“I’m here for one reason and one reason alone. I’m here to guess what the music might do a week, a month, a year from now.

That’s it. Nothing more.”

John Tuld, Margin Call (2011)

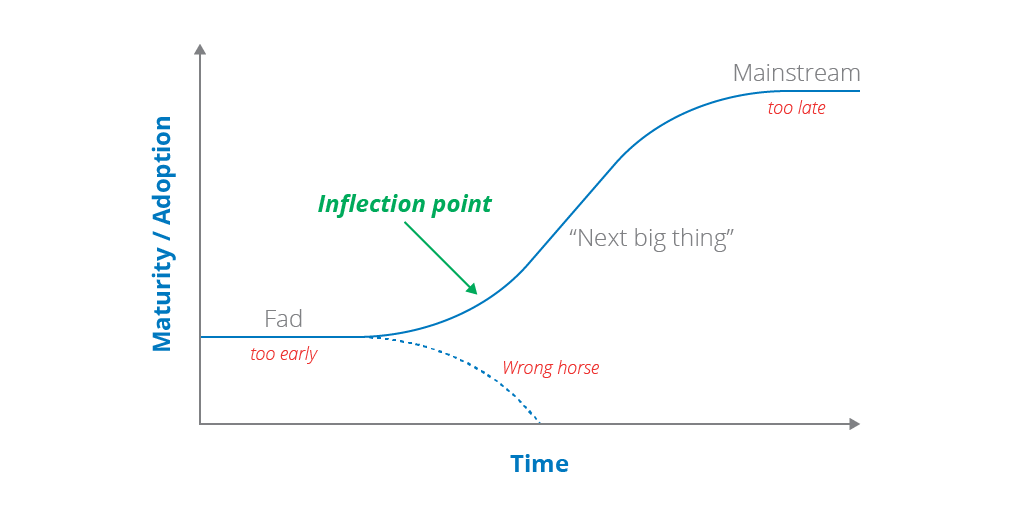

A lot of time in the tech community is dedicated to understanding growth and moat dynamics like network effects and loops. While both of these components contribute to the building of individual companies, business models, and sectors, inflection points are the bookends to all of those and more, representing the beginning and end of larger movements.

If loops are the power source that accelerate the flywheel, inflection points build the physical properties of the flywheel, create the initial spin, and eventually are the resistance which stops the wheel dead in its tracks.

Andy Grove defines inflection points as “an event that changes the way we think and act.” There are few skills as powerful as understanding when things change.

Matt Cohler of Benchmark once said “Our job as investors is to see the present very clearly, not to predict the future.”

This quote is often misinterpreted. Seeing the present clearly is merely one function in the equation. In reality it is understanding what the past and present does to the future that matters most.

As seed stage investors, we help companies build, survive, and scale, but one of the main components of my job is understanding how and when the world is going to change. Our portfolio is a collage of various futures that we believe in, and our capital and expertise are assets to hopefully pull these futures forward.

Within Compound we often speak of technical inflection points as a concept that we love and deeply understand. When we say this, we mean companies that are creating or utilizing a sizable technological shift to create a venture-scale business. While many of our companies do follow this paradigm, at a higher level our focus in being thesis-driven is to understand multiple types of possible inflection points and predict the timing of such events in order to build various theses.

If we are to understand what the next decades of inflection points are to hold, we must build a framework for how to look at these important events.

WHY INFLECTION POINTS Matter

Whether you’re an investor, researcher, startup founder, or scaled operator, by understanding inflection points, you’re able to best position yourself to be ahead of where the futures you believe in are going. Decoding inflection points past, present, and future all have varying value.

- Past inflection points allow you to pattern match prior events to the present and future, as well as build a better view on where in a given cycle you are, or what other next order effects could come.

- Present inflection points allow you to identify how to prioritize learning, understand competitive dynamics, as well as begin to more properly look at companies through this lens to answer the most important question of “why now?”

- Future inflection points allow you to understand who are the types of people that can bring forward this future, and invest in a longer-term time horizon of building institutional learning and brand network effects to be best positioned to exploit the first and subsequent waves that result from the given inflection point.

Given the amorphous nature of an inflection point, how do you know the right moment to take appropriate action, to make the changes that will save your company or your career? Unfortunately, you don’t.

But you can’t wait until you do know: Timing is everything…When you’re caught in the turbulence of a strategic inflection point, the sad fact is that instinct and judgment are all you’ve got to guide you through.

Only the Paranoid Survive, Andy Grove, 1998

Thinking through these allow us to be better prepared to navigate the proverbial idea maze and understand what ripple effects users, researchers, companies, and governments are creating, to inform our decisions today and tomorrow.

This understanding can build a core knowledge base which helps answer questions including (but not limited to):

- Who/what are the existential or emerging threats to my area of focus?

- Which parts of the stack are ready to be built within a given category?

- Where will value accrue/moats be built in both the short-term and more importantly, the mid to long-term?

- Who are the right groups of people that are best positioned to build in a given space?

- Examples of this include the 2007 DARPA Grand Challenge roster (they formed much of the basis of the self-driving industry for the next decade), the early Willow Garage team (built ROS and founded multiple robotics companies), and even early researchers in deep learning that were deemed too early (and crazy) like Geoff Hinton and Yann Lecunn and their resulting students/researchers that went on to build some of the first deep learning startups in the 2010s.1We often call these groups “mafias’ however there is a notable difference between the underlying founder/market fit within these groups versus a perceived broader excellence like is interpreted in the Paypal Mafia, as well as with potential mafias today made up of ex-Stripe, AirBnB, or Uber employees. There is signal here though in some specific groups. For instance, as data science became incredibly complex with large datasets, we saw a ton of institutional knowledge creation within large companies like Uber, leading to a strong founder/market fit for these teams to spin out core internal technologies and democratize them for the masses as second-mover companies needed new infrastructure.

- What is the scale of value creation we will see within a given company or industry?

- Series B+ venture investing has become increasingly about having a view on outsized value creation relative to other investors, which then drives round pricing. For those that understood the scale of technology proliferation, as tech went from local to global, and capital intensive to scalable, there was meaningful alpha relative to others who didn’t anticipate these changes.

Inflection points matter because they create shifts that cascade down for multiple decades and can cause companies to outlast, take advantage of, and thrive during bull markets, and more relevant today, downturns.

Why the common narrative around recessions and companies is a lie.

Great companies are started in all markets.

– All VCs as the world began to meltdown due to COVID-19

Over the past few months, as the reality of our economic situation has set in due to the COVID-19 pandemic, tech’s echo chamber has produced a rallying cry of “Great companies are started in all markets”

This echo chamber paired with our industry’s blind optimism can lead to a proliferation of startup cliches that miss the forest for the trees and/or are frozen in time, not naturally evolving with our tech ecosystem. Statements like:“Do things that don’t scale”, “Move fast and break things”, and today “Great companies are started in all markets”.

This paradigm is comforting during an onslaught of horrible news and seemingly little light at the end of the tunnel in the near term, as we sit inside our homes in some semblance of fear or exhaustion from the world, seeking respite on Zoom calls, Twitter threads, and Clubhouse rooms.

We are missing what is really happening. Great companies are not merely built at all times just because we say so. Though, there are reasons as to why many say this.

These include:

- Startups are outliers building on a decade long timeline.2This is probably the strongest argument of any, and also the most hand-wavy. Startups are built on multi-year timelines, but the unfortunate reality is they are slaves to fundraising cycles as they trade profits for scale. Despite the continual cry for alternative financing products and steady growth, as private markets have become incredibly well-capitalized and institutionalized at all stages of the venture capital stack, it can be necessary to make that trade in order to survive as a venture-scale company.

- Broader competition theoretically decreases during a recession. This can happen across incumbent, talent, and startup company competition. 3Incumbents: Incumbents must focus and slow-down non-core areas of investment. This is the weakest argument in 2020. We have the most innovation-hungry and sprawling incumbents in history and are not slowing down during this time. If anything they finally see opportunities to deploy their war chests of cash towards these large scopes of ambition.

Talent: While layoffs could bring down the cost of talent marginally, Facebook announced plans to add 10k+ workers in 2020 and with the rise of remote work, the incumbents aren’t just shopping in our tech capital backyards anymore.

Capital availability and startup company competition: All rounds of the private capital stack have institutionalized as private markets have shown that they increasingly are capturing a massive % of returns. Some founders may wait out the downturn before diving into a new company, but we learned last year that capital is not a differentiator, and there is plenty of depth within private markets to fund fast followers, and mega-fund multiple ideas. Being a founder for better or for worse is now seen as a job, and there are many who will not stop applying for that job. - That Kauffman Study from 2009 that highlights 57% of Fortune 500 companies were founded during a recession. 4This data is borderline worthless in 2020, especially as we’ve seen replacement rates continually increase.

What Actually Happened?

What we see during downturns is a strong proliferation of have and have nots within the tech ecosystem, where certain categories are materially overbid, while others are near impossible to raise for.

When we look at past recessions through this lens we can obtain learnings about the catalysts surrounding the various companies that lived and died through these recessions and how this influences haves and have nots moving forward.

These catalysts are inflection points.

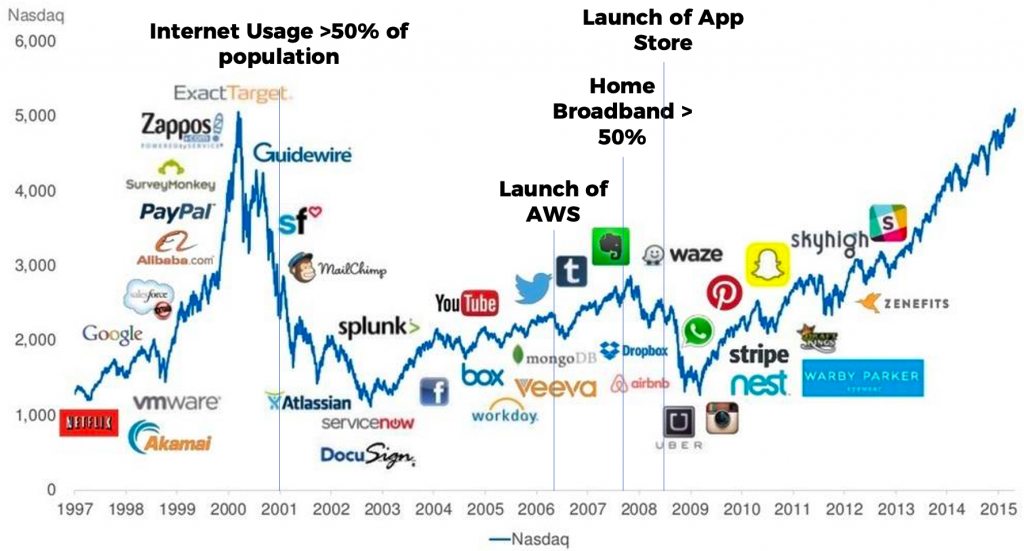

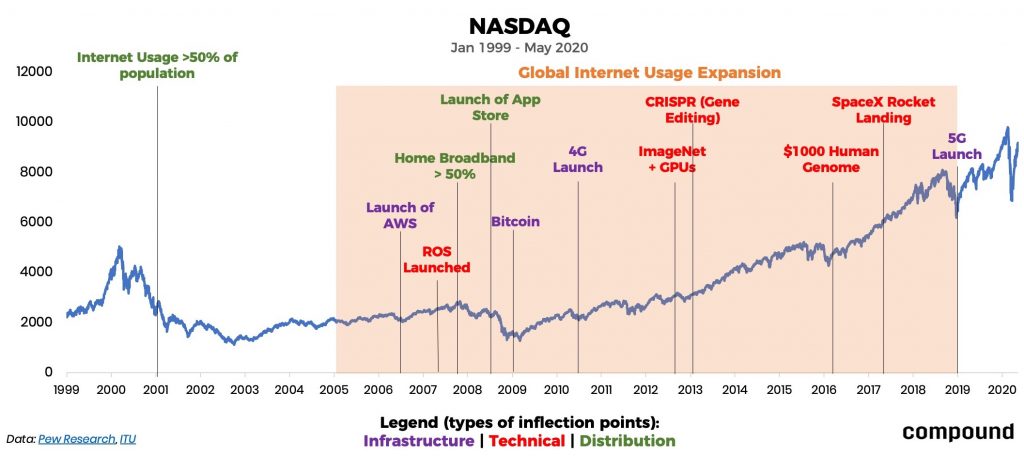

The 2000 dot-com bubble represented an overly enthusiastic behavior surrounding the possibilities of the internet. It was the next BIG thing, which meant tons of capital, lots of IPOs, and the NASDAQ hitting over 5000, a point that it took ~15 more years to reach after the bubble popped.

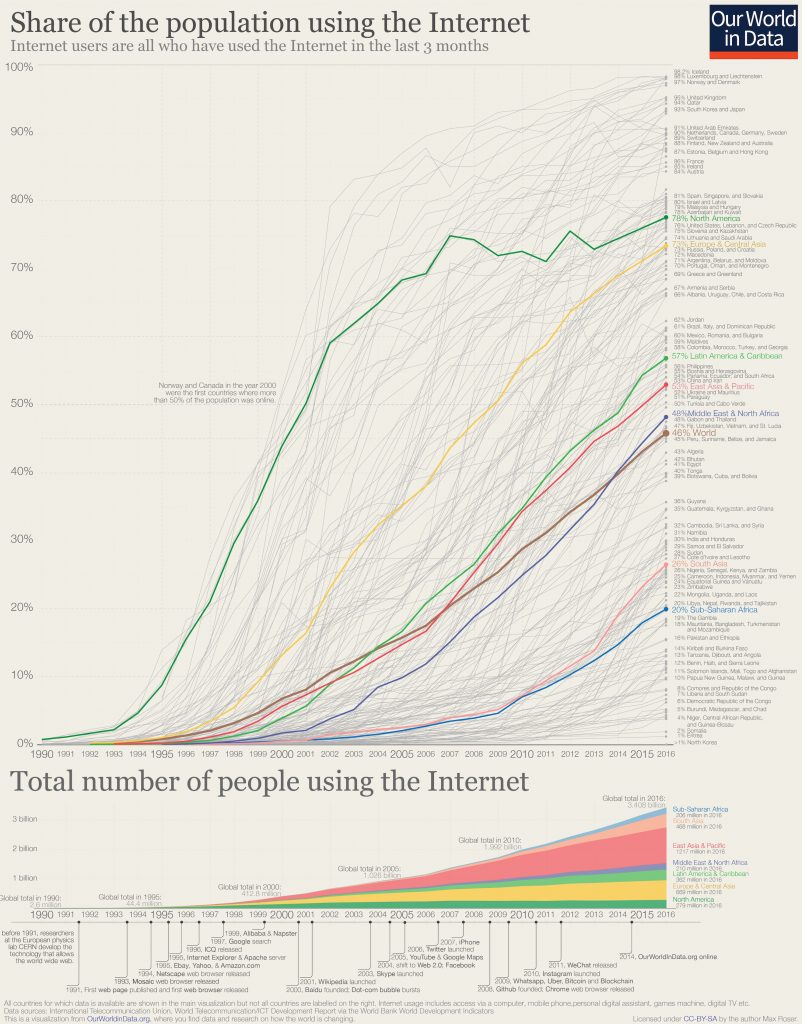

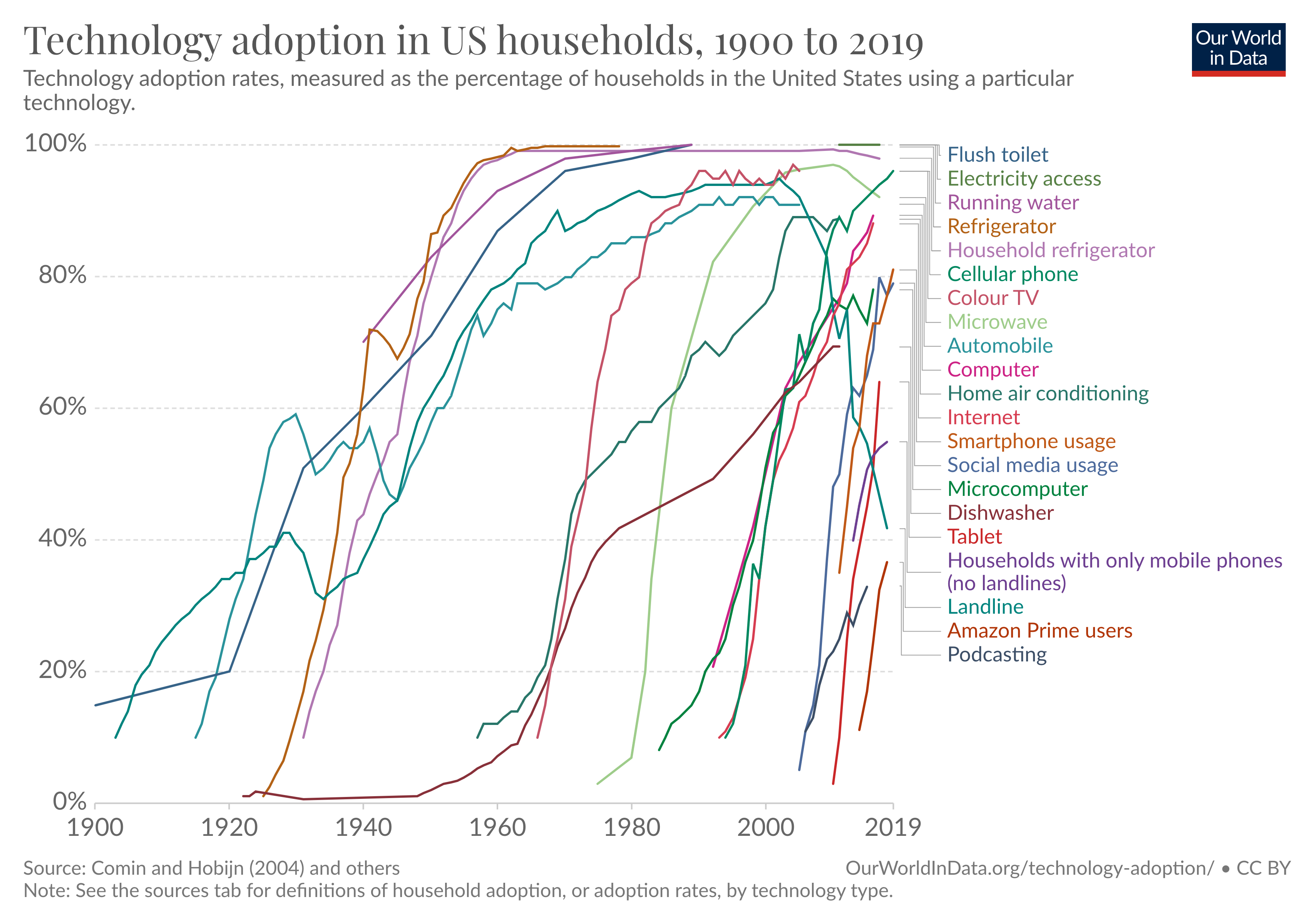

It turns out, the internet was the next thing, but it wasn’t the next big thing just yet. It wasn’t until 2001 that we saw internet penetration in the US top 50%, allowing for internet companies like Netflix, Google, Paypal, and more to survive both as public companies and large-scale growth stories, even though less than 7% of the world was online.

As people began to understand the implications of the widespread internet, we saw future unicorns like Atlassian, Mailchimp, Docusign, and of course, Facebook, take advantage of the ever expanding information superhighway (1B people by 2005).

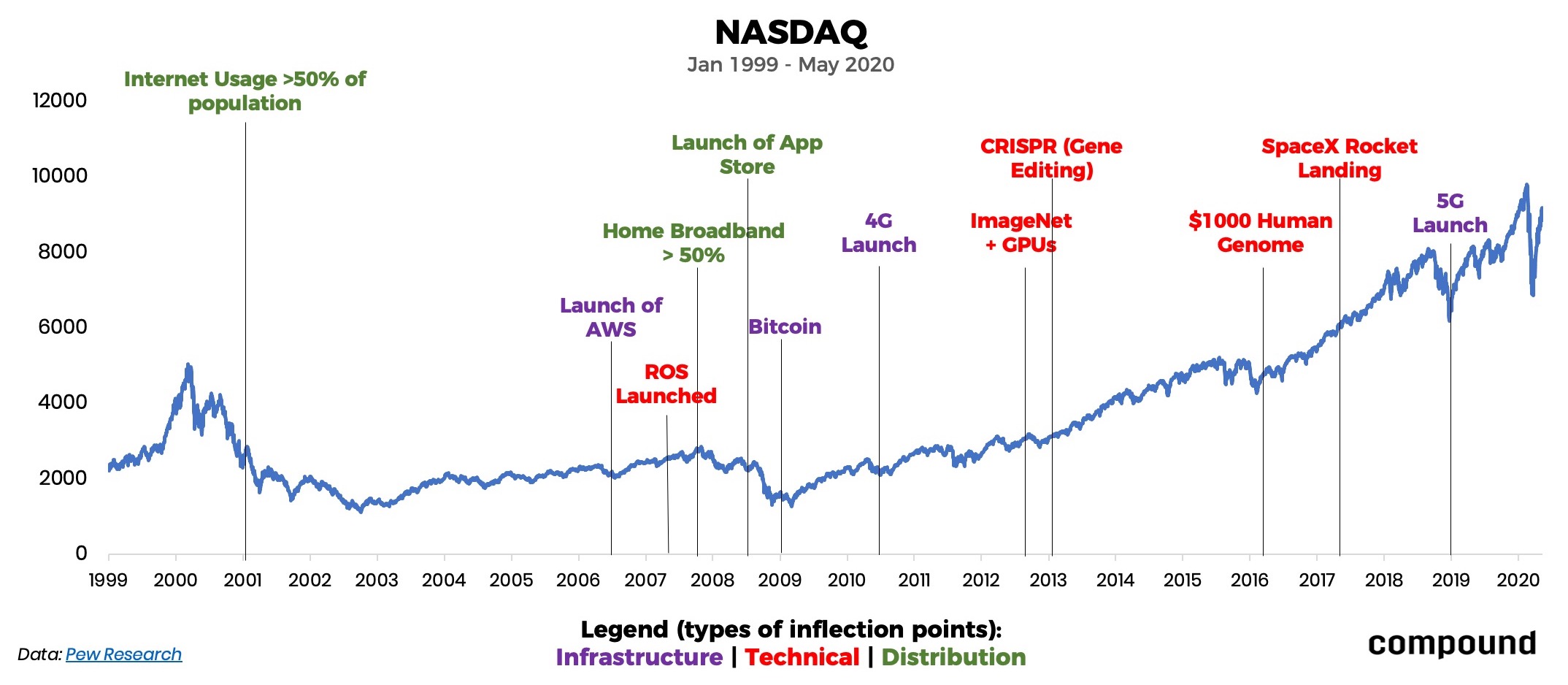

Great companies were indeed built during the prior two downturns, however it was societal shifts paired with the major inflection points like the launch of AWS, which birthed cloud computing and materially lowered the barrier to entry for distributing software, the launch of the App Store, and even 4G penetration, all of which brought new business models and modalities for usage.

Infrastructure, Distribution, and Applied Technical Inflection Points

There are two core ways to look at inflection points. The first is the type of inflection point, in the sense of the part of the stack that they operate. The second is how these inflection points come to be, which I will discuss later.

Inflection points have created a variety of unicorns over the past two decades, existing across infrastructure and distribution-level vectors. More recently we’ve seen applied technical inflection points that play at a different abstraction layer and can be viewed as potentially more singular toward industry or enabling specific applied use-cases.

These technical inflection points include the creation of ImageNet paired with AlexNet, which showed the power GPUs bring to deep learning, the ability to cheaply sequence a human genome to enable personalized medicine, and unlocking the space economy with reusable rockets. This list is by no means exhaustive, but these technical inflection points feel far more prevalent as we sit and wonder if we are at the end of the beginning.

This framing of types of inflection points may not be perfect as there were infrastructure level inflection points that enabled the technical inflection points and technical inflection points that created new distribution. Regardless, it is these core shifts that created these categories, and when we think of category creating inflection points, technical ones are driving the past few years or so of innovation across biology, automation, machine learning, aerospace, and more.

Infrastructure level inflection points create categories, distribution level inflection points grow categories, and technical inflection points do both.

Single Inflection Point Companies

There are two types of companies that utilize inflection points broadly. The first are those that are created and capture a vast majority of their value at once, due to a single shift (or collection of shifts at the same time) in the world. The other are those that benefit from waves of inflection points. I call the former single inflection point companies.

Single inflection point companies benefit from a moment in time that acts as a perfect storm for their rise. This include a slew of businesses built on the first wave of the internet, that thrived from the late 1990s to the mid 2000s, to the first wave of mobile from the mid 2000s to the early 2010s, to even more recently a first wave of deep learning companies being built in the 2010s.

E-commerce companies have lived through this across two cycles now. The first, being the dot-coms that took analog businesses and brought them online, thanks to the birth of the internet, such as Pets.com. These companies took advantage of growing internet penetration in the US and flipped the idea of regional expansion and reach on its head due to the scale advantages of the internet.

In more recent decades, we’ve seen single inflection point companies manifest as digitally native vertical brands (DNVBs) like Warby Parker, taking advantage of new distribution and acquisition pipes like social media and programmatic advertising, which enabled them to reach customers in a more precise way at theoretically a lower cost, and thus greater margin, relative to pre-existing, less digitally native brands.5In my view, the inflection point here was one largely of distribution, with core infrastructure like Paypal or Stripe acting as efficiency creators.

A new wave of companies have since been born like Thrasio, taking advantage of the proliferation of horizontal marketplace like Amazon and Walmart, paired with logistics enabled by Fulfilled by Amazon, to build an entirely new type of digitally native conglomerate.

First Order & Aftershock Inflection Points

“Think of the change in your environment, technological or otherwise, as a blip on your radar screen. You can’t tell what that blip represents at first, but you keep watching radar scan after radar scan, looking to see if the object is approaching, what its speed is, and what shape it takes as it comes closer. Even if it lingers on your periphery, you still keep an eye on it because its course and speed may change.”

Only the Paranoid Survive, Andy Grove, 1998

Understanding the first shift is far different than understanding the resulting change that allows a technology to cross the chasm from “production-level” to “mainstream” or “global.”

First order inflection points signal the beginning shift and step function change, for example, the birth of the internet at scale in the US, versus global penetration.

Aftershock inflection points are those that follow in the steps of a first order inflection point to create multiple reverberations of value.

Examples of first order inflection point companies include Youtube (Network built on top of first wave of broadband internet and personal camera proliferation)6In the original investment memo by Sequoia, Roloef Botha cited both of these as core drivers for market size opportunity. There also was the launch of Adobe Flash (remember that?), Zynga (game studio built on the rise of Facebook), and 23andMe (consumer-centric genetic testing company built on the lowered cost of genotyping).

First Order inflection points are important to understand when we think of maturation of industries and the past decade run we’ve seen that has taken the NASDAQ from 6,000 to 10,000+, and resulted in our first group of trillion dollar market cap companies.

First order inflection points signal a first wave of value creation, while aftershocks are often what create multiple, larger cumulative value spikes. Sitting between these are Cambrian explosion events, which are rare in that they create singular points of value but are incredibly difficult to anticipate.

Expand here for my related commentary on the fallacy of frontier tech funds and capturing Cambrian explosion events

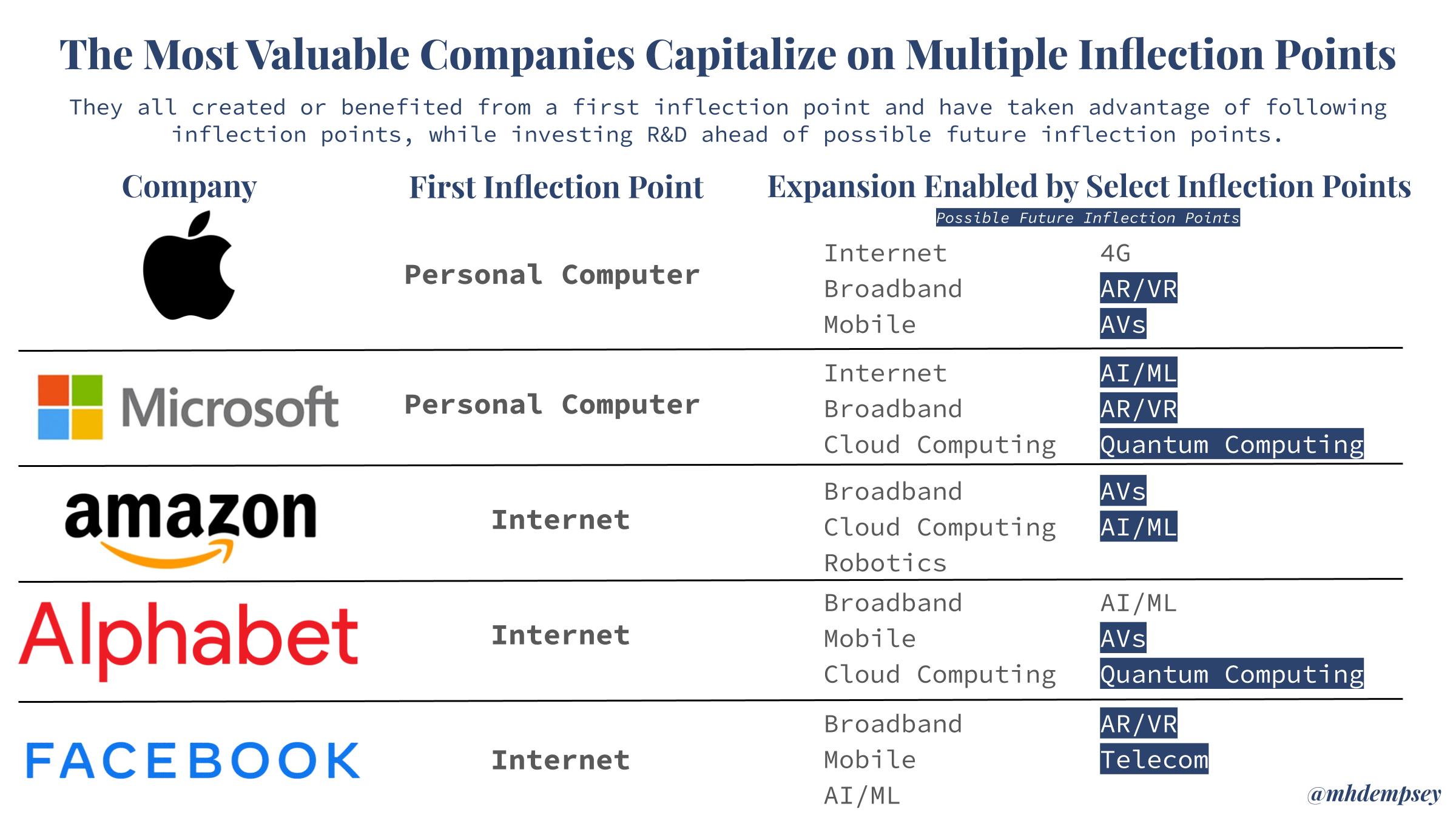

Aftershock inflection points are most importantly about knowing how fast various futures pull forward, what pulls them forward, and at what point the changes accelerate exponentially (what some might call a tipping point). While single inflection point businesses can create material value, a billion dollar company isn’t cool. You know what’s cool? A trillion dollar company.

Trillion Dollar Companies come from Maturation Waves

Trillion Dollar Companies come from maturation waves and aftershock inflection points. From 2005 to 2019 global internet usage penetration grew on average 10% per year. Today we sit at nearly 5B people consistently online (86% of the developed world) partially enabled by ~5.2B global smartphone owners.

In 2011, after multiple key inflection points, Marc Andreessen famously said “software is eating the world” and cited that at that point 2B people were online. The following 9 years has produced more billion dollar companies each year than ever before, as well as a surge in market cap and broader value creation towards technology companies.

Internet usage, mobile, and cloud computing all ate the world, because for once they could easily reach the world.

The Fault in Installation & Deployment Periods in Today’s World

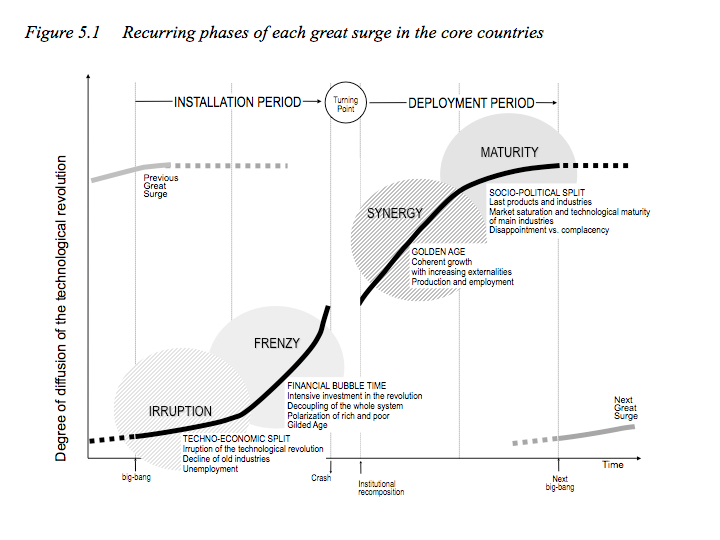

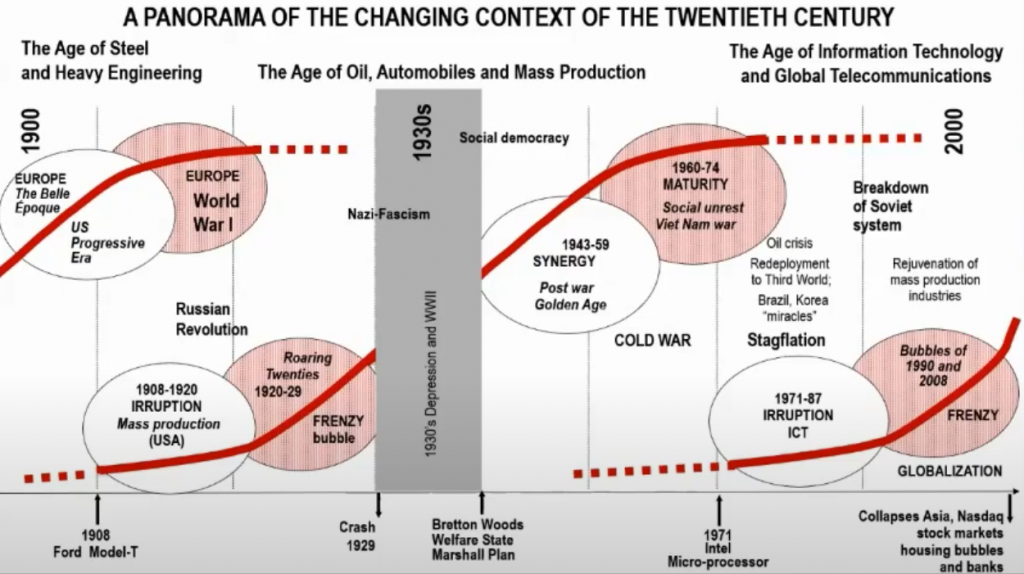

Many think of S-curves and Carlota Perez’s profound Great Surges of Development framework which frames paradigm shifts surrounding installation periods and the deployment periods. These, at a high-level, could be used to paint technology-related inflection points within those borders (first order inflection points = installation period, aftershock inflection points = deployment period).

Perez’s framework is deeply relevant today as we look at the end (?) of a 12 year bull-market, with mature technology platforms, and a shattered economy. That said, the framework oversimplifies and misses the reality of today which are the compounding and overlapping effects of technologies which create significantly compressed (and possibly larger) cycles of innovation.

Looking at the chart on types of inflection points as an example, inflection points across infrastructure, distribution, and more pure applied technology, all created a faster spinning flywheel for maturation and expansion across given categories in sometimes just a decade.

It wasn’t just that the best companies benefitted from desktop internet penetration globally, but instead they also understood how the internet would proliferate into mobile, and how high speed networks would expand the use-cases, moats, and horizontal expansion of their businesses. In a historical context, the sophistication, malleability, and ambition of scope is what often separates single inflection point companies from maturation wave companies, and thus billion dollar companies versus trillion dollar companies.

The most valuable tech companies of today all exhibit this to some degree. Apple created multiple inflection points due to their product excellence across both personal computers and mobile computing. They have since recognized their power within tech ecosystems and have shifted their stance to be the late but final mover on emerging categories and products (ARVR being a perfect example of this).

On the other hand, Facebook was enabled by the proliferation of the internet (and the resulting behavioral expansion from commerce to social taking place online), then pivoted the business materially towards mobile, and is now pushing the limits on both AR/VR as well as machine learning.

Expand here for related context on Facebook's understanding of mobile and their pivot around their IPO

In addition, much of Perez’s framework discusses the importance of societal shifts that then drive technology. I’d argue that we may be at a new type of paradigm within our society where instead it is technology that is driving societal shifts, not the other way around.

What Can Be Done, Will Be Done

As we move down the stack of the world’s most valuable companies even outside of those with market caps of $500B+, a macro shift has occurred due to the increasing pace of technology proliferation as well as the depth of private capital markets and scale of incumbents creating faster disruption than ever before. This has led to investors and acquirers demonstrating a strong willingness to pay up materially for potential expansion and the perceived moats that this can create/replenish.

The new environment dictates two rules: First, everything happens faster; second, anything that can be done will be done, if not by you, then by someone else, somewhere. Let there be no misunderstanding: These changes lead to a less kind, less gentle, and less predictable workplace

Andy Grove, 1995

In 1995, Andy Grove recognized the impending value creation we’ve now seen created by technology and waves of inflection points for two decades. This understanding of these dynamics in this new environment was prescient and can’t be taken for granted when analyzing the next decades of inflection points.

Types of Inflection Points

The difficulty with understanding inflection points is that they do not all look the same in how they develop and there is no silver bullet for spotting them. There are however multiple seeds of changes to look out for when attempting to understand inflection points, such as:

- Emerging research that points to a possible future

- Narratives around the possible becoming an “official future”

- Exogenous shock to a system creating next order effects (ranging from the micro-level of an industry hack, to macro-level of a global pandemic)

- Emerging behaviors from generational shifts

- Possible maturation of platform technologies

As we attempt to understand how to anticipate and spot inflection points, we need to understand what types of inflection points are common.

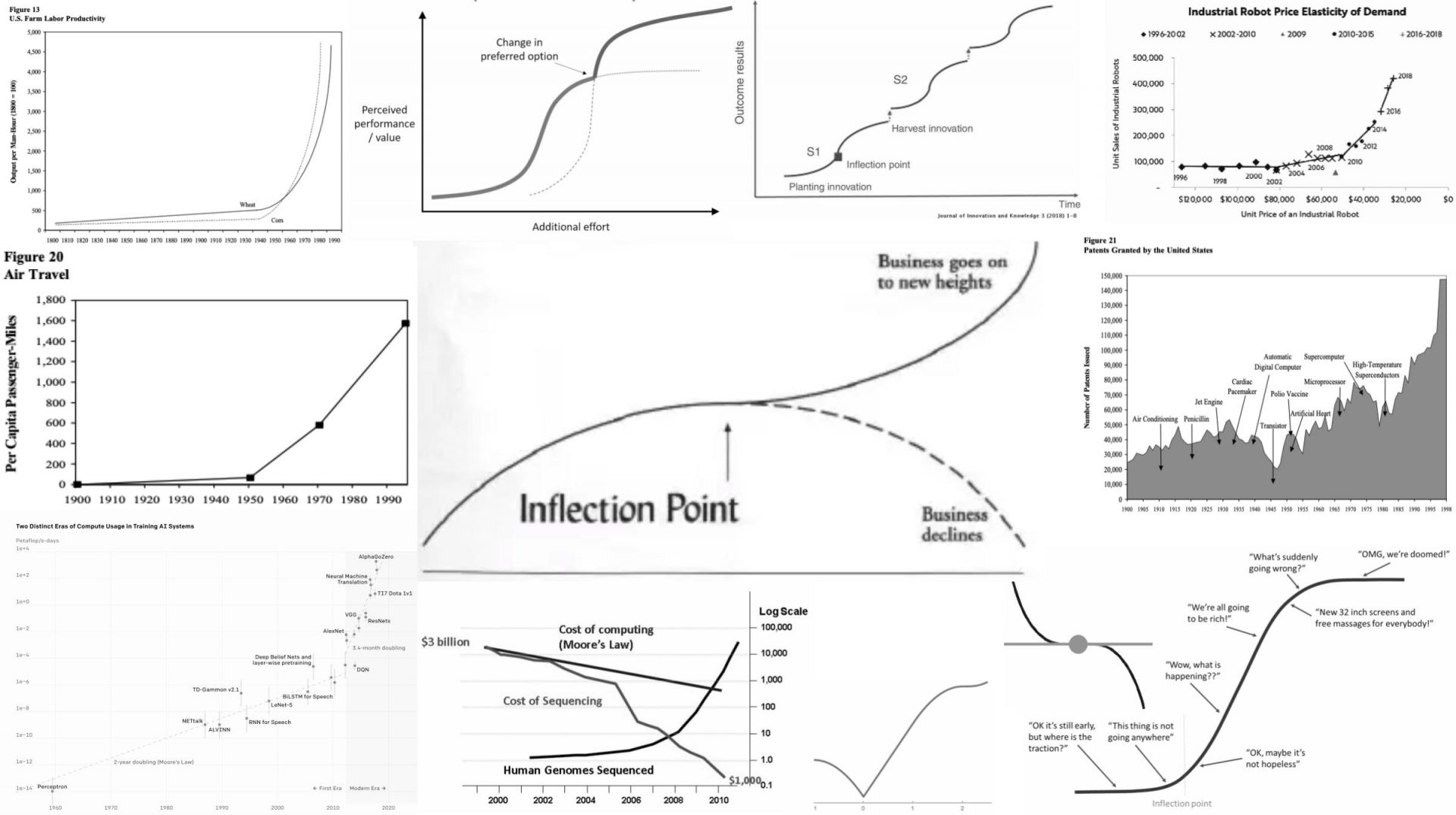

COST CURVE INFLECTION POINTS

One of the more obvious inflection points is that of cost functions of new technologies. To put cost curve inflection points simply, they are when a new technology with similar utility drops below the cost of an existing technology.

These cost curve disruptions can come from material and long-term technological R&D that is finally perfected and production ready (a “breakthrough”). This shift that seems to happen overnight can create what is called a “jump point” which causes a fast and sudden shift within a given category or industry. Once a production-ready technology reaches perceived feature supremacy or parity to a pre-existing one, we see adoption increase exponentially.

When it comes to cost curve inflection points, the dynamics of the country or users you’re serving matter. Some of the largest innovations and disruptions in cost curves have come in emerging markets where consumers are unable to use existing, mainstream technologies due to prohibitive cost, and thus innovate on (at times) slightly less powerful versions of a technology at a significantly reduced cost. RA Masheklar describes this as “value for many” and “getting more, from less, for more” and cites the Tata Nano $2000 car (which birthed the Nano car segment) and the Jaipur Foot ($20k → $28).10TED has aggregated many of these types of innovations here.

Put more simply, the opportunity for technology is not evenly distributed, and for those in privileged positions, the only savior for incumbents on the disruption end of a cost curve are products that have high entrenchment or switching costs.

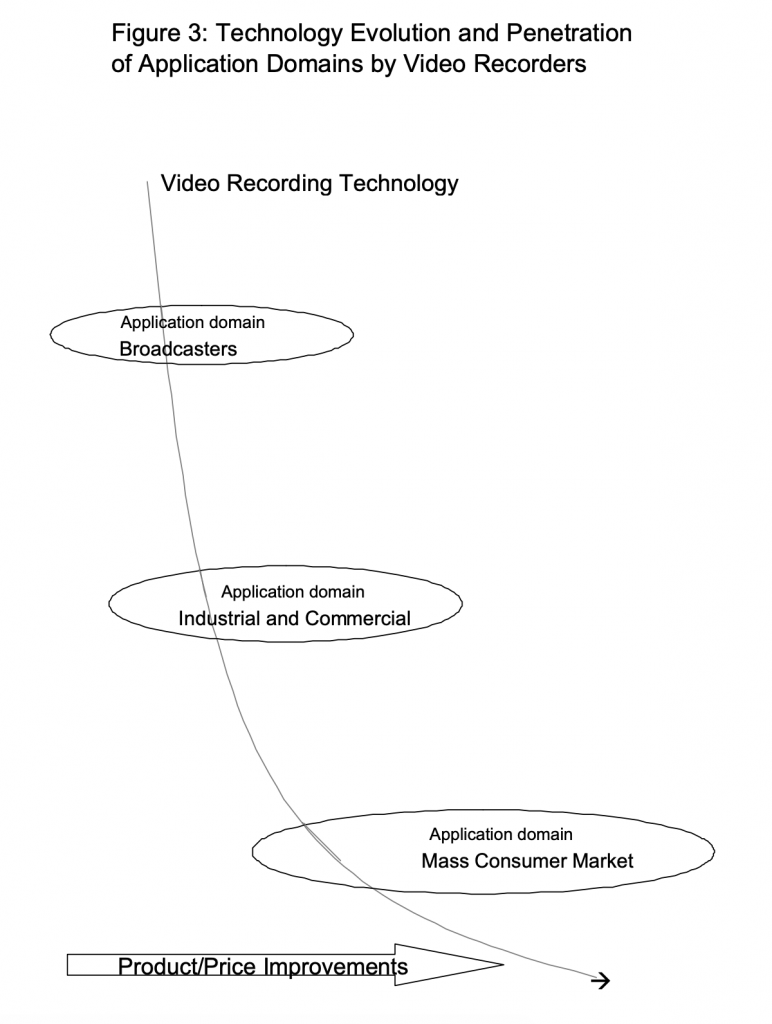

Technology Evolution on the cost curve

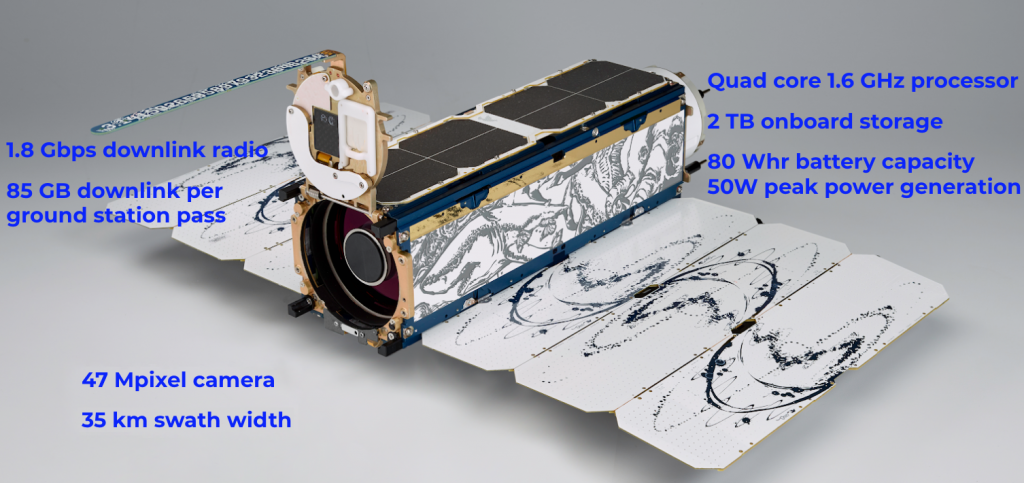

Other times a new technology emerges which begins in a given niche and invades more application domains over time. A good example of this would be GPS, which originally was aimed for military applications, then shifted to more commercial-centric tracking domains (once the government allowed it to), and eventually enabled an entire new category of startups like Uber, Postmates, Instacart, and more as the technology gained distribution via the smartphone. One could argue that as the technology further improves, we could see a new domain born out of the innovations that come from millimeter level precision GPS, up from today’s standard of meter-level precision.11There is a very similar dynamic potentially at play with geospatial imagery today. Currently the government limits the resolution that commercial satellites are allowed to image at. Eventually, as we get better “local” surveillance or perhaps society shifts away (or towards) more privacy, we could see this dynamic change.

When thinking through this type of progression, we have essentially mini-inflection points or step functions which enable a company to meaningfully invade a new domain, and thus expand TAM.

Between cost curves and cost progressions, we often see companies split.

On one end you have companies that are able to release new products based off of underwhelming, but needed technologies and invade more domains over time as the product feature-set increases and price decreases.

Examples of this include:

- Solar powered calculators which were proving grounds for solar cells.

- Digital watches which became platforms for early LCDs.

- And in the future at a product level, VR headsets which could prove to be early proving grounds for dual-use AR/VR headsets.

Expand here for quote of full breakdown of this dynamic related to the above examples.

On the other end of the spectrum you have long-term R&D projects that can’t get to commercialization due to a feature set that needs material technological development in order to become commercially viable. This has been documented well in autonomous vehicles, with some companies aiming to be in-between solutions to full-scale autonomy, while others like Zoox (recently acquired by Amazon) went heads down, raising billions to reinvent the car as well as build the autonomy stack. These companies often are threading a needle of perfection in order to launch, as eventually capital markets, competitive dynamics, or consumer demand has to give.

Sam Lessin called this dynamic within autonomous vehicles (while essentially denouncing many core views of this post) as a techno-idealized J-Curve.

Magic Leap is an example of a company that was forced into shifting domain likely due to capital markets pressures and slower than anticipated technical progress. The company made a meaningful marketing change from incredibly consumer-centric messaging to an eventual heavy focus towards enterprise use-cases.

![Why SpaceX Is A Game Changer For NASA [Infographic]](https://specials-images.forbesimg.com/imageserve/5ed8bf4a6185070006a94914/960x0.jpg?fit=scale)

SpaceX is a compelling example of a company that sits in the middle of these two paradigms,. investing long-term in R&D (~8 years from founding to first successful launch and spacecraft recovery), partially thanks to government forward-funding, in order to build reusable rockets for the domain of space infrastructure/logistics broadly, but with future investment in technologies to lower the cost curve for telecom and broader space travel/tourism.

Across all of these examples, there is the underlying dynamics of technological change that meaningfully impacts prices and feature sets which progress from one domain to another, or in some cases obliterate most relevant domains immediately and create an immediate shift.

The important part to understand when building a company that takes advantage of domain progression is the scalability and transferability of your technology over time. While SpaceX can innovate over time, improving the economics of their first domain (launch services), eventually reaching scale to invade new domains, there isn’t material wasted R&D that doesn’t capture value along the way, as each innovation improves their core domain use-case.

This dynamic is one of the reasons that I love full-stack robotics companies. They are able to build technology to solve a single problem, augmenting automation with human labor in order to capture value and create increasing efficiencies, as they continue to automate more and more of a given industry.

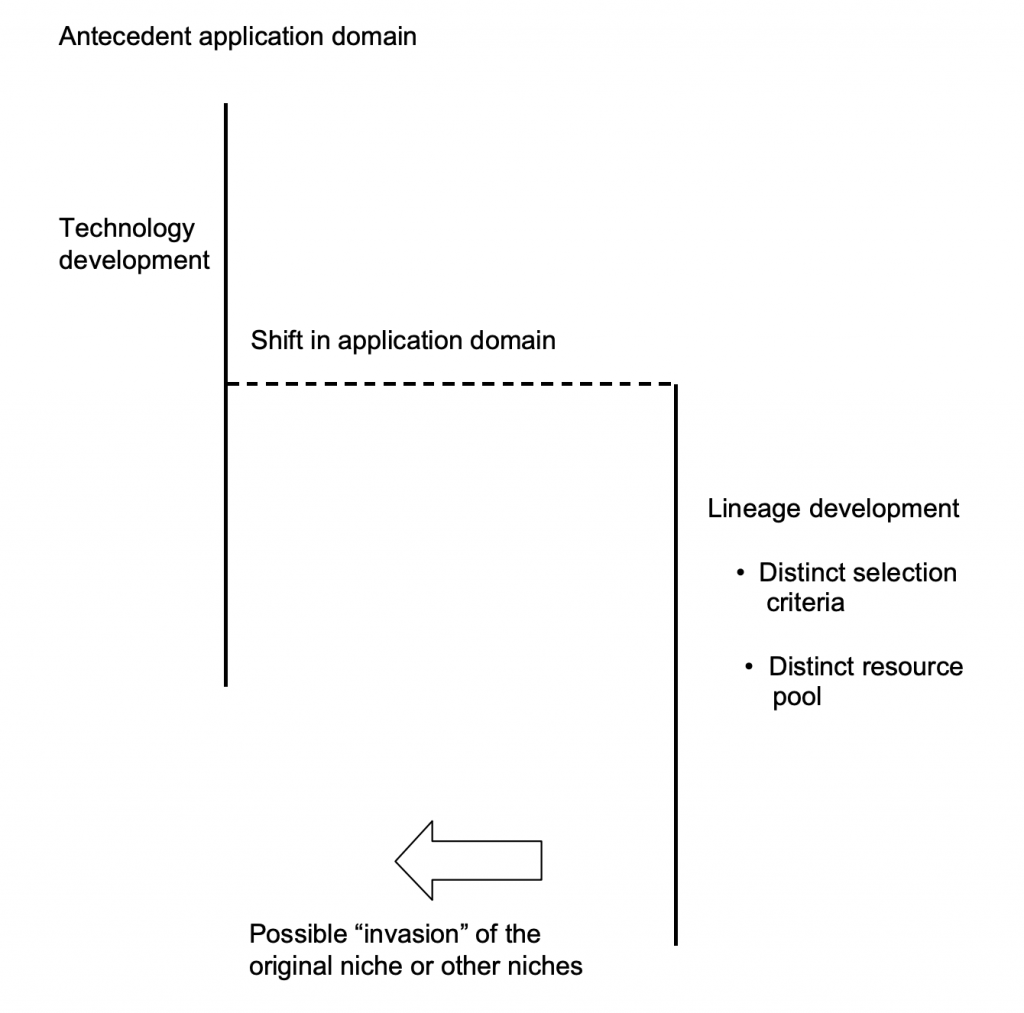

Domain Shift Inflection Points

But what happens when a technology is instead re-applied and invades new domains? When a technology is born in a specific, niche use-case and eventually makes its way to create outsized value in the mainstream via a new application, we call this a domain shift inflection point.

In domain shift inflection points, technologies often adapt to their new domain via functionality that was perhaps irrelevant to the prior domain, or has since been passed over. An example given in research is the disk drive industry, where the core attributes of size, weight, and power became incredibly relevant at the advent of laptops, despite these assets not being materially considered for desktop computers.

Another famous example of this is Nintendo’s product philosophy of using Lateral Thinking with Withered Technology, the idea led by Gunpei Yokoi of using mature technology in creative novel ways to create value in gaming products. Most notably, the Nintendo Gameboy, with a monochrome screen and 8-bit CPU, used fairly mature technology that allowed it to be cheaper, easier to program for, and more power efficient than other mobile game devices.

On the other end of the spectrum, we often talk about “post-science project” investing at Compound with the idea that we spend a lot of time with academics and researchers building and solving difficult science problems, but not necessarily doing so in a way that creates venture-scale companies. Domain shifts allow a given group to take a technology in search of a problem, find that problem, and make the transition from Science Project to Company.12There’s an entire other post as to why we shouldn’t build hammers in search of nails, and this is something many founders leaving academia don’t internalize well, but we’ll leave this out for now.

In certain areas of deep tech, core innovations for certain sensing technologies have created entirely new categories. Because of mobile phone R&D by the likes of Apple, Samsung, HTC, Nokia, etc. in the 2000s, sensing component costs fell materially, opening up a new suite of products in seemingly non-adjacent industries.

“Pete Klupar, director of engineering at Ames Research Center, was fond of pulling a government-issued smartphone out of his pocket during speeches and wondering aloud why the phone, which had a faster processor and better sensors than many satellites, cost so little in comparison — after which he slipped the phone back in his pocket and carried on.” – How a NASA Team Turned a Smartphone into a Satellite Business

This unlocked many parts of commercial space sensing (pioneered by Skybox and Planet Labs via the deployment of scaled SmallSats and CubeSats), as well as the first wave of lower-cost robotics.

Technological Convergence Inflection Points

Applying cutting-edge technology to less-technologically innovative industries is a strategy we love at Compound. We’ve previously partnered with companies at the intersections of machine learning and creativity (Shadows, RunwayML), robotics and food service (Ono Food Co.), as well as computer vision and fashion, among others.

We can more broadly look at this phenomenon as a type of inflection point called technological convergence, which often leads to novel applications and/or technologies.13This terminology has since taken on a tangential meaning, which is the continual simplification of technology into a fewer and fewer devices, most famously shown in the iPhone.

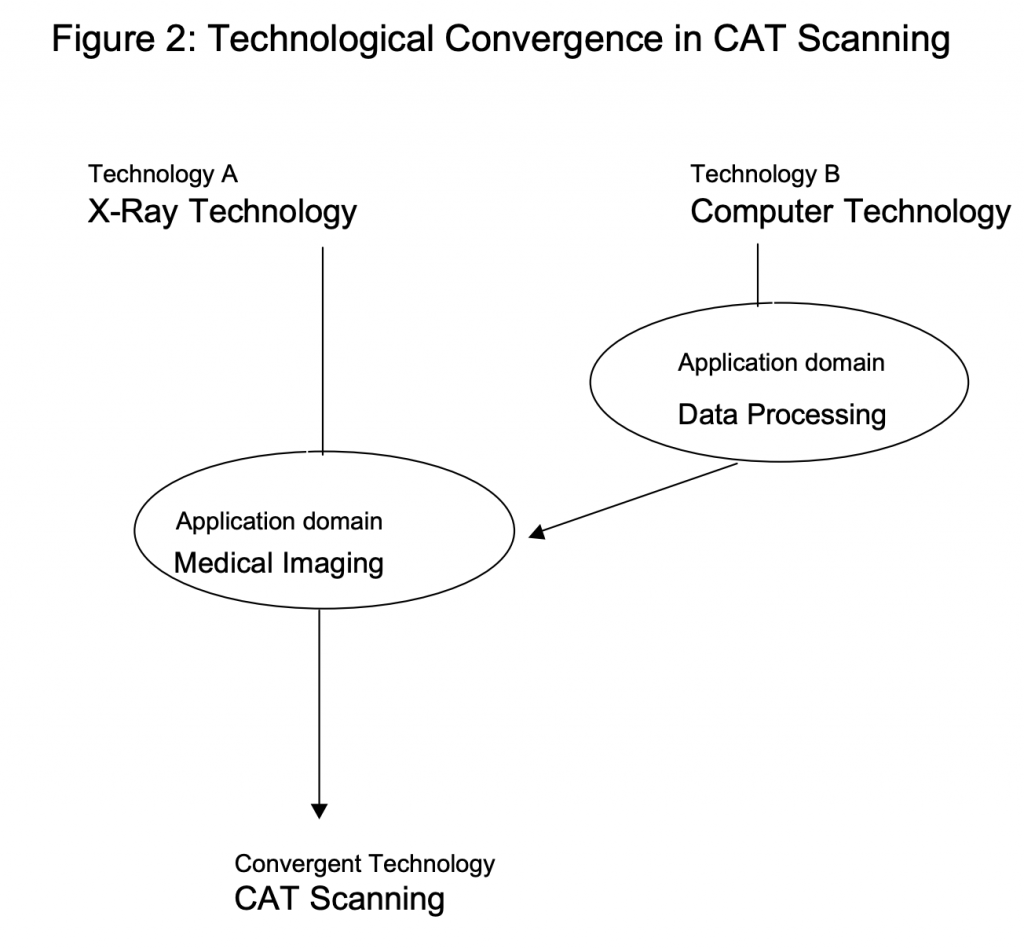

Technological convergence occurs when you have two different advanced technologies14In addition, convergence can happen based off of a variety of non-technological combinations that allow these two dynamics to either create a new method of production, new geographic market, new source of supply, or a new organization of an industry. merge to create a new technology in either a new or adjacent domain. An example of this is the invention of CAT scanning which resulted from X-Ray Technology and broader “Computer Technology” as detailed in The Emergence of Emerging Technologies.

Technological convergence often does not immediately destroy incumbents but instead creates a new domain and competition field.

Examples of convergent technologies include LIDAR sensors (a combination of multiple technologies including lasers, GPS, and computation) and High Throughput Screening (Robotics + Deep Learning and computer vision).

While these equations oversimplify the convergence of various technologies, often these still require changes to each of the combined technologies and aren’t built entirely from “off the shelf” combinations. While many examples in literature look pedantic in 2020, the underlying value to understand here is the repeatable building blocks in the technological convergence equation.

Specifically, if we look at these intersections we can see things like Cloud Computing + X, Machine Learning + X, Robotics + X, and a variety of platform technologies that could be considered the “technology B” in the chart above that combine with a more domain specific “Technology A” to create a new, dominant category or product within a given vertical.

It is thus important to not only understand technological innovations that have an ability to be applied across multiple sectors, but also the dynamics within a given sector that makes them susceptible to both adoption as well as efficiency creation.

ON CATCHING UP TO INFLECTION POINTS

All advantage is temporary. No capability is unassailable, no lead is uncatchable, no kingdom is unbreachable. Indeed, the faster the clockspeed, the shorter the reign. Sustainable advantage is a slow-clockspeed concept; temporary advantage is a fast-clockspeed concept. And, clockspeeds are increasing almost everywhere.

Charles Fine, 1998 via Clockspeed: Winning Industry Control in the Age of Temporary Advantage

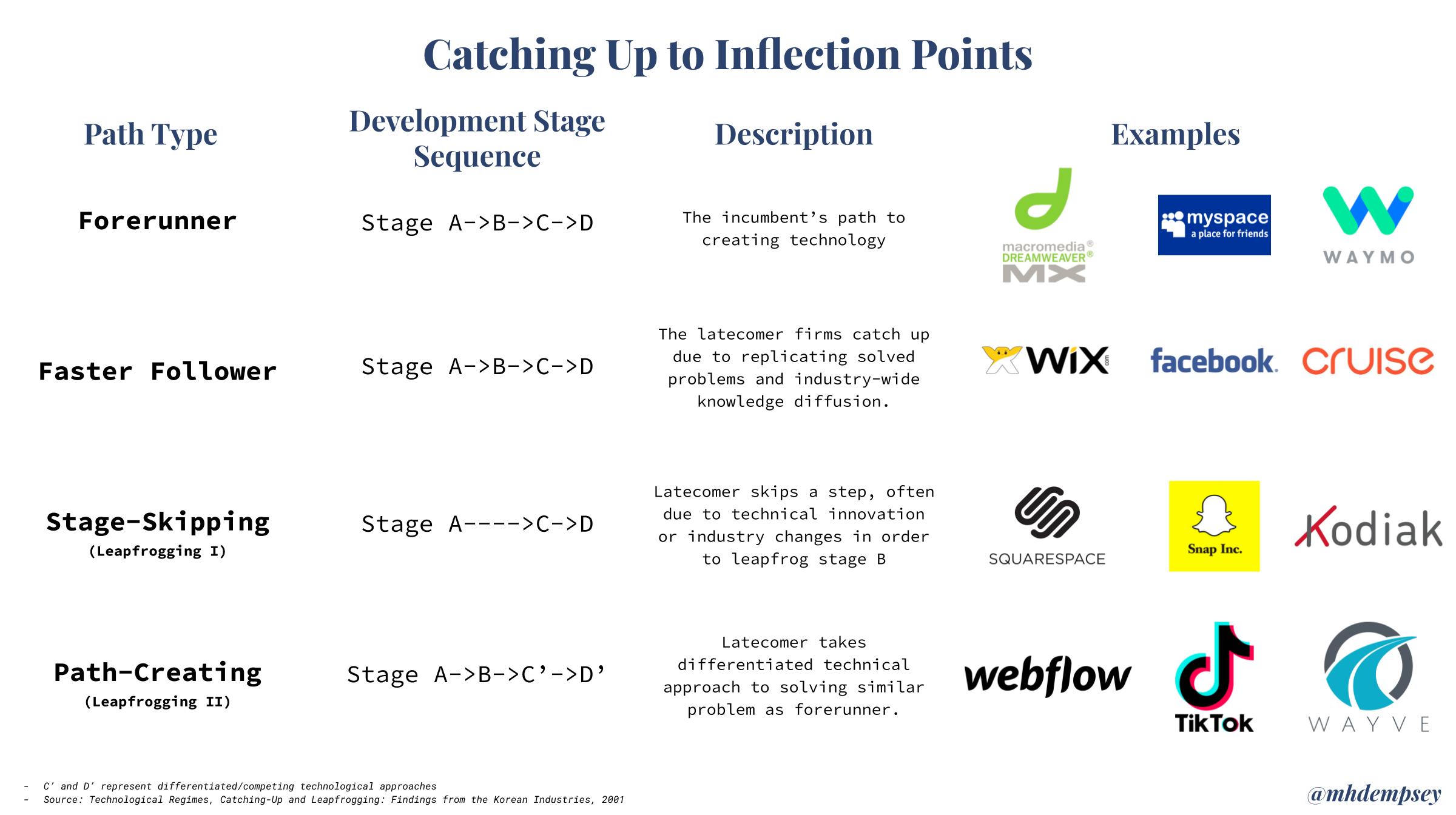

Many people view inflection points as existential runaway freight trains that must be timed perfectly in a given industry. While in many cases that is true, there are times where new paradigm shifts allow companies to catch up to other competitors by taking advantage of a slightly different vector of inflection point. Often these can be last-mover or final-mover advantages.

In Technological Regimes, Catching-Up and Leapfrogging: Findings from the Korean Industries Lee and Lim talk about these in-depth and classify them across three main catch-up patterns, highlighted in the graphic above.

What we most often see from startups in high barrier to entry areas, are path-creating catch-up dynamics. Path-creating catching up enables late-movers to take a differentiated technical approach to a well-tried, and potentially under-optimized problem.

For example, real-world demonstrations of autonomous vehicles driven by leaps in compute and deep learning, made many companies believe AVs were a solved problem. The attempts of companies like our portfolio company Wayve could be considered some form of what is called Leapfrogging, enabled by a materially different technical approach surrounding end-to-end learning.15The more common example you’ll see here is mobile phones and how they leapfrogged the PC in emerging markets like India, but alas, I think about AVs ahead of mobile

Because there are no sunk costs, and perhaps more limited than we thought economies of scale 16This is strongly debated when it comes to getting appropriate training data and the operating costs of scaling a fleet, being a last mover has theoretically allowed some post-2016 entrants in AVs to be in a more advantageous position and not locked into old technologies built on hundreds of millions to billions of dollars of technical debt.

A story I’ve heard echo’d a few times from early AV engineers has been that the 510 Systems (eventually Waymo) team figured out many core components of AVs far faster than anticipated, resulting in high confidence in their ability to solve self-driving. It was only after more time that they realized that lane following across the Golden Gate Bridge and the 90% of driving tasks, were not the hard part.

This caused them to throw out their codebase essentially, multiple times, to reach new step functions in progress. It was only until they reached a point where they thought they had now entered into the last, last 10% that they began to scale up partnerships, production, and a budget of hundreds of millions of dollars per year.

Despite the multi-year headstart, there is material competition from companies like Tesla, Wayve, and others as more expertise has diffused across the ecosystem and adjacent research communities.

In many cases, inflection points that happen at the technological level enable broader competition versus create solid moats.

It is often these winner take all dynamic markets which have long incubation times or perceived moats, that we see late-movers try to meaningfully change the vector of competition. Whether these markets are autonomous vehicles, social networks, or geopolitical battles for AI supremacy.

AI Supremacy and Existential Technologies

The United States and China are in a deadlock battle for AI supremacy. China, a late-mover relative to the robust technology and academic industries in the US, has opted to change the vector of competition at a more social level.

China has taken advantage of their authoritarian social structure to disregard potential roadblocks to faster innovation such as privacy or security, in order to make up a large portion of their initial late start.

Again, Lee and Lim address this by clarifying that “path-creating catching up is much more likely to happen by public-private collaboration when the technological regime of the concerned industry is featured by a more fluid trajectory and high risk.”

As technology continues to proliferate and influence every component of geopolitical dynamics, it is clear that existential beliefs around technological supremacy will continue to inform how structural inflection points are created.

When a technology is viewed existential to a set of stakeholders, odd things can happen resulting in massive expenditure. Whether it’s in machine learning, self-driving, human computer interfaces, or at the government level, AI or Space supremacy.

Official Futures, Psychological Tipping Points, & FALSE Inflection Points

For any of these tools to work, however, those engaged in the process have to be willing to escape their own mindsets, to discard what Crews calls the “official future” and see what’s really out there. As Kennedy says, it doesn’t matter whether the technology is actually superior or mature, or even what the experts say about it: “It really comes down to the world’s collective assessment of whether that’s true or not”— whether the value the technology offers outweighs the costs, real or imagined, of adopting it

– Identifying the Tipping Point, 2019

While often the principles that are written above relate to various types of strategic wins ranging from technology development to company strategy, in the end these narratives must be realized, especially for venture-backed companies. Startups use the idea of incepting narratives via pseudosecrets or other methods in order to paint a picture of the future they believe in.

The core principle that underscores this is that your key stakeholders must believe this future as well. Specifically, as an inflection point occurs, you must be able to communicate both how and why this is happening AND why it matters.

This is a difficult principle to grasp because with each realized narrative there are many false narratives. Today’s massively ambitious and disruption-aware incumbents often are thinking ahead into the future in ways that startups can’t, and thus can sometimes create Cambrian Explosion events that serve as red herrings for actual inflection points. A good example of this was the Oculus acquisition by Facebook.

Facebook has a core view around the future of VR being the next place they need to own, after seeing mobile slip away at the hardware and core infrastructure layer. Facebook knew that their core business and frankly, voting structure with Zuckerberg in power, would enable them to operate on a time horizon that many other companies can’t, and thus make damn well sure they were one of the core companies in our VR-enabled future.

Famously, Mark signals his clear fear of this slipping away in his memo about acquiring Unity:

“We are vulnerable on mobile to Google and Apple because they make major mobile platforms. We would like a stronger strategic position in the next wave of computing…From a timing perspective we are better off the sooner the next platform becomes ubiquitous and the shorter the time we exist in a primarily mobile world dominated by Google and Apple. The shorter this time, the less our community is vulnerable to the actions of others.”

Mark Zuckerberg on Acquiring Unity, 2015

The Oculus acquisition set the broader VR industry on fire, with venture funding spiking, and a resulting graveyard of VR companies as we all learned the technology wasn’t yet ready for mass market consumption. It is with this that we can go back to our initial charts surrounding “first inflection points” and then “maturation waves” to study what types of inflection points create value for startups. I’d argue that we are still headed for our first inflection point within VR, as cost curves will likely still be high enough that we won’t be able to see global penetration for some time, nor use-cases that support that adoption. With that said, I’m certain Facebook/Oculus will be there for the beginning of that inflection point. Whether they end up Blackberry/Nokia/Motorola, or Apple is unclear.

The importance of conviction

Another example surrounding Cambrian Explosion events is the Cruise acquisition by GM. While we had early signal in the self-driving space from Google, Cruise is what signaled that self-driving cars was more than a science project for a massively profitable tech incumbent…or so we thought. Despite continued progress over the years, it has become increasingly clear that there is a world where you could categorize the first wave resulting after Cruise as a false inflection point. Deep learning was applied to perception to enable more robust self-driving than ever before, but perhaps self-driving cars were far earlier on the maturation curve than we thought.

On both of these examples, there’s a notable caveat to this that conviction is important when embarking on an inflection point creating business. While Facebook has trudged forward and iterated on their headset ecosystem, plowing capital and resources into both software and hardware R&D surrounding VR, Google has pulled back. Specifically, we’ve seen a broader focus within Alphabet to focus on core cash drivers and ratchet down poorly-guided R&D spend (in the real sense, not GAAP accounting sense), and the lack of conviction surrounding VR has impacted their willingness to support the ecosystem, resulting in an effective abandonment of projects like Poly as well as Daydream.

This conviction can also relate to how companies think about value capture and accrual in a given space. The GM acquisition of Cruise was driven by an early shift in Cruise’s “official future” that AV technology was existential for OEMs. With multiple OEMs interested, GM moved quickly to take Cruise off the market and survive the anticipated contraction in the industry driven by the next order effects of this technology.

From 2016 to 2019 we then saw massive investment by a variety of Tier 1s/OEMs/and startups to build or acquire solutions to similarly verticalize this value capture. As we’ve entered the trough of disillusionment, this official future has become increasingly cloudy.

Last year, at a prominent, large AV company’s all-hands meeting, the head of the group asked the team of over 100 engineers how many believed that they would solve autonomous vehicles…over 20% said they didn’t think they would…ever.

As with all things, this thinking moved from engineers to overeager (and frankly, overpromising) executives who then began to democratize the investment and spending, resulting in Cruise raising outside capital, Aurora gaining material partnerships and money due to their “enabling technology” go to market approach, and a slew of OEM to R&D group/tech company partnerships.

When conviction fades due to either slowed technological or economic progress, “official futures” become “possible futures”, and value accrual and capture becomes less existential and imperative.

Bad narratives can turn inflection points into false starts and mere forgotten blips on the historical timeline of technology.

COVID-19 AND Chaos Driving Inflection Points

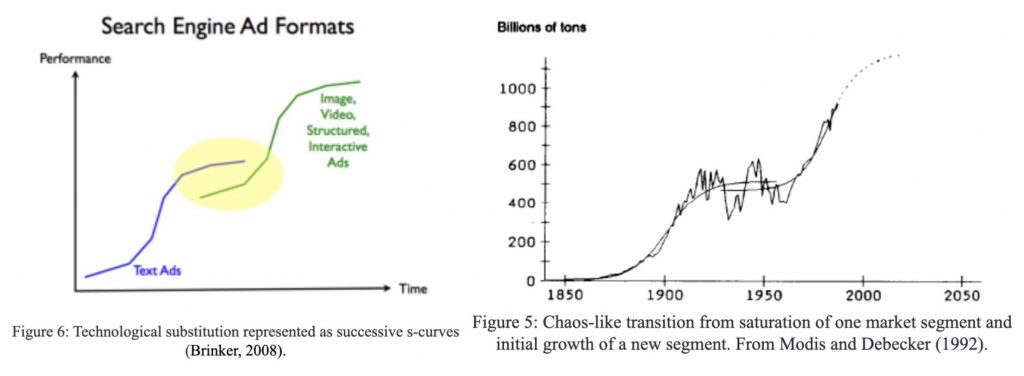

The timing of inflection points can also be materially influenced by chaos. In Inflection points and industry change: Was Andy Grove right after all? the authors talk about how chaotic points in time can create S-curves of market transfer for categories, but also that can lead to the birth of initial growth of a new category or technology.

Carlota Perez similarly describes the importance of these periods as Turning Points that shift technological progress driven by the financial sector, towards synergistic direction driven by the government.17In a recent talk she compared our current Turning Point to the 1930s and concluded that sustainability was the core shift to drive the next golden age, which felt overly simplistic/idealistic.

Prior chaos in the US has resulted in innovations like nuclear weapons, a space program, and Bitcoin. All of these take a core understanding of social imperatives and resulted in both governments and citizens meaningfully changing history with technology. 18There are very compelling readings surrounding this of how the initial Space Race materially changed our country’s view on the importance of technology supremacy. Not only that, but the way in which we financed this technology was in direct opposition to Russia who took a public sector approach to funding, versus our private sector one.

Today due to the COVID-19 pandemic we are in more chaotic times than possibly ever before, with very little change thus far in technological paradigms. The narratives surrounding COVID-19 as well as the societal changes create a perfect storm for false inflection points.

Many investors, founders, and corporates are in the process of understanding just what type of an inflection point COVID-19 will be relative to given industries. In the present, we’re seeing the chaos push forward a slew of categories from gaming to remote work and collaboration tools as our lives shift from physical to largely digital.

I believe we’ve seen shifts that will be lasting in telemedicine, automation, drug development, gaming, and the TAM expansion to a slew of digital-life categories. Whether the strong shifts around other consumer behaviors and enterprise spend will last outside of those areas, I’m far less sure of.

In situations with this much volatility due to both political, social, and technological factors, I find it instead best to model out what has changed that is certainly lasting, and then build out divergent futures based off of various branches of inflection points.

In the 1992 paper Chaoslike States Can Be Expected Before and After Logistic Growth Modis and Debecker said:

‘The chaotic fluctuations belong to the end of [one] growth phase as much as to the beginning of the next one…. Associating a peak with the past as an overshoot, or with the future as a precur-sor, is in some cases a simple question of taste.’

I feel that COVID-19 will be as much about the deaths to prior models, as it will be the births of new paradigms.

The pursuit of understanding

Trying to decode inflection points to some is considered a fool’s errand, and analyzing them in the written word, even moreso due to the massive grey areas that exist when things are changing, as well as the various conflicting terminologies that have proliferated throughout 3+ decades of writing.

While there are days in our history and moments in our lives that very obviously change everything, there are far more often changes that build up latent progress and force, waiting for their Pandora’s Box moment.

I’m not here to prescribe an exact framework for spotting inflection points outside of a continual awareness of their power in our lives. The pursuit of understanding inflection points is one that is lifelong, ever-evolving, and incredibly important in an increasingly competitive, rapidly-changing, and ambitious technology industry, and private market landscape broadly.

As Mikael Krogerus once wrote, “Preemption means you don’t prepare for the future, you create it yourself.” As our world turns, no longer are we able to be merely reactionary to the tectonic shifts that inflection points create. We must instead preemptively react to these possible shifts and take stances on when, how, and why these moments happen.

The learnings from decoding these moments in time (whether past, present, or future) are immeasurable, and in a world where the force these moments exert on society only continues to grow, not doing so consistently would be irresponsible.

Strategic inflection points can be caused by technological change but they are more than technological change. They can be caused by competitors but they are more than just competition. They are full-scale changes in the way business is conducted, so that simply adopting new technology or fighting the competition as you used to may be insufficient. They build up force so insidiously that you may have a hard time even putting a finger on what has changed, yet you know that something has. Let’s not mince words: A strategic inflection point can be deadly when unattended to.

Andy Grove

Thank you to Max Bulger, Daniel Dehrey, Zach Hamed, Kevin Kwok, Toby Shorin, and Kunal Tandon for their thoughts and help on this piece.

Recent Comments