for your business:🧵

But years earlier, an unforeseen threat left him with NOTHING.

Here's how to identify & neutralize risks coming for your business:🧵

Sam Walton built Wal-Mart from concept to the largest retailer on earth.

With $559B in sales & over 2.3M employees (2021), the magnitude of his creation is hard to comprehend.

But all of this success isn't random, it can be traced back to a turning point in 1950.

With $559B in sales & over 2.3M employees (2021), the magnitude of his creation is hard to comprehend.

But all of this success isn't random, it can be traced back to a turning point in 1950.

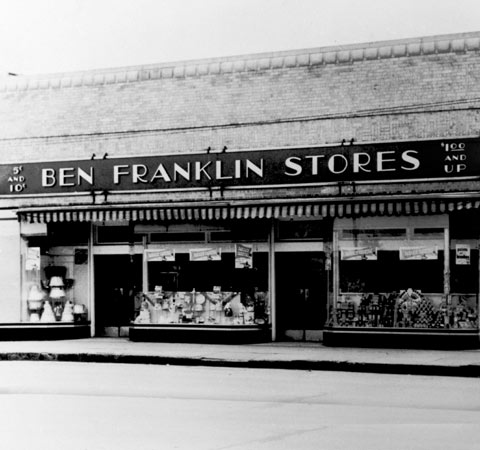

5 year earlier, in 1945 Walton purchased a Ben Franklin Variety franchise in Newport, Arkansas.

Undeniably ambitious, his goal was to have the most profitable Ben Franklin within 5 years.

He smashed his goal & earned $250K in revenue with $40K in profit ($400K in 2021).

Undeniably ambitious, his goal was to have the most profitable Ben Franklin within 5 years.

He smashed his goal & earned $250K in revenue with $40K in profit ($400K in 2021).

With 4 young kids, a loving wife, and a thriving business, he had it all.

Until he didn't.

In 1945, an eager Walton signed a 5 year lease with an opportunistic landlord.

It had no option to renew -- Walton had unknowingly handed the landlord leverage.

Until he didn't.

In 1945, an eager Walton signed a 5 year lease with an opportunistic landlord.

It had no option to renew -- Walton had unknowingly handed the landlord leverage.

Then in 1950 with the lease expiring, Walton received unexpected news.

The landlord would not renew at ANY PRICE.

Impressed by Walton's success, the shark-minded landlord used his leverage against him.

The landlord would not renew at ANY PRICE.

Impressed by Walton's success, the shark-minded landlord used his leverage against him.

With no other suitable locations in town, he gave Walton these options:

1. Close the store & face financial ruin

2. Sell the franchise to his son for pennies

He had no choice and sold the business.

His family's security and 5 years of his life were gone in an instant.

1. Close the store & face financial ruin

2. Sell the franchise to his son for pennies

He had no choice and sold the business.

His family's security and 5 years of his life were gone in an instant.

Not surprisingly, Walton recalled this experience as the lowest of his business life.

A devasted but undeterred Walton opened a new store that would later become Wal-Mart, in Bentonville, AR.

Where he INSISTED on a 99 year lease.

A devasted but undeterred Walton opened a new store that would later become Wal-Mart, in Bentonville, AR.

Where he INSISTED on a 99 year lease.

What's the lesson?

There are systemic risks that threaten your business and livelihood.

Without analyzing & preemptively protecting against them, you're on borrowed time.

3 of the biggest risks I'm seeing:

1. Self-inflicted

2. Platform dependency

3. Market

⬇️ ⬇️ ⬇️

There are systemic risks that threaten your business and livelihood.

Without analyzing & preemptively protecting against them, you're on borrowed time.

3 of the biggest risks I'm seeing:

1. Self-inflicted

2. Platform dependency

3. Market

⬇️ ⬇️ ⬇️

Self-inflicted risks:

Are usually a function of inexperience or ego.

In hindsight they're obvious which makes them frustrating.

Mitigate via better decision making by assembling a team of experienced subject matter experts who have the freedom to speak their mind.

Are usually a function of inexperience or ego.

In hindsight they're obvious which makes them frustrating.

Mitigate via better decision making by assembling a team of experienced subject matter experts who have the freedom to speak their mind.

On your team include:

Legal, insurance, & financial experts.

Because poor cash management, inadequate coverage, and contract oversight are 3 HUGE risks that span industries.

Hold quarterly meetings & use a "devil's advocate" approach to find potential holes - then plug them.

Legal, insurance, & financial experts.

Because poor cash management, inadequate coverage, and contract oversight are 3 HUGE risks that span industries.

Hold quarterly meetings & use a "devil's advocate" approach to find potential holes - then plug them.

Had Walton had a super-team, his lawyer would've suggested an option to extend in the lease.

He would've seen he was creating a pathway to become a victim of his own success.

With legal assistance he could've de-risked the lease process & kept his business.

He would've seen he was creating a pathway to become a victim of his own success.

With legal assistance he could've de-risked the lease process & kept his business.

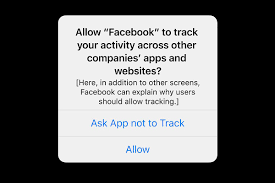

Platform dependency risks:

Millions of businesses rely on platforms like Facebook and Amazon to sell their products.

These platforms can remove you (for no reason) and even face risks of their own - which means you inherit THEIR risks in addition to yours.

For example...

Millions of businesses rely on platforms like Facebook and Amazon to sell their products.

These platforms can remove you (for no reason) and even face risks of their own - which means you inherit THEIR risks in addition to yours.

For example...

In 2021 Facebook lost $10B in sales due to an Apple update (iOS 14), which restricted certain data tracking.

Without the same level of data, ads became less effective, driving their costs up 89% YoY.

With costs up, fewer companies were willing to spend on FB ads.

Without the same level of data, ads became less effective, driving their costs up 89% YoY.

With costs up, fewer companies were willing to spend on FB ads.

Reduce platform dependency risk by diversifying revenue/supplier channels.

Sell on your own website, Amazon, Etsy, FB, brick & mortar, etc.

On the supply side have 2-3 product suppliers.

Remember: platform/supplier reliance exposes you not only to your risks, but THEIRS too.

Sell on your own website, Amazon, Etsy, FB, brick & mortar, etc.

On the supply side have 2-3 product suppliers.

Remember: platform/supplier reliance exposes you not only to your risks, but THEIRS too.

Market risks:

Incumbent leaders often believe there will NEVER be a seismic shift in their industry.

They are ALWAYS wrong.

Don't scoff at new trends or technology, instead ask customers and prospects how they feel about it (do your market research) before it's too late.

Incumbent leaders often believe there will NEVER be a seismic shift in their industry.

They are ALWAYS wrong.

Don't scoff at new trends or technology, instead ask customers and prospects how they feel about it (do your market research) before it's too late.

Blockbuster CEO John Antioco laughed at Netflix's Reed Hastings when he requested a $50M acquisition in 2000.

Antioco said "the dot-com hysteria is overblown" and suggested online businesses couldn't make money.

Antioco said "the dot-com hysteria is overblown" and suggested online businesses couldn't make money.

Antioco didn't understand:

When technology makes life easier, customers will crave it & the market will find a way to deliver it profitably.

He should've spent more time understanding the long term utility of the internet.

It would've been clear - streaming was inevitable.

When technology makes life easier, customers will crave it & the market will find a way to deliver it profitably.

He should've spent more time understanding the long term utility of the internet.

It would've been clear - streaming was inevitable.

To summarize, each quarter:

- Meet with your super-team

(review legal, financial, & insurance risks)

- Review revenue and supplier channel risk

(diversify where possible)

- Identify new trends and technology

(allocate budget for market research/development)

- Meet with your super-team

(review legal, financial, & insurance risks)

- Review revenue and supplier channel risk

(diversify where possible)

- Identify new trends and technology

(allocate budget for market research/development)

In 1950 a greedy landlord taught Sam Walton a timeless lesson that is just as relevant today.

CONSTANTLY search for vulnerabilities and develop a plan to reduce risks before they become fatal.

Legendary Intel CEO, Andy Grove, said it best:

"Only the paranoid survive."

CONSTANTLY search for vulnerabilities and develop a plan to reduce risks before they become fatal.

Legendary Intel CEO, Andy Grove, said it best:

"Only the paranoid survive."

If you found this helpful...

Follow me @barrettjoneill for content on business & growth.

Please RT the 1st tweet so others can learn to asses and destroy risks coming for their business.

Follow me @barrettjoneill for content on business & growth.

Please RT the 1st tweet so others can learn to asses and destroy risks coming for their business.

Mentions

See All

David Morris @wdmorrisjr

·

Apr 3, 2022

Great thread, Barrett! I know that for my business, Covid was a market risk wake up call. We watched our primary markets crater overnight. It's incredibly easy as a business leader to fall into the trap of projecting out future success without also projecting out future risk.